This is a continuation of the previous thread about their FDA approval. That play didn’t go quite as expected, however, there is another emerging opportunity to lose money on this stock.

You can read through the previous thread HERE

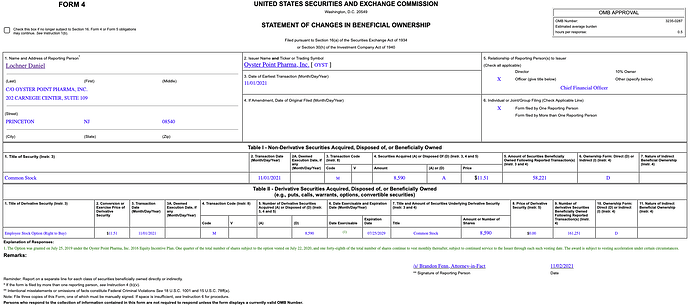

OYST is a company that received recent FDA approval for their drug TYRVAYA, which is a nasal spray that treats dry eye. After the approval, the stock promptly fell from it’s height of $15 and tapped a recent all-time-low of $9. The reasoning, as we’ve come to find out, was likely because the approval did not include a specific item on the label that was required for them to get their second “tranche” of funding… 50M dollars to actually manufacture the product. So essentially, despite approval, it was looking as though they may not be able to actually produce any of the medication to sell.

Thankfully, they were able to reach an agreement and filed the amendment to their financing agreement that granted them a waiver for the label stipulation on October 19th:

Item 1.01 Entry into a Material Definitive Agreement. On October 19, 2021, Oyster Point Pharma, Inc. (the “Company”) entered into a waiver and amendment (the “Amendment”) to the Company’s $125 million term loan credit facility (the “Credit Agreement”) with OrbiMed Royalty & Credit Opportunities III, LP, as administrative agent and initial lender (“OrbiMed”), to waive certain labeling requirements required for, and to permit the availability of, the second $50 million tranche of funding under the Credit Agreement (among other customary funding provisions) and make certain other amendments thereto, subject to the terms and conditions contained therein. Because the label approving TYRVAYA™ (varenicline solution) Nasal Spray (formerly referred to as OC-01 (varenicline) Nasal Spray) for the signs and symptoms of dry eye disease did not include eye dryness score data from clinical trials, the Amendment was required in order for the Company to draw the second tranche and to be eligible to draw the third tranche under the Credit Agreement. The Amendment also increases the amount of principal that is required to be repaid if the Company does not meet certain minimum recurring revenue thresholds from the sale and/or licensing of TYRVAYA on a quarterly basis for the most recently ended four fiscal quarter period, from $5 million to $10 million, in the event an improper promotional event occurs. The Company delivered a notice to OrbiMed on October 19, 2021 that it intends to borrow the second tranche on November 4, 2021. The Company would also be barred from drawing the second tranche if an improper promotional event occurs prior to the funding of the second tranche.

The portion that is pertinent is that they’re intending to borrow the second tranche on November 4th. Today, they announced that they also intend to present earnings that same day:

Oyster Point Pharma to Report Third Quarter 2021 Financial Results on November 4, 2021

Conference Call and Webcast Scheduled for November 4, 2021, 4:30 p.m. Eastern Time

PRINCETON, N.J., Oct. 28, 2021 (GLOBE NEWSWIRE) – Oyster Point Pharma, Inc. (Nasdaq: OYST), a commercial-stage biopharmaceutical company focused on the discovery, development and commercialization of first-in-class pharmaceutical therapies to treat ocular surface diseases, today announced that it will report third quarter 2021 financial results on Thursday, November 4, 2021, after the market close. The announcement will be followed by a live audio webcast and conference call at 4:30 p.m. Eastern Time.

Conference Call Details

To access the live call by phone, please dial (855) 548-1220 (US/Canada) or (602) 563-8619 (International). The conference ID number is 4538958. A telephone replay will be available for approximately 7 days following the live conference call. To access the telephone replay, please dial (855) 859-2056 (US/Canada) or (404) 537-3406 (International). The conference ID number is 4538958.

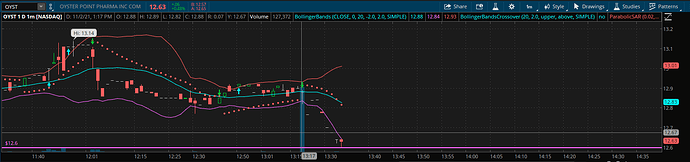

So this is where it gets potentially exciting. During this earnings presentation, they’re going to simultaneously announce that they’ve closed on $50M worth of funding to produce and sell their medication while also touting the projections they have for potential customers and revenue. When you factor in that this stock is currently sitting a little shy of all-time-lows with a revolutionary product in their industry… it gets a bit interesting.

NOTE: We have already lost money on this stock once. Make sure you use responsible position sizing if you choose to get in on this play. We have a proven track record of not being really great at Pharma plays and there really isn’t a reason to suspect that this wouldn’t be more of the same.

[event start=“2021-11-04 20:00” status=“public” name=“OYST Earnings Catalyst” url=“https://investors.oysterpointrx.com/news-releases/news-release-details/oyster-point-pharma-report-third-quarter-2021-financial-results” end=“2021-11-04 21:00” allowedGroups=“trust_level_0” reminders=“1.days”]

[/event]