@AlexanderJRL /@The_Ni I can see the optionstrat profits for these trades by each day, but in your opinion when is it best to cut these? The very next day or nearer to expiration of the week

It seems its almost always better to take profits within the first hour of trading after earnings are released. As both short and long leg lose IV, and theta eats away too.

Only if price remains close enough to the wing and is moving in that direction but has not reached it yet, would I consider waiting a bit longer, but no longer than the end of the day.

This IV crush works best for Thu and Fri plays, so one consideration is not to take plays earlier in the week. This way “the very next day” and “expiration of the week” coincide.

Thank you! This makes sense.

Just to confirm, one could potentially close out the puts, and wait for calls to be profitable and close that out later (if there is conviction/ anticipated direction).

I personally am pretty bad at directional bets so every time I’ve tried this I’ve ended up losing more. If you have conviction in a specific move then I don’t see a reason not to.

Another important thing to note is that with double calendar spreads, the “peaks” don’t really start to form until expiration day. It’s possible that for plays earlier in the week (if you close the day after earnings), your max profit is actually closer to the middle of your strikes.

Totally! Can always “leg out” in any way that works with the price action.

Since the wings are pretty far apart and it’s 1-10DTE ish, it’s somewhat unlikely though that prices will go all the way to one direction, and then move back the other direction by twice as much.

Perhaps a more profitable approach to legging out is getting out of the put legs as prices move up, or call legs as prices move down. Because they will lose value very quickly, as the opposite legs gain value. Then after a while, we can take profits for the legs that are aligned with movement. I.e. the remaining call leg as prices move up, or remaining put legs as prices move down. Toyed with the idea but never quite had time to try it out. Should work though.

Looking at Earnings this upcoming week I wonder if there is a proper calendar spread to take advantage of the IV growth. For example NVDA earnings are the 22nd and IV is at 70%. I can easily see that grow to 100-120 in the next week but I would want to be directionally neutral.

I tried a variation on that with AMZN, didn’t quite work the way I thought it might. I still have the call open on that ., likely to expire worthless this week. ![]() Unless there is a big upward move

Unless there is a big upward move

Wednesday 02/15/23

AMC

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $SHOP | 9.52 | 8.84 | 10.80 |

| $TWLO | 13.01 | 12.98 | 16.02 |

| $RNG | 8.97 | 14.87 | 17.77 |

Thursday 02/16/23

BMO

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $SO | 2.40 | 2.26 | 3.06 |

$RNG is interesting, a much larger move than average is being priced in for this report. Probably worth looking into.

One could certainly play it the other way around, where one benefits from the increase in IV going into earnings. So one goes long the nearer-dated leg, and goes delta neutral by going short the farther-out leg. Have not tried this myself, but the challenge I see is that the underlying can move quite a bit in that one week. If wings are breached, you have the same problem - extrinsic is reduced significantly, which could more than negate gains through IV rise.

Some play a variation of this on FOMC day, between 1pm and 2pm. Price is usually flat enough, and one can usually get out with 10-15% over that hour.

After checking all the possibilities, these are only ones that seem to have enough liquid options and where the premium is not nuts, that could be worth the calendar play today:

Thursday 02/16/23

AMC

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $DASH | 8.63 | 10.47 | 11.96 |

Friday 02/17/23

BMO

DE looks like the only big one reporting but the implied move is lower than average and not great option liquidity.

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $DE | 5.65 | 3.77 | 5.07 |

Thanks! These are the four I’m keeping an eye on:

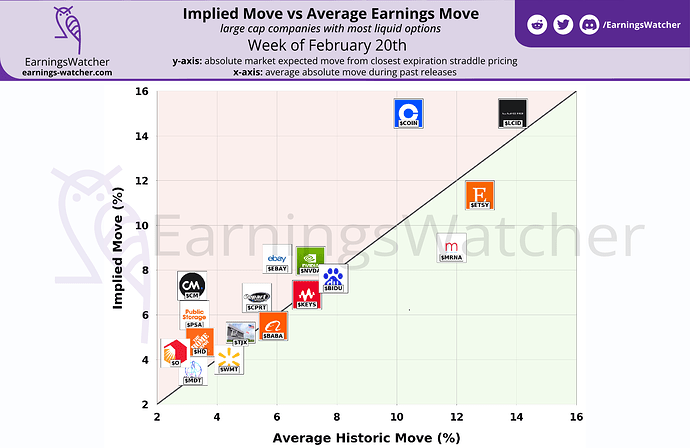

I’m not so sure this implied move vs historical move is really turning out to be that helpful so I’ll start adding some reports to these lists if the option liquidity looks decent.

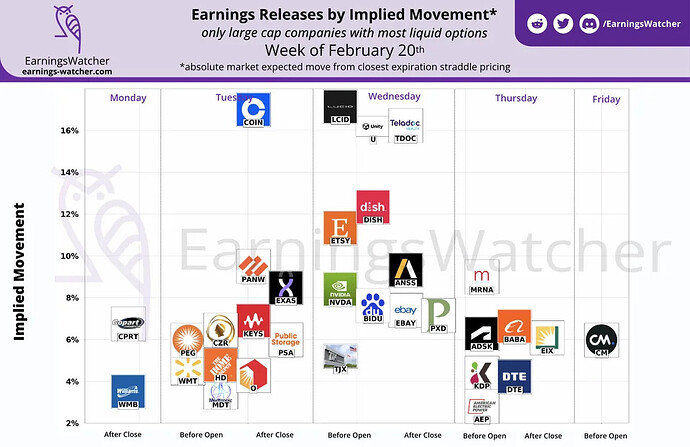

Tuesday 02/21/23

AMC

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $COIN | 10.39 | 18.08 | 20.03 |

| $PANW | 8.44 | 6.91 | 7.85 |

Wednesday 02/22/23

BMO

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $TJX | 4.79 | 4.66 | 5.21 |

| $BIDU | 7.88 | 7.06 | 7.62 |

EarningsWatcher says $NVDA, $DISH, and $LCID are reporting BMO tomorrow but I don’t think that’s right. Tastyworks and Earnings Whisper have the dates as: $NVDA after close on the 22nd, $LCID after close on the 22nd, and $DISH before open on the 23rd.

After reviewing these and a few others, it seems the only viable play is PANW:

All the others either do not have enough OI or are too expensive - cost is 3-4% of underlying vs the <2% we may prefer.

Wednesday 02/22/23

AMC

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $NVDA | 7.13 | 6.97 | 7.71 |

| $EBAY | 6.01 | 6.69 | 7.11 |

| $LCID | 13.88 | 15.47 | 17.98 |

| $TDOC | 11.93 | 14.52 | 15.15 |

| $ETSY | 12.77 | 10.90 | 11.86 |

| $U | 17.34 | 15.55 | 16.01 |

Thursday 02/23/23

BMO

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $DISH | 6.48 | 10.20 | 12.14 |

| $BABA | 5.87 | 5.46 | 6.23 |

| $MRNA | 11.82 | 6.77 | 7.55 |

Quite a few big names today.

Thanks for putting the list together!

Only the following seem to be affordable; checking a few more, will list in TF.

Thursday 02/23/23

AMC

| Ticker | Average Historical Move (%) | IVx Implied move (%) | EarningsWatcher Implied Move (%) |

|---|---|---|---|

| $CVNA | 13.91 | 20.71 | 23.24 |

Friday 02/24/23

BMO

Doesn’t look like anything that has weeklies.