! NO POLITICS in this thread !

President Biden refers to the Drug Pricing reform as part of the Inflation Reduction Act. The drug pricing reforms includes:

- For the first time, requires the federal government to negotiate prices for some top-selling drugs covered under Medicare

- Requires drug companies to pay rebates if prices rise faster than inflation for drugs used by Medicare beneficiaries

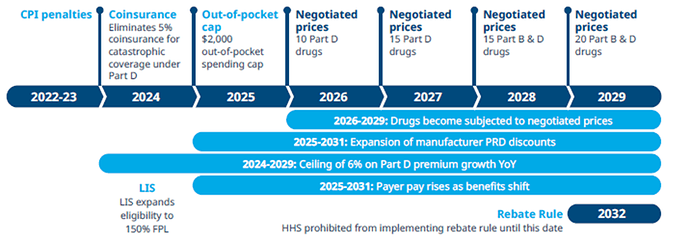

- Eliminates 5% coinsurance for catastrophic coverage in Medicare Part D in 2024, adds a $2,000 cap on Part D out-of-pocket spending in 2025, and limits annual increases in Part D premiums for 2024-2030

- Limits monthly cost sharing for insulin products to $35 for people with Medicare

- Expands eligibility for Medicare Part D Low-Income Subsidy full benefits

- Eliminates cost sharing for adult vaccines covered under Medicare Part D and improves access to adult vaccines under Medicaid and CHIP

- Further delays implementation of the Trump Administration’s drug rebate rule

The Implementation Timeline of the Prescription Drug Provisions in the Inflation Reduction Act is spread out over the next years, key milestones:

Scope pf the Medicare Drug Prices Negotiations (2026-2028):

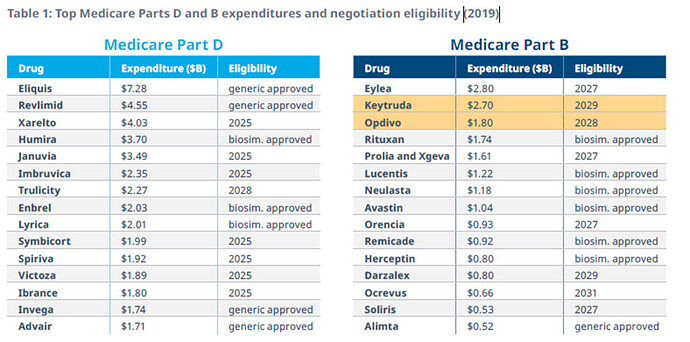

The Secretary of HHS selects drugs to be negotiated from the 50 “negotiation-eligible” drugs with the highest total Medicare Part D spending and the 50 “negotiation-eligible” drugs with the highest total Medicare Part B spending.

“Negotiation eligible drugs” include brand-name drugs or biologics and exclude the following drugs:

- Drugs that have a generic or biosimilar available

- Drugs less than 9 years (for small-molecule drugs) or 13 years (for biological products) from their FDA-approval or licensure date

- Certain “small biotech drugs” (from 2026 to 2028)

- Drugs that account for Medicare spending of less than $200 million in 2021

- Drugs with an orphan designation as the only FDA-approved indication

The data below gives an idea what Drugs will be most likely be in scope:

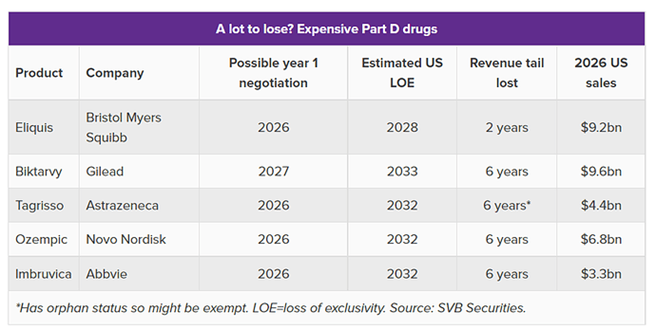

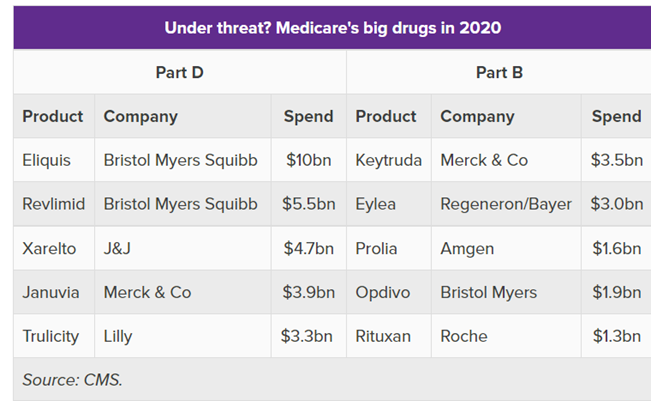

The most interesting part is that the majority of the big drugs will face loss of exclusivity (LOE) in the next years. Approximately one-third of large biopharma’s 2025 estimated revenue will be impacted by LOE revenue erosion between 2024 and 2030 across all big players.

- AbbVie: loss of the mega-seller Humira (adalimumab) in the US beginning in 2023.

- Johnson & Johnson: company’s top-selling drug Stelara (ustekinumab) expected to lose patent protection in the US in 2023, followed by Simponi (golimumab) in 2024.

- Pfizer is headed over the cliff with the potential US loss of the rheumatoid arthritis drug Xeljanz (tofacitinib) in 2025, the blood thinner Eliquis (apixaban) in 2026, and the cancer drugs Ibrance (palbociclib) and Xtandi (enzalutamide) in 2027.

- Bristol markets Eliquis with Pfizer but will experience other losses as well. This year, it is already under pressure, facing the loss of Revlimid (lenalidomide) in Europe and Japan and on a volume-limited basis in the US. Its first immune checkpoint inhibitor, Yervoy (ipilimumab), could lose exclusivity in 2025 followed by Opdivo (nivolumab) in 2028.

- At Merck, meanwhile, the entire plotline is pivoting on its checkpoint inhibitor Keytruda (pembrolizumab) and how the company will reduce its dependence on the big anchor brand before it faces LOE in 2028.

This means pharma is hit with pricing negotiations and patent cliffs at the same time.

How Big pharma will battle with governments on drug prices?

Let me first say that pricing regulations may be new in the US, but similar, even stronger regulations, have been introduced in the majority of countries with a robust private or social healthcare system in the last years. So, Pharma has strong experience on how to manage pricing negotiations and rebates.

I believe as an outcome we will see the following in the next years:

- R&D investment have been highly science base driven in the past, going forward R&D efforts will be much more commercial opportunity driven. In order words focus on the research where money can be made. I believe we will see a shift of R&D investments as well to outside US, for example China has become an important alternative (cheaper and faster) base for research. One challenge is that the average cost of drug development had increased to $2.3bn by 2021 while the average annual peak sales per drug had fallen to $500mn. So accelerated and cost-effective research will be critical going forward. The lifetime of a patent starts often early in the research, so if a drug enters the commercial market more money is to be made.

- Big pharma will diverse and refresh their portfolio in the upcoming years. Partially driven by the patent cliffs and by the need of having bigger range of drugs to be less impacted by pricing negotiations. Cash is not a problem; pharma sits on billions on Cash and they are public about that they will use the cash for M&A activities.

Is there a play?

- Shorting a Big Pharma company will only make sense if there is an indication that the company will fail on refreshing their product portfolio.

- The opportunity sits more with the M&A activities, so I believe we will see again more acquisition of smaller biopharma companies by big pharma. As part of the acquisition DD the buyer gets access as well to research data that has not been announced yet publicly, so they build an opinion if a Phase 1-3 trials will successful. So, to play this, we need to be ahead of the game and focus on catalysts that are 4-6 months out.

I will let you decide if we beat pharma.