TLDR; SOFI appears primed to continue on it’s upwards movement. All of this like everything else is dependent on market conditions. Since Friday’s earnings were better than expected we need to see what this weeks earnings are. If that are also better than expected SOFI has room to run and options are cheap. Will most likely be taking a starter position this week if the stock drops to it’s support level.

Okay so SOFI has been on a upwards trend recently. Somewhat due to the market but I think there are some underlying factors that are making investors purchase more shares now. Previously @Kevin laid out a very detailed analysis of SOFI a few months again, thank you @Kevin! See that information here: SOFI - $5 entry for long term investment?

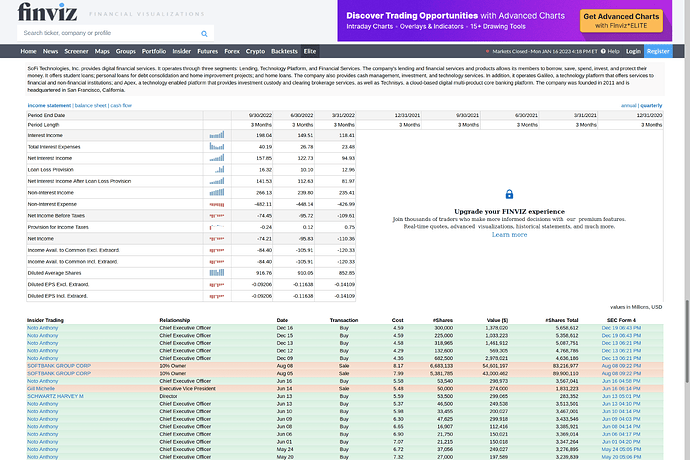

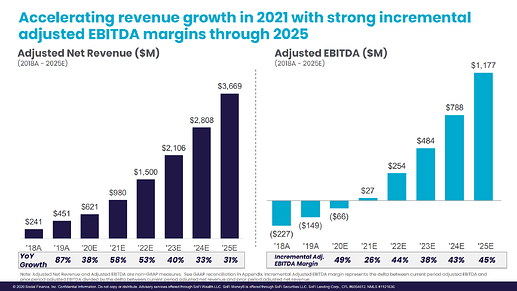

So SOFI has a few things going for it right now. Other large banks (JPM, BA) posted some moderate gains this past quarter which gave the market hope that the FED is done with large rate hikes. While the jury is still out on that as of yet since the FED has no plans to cut rates this year and will most likely just reduce the rate hikes to 25bps until we get to 5bps. This has actually been one of the major factors in driving users to the SOFI platform. From all my research SOFI has the highest APY savings rates for both checking (2.50%) and savings (3.75%), if there’s one that’s higher let me know. Just like previously quarters I think SOFI is going to post an increase in users and this increase is more than offsetting the loss from the student loan pause / forgiveness that is occurring. If you look at the the data from Finviz you can see that SOFI keeps increasing it’s net income every quarter. If we were to exclude everything else SOFI is doing and just looked at the increase in interest income then the increase in users this quarter would cause that number to increase again which should cause the net income to increase as well. The other factor that’s interesting is that the CEO keeps buying up large quantities of stock. This normally implies that the company is cheap and will continue to rise. All these factors are looking good. Time will tell.

Some other benefits are what @Kevin already mentioned. Most of them are new features that SOFI has added or new customers it’s added due to those features form Galileo arm that continues to bring in more revenue each quarter. I’m also thinking that whatever the student loan supreme court results are won’t matter much in the short term since they have until Summer to decide if forgiveness is legal or not. If it isn’t legal then SOFI will rocket up more, if it is legal then it will drop but hopefully not as much. I might play both sides of this just to hedge if this happens.

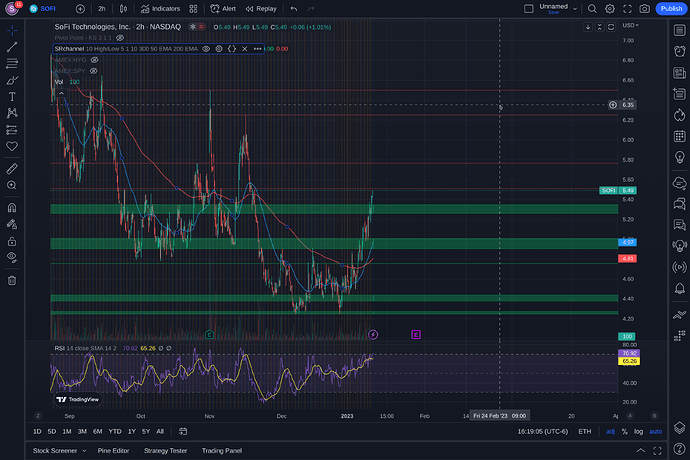

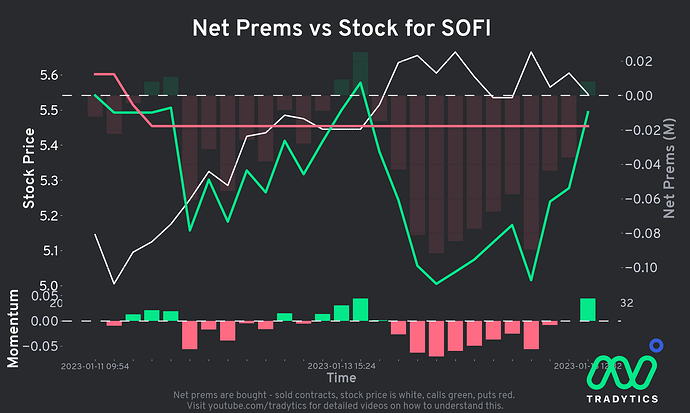

I’m of the belief that SOFI finally hit it’s bottom at $4.24 a few weeks ago and it appears to be on an uptrend. I think the safe play would be to wait for the current price to fall back down to the $5.25 - $5.34 price range and then pick up some longer dated Calls. Most of the calls are very cheap even if their expiration is far out. I think will earnings coming at the end of the month if the market data we see is trending in the correct direction and earnings season is better than expected then SOFI is going to take off. I’m going to start a small position if it drops to the level mentioned above. Probably try and target the $5.50 calls or $6.00 calls. Don’t know which month yet but probably June or July.

Again if I’ve missed anything point it out or tell me what I’m missing.