Today I took a peak at the SOFI chart and noticed it seems to be at a nice entry point for a long term investment. So I searched “SOFI” in our forum to see what our collective brain has been up to re: SOFI. I was very surprised that such a popular name does not have a thread, so I am creating it now.

[size=4]Disclaimer[/size]

I am not very experienced with fintech DD, and not very savvy with how fintech “should” be valued.

[size=4]What is SoFi Technologies?[/size]

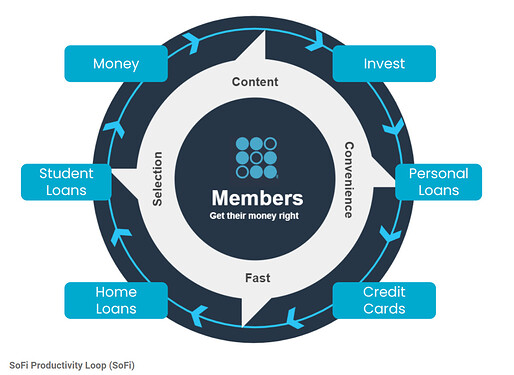

My understanding is that SoFi is meant to be a “one stop shop” for all things financial. This SeekingAlpha article says it best:

SoFi’s pitch is pretty simple, it’s a “One-stop shop for all your financial needs.” The products include checking and savings accounts, investment and crypto brokerage (including IRAs and robo-advisors), credit card, personal loans, student loans, mortgages, SoFi Relay (finance tracker, budgeting, and credit score tracking), insurance offerings, and other smaller products. They want to be there for and support their members (what they call their customers) through every part of their financial journey. The playbook they have is laid out by CFO Chris Lapointe (I’ve lightly edited his words for brevity and clarity):

There is a Reddit comment here allegedly from a SoFi employee, dropping bullish hints at future products to come.

[size=4]Stock Price and Chart[/size]

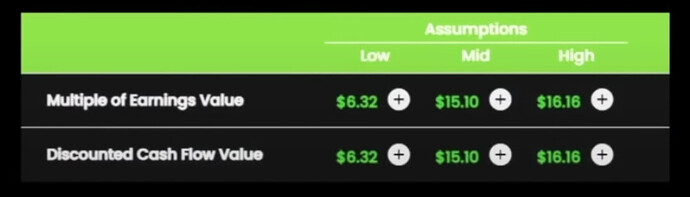

Sometimes I watch Everything Money on YouTube. Essentially they are self-proclaimed “value investors” who do various analyses on stocks as well as macro. They have a proprietary software where you can input your own assumptions on future revenue growth, profit margins, P/E, etc. I have watched many of their videos and I can easily say that 95% of the time, their assumptions give price targets that are multitudes lower than current price, e.g. you would never buy anything after watching their videos. However, their SOFI video on September 23, 2022, shot out price target assumptions of $6.32 on the low side to $16.16 on the high side. The current stock price is $5.13. So even the super super conservative Everything Money agrees with going long on the current stock price.

Their growth assumptions and resulting PTs are pasted below. Note that the “Mid” PT should be ignored because the guy in the video mistakenly put in 35% revenue growth instead of 25% lol, but I would assume that the “mid” should be around $10 or $11 based on the pattern here.

Here’s the chart since deSPAC (yes SOFI was one of Chamath’s famous SPACs). SOFI is currently testing the ~$4.80 to $5.46 range which was also its YTD bottom in the month of May.

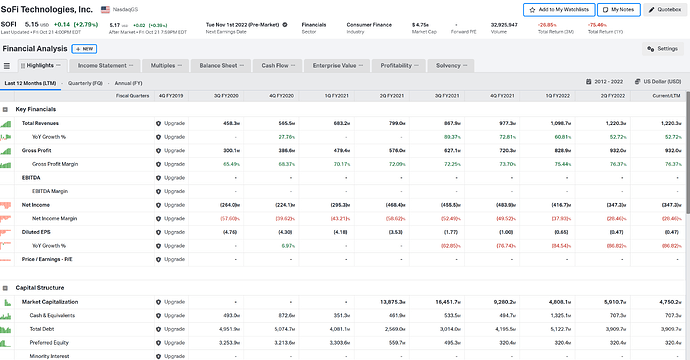

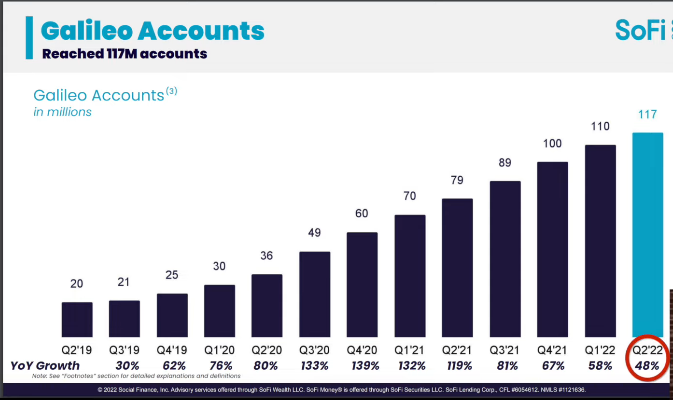

At current price, the valuation of SOFI is 4.75B. In Q1 2022 it did 1.1B in revenue and Q2 2022 it did 1.2B in revenue. The Price to Sales ratio for 2022 is looking to be a remarkably low ~1:1 ratio at this pace.

However, SOFI is still burning ~350M to 500M in Net Income every quarter, and holds 3.9B in debt with a cash position of 707.3M. Large debt is not good in a rising interest rate environment.

See summary of financial highlights below, courtesy of Koyfin.

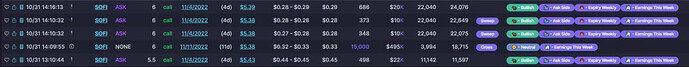

[size=4]Options Flow[/size]

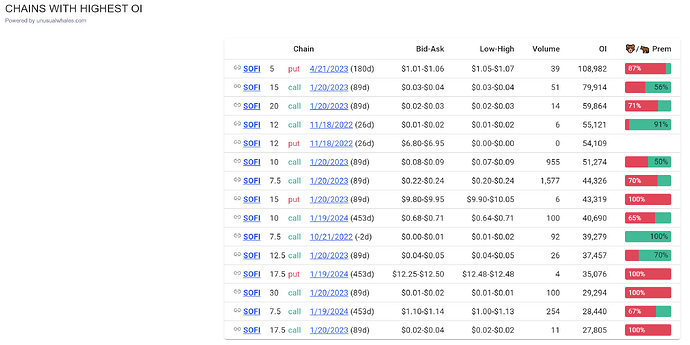

Using a filter of 100K size, I observe that the large options on SOFI appear bearish in the short term and bullish in the long term from the non-Floor trades.

But the Floor trades are particularly bearish… and very large. ![]()

The Chains with Highest OI tend to be calls, particularly for Jan 2023. I assume most of these were opened earlier in the stock’s history. However, notice the 40k OI on Jan 2024 10c and 28k OI on 7.5c.

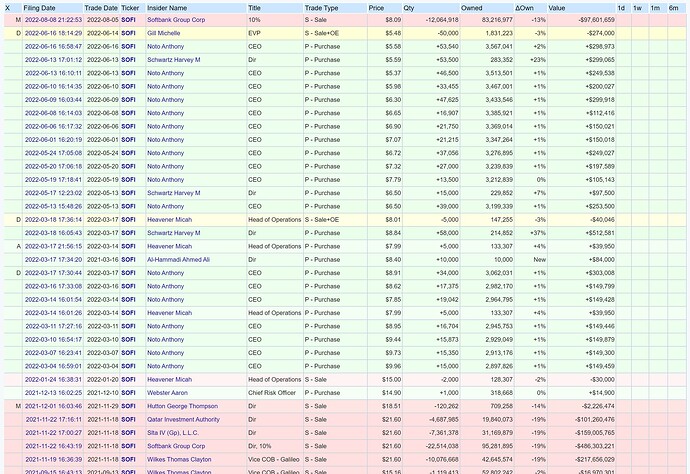

[size=4]Insider Trades[/size]

Holy crap this is nice to see.

After those gigantic sales in November 2021, I assume related to lock up expirations(?), it is abundantly clear that CEO Anthony Noto is bullish on his company. There is not a single sale on the page from Anthony. He has been buying all year long, along with Director Harvey Schwartz.

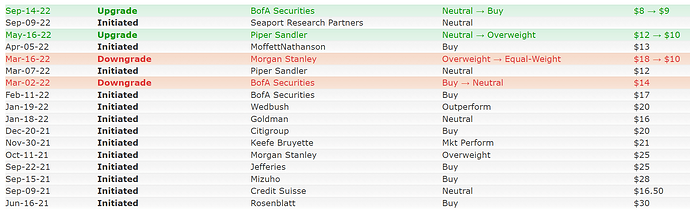

[size=4]Analyst Price Targets[/size]

Bullish. Even the downgrades are at least 2X from current level.

[size=4]Concluding Thoughts[/size]

I am thinking about a “set it and forget it” type of position on the Jan 2024 7.5c or Jan 2025 10c, or perhaps loading up on shares at the $5 range and then selling OTM CCs.

Again, I am not particularly savvy on fintech stocks and I am opening this thread up hopefully to rally the collective advantage of Valhalla.

One thing that I am not sure of is the impact of a recession in the US, or global recession, on SOFI. Financial products do not seem very recession-resistant …