Hello Valhalla,

I’m back, and the next target only got bigger.

![]()

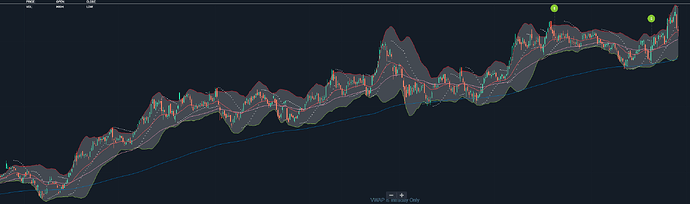

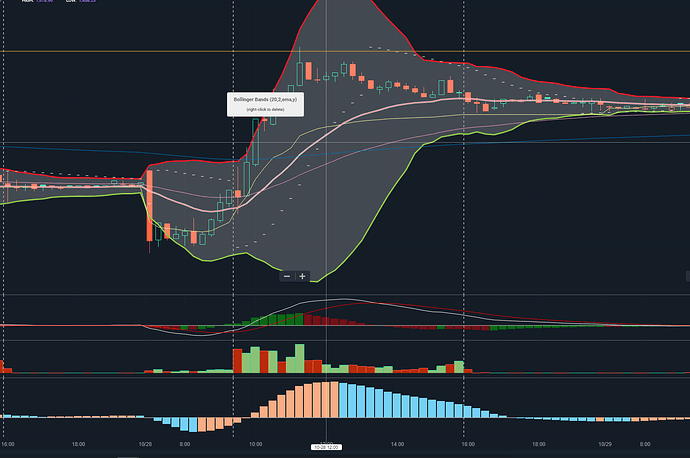

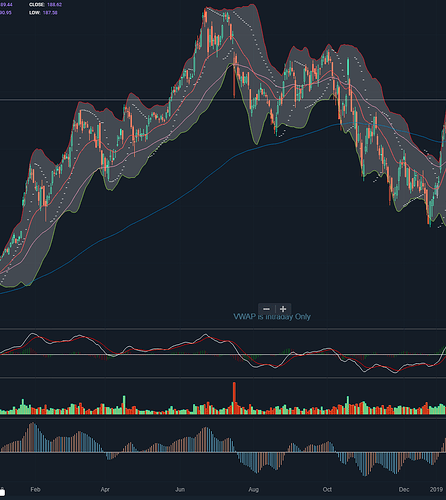

At the time of writing here is Shopify’s current chart since April 2021:

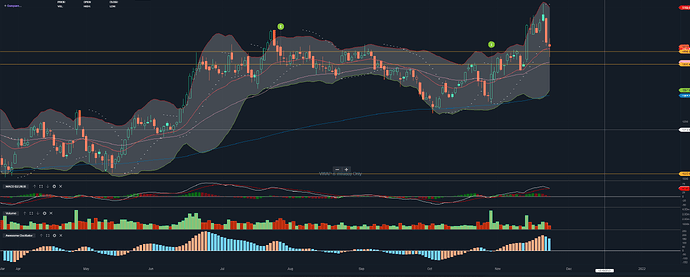

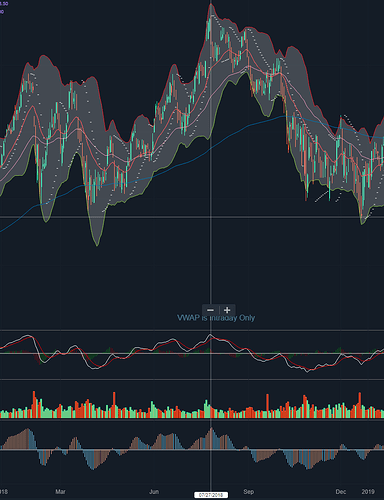

Now here is SHOP with the main focus being the last two earnings it just had:

The last two earnings for Shopify are rather surprising to me and how the stock has reflected what the market thinks about it at the current levels it is at.

Well lets start with the hedge funds:

According to the author of this article here are the respective hedge funds and what they’ve been selling:

- Melvin Capital exited JD.com, PayPal, Uber and [color=yellow]Shopify[/color].

- Viking Global dumped Square, [color=yellow]Shopify[/color] and Alphabet.

- Baillie Gifford also reduced its positions in Alibaba, Amazon and [color=yellow]Shopify[/color].

- Coatue slashed its positions in Amazon, Square, PayPal, Tesla, [color=yellow]Shopify[/color], Peloton, Zillow and Facebook.

- Lone Pine sold some of its shares in Facebook, Amazon, [color=yellow]Shopify[/color] and Adobe Systems

Hmmmm odd you would think that with the secular tailwinds from Covid that you would want to hold onto a lot of these companies, no? Well if the hedge funds are selling/reducing exposure to a stock its probably because it’s just grown to be too large a portion of their portfolios and they need to thus reduce exposure as the equity causes the portfolio to be too heavily weighted for their risk tolerances. But that causes selling none the less.

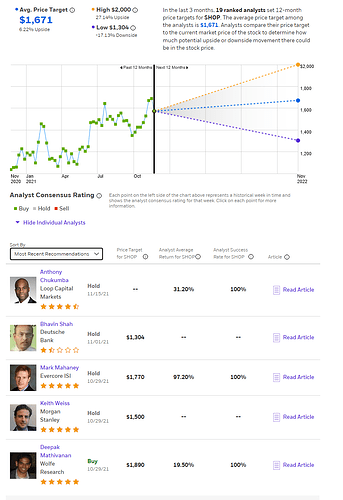

So what do the analysts think?

Note: I get my analyst ratings from ETrade and so if you got another more objective source with better overall view of analysts ratings please feel free to throw it my way*

The general consensus for SHOP is an AVG price target of about $1,671 and that yields about a 6.22% upside to the stock at its current level. (Keep in mind the top graph is from averaging the the price targets of [color=red]19[/color] analysts so you shouldn’t take that as a super strong signal)

But the more interesting point for me is the recent amount of HOLD’s that SHOP has gotten recently. 4 in a row.

Seemed to start around 10/29 wonder why?

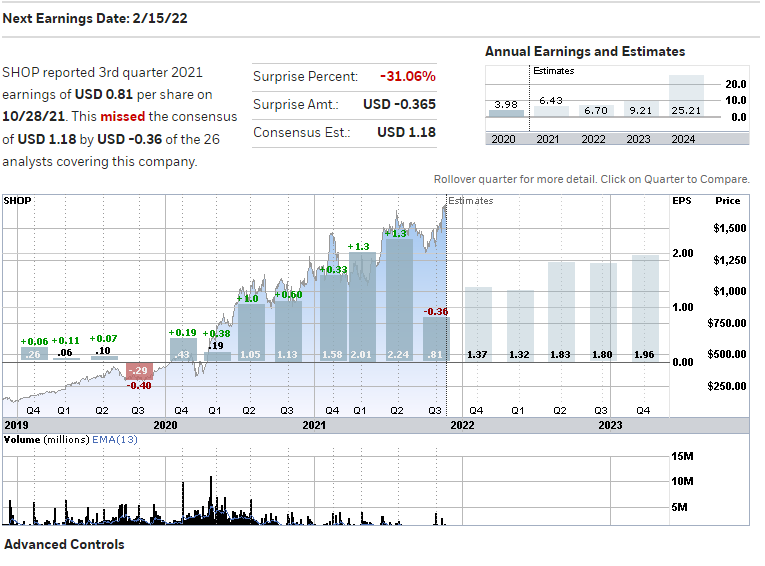

O… Yeah that might do it. For a company like SHOP who has been absolutely crushing earnings ever since COVID started to have a surprise miss of -0.36 is the miss and the analysts and market seemed to care… for like 30 minutes.

Now any sane person would look at that response to a ~30% EPS miss and think I’m absolutely bonkers for wanting to having a bearish stance (and that could be true as I write this or in the future as more news comes out; it’s just how I’m feeling right now tho). But this one slide on ER has now raised a very important question that impacts SHOP where it is at.

A small excerpt from a analyst update from BUY to HOLD sums it up pretty well:

Loop Capital analyst Anthony Chukumba downgraded Shopify’s stock to hold from buy Monday, writing that his rating change is “[color=red]based on Shopify’s valuation[/color], as opposed to a more bearish view of the company’s fundamentals.” He still sees Shopify as “well positioned for the secular shift to e-commerce” and is “impressed by the company’s laser focus on eliminating merchant pain points and continuous innovation.” At the same time, he argues that Shopify’s current valuation is “in line with our bullish outlook” given that shares are trading at 34.1 times his 2022 revenue estimates. “We would await a more attractive entry point before becoming more constructive on the stock again-and given the high volatility in the stock price…we may not have to wait very long,” Chukumba wrote, while keeping a $1,600 price target on the stock. Shopify shares are up 47% so far this year as the S&P 500 has risen 25%.

Source: https://content.seleritycorp.com/hosted2/assets/www/tfqpaDFcFya74pI4UoikVrx3T7fPMp3uVZz790--Yqk

So the valuation talk that’s not a very scary prospect right?

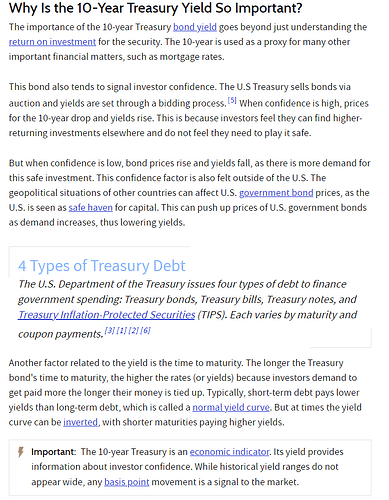

Source: 10-Year Treasury Bond Yield: What It Is and Why It Matters

And I know I know. You’re sitting here thinking, “Fucking Navi gets one thing right and now he’s lecturing me on fucking bond yields.”

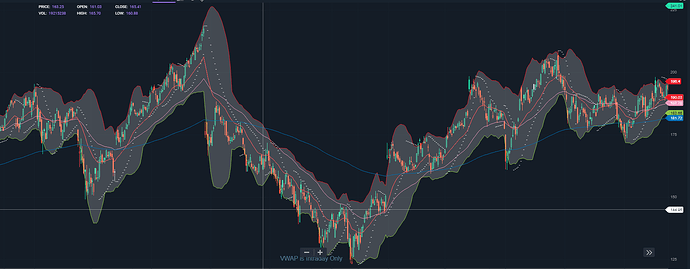

So, lets look at a few charts (no names just yet! Just charts!)

Now for your own awareness the stocks above are FB, AAPL, NFLX, and GOOG during the 2018-2019 year.

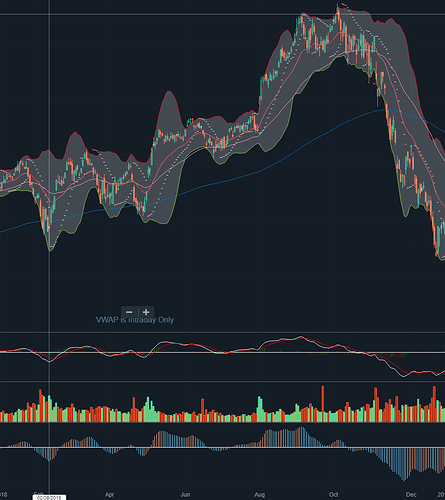

Here is where 10 Year Treasury Yields were:

Source: https://www.google.com/finance/quote/TNX:INDEXCBOE?sa=X&ved=2ahUKEwiH16ObsLD0AhXhN30KHautA8YQ3ecFegQILBAc&window=5Y

So at the beginning of 2018 you were basically able to get a 26% return on your money for a 10-year bond (I know that sounds fucking horrendous but they’re safe so I guess there is that).

But more importantly that money was essentially risk free (I know we’d all love to argue about how the Gov fucks around with the debt ceiling and fucks our SPY FD’s but just buy puts next time fam and weather the storm). Risk free money means a lot and whether or not you want to appreciate it, investment firms have to balance their risk so that you can retire within your retirement plans timeline (unless you’re Fash and yolo you’re Roth in ESSC) and not have to worry about whether you’re going to be one of those clerks at Aldi’s when you’re 75 as 18 year olds chuck liters of root beer down the aisles.

When we see the bond yield prices moving up we’re going to start seeing some bigger P/E ratio stocks start to lose some of the steam that they’ve been having. Everyone’s making money and of course retail will still have a larger part to play in this market moving forward but the underlying factors are still at play and its up to us to learn how to play with them.

Now back to Shopify lets talk about the good (cause they got a lot of it):

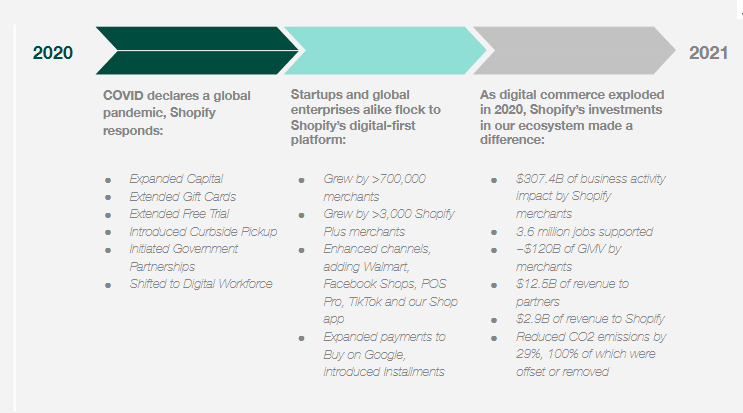

This is a slide from Shopify’s annual shareholders meeting

Interestingly during this meeting a shareholder did ask about a stock split, the CFO said no, but however they do monitor the capital markets (so it was not a heavy no).

So it goes without saying that SHOP had a pretty killer 2020 fiscal year. I mean nothing on this slide would ever tell me that their upcoming ER in Febuary would be one to possibly be looking for some downwards movement. If anything I look at this as most investors would and see nothing but growth, scalability, huge partnerships, and a lot of of $$$ coming in from Covid tailwinds.

Now what does SHOP have coming down the pipeline?

Well if you want to check it out here’s their Unite 2021 video

One of their big announcements was “The Online Store 2.0”

It focuses on 3 themes:

Most of these updates allow for merchants to manage their online store with some new features like templates and sections, allow for easier page reproduction for new products quickly, and some developer tools. In wrap up it allows for some better management and ease of use for shopify developers. Overall this may reduce the barrier to entry (from a technical perspective) but I’m no confident that will translate to increasing customer acquisition for SHOP.

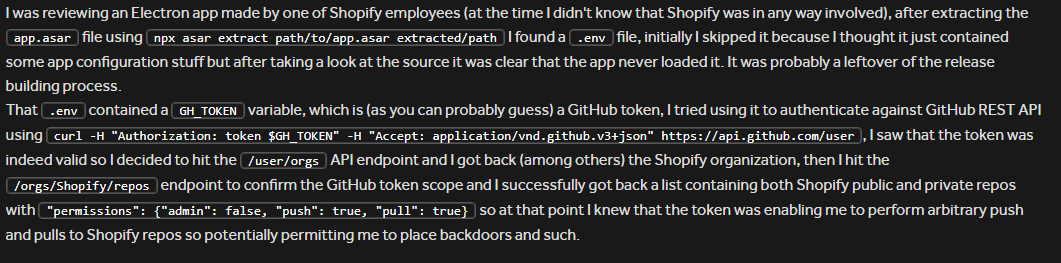

Oh god… So for reference for people who don’t know me or what I do for a living. I work as a Cybersecurity Compliance Engineer. I do SOC, PCI, ISO, and international regulatory gap assessments to name a few of my duties. But before that I worked as a Bug Bounty Engineer. Bug Bounty is essentially a team that receives vulnerabilities from security researchers (their just good hackers really) on your websites essentially.

SHOP announced that everyone had access to a new feature;

DAWN: basically open sourced GitHub repo for SHOP developers.

Which involves using HTML, CSS, and progressive Java Script.

This will undoubtedly cause some issues, not just within the possible vulnerabilites that could plague SHOP websites/developers but also on the internal management of how SHOP manages this GitHub Repo… Which they already fucked up lol. This could definitely lead to some regulatory fines if bad actors decide to target SHOP.

This is from their Bug Bounty program with HackerOne and this researcher was awarded their highest payout (being $50,000) and yeah its really fucking bad.

I’m sure the devs/IT people we have in here are laughing and thinking about their own misgivings.

Shop also announced that their investing in their Shopify GraphQL engine by by bringing their GraphQL engine to be within <50ms of every buyer ON EVERY CONTINENT. This is pretty big, I’m not sure on overall cost this will incur but again adding to better customer experience is always a nice sign to see.

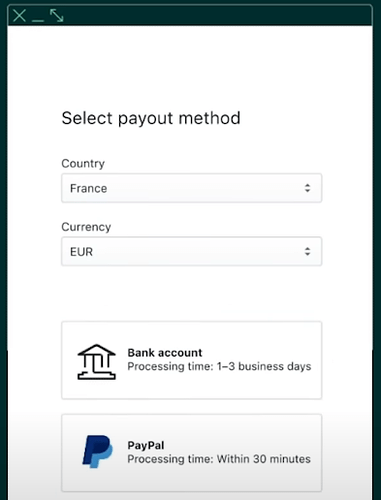

Another big announcement was that they will be allowing merchants to recieve payouts in different currencies (200 regions and many currencies) including…

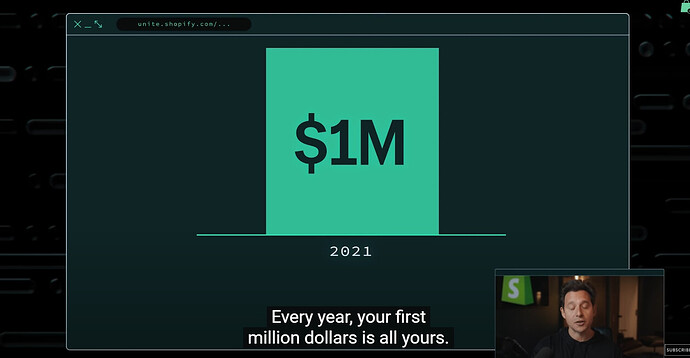

They also announced they will not be collecting revenue on Shopify apps for the first $1M of revenue earned by Shopify app developers. (This occurs every year for all apps)

Their biggest announcement is undoubtedly:

Hydrogen

To check out a little bit of what its capable of just watch this little snippet of their UNITE 2021 video:

That is really cool hahahha I’m super impressed honestly.

I won’t go into the specifics but heres their documentation on Hydrogen:

Notes:

Etrade Analyst: https://www.etrade.wallst.com/v1/stocks/research/research.asp?ChallengeUrl=https://idp.etrade.com/idp/SSO.saml2&reinitiate-handshake=0&AuthnContext=authenticated&env=PRD&symbol=SHOP

Etrade Earnings: https://www.etrade.wallst.com/v1/stocks/earnings/earnings.asp?view=revenue

Open Store idea (buying Shopify merchants): OpenStore Raises $75 Million To Acquire More Shopify Sellers, Reaches $750 Million Valuation In Eight Months

Loop Analyst Hold (based on Shop’s valuation): https://content.seleritycorp.com/hosted2/assets/www/tfqpaDFcFya74pI4UoikVrx3T7fPMp3uVZz790--Yqk

SHOP 3rd Qtr results: Bloomberg - Are you a robot?

SHOP ER chart: Shopify (SHOP) Earnings Date and Reports 2024