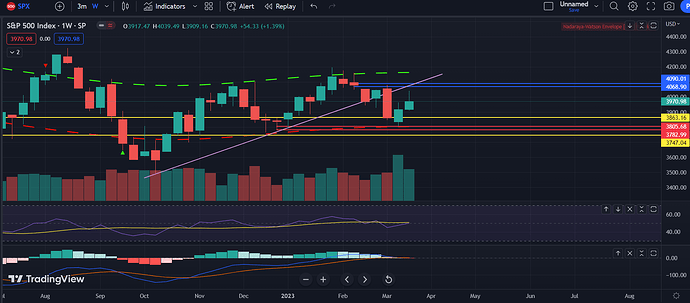

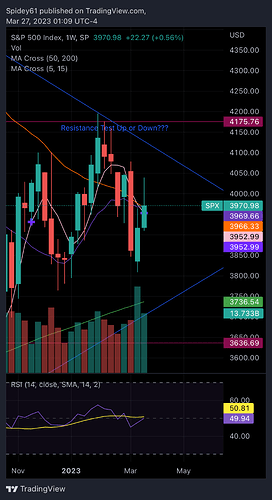

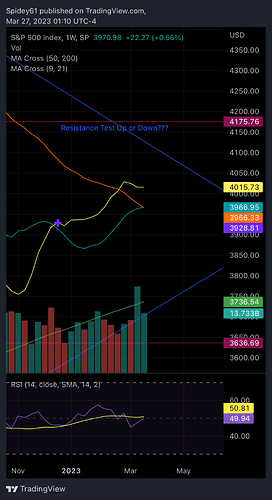

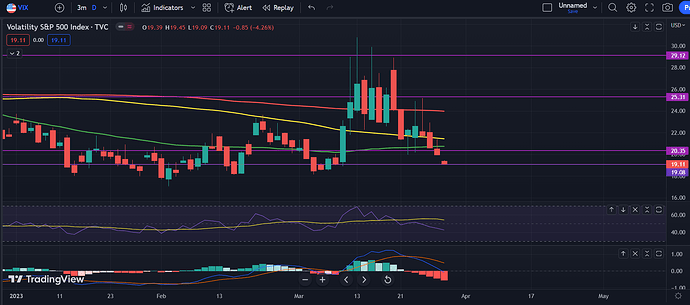

TLDR: Given the monthly candle close and the constant selloffs with increasing volume, I am kinda leaning towards more downside than a rally into more downside.

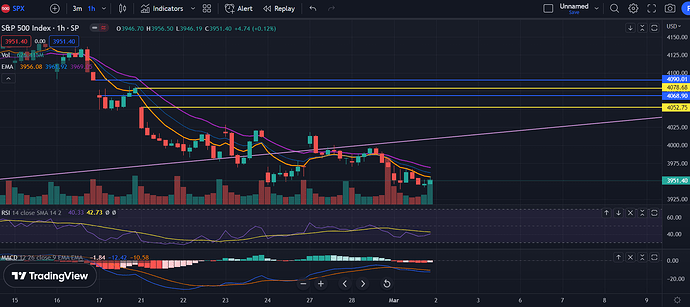

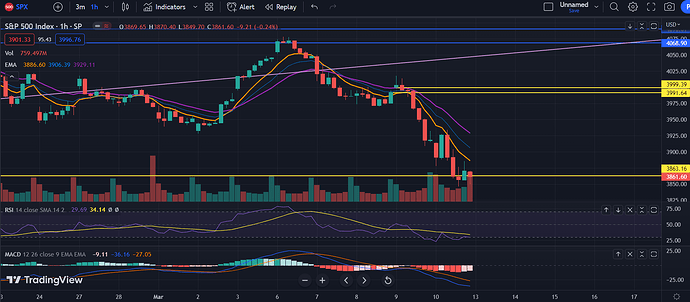

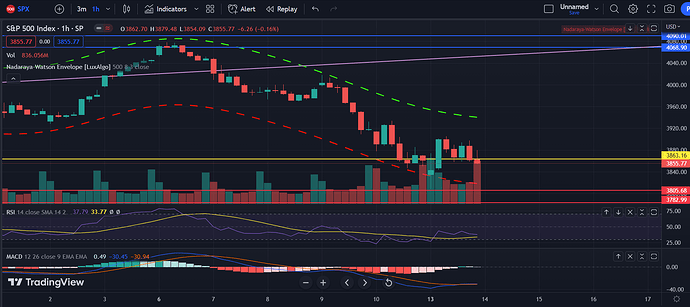

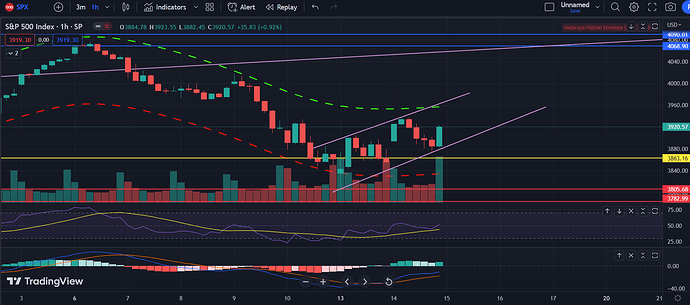

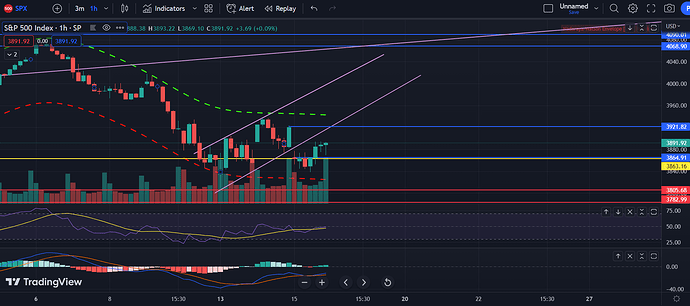

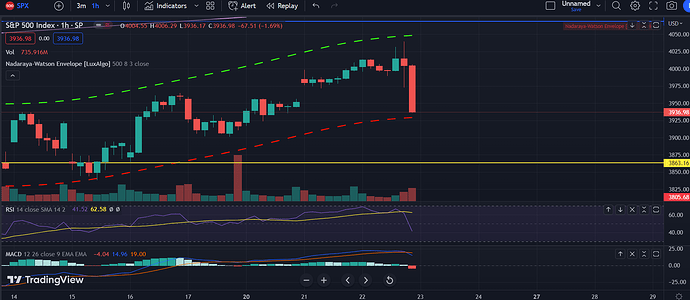

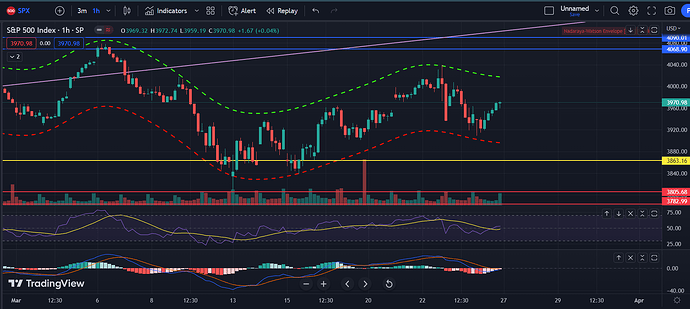

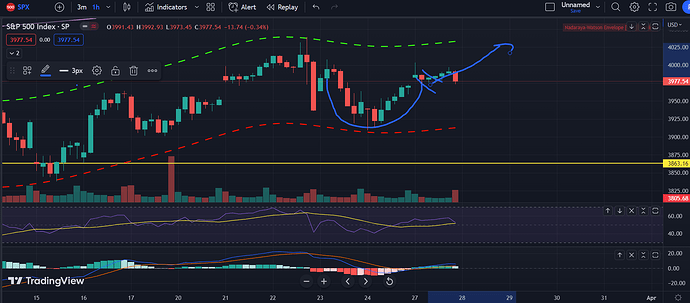

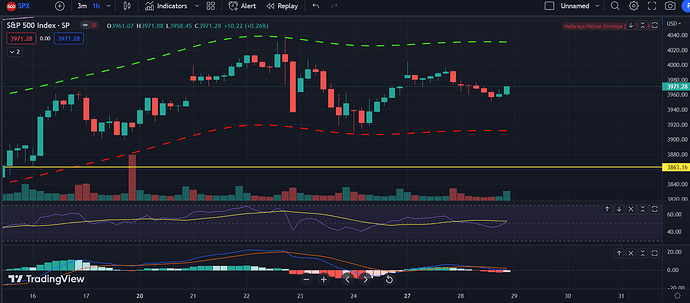

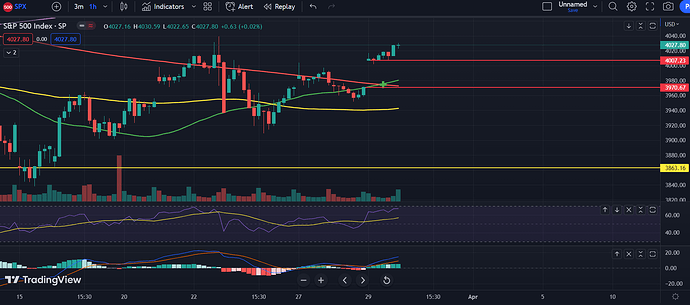

On the hourly, we see multiple bullish divergences on the RSI and the MACD. We have a bigger divergence with the previous 2 lows and another smaller bullish divergence with today’s double bottom. Seems like we want to rally up given the bullish divergence, but there is not enough bullish momentum.

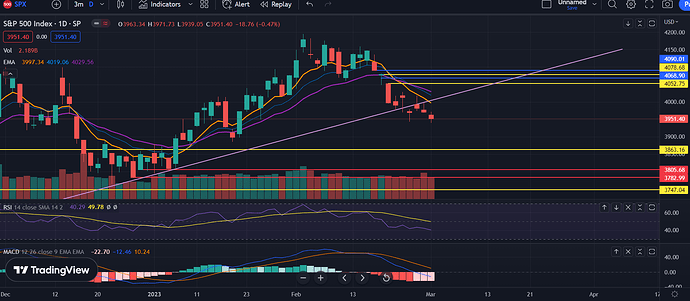

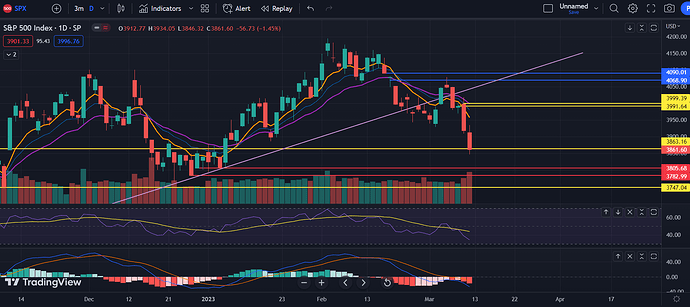

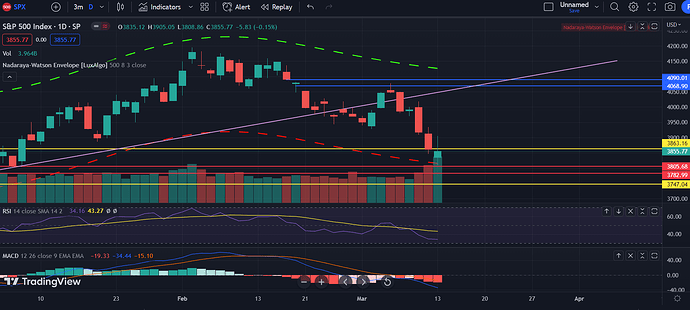

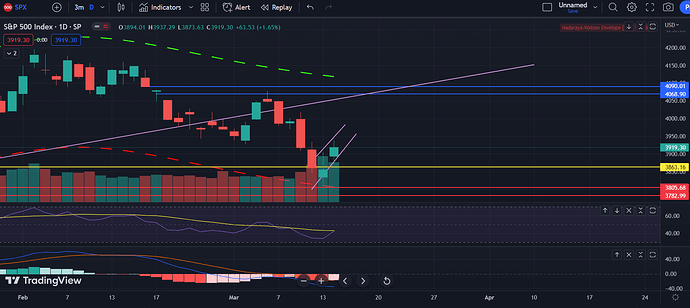

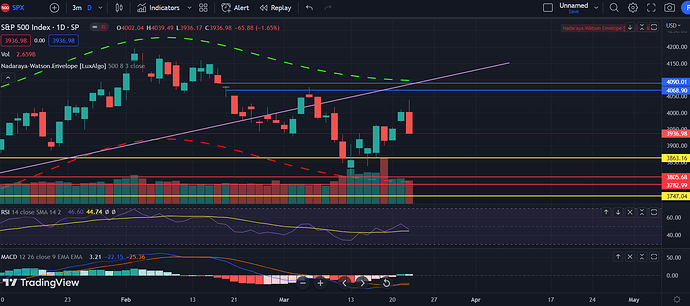

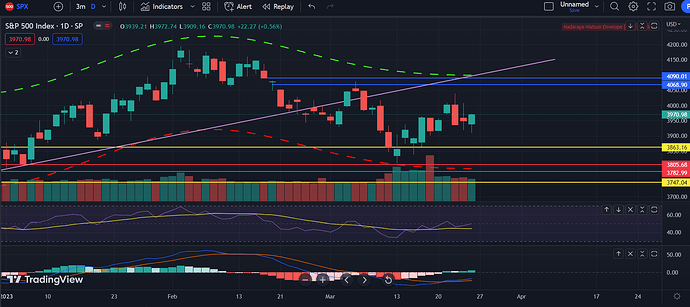

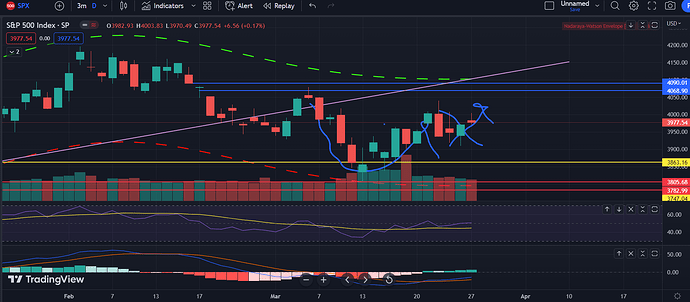

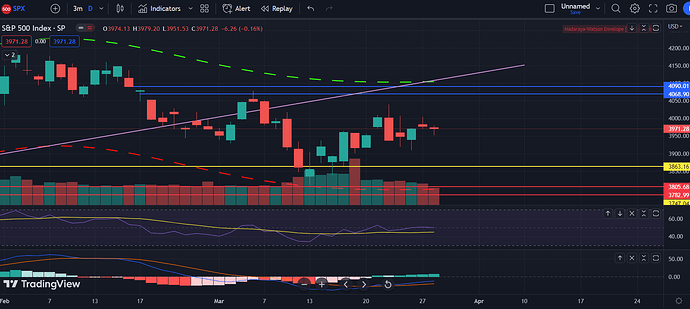

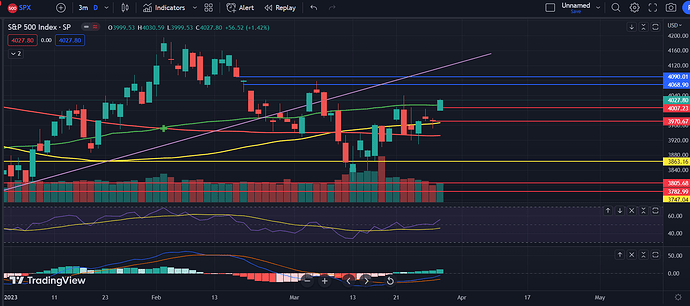

On the daily, we have increasing volume with another upwick. Seems like there are lots of buyers here not willing to let SPX fall to the ground, but there are equally the same number of bears looking to push it down. We also broke an uptrend line that it seems like we backtested and now heading lower. The RSI and the MACD are looking strong to the downside.

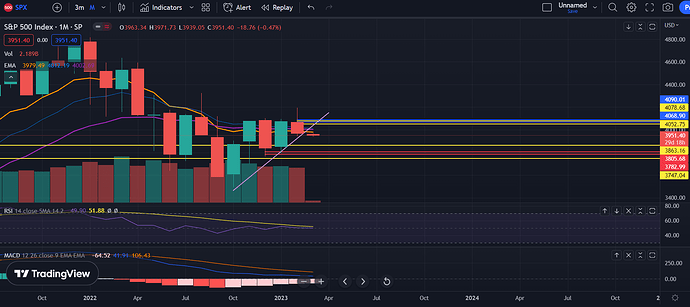

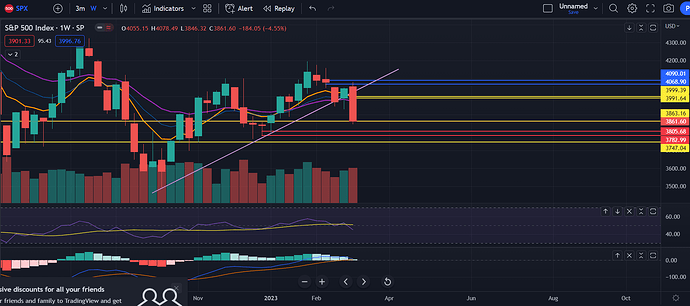

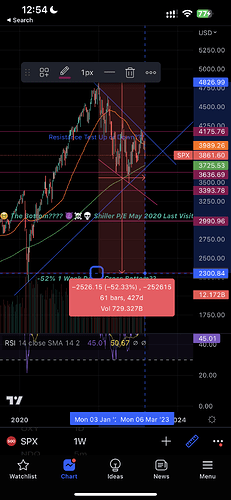

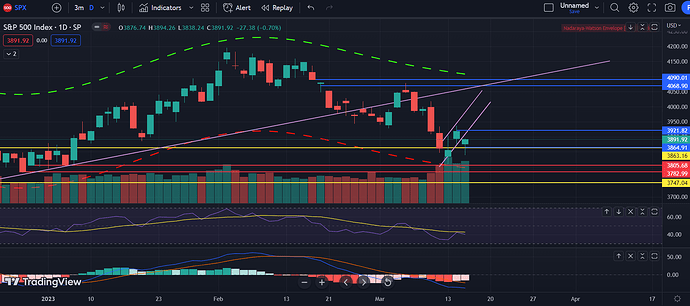

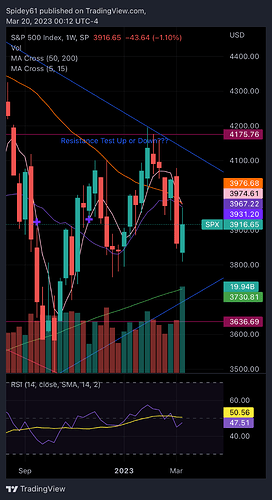

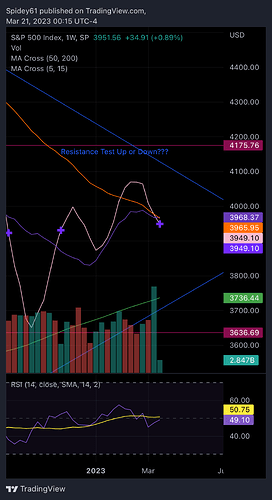

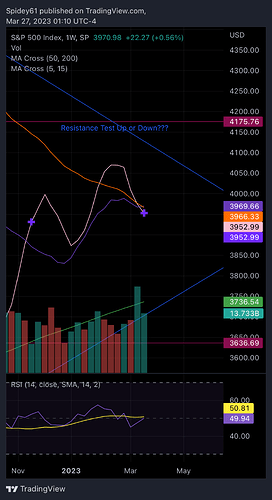

On the monthly, we had a big upwick with us ending red. On the monthly candles, we usually don’t need confirmation and stuff just happens immediately. The last time we had a major upwick with a red close, we had a huge red month. I expect a similar thing to happen here and us to have another red month.

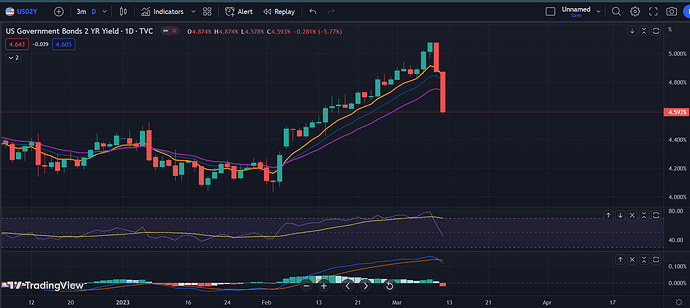

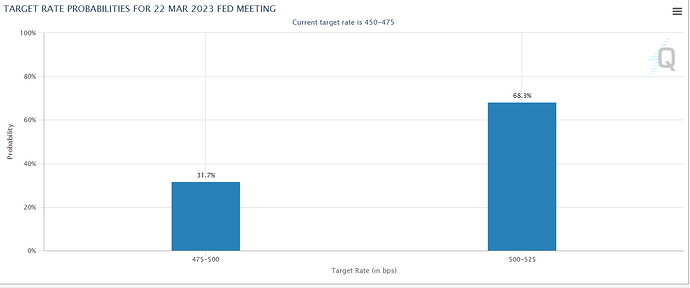

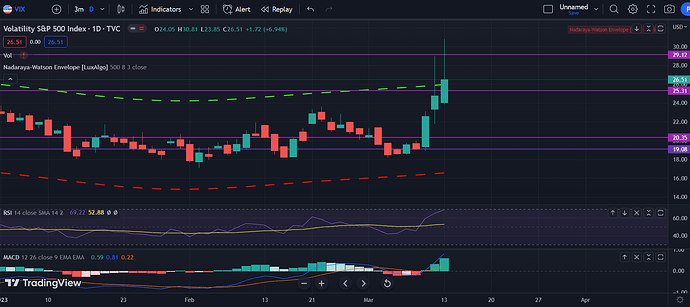

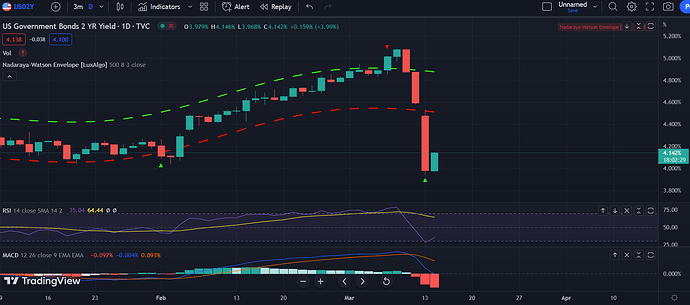

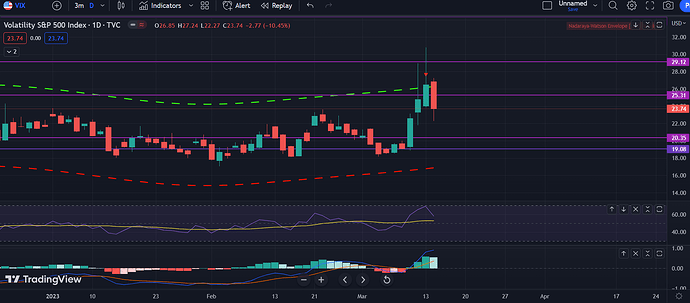

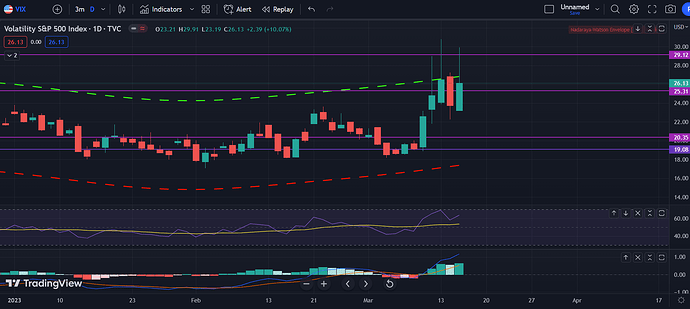

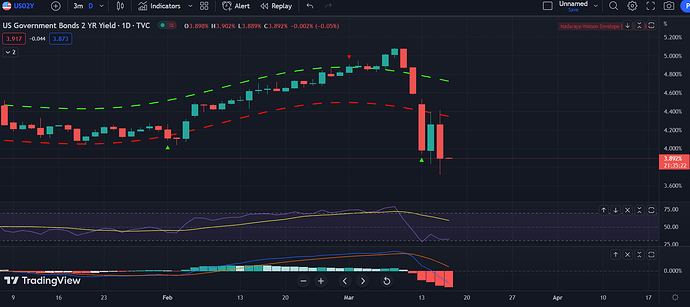

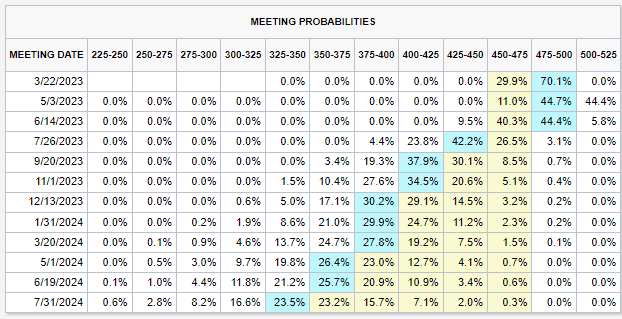

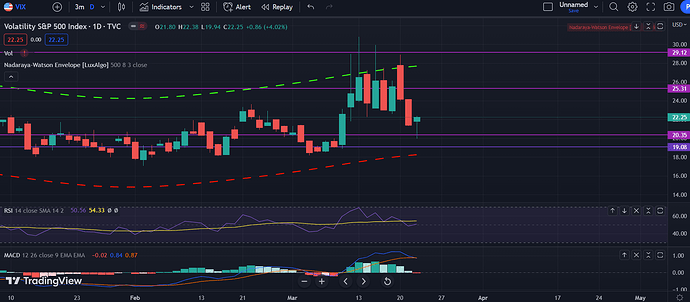

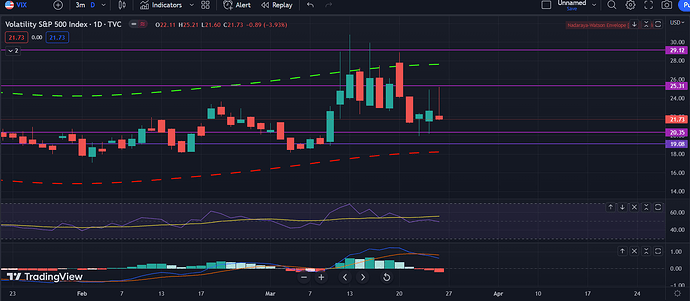

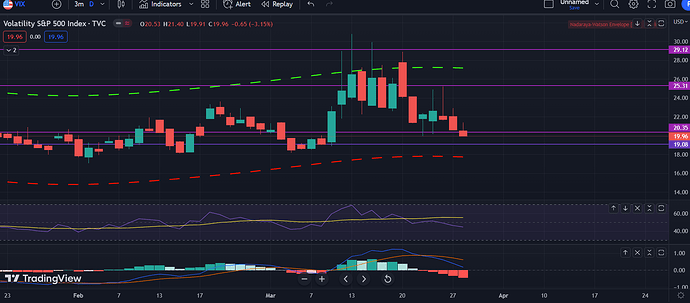

The yields seem like they’re heading upwards with strong momentum and doesn’t seem to be stopping soon. These red candles just seem like a random red candle in the strong uptrend. This will put lots of pressure on stocks and we’ll probably continue to head lower and no rallies will happen (at least big mulitple day rallies).

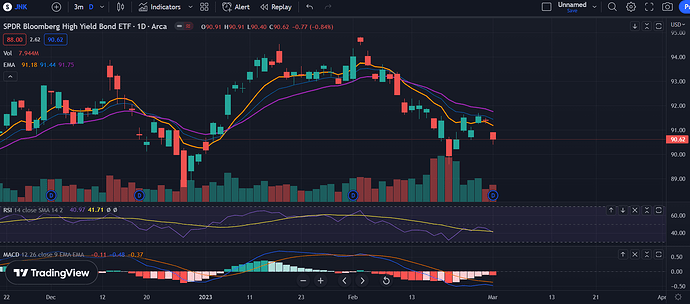

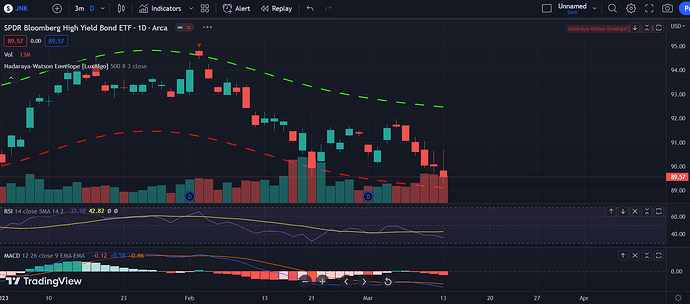

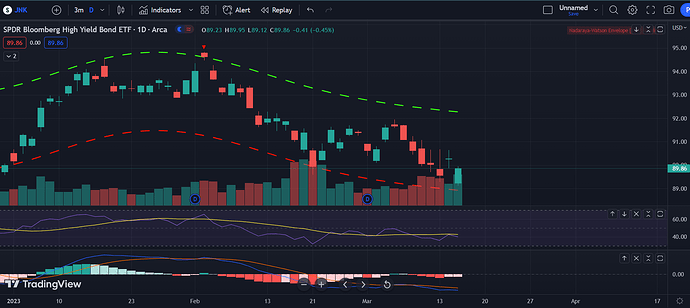

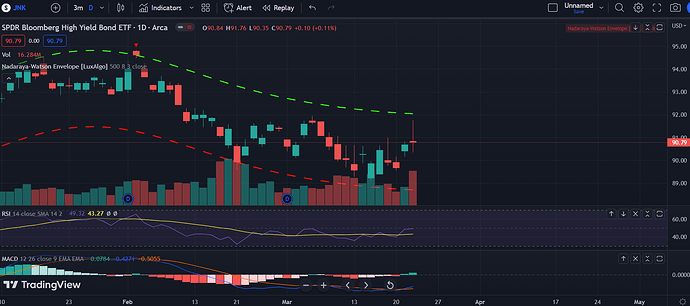

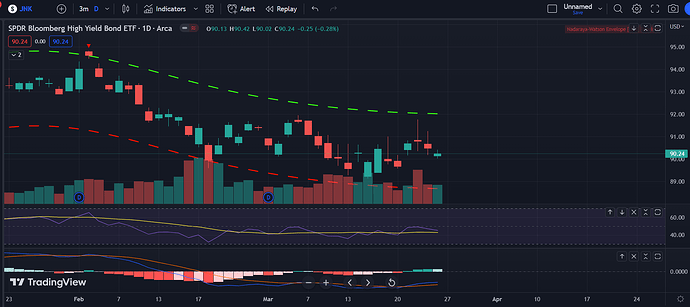

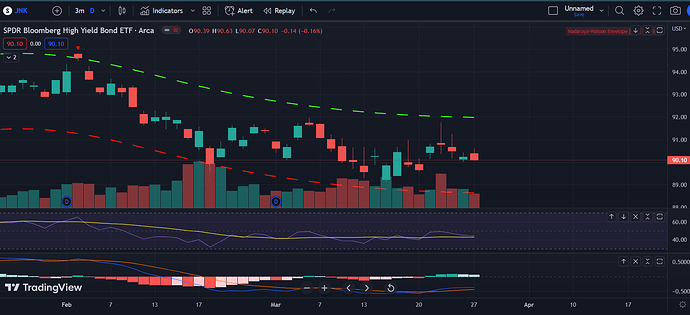

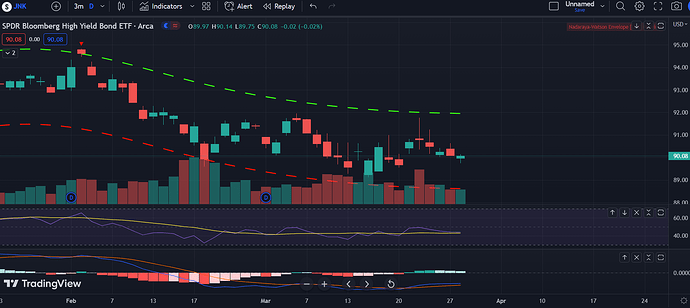

Another reason why I think that we’ll head lower on SPX without a rally is because the junk bonds are just dying now. They gapped down and seems like not slowing down to the downside. One thing to notice though, is that we are forming a higher low compared to us forming a lower low on SPX. Maybe this signals that we’re going to actually have a rally on SPX? Who knows.

Overall, I think the signs of a rally are basically gone and disappearing. I’m looking for a continued move to the downside because of no bullish momentum and increasing selling volume, combined with the very bearish monthly chart. Good luck all.