TLDR: I expect us to make new lows in January.

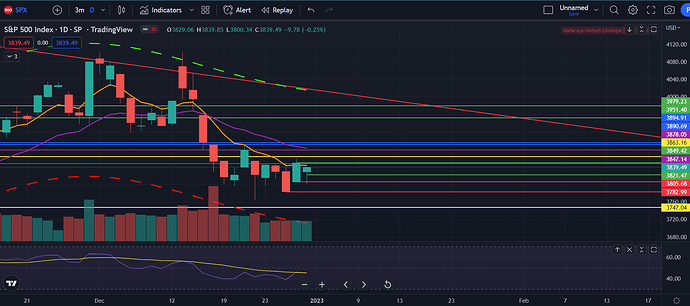

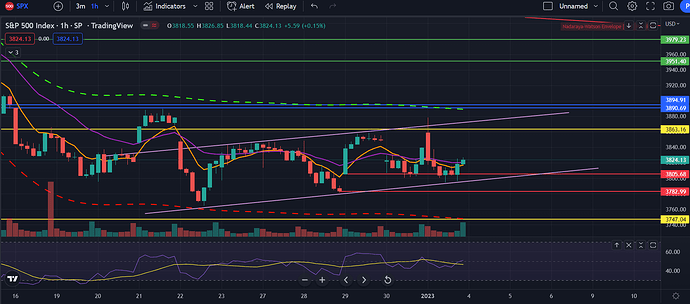

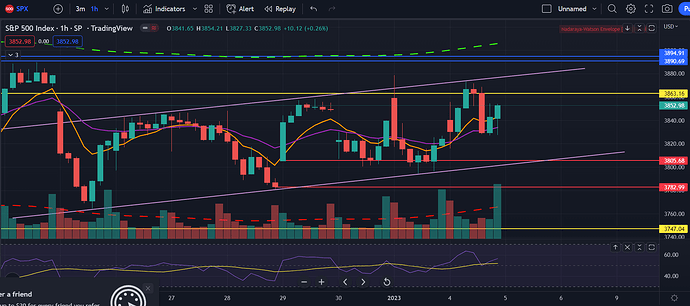

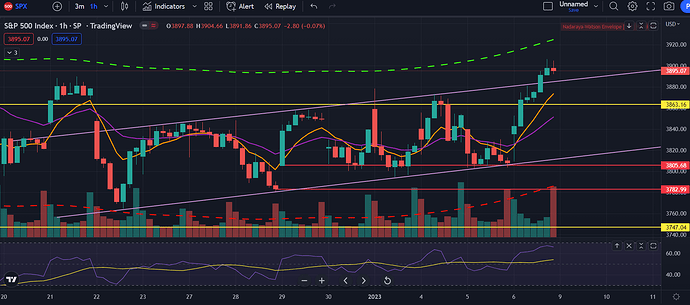

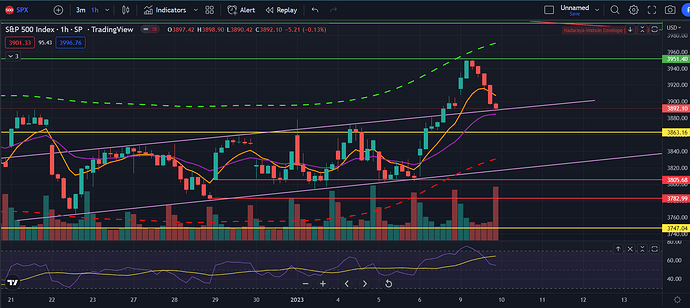

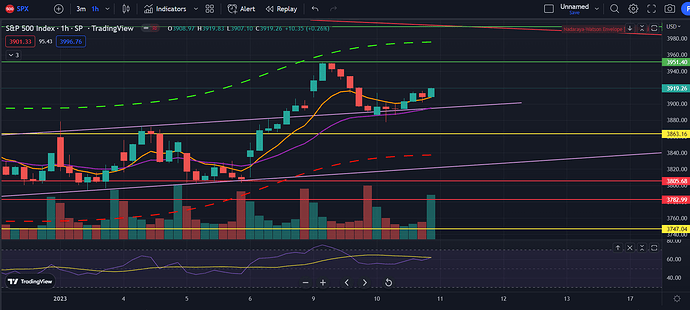

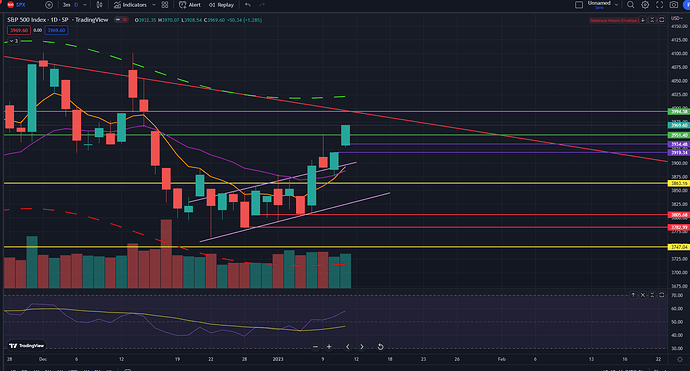

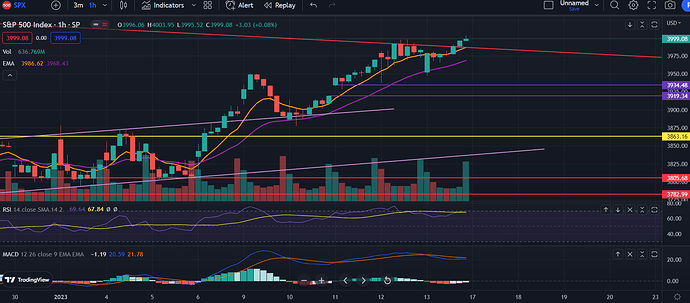

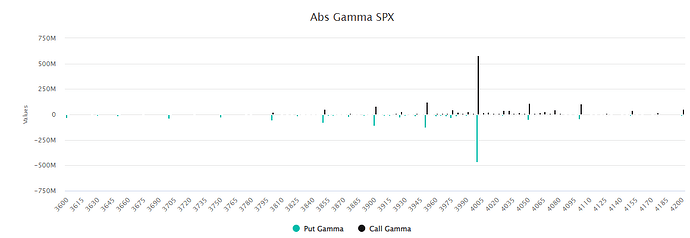

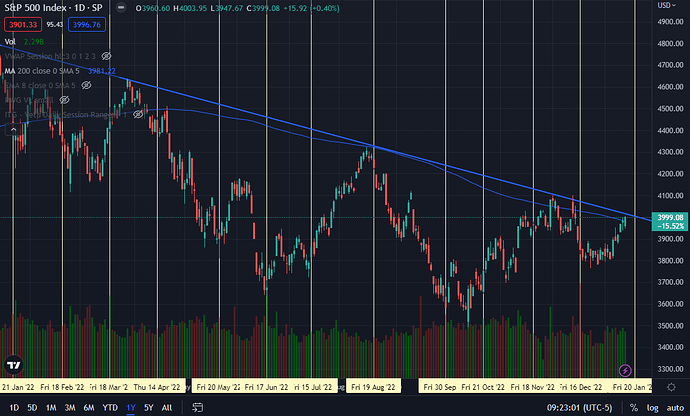

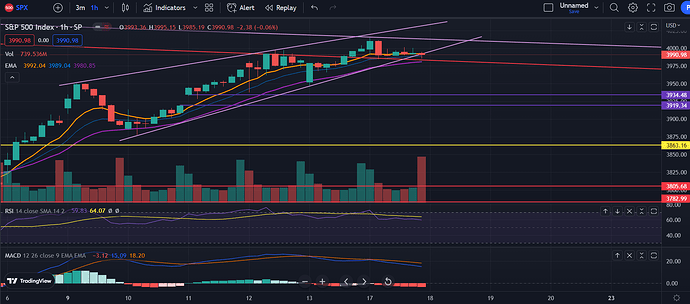

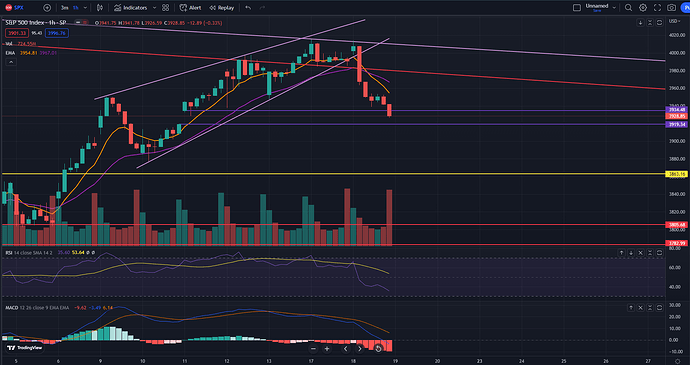

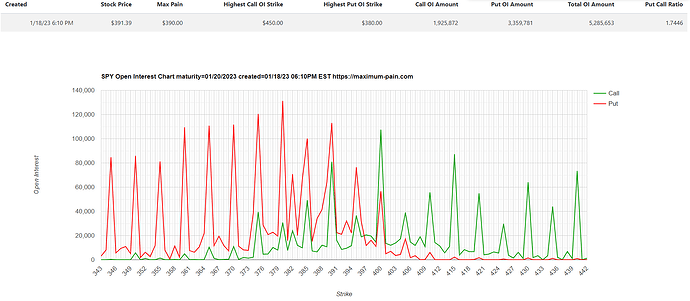

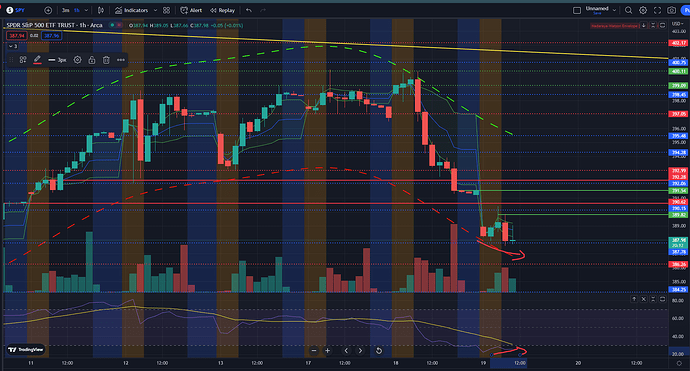

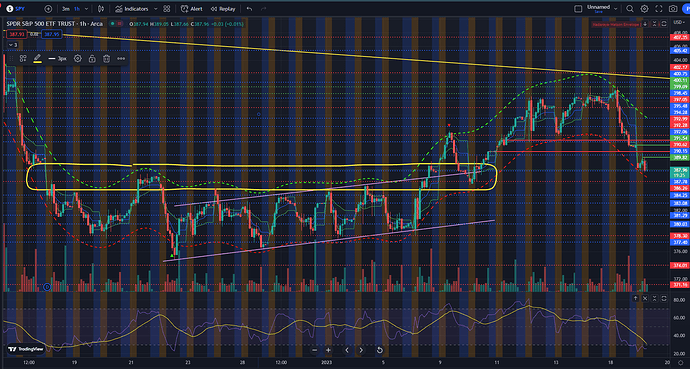

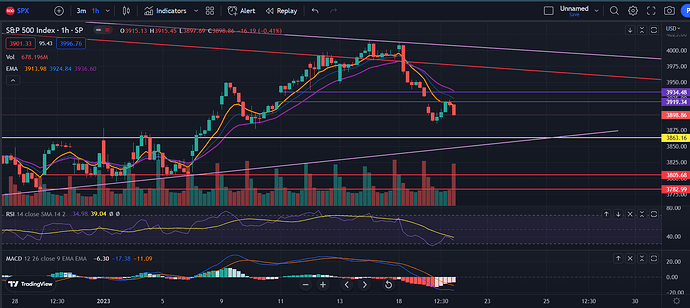

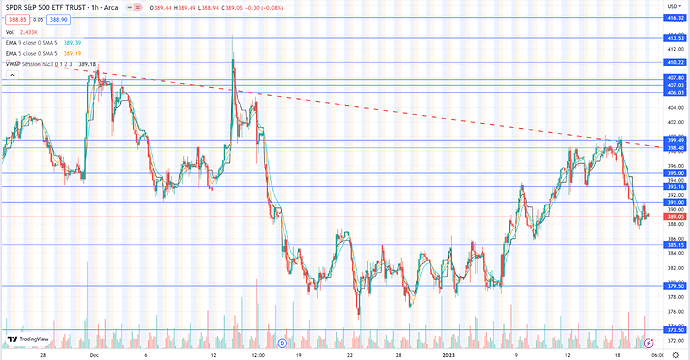

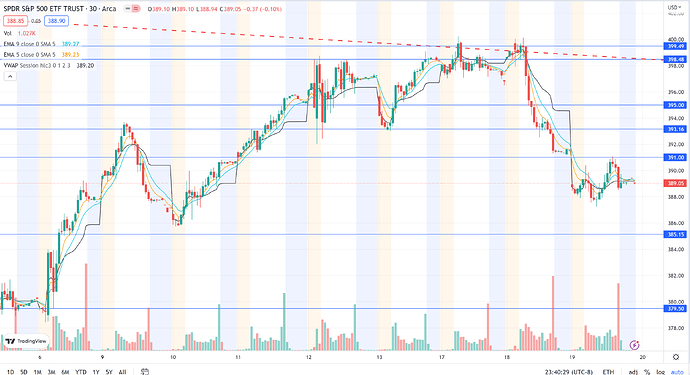

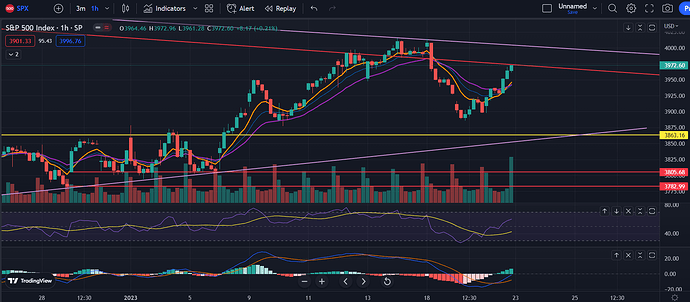

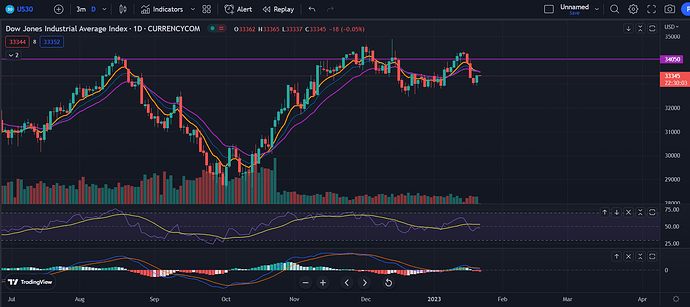

Looking at the daily chart, we are seeing some hard consolidation previously seen before huge moves. Since the holiday season is coming to an end and the options are expiring, we are most likely going to have a move after being unpinned from this level. I expect a rally honestly, looking at the Friday close’s rally and how many bottom wicks we are forming here. Tons of gaps to fill too. I expect us to rally into the FOMC minutes and then shat down, but we’ll see. I’m looking at us going to the blue or upper green gap fills for the lower high. I’m going to go pretty heavy into puts if we do rally.

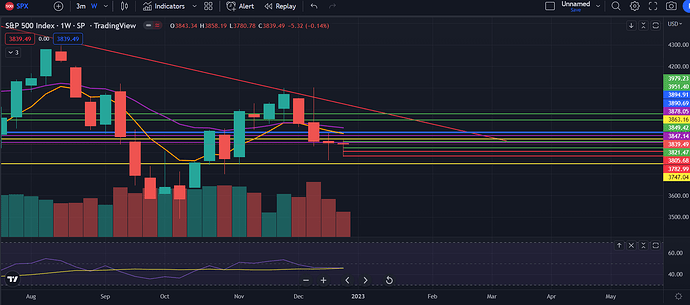

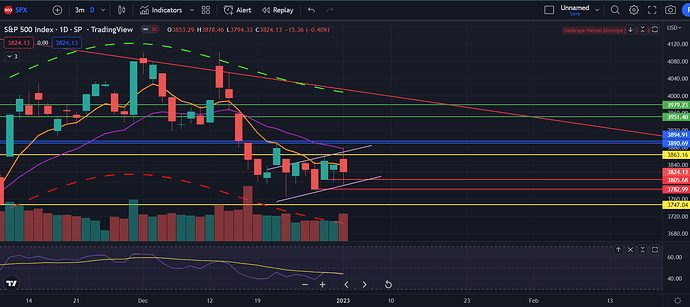

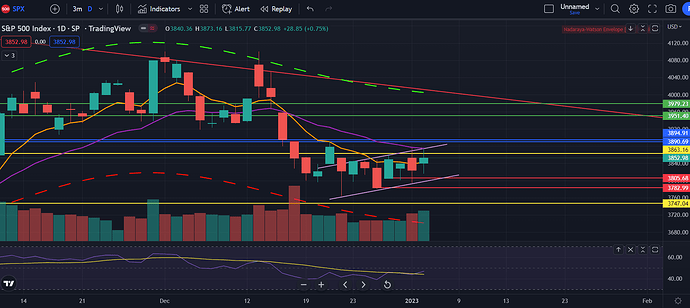

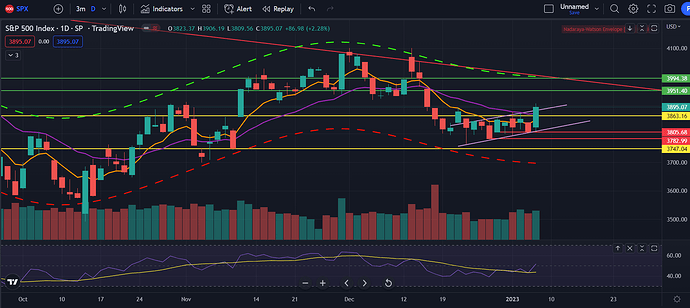

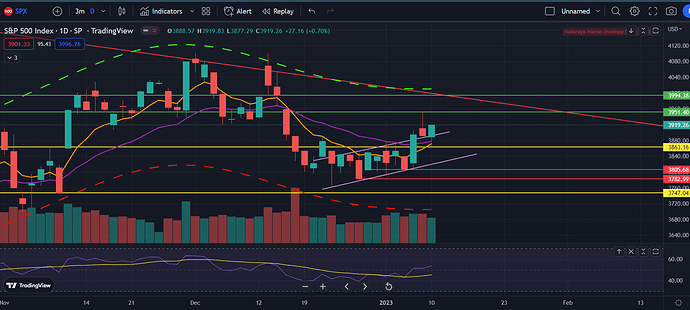

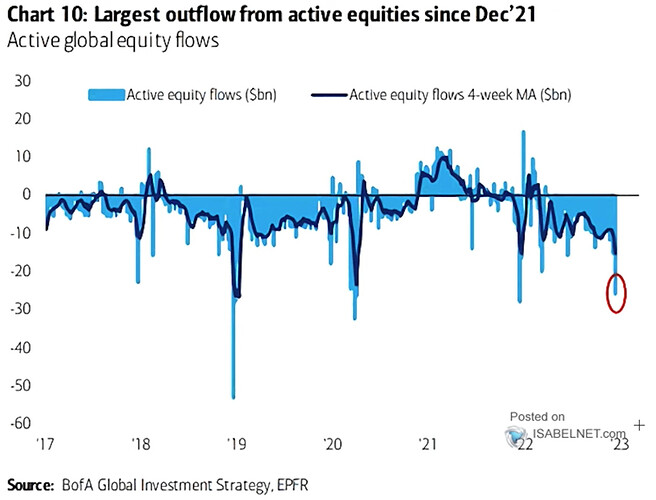

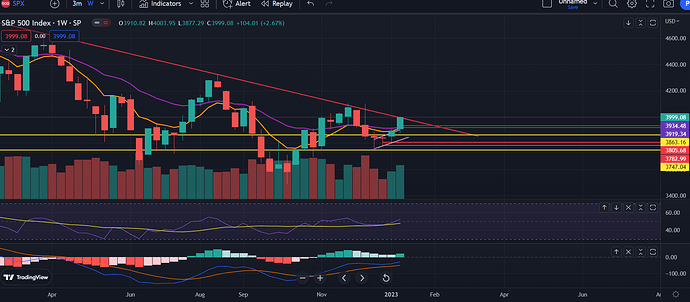

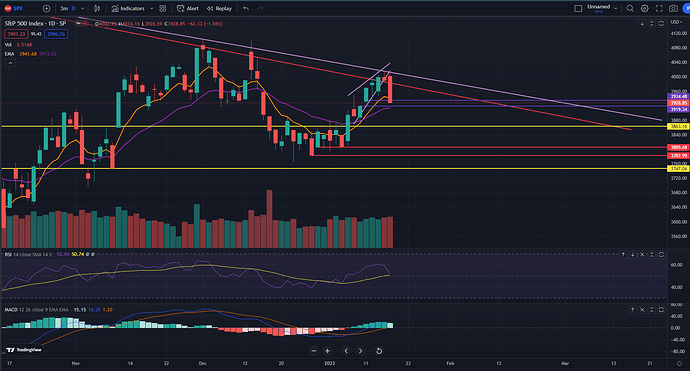

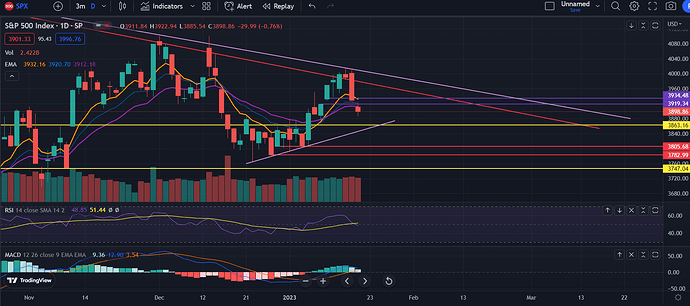

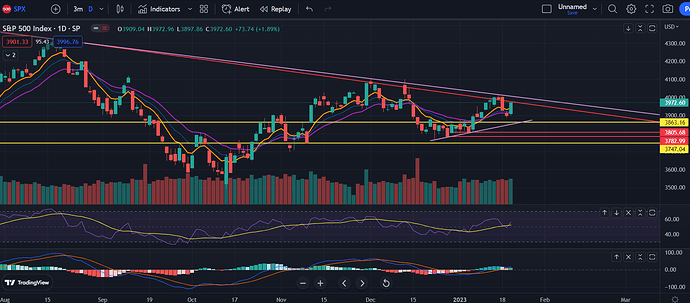

Looking at the weekly chart, I am further seeing signs of a rally. The selling volume has decreased (yes holiday season is a factor, but still something to mention). Also, we have gotten two big bottom wicks on the weekly. Shows that there are buyers here which I expect to continue to step in this week into the FOMC minutes. Maybe we reach up to the 21 EMA on the weekly and then get rejected like we ahve been doing a good amount this bear market. I do expect us to sell off on the FOMC minutes, either right when it comes out or the day after if the market short squeezes the puts and shorts on the minutes release. This is because the last FOMC meeting was hella bearish. I expect the minutes to be bearish with the mentions of continued rate hikes and holding the rates at an elevated level for a while. Whether the market rallies by only looking at the bullish points or tanks realizing that it’s bearish doesn’t really matter to me because I think we’ll make new lows anyways.

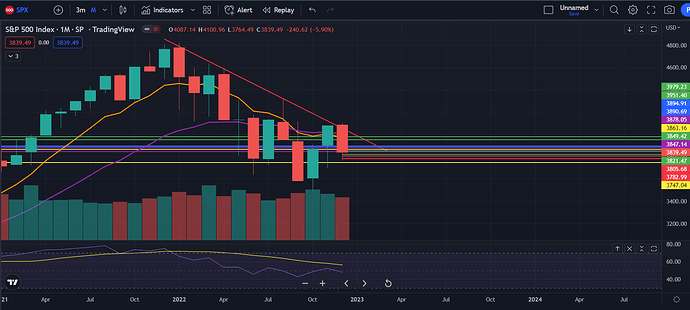

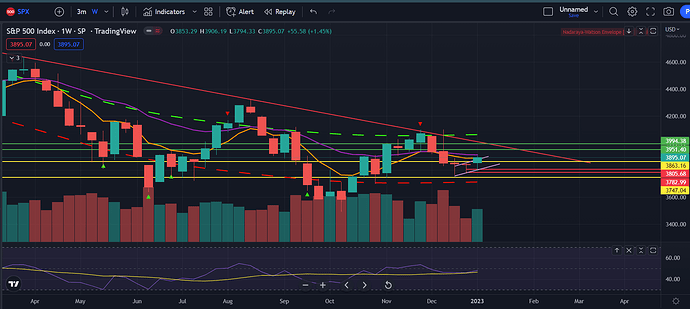

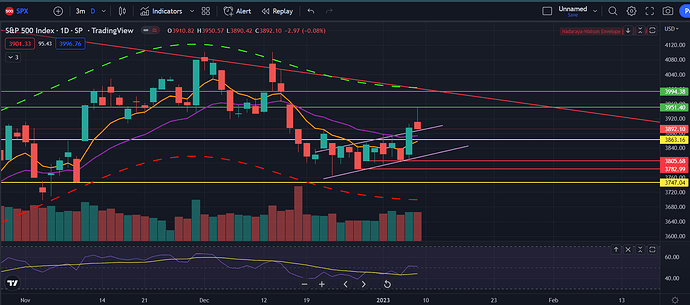

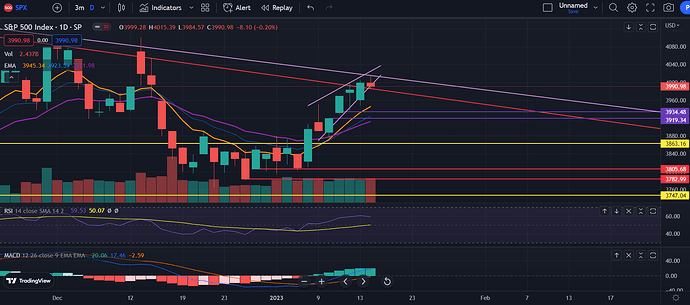

Looking at the monthly chart, we see a bearish engulfing. Basically every monthly candle that had a bearish engulfing led to new lows in the next month. I expect this pattern to continue to play out and have us make a new low this month or have a significant drop. Bearish engulfing just means that the monthly candle’s open and close is bigger than the previous candle’s body. Additionally, the monthly RSI seems to be rejecting off the 50 level which is not a good sign to see. Probably means that we have another leg to go down, but we’ll see if we form a bullish divergence or something.

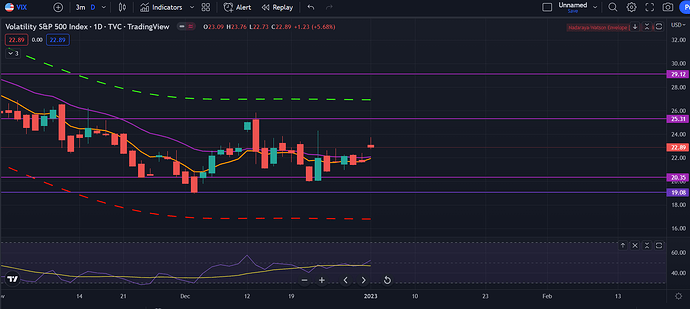

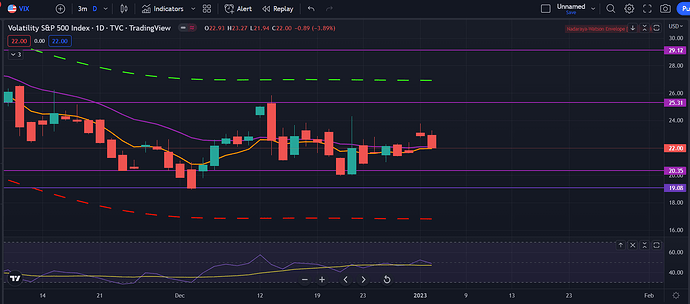

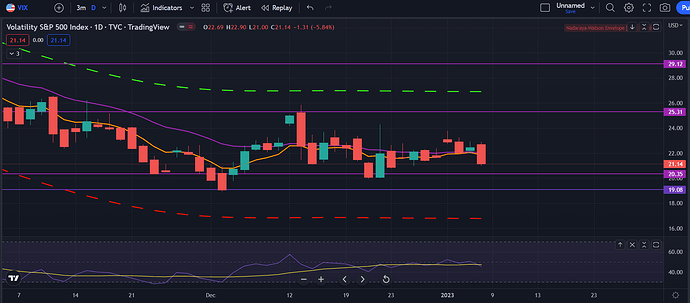

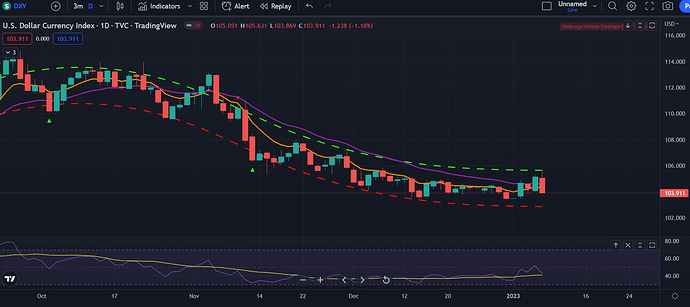

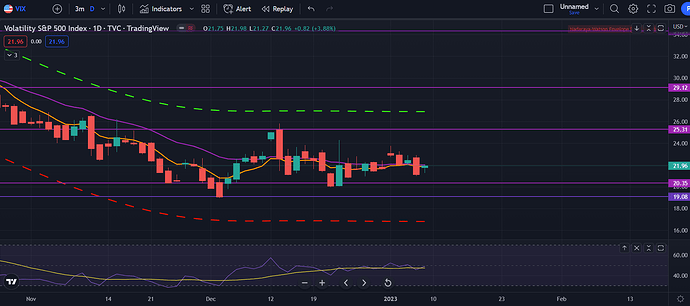

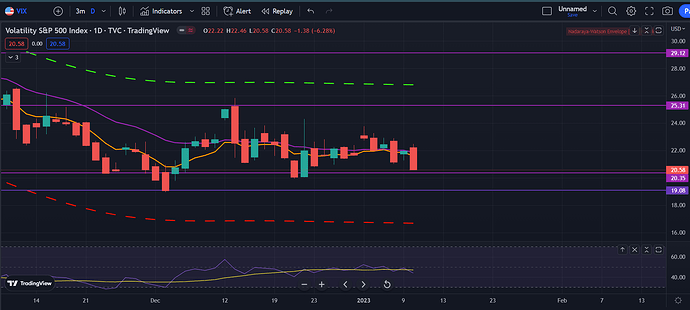

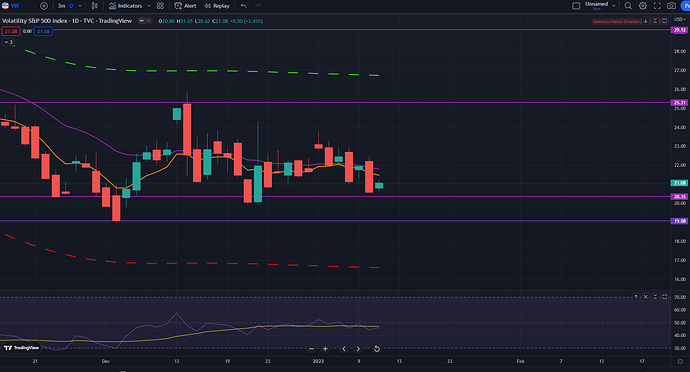

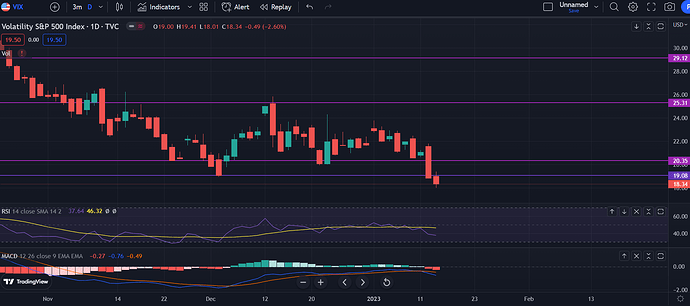

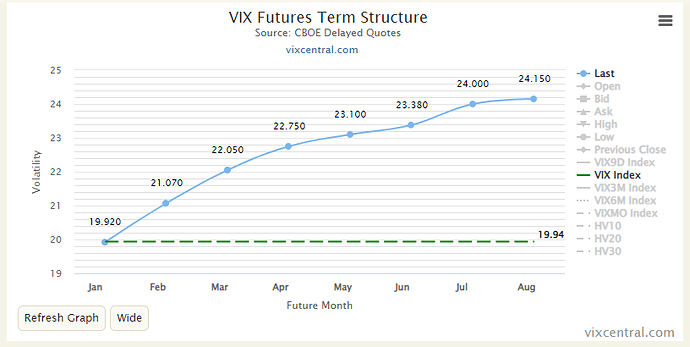

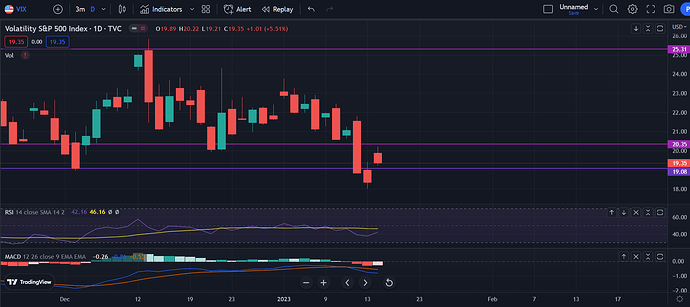

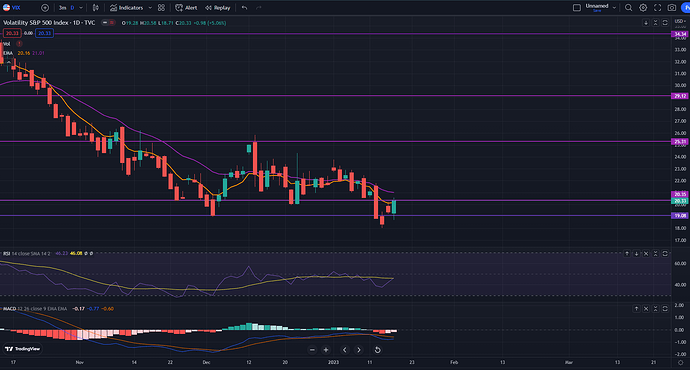

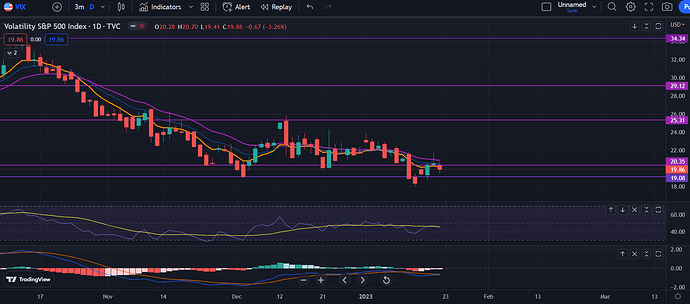

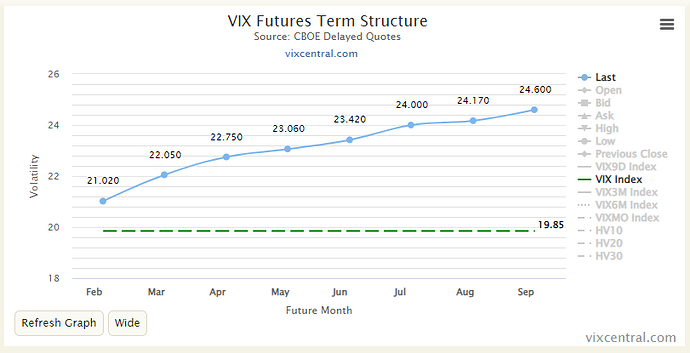

The VIX is dicking around to the right so I won’t mention it, but once it explodes, I expect it to be a hella violent move upwards. I’m personally looking to ease into UVXY calls starting Tuesday close or Wednesday. The dollar is on a slow bleed downwards, but we’ll see if it starts to turn upwards and put pressure on the markets.

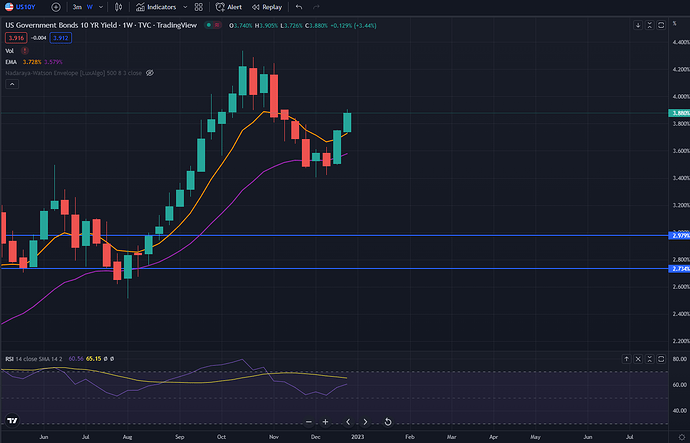

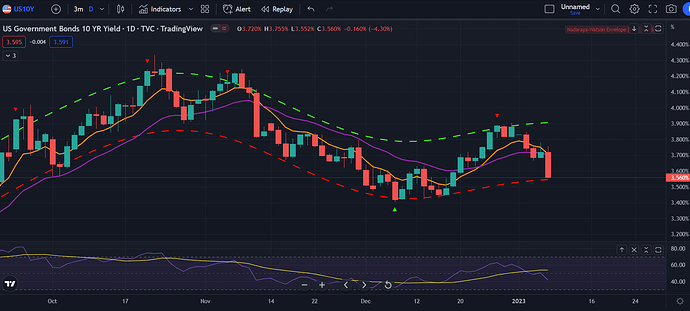

Another thing that makes me lean to the bear side for the month ahead are the yields. The 10 year yield has been soaring higher. This will keep putting pressure on the markets and help push the markets down further.

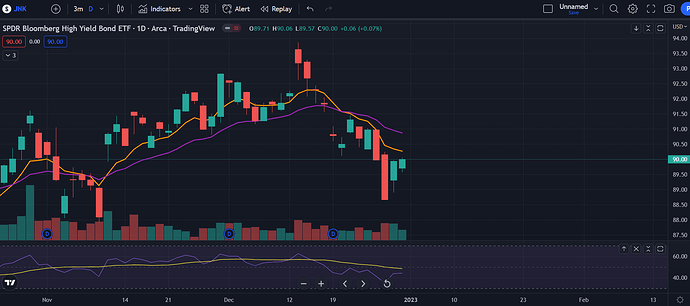

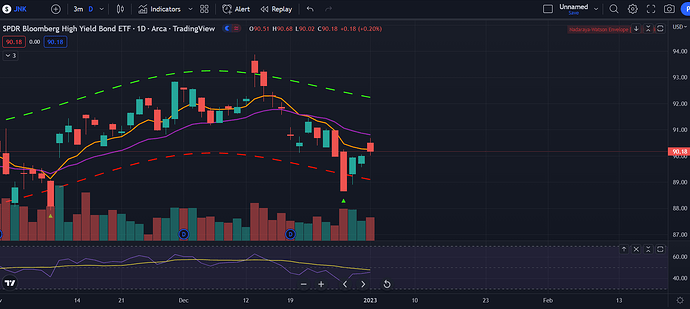

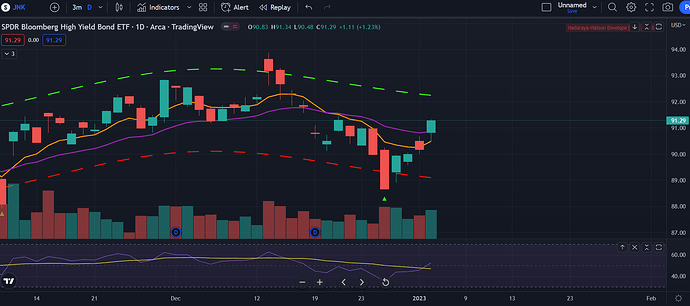

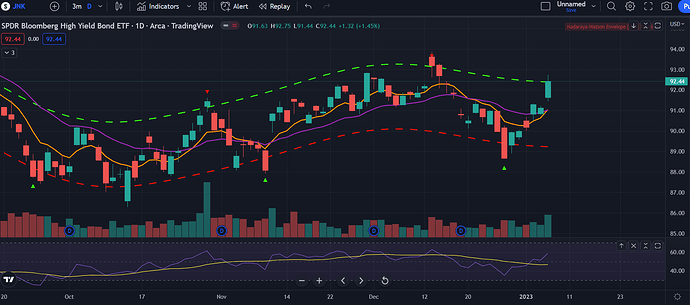

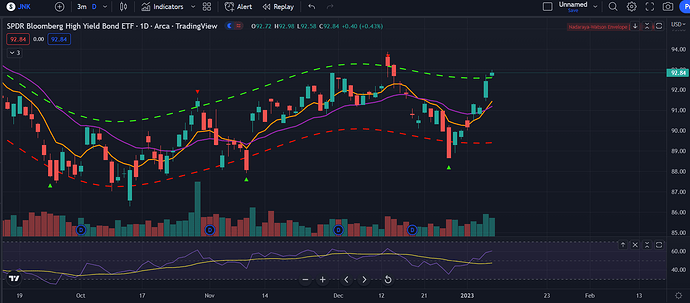

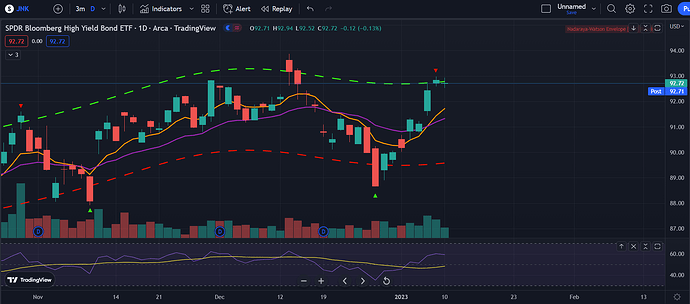

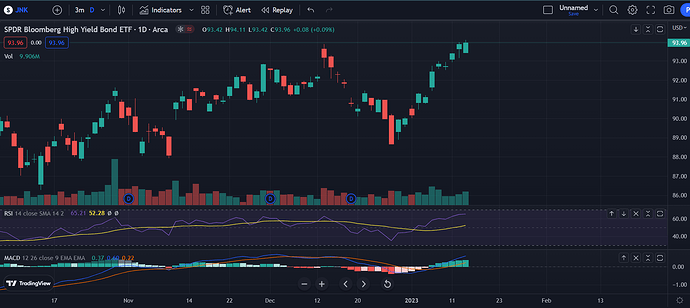

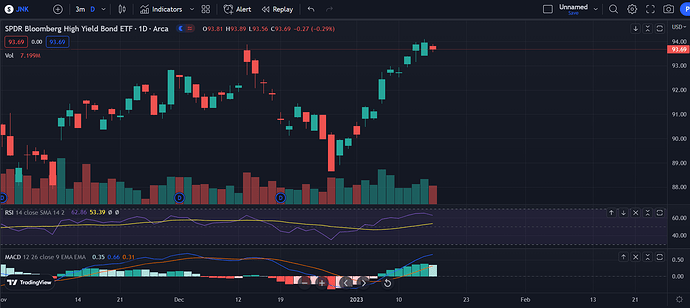

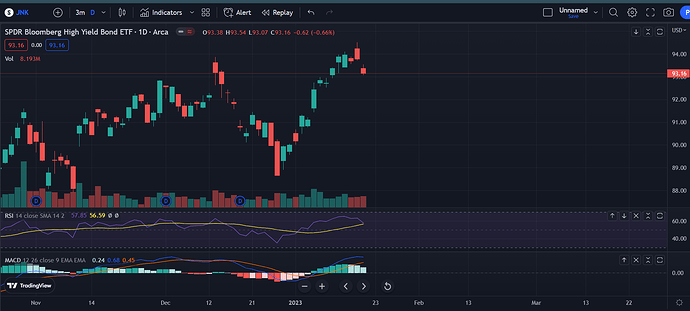

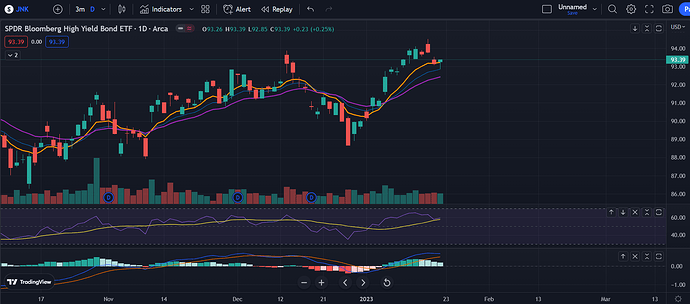

Adding on to the yields moving up, the bond market is getting hit hard right now. I focus on the junk bonds (JNK) or high yield bonds (HYG) since they show the underlying health of the markets since these are the risk on assets. The junk bonds moved down a ton, forming a lower low, which makes me believe that SPX will follow and have us continue to make lower lows too. But, the JNK on the last 2 days has formed some bullish signs with a gap up and then making a new high and closing at that level. I think this signifies that we’ll probably have a rally if these risk on assets are being bought, but we’ll see.

Overall, I expect a rally leading into the FOMC minutes and then have us get completely shat down for the next leg lower. We’ll see if we bottom there and rally upwards to a better 2023, but I think there is a great opportunity for money making upcoming on this leg lower. Whatever plays out, I’m expecting a leg lower and an entry for puts. Happy new year and I hope everyone makes money this year.