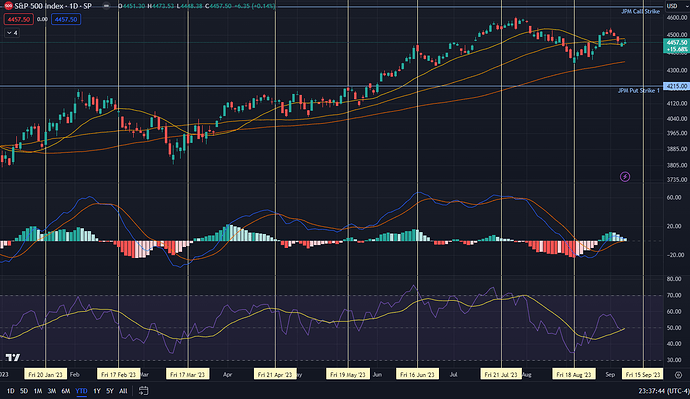

Don’t really have a strong feeling going into next week. Technically option flows should be supportive, but we’re quite below the vol trigger (4495), closing Fri at 4457. More importantly, CPI Wed PM, and that will likely set the tenor from then onward than anything else.

Nevertheless, it’s good to go into the week with some market awareness.

SPX is kinda muddling around between the 20SMA and 50SMA, and just retraced back the JOLTS green dildo. We have a lower low, but this seems inconclusive.

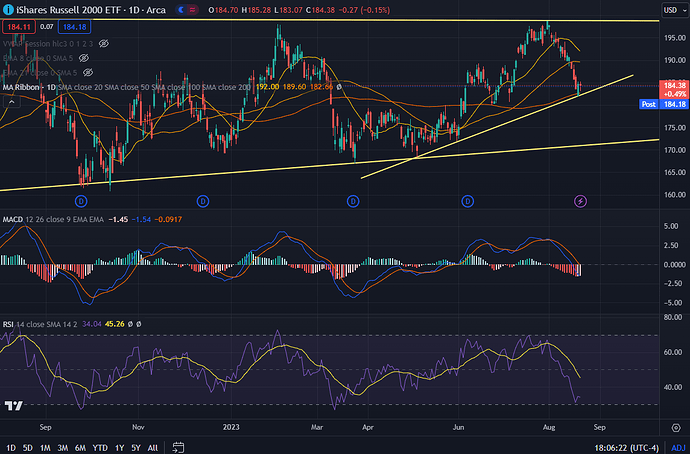

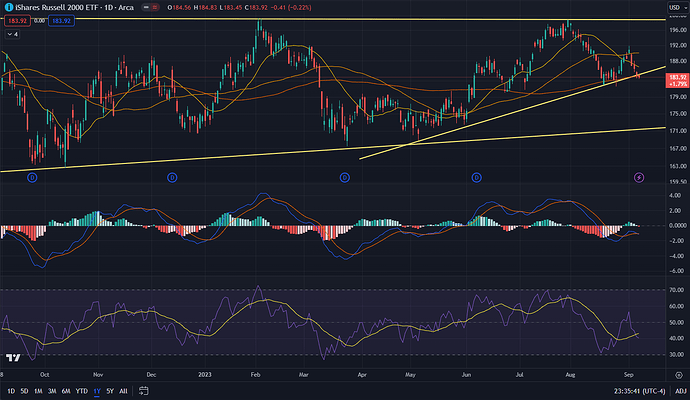

IWM is more interesting. 20 days ago, we wondered if it would bounce off the trendline and moon, or if it would be a H&S pattern. Turns out it did the latter very clearly. This is bearish.

Spoiler: IMW comment from 20 days ago

Also interesting - IWM (the real-economy companies) - bounced right off its 100SMA and trendline. Nice supportive move there. Shall we see IWM go back to the top trendline, or will it form the second shoulder and resume its move downward? Will be watching this closely.

NDX isn’t showing anything that different from SPX.

Underneath this all, there’s the heavy quarterly option structure, expiring on Fri. It shows surprisingly strong gamma levels at three strikes - 4400, 4450 and 4500. Can’t say I have seen it before. Movement should be sharp between those levels, given negative gamma, snapping to those levels acting like magnets.

Let’s touch base again Wed morning, after we have the CPI print, to see if we can have a better sense of up or down.