Green day. Likely a combination of post-opex dehedging of all them puts (see #2), and a general breather after a sustained 3 week fall.

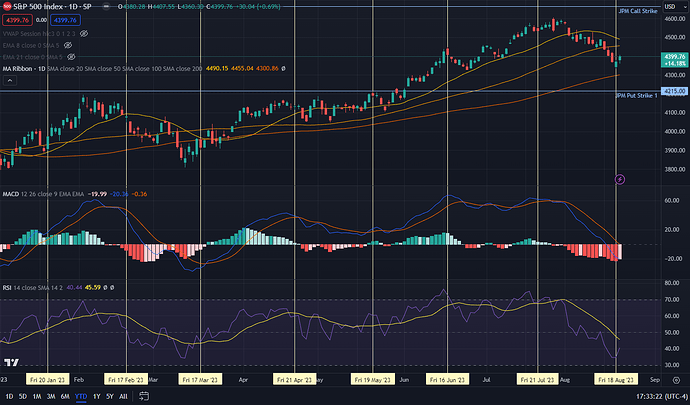

Given that we just had opex, flows won’t really matter for now, so we can look at option positions mostly for signalling purposes. We started the day with call wall at 5000 (![]() ) and put wall at 4300 (also

) and put wall at 4300 (also ![]() ) so not really helpful for signalling either. Vol trigger was right at 4400, which is where we ended the day, but again, all that positive/negative gamma shouldn’t really be coming into play yet.

) so not really helpful for signalling either. Vol trigger was right at 4400, which is where we ended the day, but again, all that positive/negative gamma shouldn’t really be coming into play yet.

Other signals are somewhat confusing. Bonds fell (yields rose) pre-market but was mostly flat for most of the trading day. VIX didn’t move much either, and neither did DXY. Almost like everything is in a holding pattern.

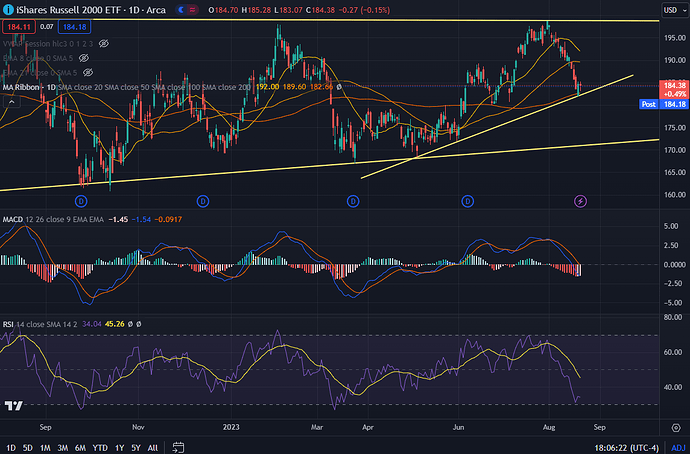

Also interesting - IWM (the real-economy companies) - bounced right off its 100SMA and trendline. Nice supportive move there. Shall we see IWM go back to the top trendline, or will it form the second shoulder and resume its move downward? Will be watching this closely.

For now … barring major 0DTE action, its possible the market moves up to where the 20SMA and 50SMA will meet, around 4450. Possibly by end of day Wed, when NVDA earnings are released. Not to overplay the significance of this too much, but it could signal sentiment for the entire market - bullish or bearish. Will therefore read tea leaves again on Thu.

Note that Jackson Hole is Friday, and there is event vol associated with it. If JPow does not spook markets, this will also help push markets higher after. Between NVDA and JH, we could have decent clues on what happens next week, too.