@Yong , took the liberty of starting the SPX thread. The title is not nearly as colorful as your other ones ![]()

A few quick thoughts on the markets:

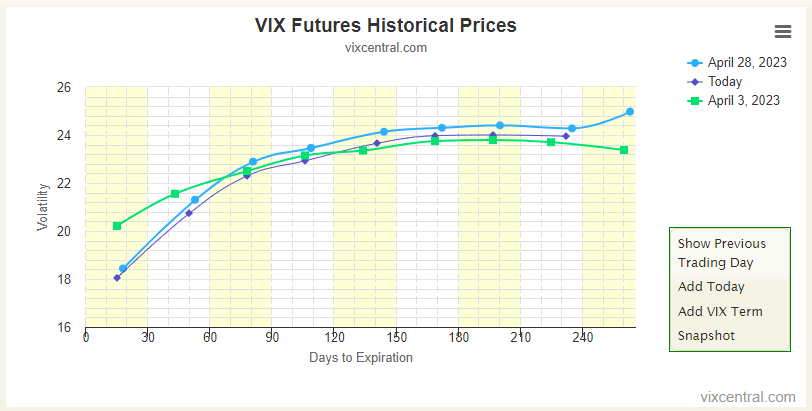

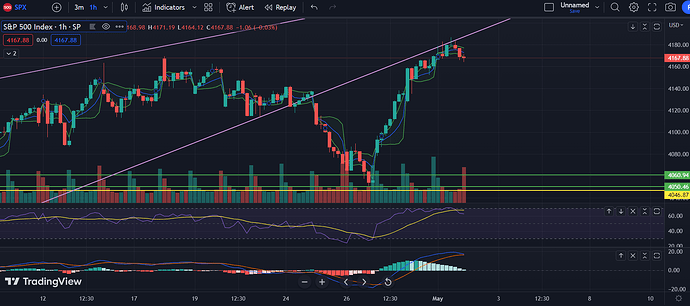

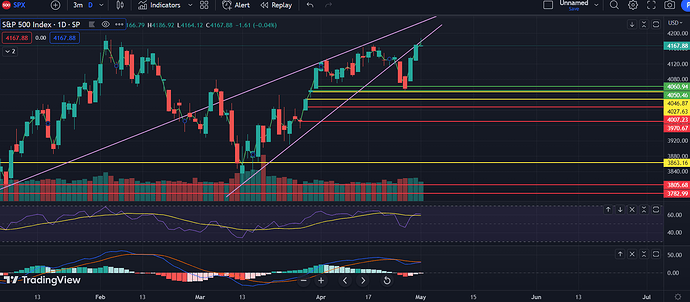

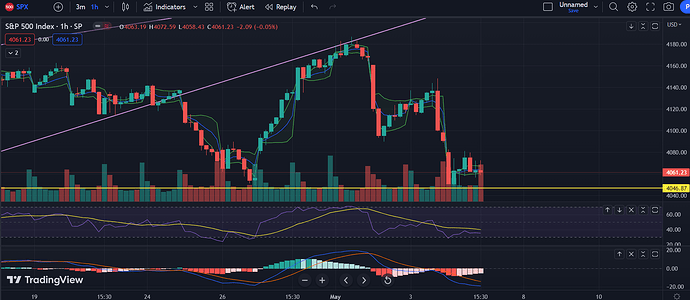

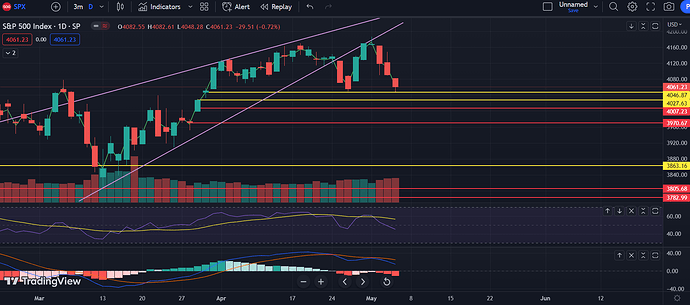

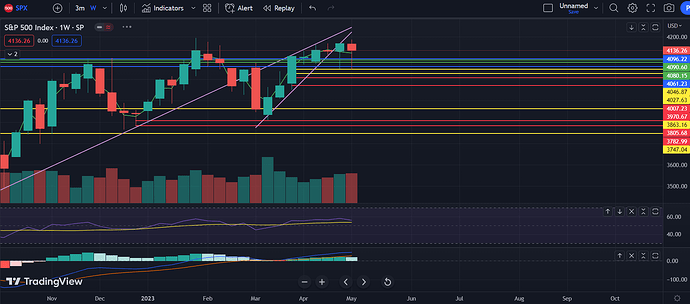

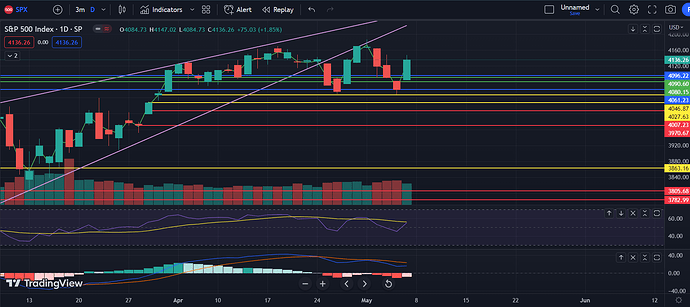

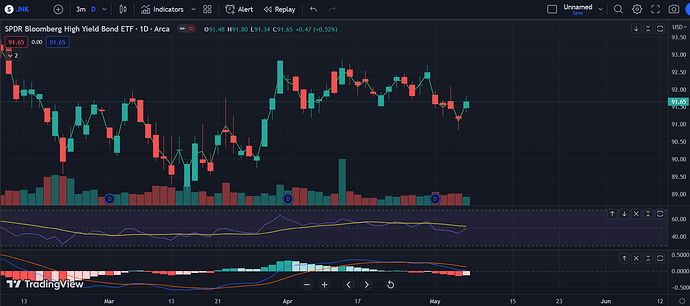

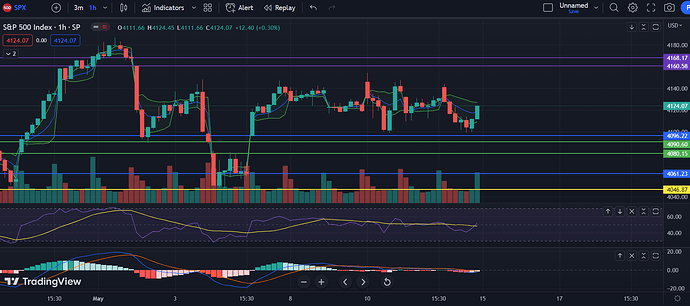

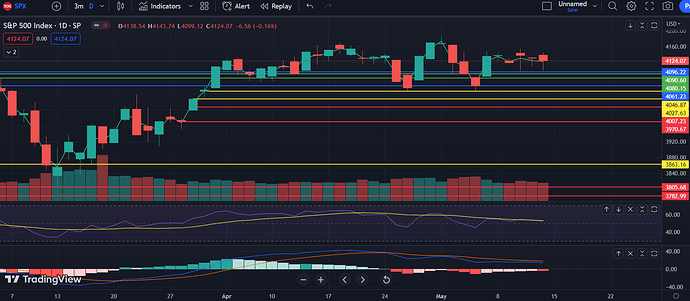

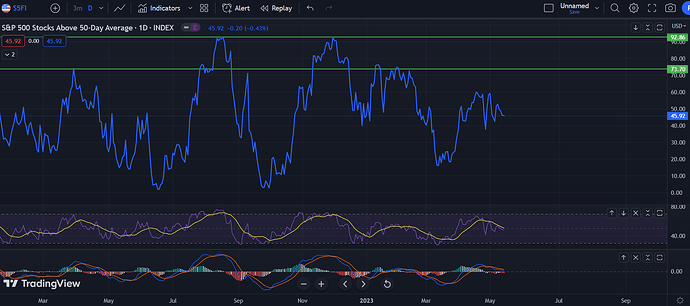

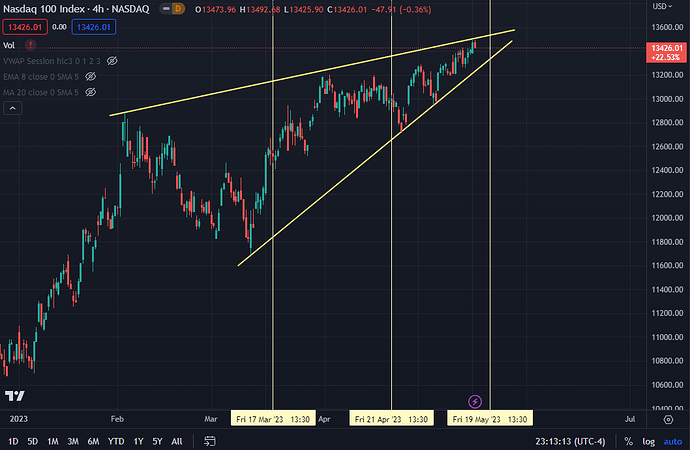

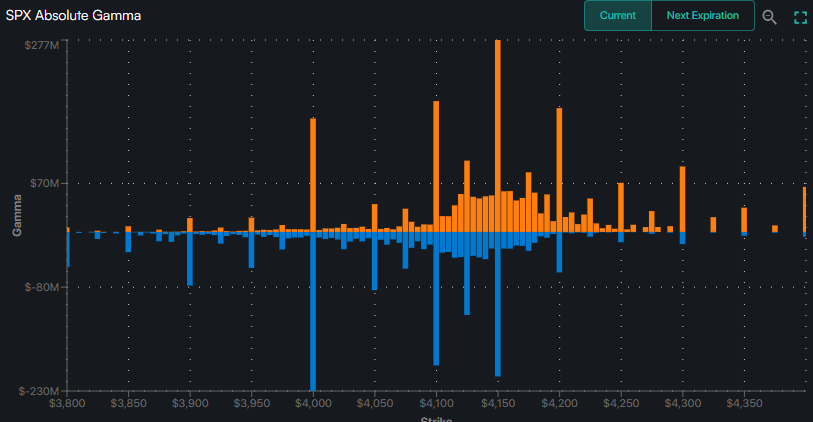

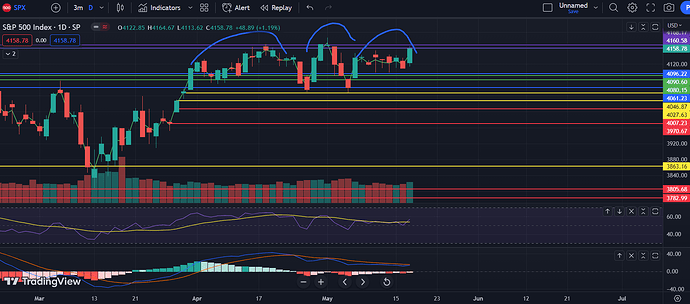

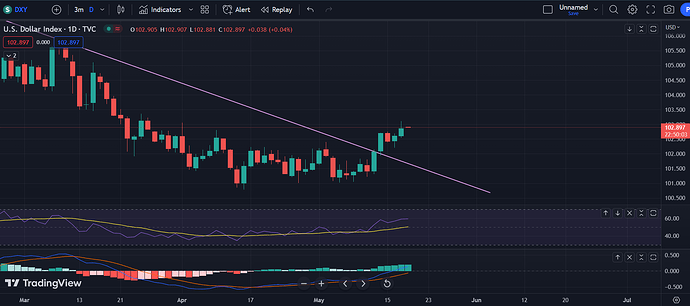

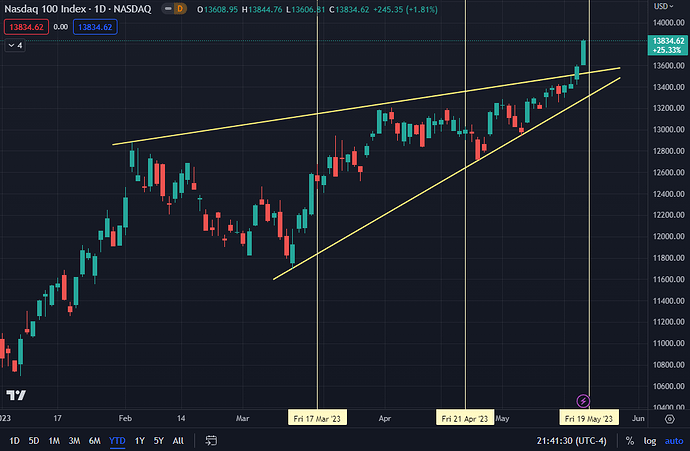

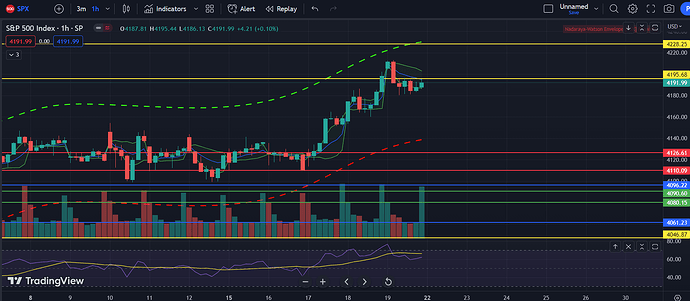

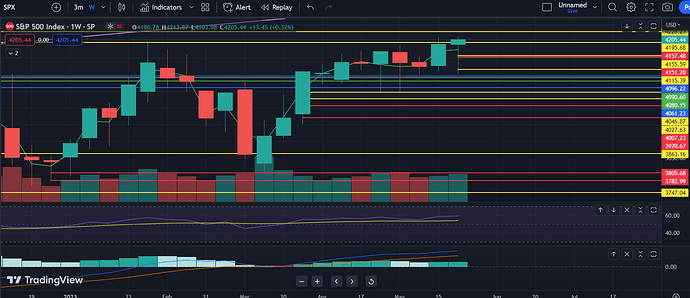

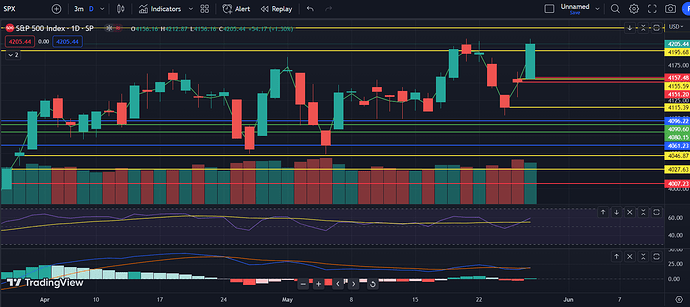

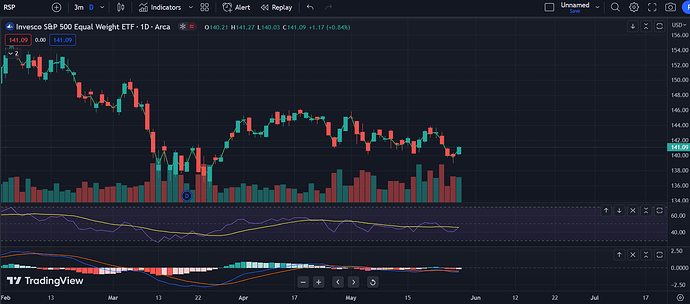

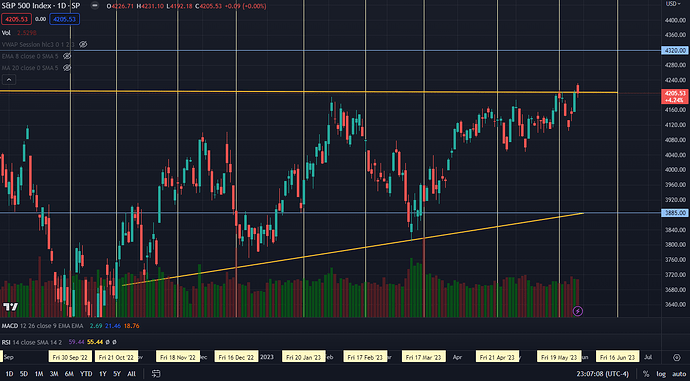

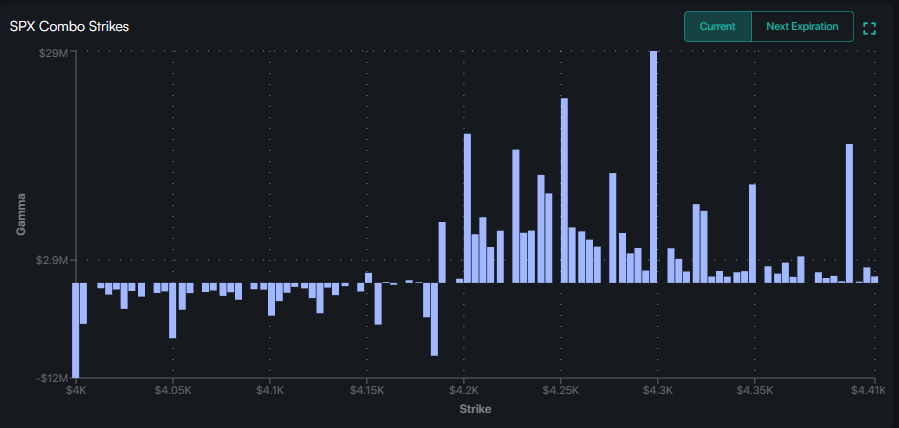

- Not that gamma levels matter this early in the opex cycle, but to the extent that they are indicative, we can see the call heavy structure around 4200 (First image). The Combo chat (second image) suggests a gentle pull upward for the time being. Vol trigger (where gamma goes from negative to positive) is 4145, so we’re not deep in positive gamma territory though.

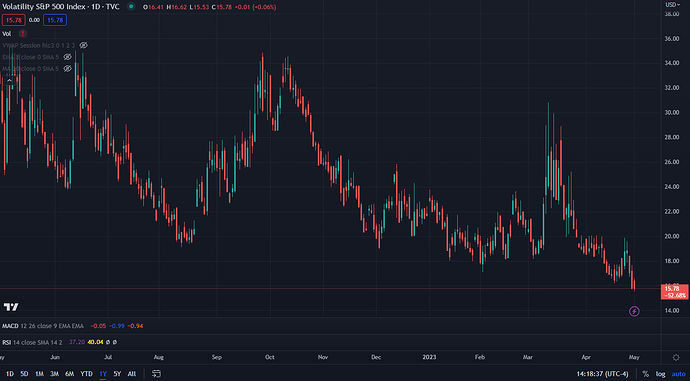

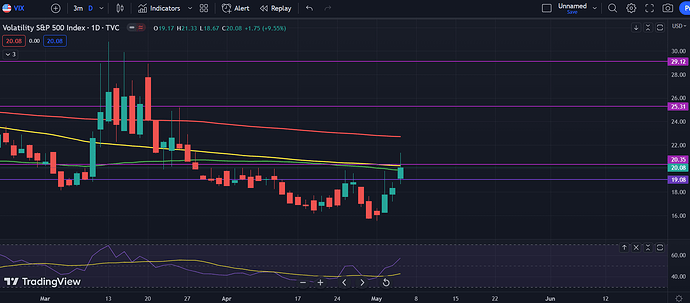

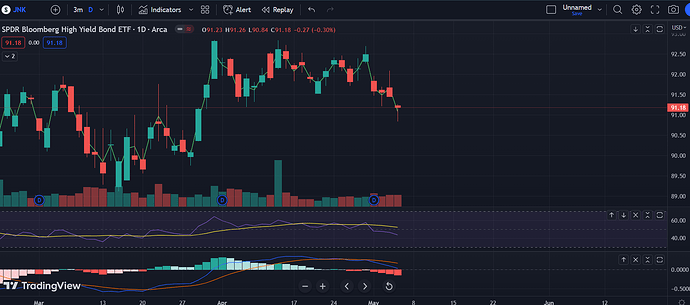

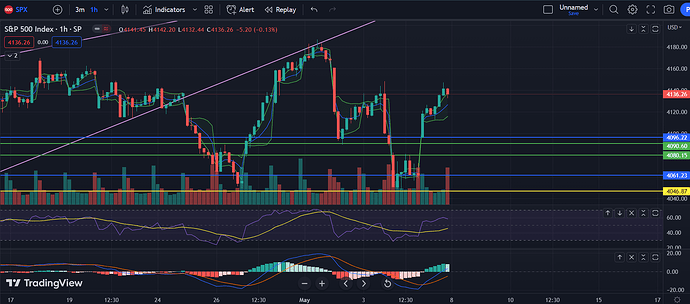

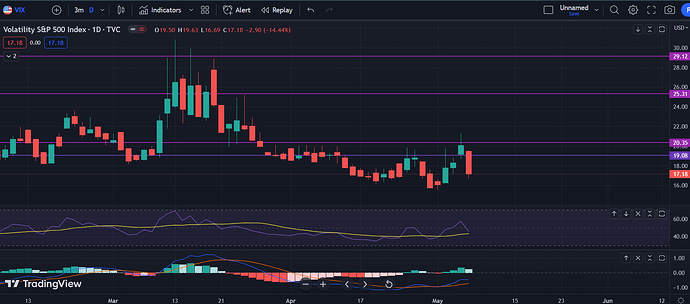

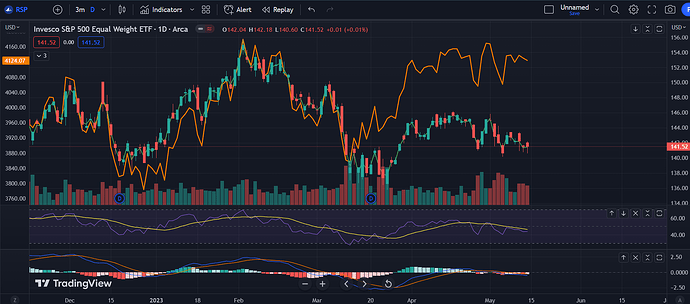

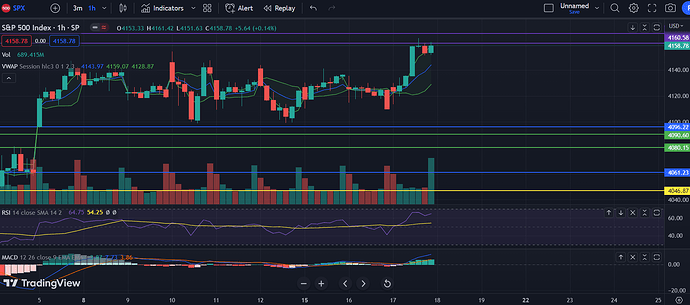

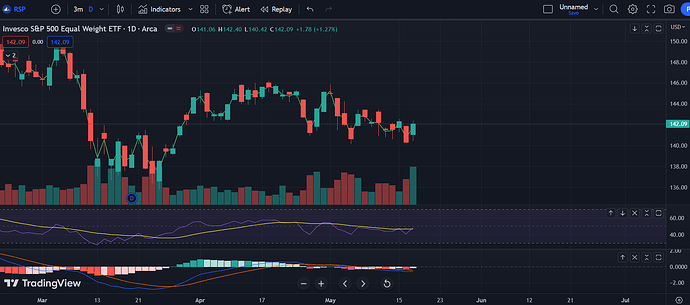

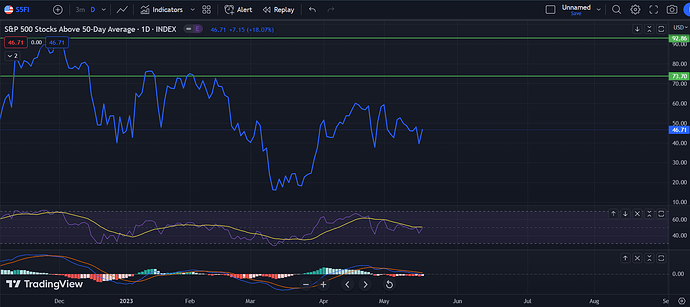

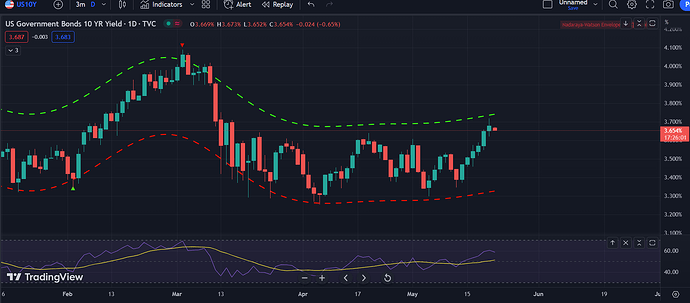

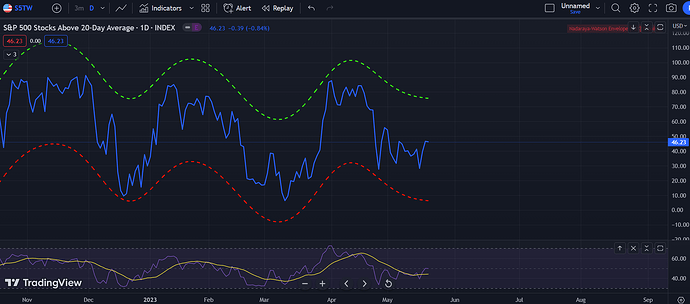

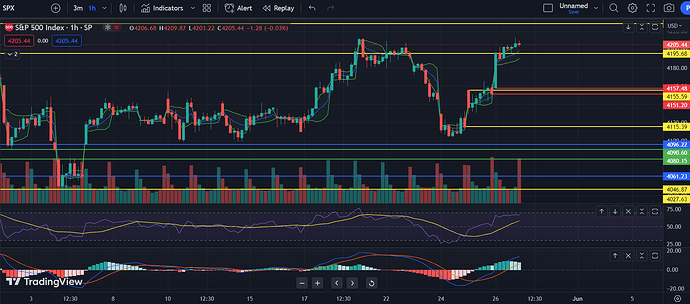

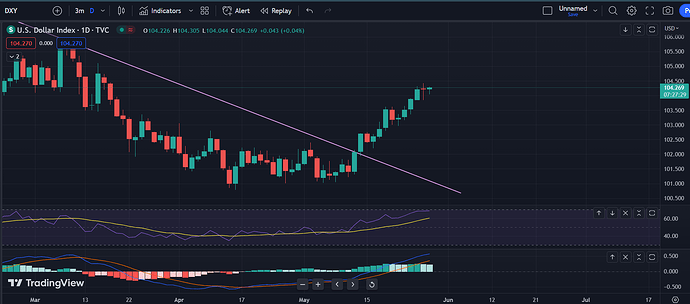

- There is no fear in the markets. VIX in contango (third image), but also lowest in a year! (fourth image). May seem surprising considering we have FOMC and 2 data heavy weeks coming up.

Markets opened pretty quiet as Europe was closed today and FRC was resolved before markets opened. Feels like it’ll be another well-behaved week, and we might eventually end up north of 4200 soon. Maybe even flirt with 4300 before opex (5/19). It would take a major move from JPow or some major macro shock to throw markets lower before then.

However, this period has Feb 2020 vibes. Recession is coming - all indicators are pointing to slowdown. Once earnings are done, there is no actual good news to prop markets up anymore. Note that are good in that they are beating expectations, but those expectations were already adjusted downward, and earnings growth is generally negative. So I’d be looking at going risk off again around opex, as all the positive gamma expires. If vol trigger is high enough and we dip below it for some reason, it could start a self-fulfilling cascade downward.

Should be clear sailing for the next two-ish weeks though. Good luck to us!