The positional analysis for next week is pretty much what it was last week. Vol trigger is at 4190 and call wall is at 4300. The 6/30 JPM collar at 4320 will only get stronger as a magnet as we hover close to it and it gets closer to its expiration.

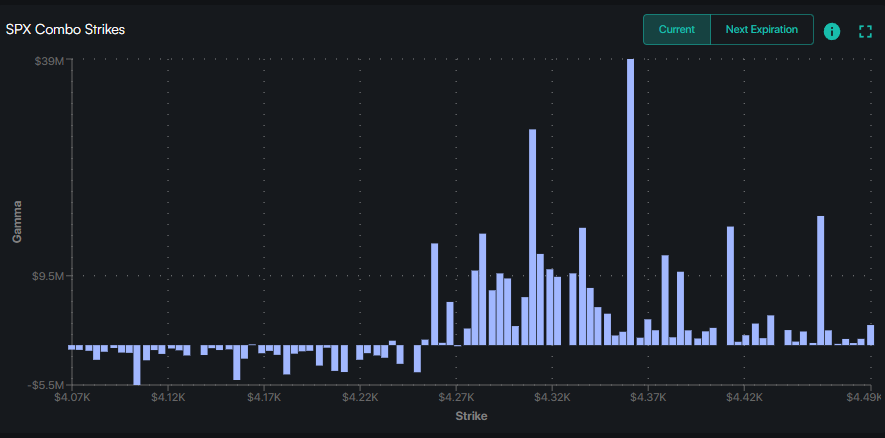

Below is the SPX gamma complex, which has moved up compared to last week too. Unlike last week though, we have covered most of the ground toward 4300, so upside seems to be limited until call wall moves again.

Something interesting from Friday - breadth actually returned to the markets. This makes the runup more resilient. Note how minerals and energy were up 3%+ and industrials just below 3%!

Thing to keep an eye on:

- T-bill issuances that start this week, and whether they are offset with RR draws or actually take out liquidity from markets (discussed in Discord here)

- Fixed strike vol going up as markets go up, which is seen as a possible sign of an impending blow-off-the-top

- FOMC on 6/14 - markets are pricing in a “skip” with 74% probability

- Of course, 6/16 opex - highly dependent on delta and gamma positioning at the end of this week

All in, we can expect markets to move up into the 4300-4320 area, and stay there, while the liquidity situation resolves.