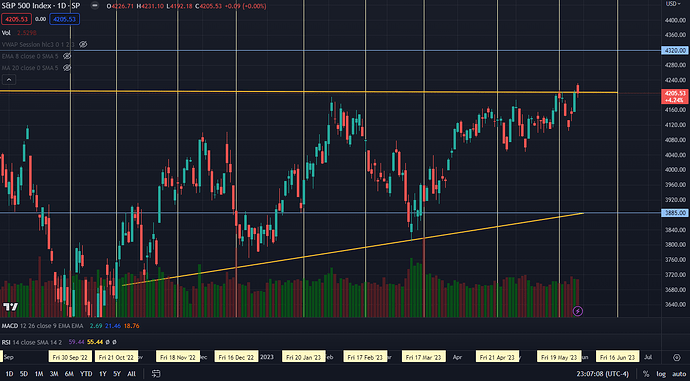

Time for a positional update, since we are a little over 2 weeks out from Jun opex, and option positions will start mattering again!

As anticipated, the post-opex dehedging made for a few red days, but between no bearish macro trigger and the ongoing the AI hype, the drop did not sustain, and markets have been up since.

Right now, the market has a bullish setup going into 6/16 June opex:

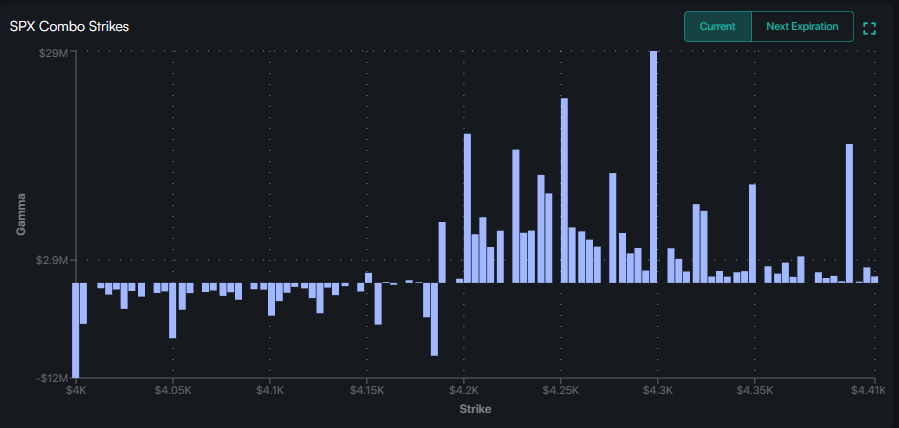

- Call wall is at 4300 so no immediate resistance overhead for about 100 points

- We are in positive gamma territory - vol trigger is 4185

- There’s a ton of call gamma overhead which should act as positive magnet as we get closer to opex

- The mammoth 6/30 JPM collar short call strike is at 4320, which can also act as a magnet if the market gets closer to it (there’s a much smaller collar strike expiring close to 4200 tomorrow, but it’s not expected to have much of an effect)

Of course, macro can always mess with this, but until it does, I expect positioning to play a bullish role at least into opex for the reasons outlined above.