Tl;dr: I think if FOMC rate hike is 0.25%, we’ll fall hard. If rate hike is 0.5%, we might have a brief rally before we fall more gently. Opex will piss in our cheerios either way.

Rationale behind tl;dr

It feels like the calm before the storm.

FOMC meeting is on Wed, where we’re expecting a 0.25-0.5% rate hike. Then there’s quad witching on Friday. We have tomorrow to make our bets, if we so choose, and then fly through possible major turbulence Wed-Fri.

There are a lot of conflicting signals out there, but on balance, I think:

-

In the short term, the market will respond favorably to a 0.5% rate hike, and negatively to a 0.25% one. Sounds paradoxical, perhaps? Rationale is, seems like market is already pricing in a 0.5% hike.

– If Fed hikes by 0.25%, it signals that they are way behind the curve, that they will have bring a hammer into play later in the year to compensate for runaway inflation, which will freak the market out.

– A hike of 0.5%, on the other hand, is consistent with the narrative of consistent rate increases every meeting for the rest of this year, and a good chunk of next, which is again what the market is probably pricing in.

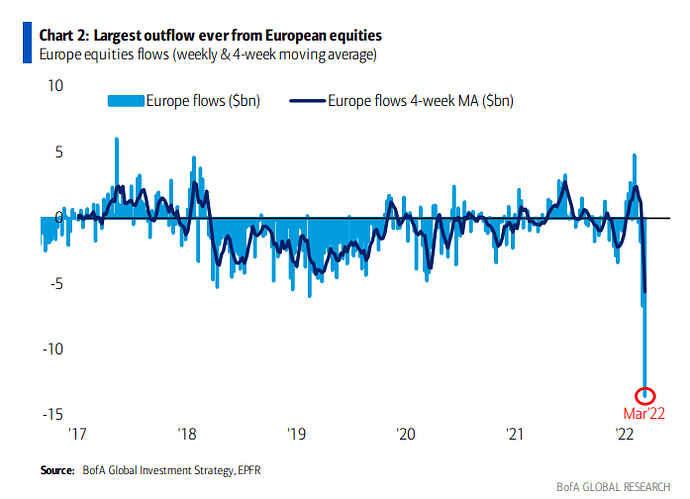

– Another potential tailwind with the 0.5% hike is money flowing into the US markets from the European and Asian ones. One reason is simply because Benjamins are still seen as the safe haven for private parties during times of uncertainty (unless one is a Russian oligarch), and the other is because a 0.5% creates an even larger return arb opportunity compared to Europe’s -0.50% (yes, negative) which they might adjust to -0.25% (yes, negative again).

-

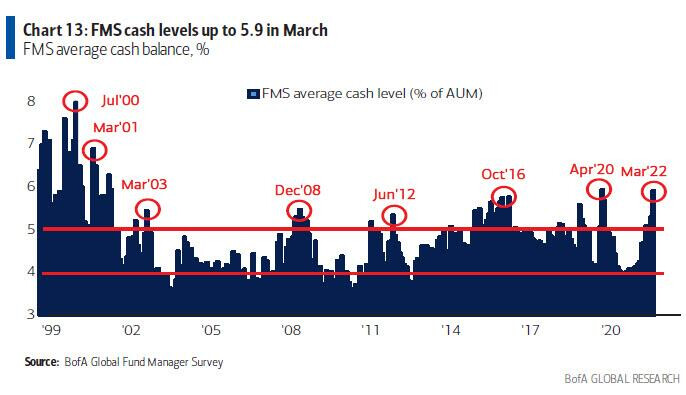

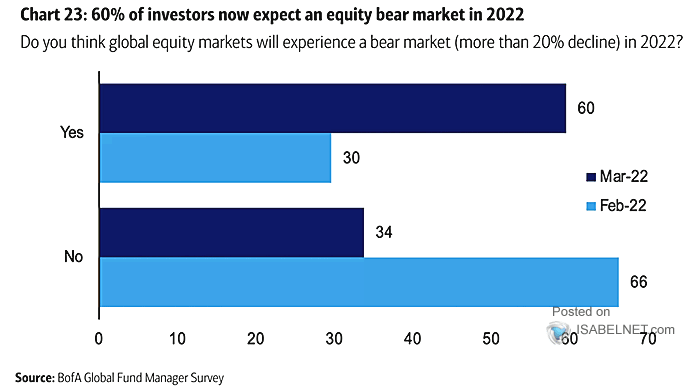

In the long run, markets will still fall for a while yet, because of inflation, supply chain issues, commodity price shocks, energy shocks, lower earnings forecasts, Russia-Ukraine, and increasing lockdowns in China. (What a list!) While we will fall some more either way, I think this week will likely determine if we jackknife or have a more gentle glide down to lower levels.

– Even if we didn’t have all this excitement in the international arena, I think we’d still go down because 0.5% rate hike is paltry compared to the near-8% inflation we are looking at, where the inflation isn’t primarily even demand side driven.

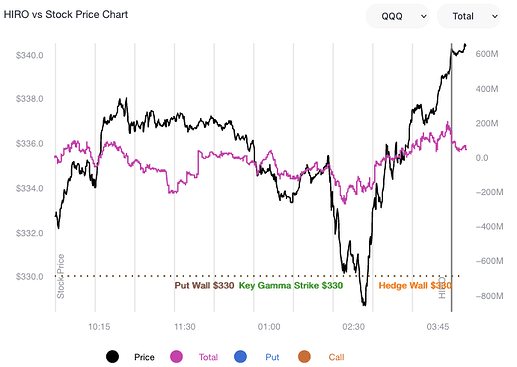

Note that with opex on Friday, all else being equal, we expect markets to drop till Friday and then rally on Monday as net-put hedges are unwound. I have no idea on how FOMC and opex will net out, except that it will probably be a hot mess on both sides of the weekend.

Enough talk. Let’s mix in some pictures.

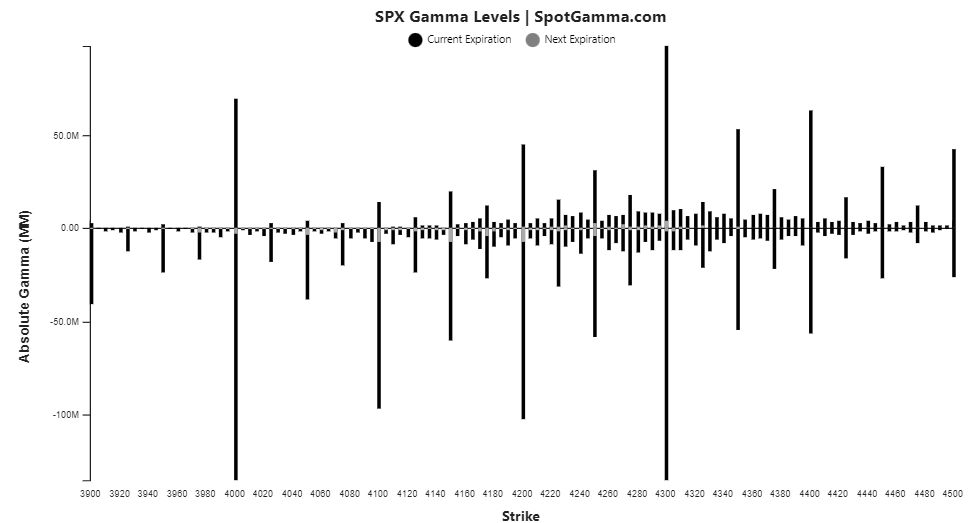

4000 and 4300 Are Important SPX Levels

We closed at 4173 for SPX. Recall that large gamma levels act as support or resistance, and can act as a magnet because of how hedging flows work, in the absence of meaningful news events. The image below is the latest SPX gamma snapshot from SpotGamma. We can therefore expect us to snap to about 4300 on positive reaction, and could easily fall to 4000 if the reaction is negative.

More worrisome, there isn’t much by way of support below 4000, so if we breach that, we could be in circuit breaker territory.

Good news is, when all these puts expire, the rally on Monday should be pretty sweet. … Sweet, but short.

Note the lack of call gamma by the way - speaks to the overall negative sentiment, which is also captured by the put to call ratios of between 2 and 3 for major expiries over the next few months.

SPX/SPY Death Cross Happened Today

A death cross happens when the 200-day SMA passes the 50-day SMA. There isn’t a good fundamentals-based reason for this to be a thing, other than the fact that traders consider this to be a thing, so it becomes a thing by the laws of self-fulfilling prophecies. Like the 8 EMA.

The death cross for both SPX and SPY happened today around 2pm.

This is seen to be a definitive sign of a bear market by many, and should have set off all kinds of algos in the back end to assume an even more bearish posture. FOMC is probably the only thing holding the algo-hounds of market-hell at bay.

SPX/SPY Stuck In A Channel…

Channels can be stubborn, once they form. Not much more to say here other than that the channel also tells us the upcoming trajectory is likely downward.