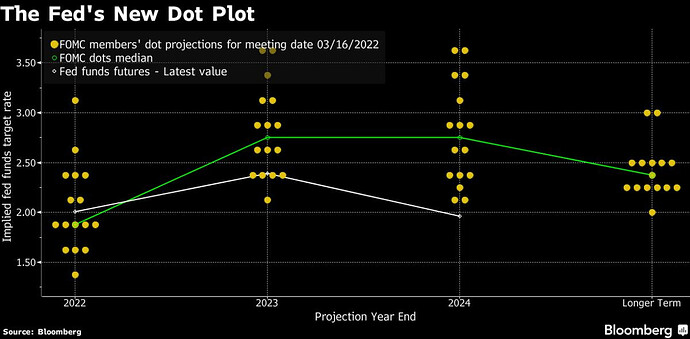

In case this has not been covered already, one of the things that seems to have fueled market sentiment is the “Fed dotplot” for the Fed Funds Rate.

(Original here on page 4 but Fed is anti-trendline…)

This shows us that the Fed doesn’t expect rates to rise in 2024, and actually decrease after.

So what does the market do? What it always does - it “prices in” easing two years from now and goes off to the races.

This is under their assumption that inflation will go down later this year and settle around the 2-3% mark in 2023/2024, thus meeting the fed rate “somewhere in the middle.”

(Source: Page 3)

So whether the dotplot ends up predicting fed rates accurately really depends on if we believe these inflation projections.

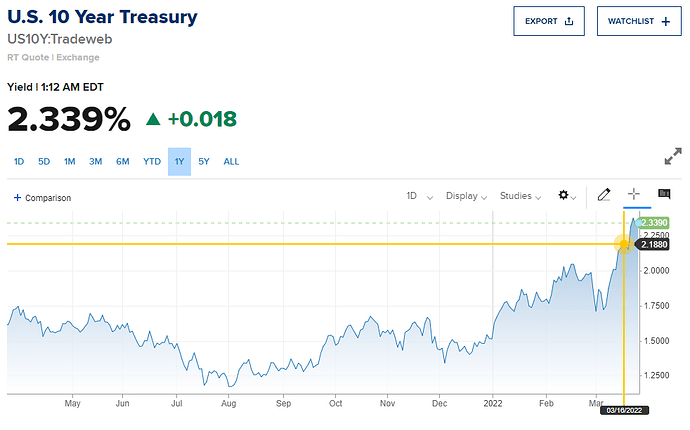

The bond market apparently does not share the equity market’s enthusiasm. It went, “hell no it won’t,” and proceeded to inch upward since the FOMC meeting.

(U.S. 10-year Treasury)

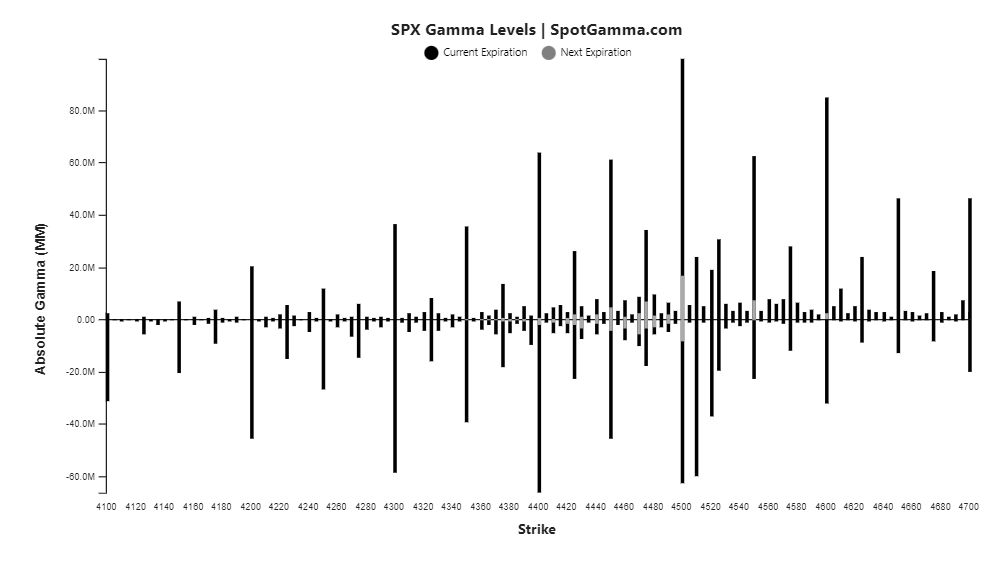

For the short term, the tea leaves are unclear. The options market isn’t very helpful at this point. We’re in a balanced state, so to speak. The market is around zero gamma levels, and there is a healthy distribution of calls and puts all around the current strike:

(From SpotGamma)

We’re kind of left to our own devices for now.

Personally, I don’t understand how the Fed is still so optimistic. Without Russia-Ukraine, it is possible that’d we’d have been back to status quo within a year or two. After all, we did survive quite ok through a global pandemic, and the economy has been fiendishly strong.

However, the conflict makes supply chains even more broken, and peace tends to take longer to be found after a war than vaccines do after a pandemic. It is possible that we will see a spike in CPI next time around, and if it gets anywhere close to 10% - not entirely impossible given gas prices - the Fed will have to slam on the brakes hard.

And I think we’ll find then that the equity boys weren’t wearing seatbelts all along.