Potential Uptrend Weakening/Reversal Point on 1m Timeframe for SPY.

Potential Uptrend Weakening/Reversal Point on 3m Timeframe for SPY.

A Normal Buy Signal has Turned Strong on 3m Timeframe for SPY. Consider Dropping Puts.

Potential Uptrend Weakening/Reversal Point on 1m Timeframe for SPY.

Potential Uptrend Weakening/Reversal Point on 3m Timeframe for SPY.

Potential Uptrend Weakening/Reversal Point on 1m Timeframe for SPY.

Confirmed Sell Alert on 3m Timeframe for SPY.

Strong Confirmed Buy Alert on 3m Timeframe for SPY.

Potential Uptrend Weakening/Reversal Point on 1m Timeframe for SPY.

If you successfully avoided buying/holding puts below 349 today, congratulations.

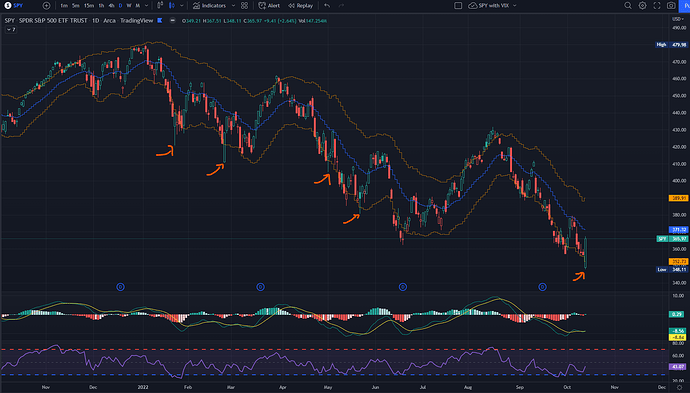

Now let me point you to my reasonings which led me to anticipate a bounce above 347…

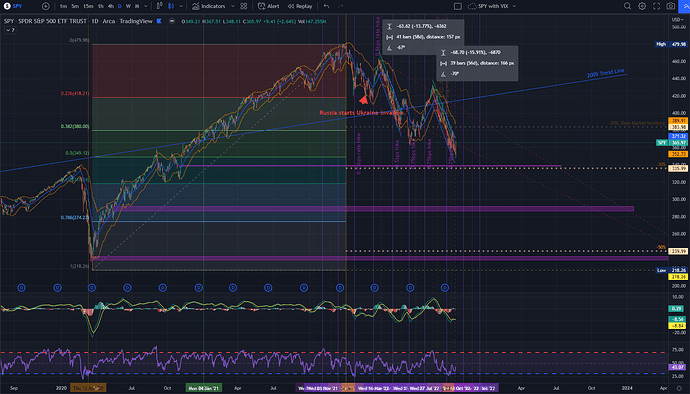

As you can see on the chart, this was not unprecedented.

This year alone, SPY has had several big bounces when strong support gets broken.

I carefully watch the MACD levels and RSI lines, and since we were once again trailing along the bottom of both indicators–as well as piercing the lower kertnel band–it was only a matter of time for another big bounce.

Note that I use the word bounce, because there simply isn’t any macro justification for a sustained bullish reversal.

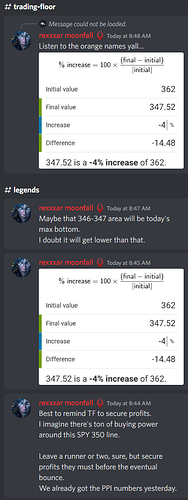

Earlier in preMarket, we saw SPY run up to 362, before crashing back down post-CPI report.

You can often note this when big reports are expected.

So knowing that SPY has a tendency of falling to a maximum of 4%, I quickly ran the math with my quick and very smart head–aka the internet…

Conqueror and the other gods were also anticipating a bounce and alerted TF early on.

Did I know the bounce would be this big of a joke back to almost +5%? Of course not.

I was only looking for a hook back around 359-360.

Brutus’ SPY Predictive Modeling also helps a lot in anticipating some bounces/reversals.

You can find his thread here: SPY Data - Predictive Modeling

While I am still holding on to my original idea of a hard fall across the broad market…

I force myself to be conservative with my expected moves and mitigate my risks best I can.

And while it’s healthy to exercise your own judgements for the benefit of growing as a retail trader, I assure you that we’re only here to help you along this journey we’re all taking.

Yes, sometimes we might seem harsh with words, but that’s just because we don’t see face to face.

IF we were, of course, yes, we will still be harsh with words. kek

We may be proud men and women here yeah, but we do aim to help.

Let’s clash heads, sure, but let’s aim to help.

We will revisit 348 soon enough.

xxx

P.S. - I am now anticipating SPY to fill all the gaps from 2020, all the way back to 229. We keep riding the waves until that number.

SPY Dark Pool prints have noted a few billion trades from 366-377, from last week and a few again AH today.

*DP prints are speculative, but sometimes do hit after several days or weeks.

xxx

Potential Downtrend Weakening/Reversal Point on 1m Timeframe for SPY.

Positioning before 10AM is generally not reccomended due to increased volatility

Confirmed Sell Alert on 3m Timeframe for SPY.

Positioning before 10AM is generally not reccomended due to increased volatility

A Normal Sell Signal has Turned Strong on 3m Timeframe for SPY. Consider Dropping Calls.

This signal was triggered near the Previous Close @ 365.97. Wait for the candle to close below this potential lower support point before entering a position as a bounce can quickly invalidate the signal.

Positioning before 10AM is generally not reccomended due to increased volatility

Potential Downtrend Weakening/Reversal Point on 1m Timeframe for SPY.

Potential Downtrend Weakening/Reversal Point on 3m Timeframe for SPY.

A Normal Sell Signal has Turned Strong on 3m Timeframe for SPY. Consider Dropping Calls.

Potential Downtrend Weakening/Reversal Point on 1m Timeframe for SPY.

Confirmed Buy Alert on 3m Timeframe for SPY.

Strong Confirmed Sell Alert on 3m Timeframe for SPY.

This signal was triggered near the Low @ 357.38. Wait for the candle to close below this potential lower support point before entering a position as a bounce can quickly invalidate the signal.