Going into next week, underlying option structure of SPX/SPY continues to show bullish signs. In fact, more bullish than we’ve seen in a while.

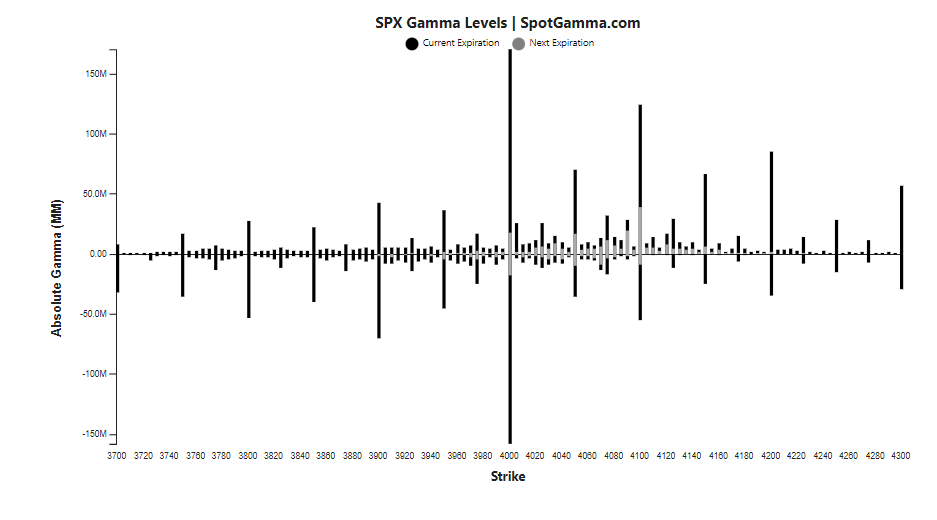

Call strike gammas have beefed up a bit more:

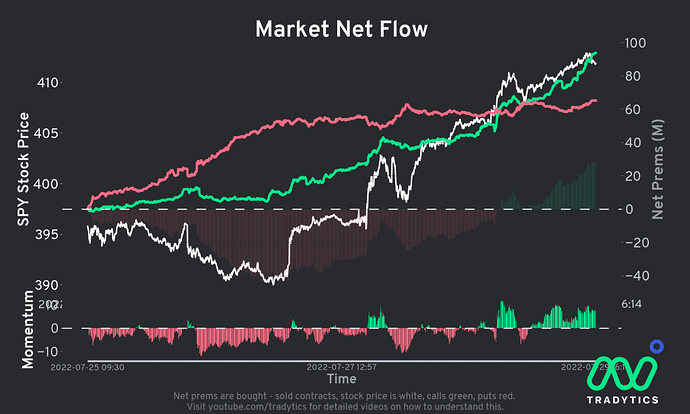

Call buying has also been healthy in the last week, which points to sustained feelings of bullishness.

There will almost always be put buying for hedging purposes - its the relative call buying amounts, or the absence thereof, that is considered an indicator of sentiment.

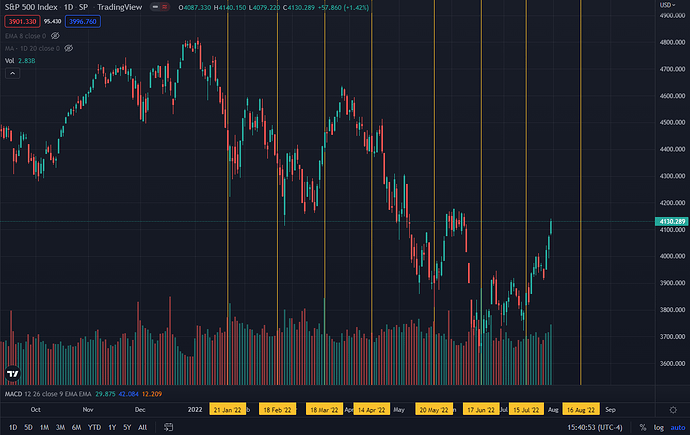

We do have opex coming up in two weeks. Note that usually, prices fall into opex more often than not, and then almost as often, bounce back. The only time this did not happen was in March when SPX rose into opex, and kept rising. That was a vanna (aka vol unwind) rally at first, which turned into a brief bull run.

Although we are missing the vanna rally here because VIX has been a bit of a wimp, we are on a steady march upward. This time, I expect MMs to support an upward move, except right after opex where they may de-hedge a bunch of those calls, which could provide some headwind.

Unless one of the scheduled economic reports turn out to be a major shocker, we could actually rally into opex, and then rally some more. With a brief 1-3 day pause right after opex as some call de-hedging takes place.

In fact, if we don’t tap out like we did between the May and June opexes, we could hit SPX 4300-4400 by end of Aug.

Will keep a close eye on these levels next week to see if we have any reversals.