TLDR: I think we’ll see some more upside, possibly to 387 which is my next major resistance to make a lower higher before we go test the 200 MA on the weekly which is at 351.

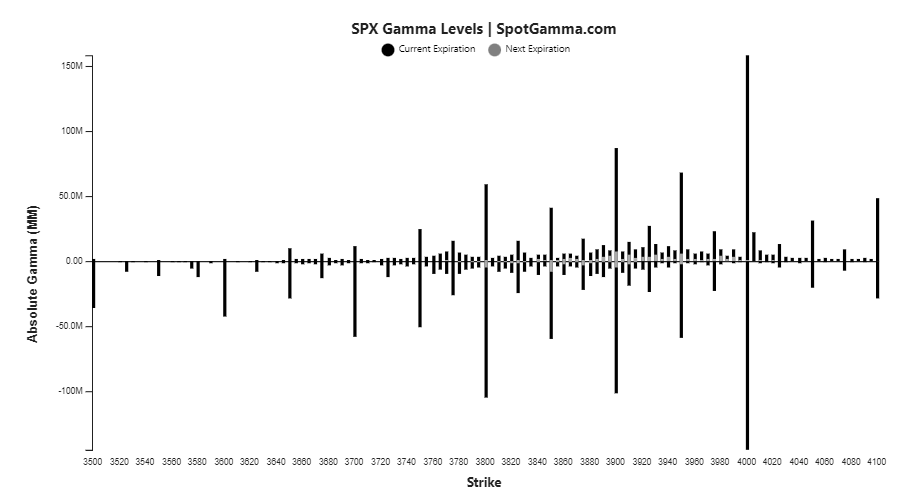

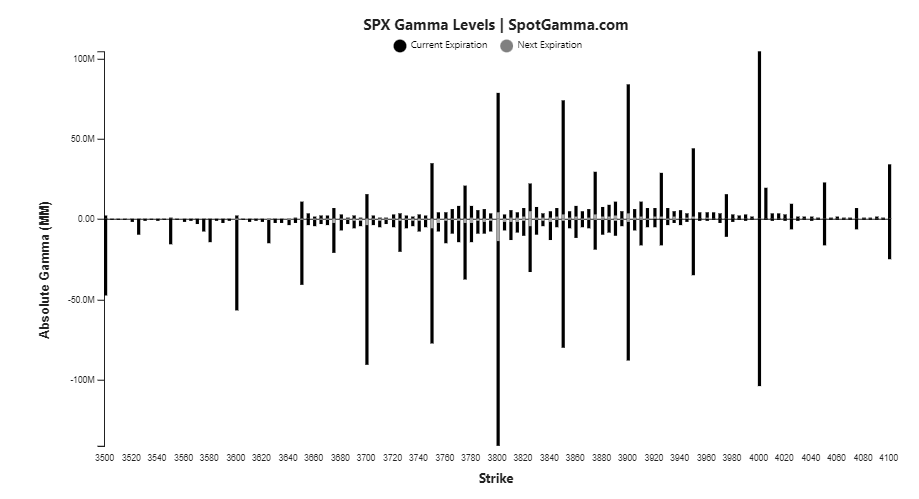

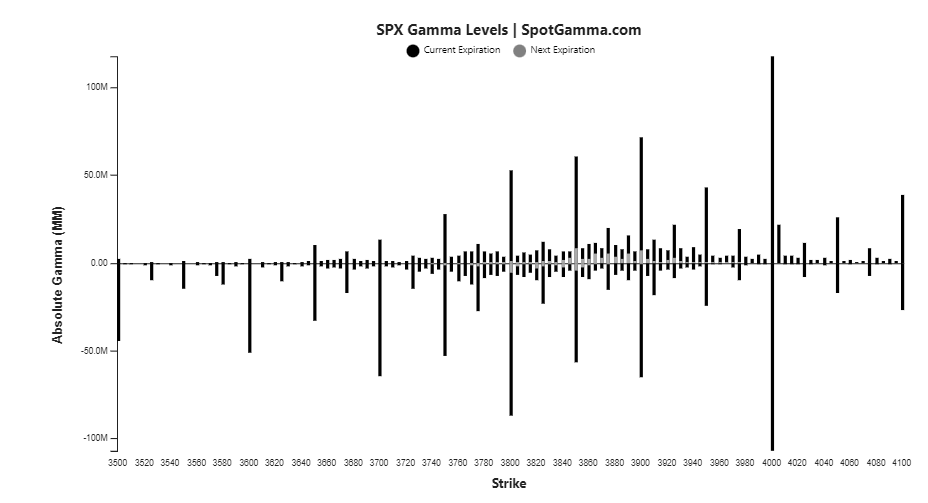

SPY on the hourly is back at the top of the channel where we couldn’t break through again today. 382 is a very strong resistance based on volume profile and previous days. Break past and I think it should be a quick trip to 387-388 because based on volume profile, there is little volume from 382 to 387-388. Another thing to note is that the 8/21 are bullish and we’re now above them strongly with bottom wicks on the recent candles. Based on the RSI, we should have a lot more upside, enough for 388ish resistance. One thing to note is that this could be a bear flag on the hourly. If this is the case, we should start to get rejected off the 382 area and then continue on downwards.

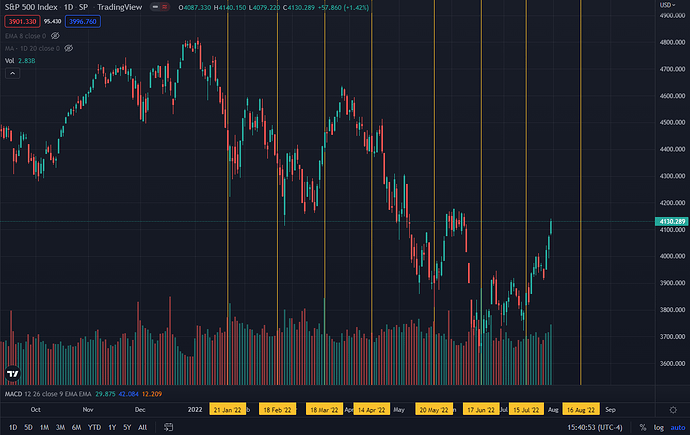

On the daily, we are back above the 8 EMA which is bullish. The volume was low, but the last few bullish rallies have been on low volume. Another thing to note is that the 388ish resistance is around the 21 EMA which typically where we have topped recently. Another thing to note is that the MACD is still bright green, showing that a continuation of this bull rally is likely. Another possibility is that we go test the downtrend line in blue to make a higher high. If that happens and there’s no bearish divergence on the RSI, I’m going to assume that we bottomed at 363 and then have a rally to the 50 MA on the daily. If there is a bearish divergence, I expect us to make a new leg lower, although I don’t think we’ll reach that high in the first place.

Now looking at the weekly chart, we have a strong bottom wick. Whether that means bullish for next week we’ll see, but so far during these rallies, we have been rejected off the 8 EMA which lines up kinda well with the 388 area, although it’s currently at 393.66. Overall, I do expect another leg lower and if we do make a lower low and there’s a triple bullish divergence, I’m going to expect a very strong dollar.

VIX has broken below the orange line which is bullish. The next support I’m looking at is the yellow uptrend line, which is where I think SPY should top. I think this should give us enough room to go to 387-388, or maybe even to 393.6. I’m going to follow VIX and most likely start a put position when I see it near the yellow line.

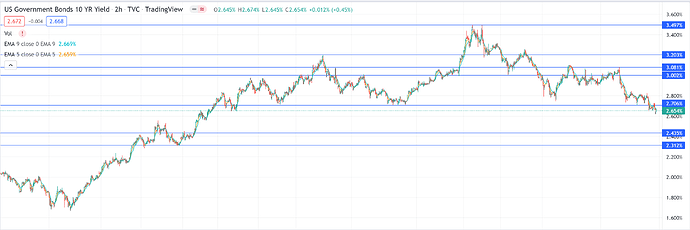

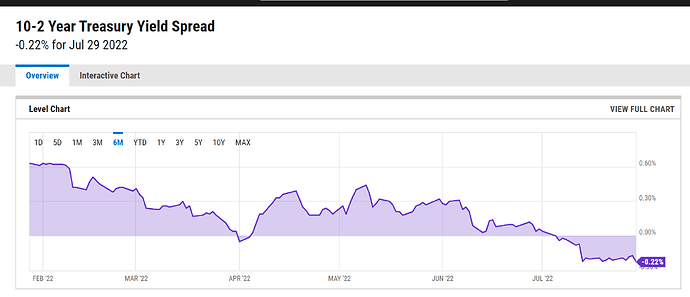

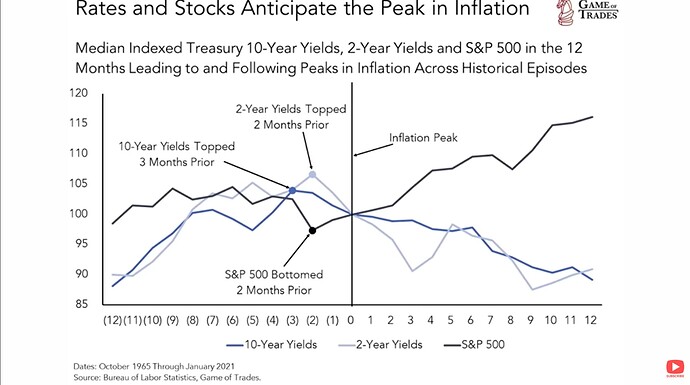

The 10 year yield got crushed hard which is bullish for stocks, although NI did mention this could be kinda be bearish based on the reason why it’s dropping. There’s a big upwick though, so something to look out for, but this is giving more signs that stocks could have a good rally in them.

So the dollar made a tweezer top which is bearish. Also there’s a bearish divergence on the hourly which is playing out so far. If this continues to play out, we should see a good rally in the stock market, again giving more reason why we should expect a rally.

Oil was up today, got crushed and then rallied again. Kinda bearish, but at the same time, this just seems like consolidation, so until I see oil start to surge up, I’m going to keep this as neutral or bullish.

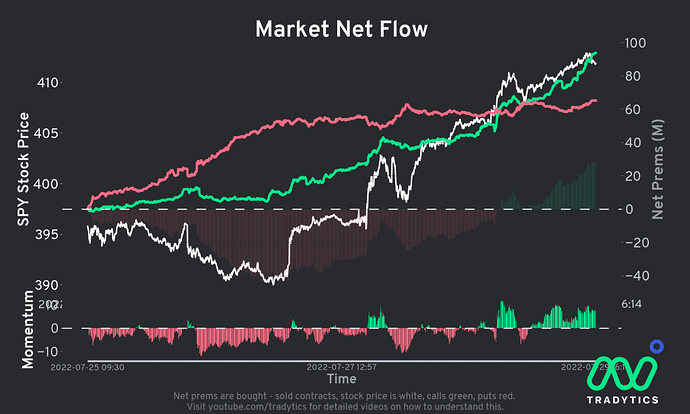

PCC shows that there is more puts entering the markets. Once I see it at the other extreme, I’ll begin to get bearish again and hopefully that lines up well with the 387 area. But overall, PCC is neutral.

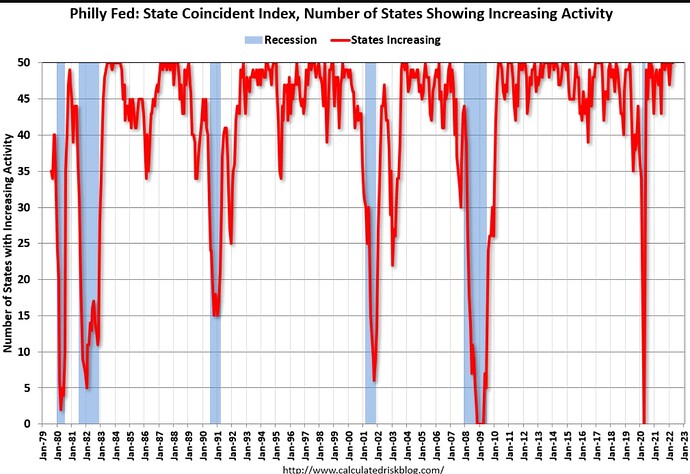

In conclusion, I do expect a rally up to 387-388 before we start to show weakness and then shit down. But if we do go higher, I’ll be looking for signs if it’s a strong rally or a weaker rally looking to get rejected at the next major resistance. SPY did form a doji and then a move upwards, which could mean that there’s a continued move upwards. Overall, there’s many situations available, but I’m leaning towards short term and then continue on to be bearish into the 350 area.