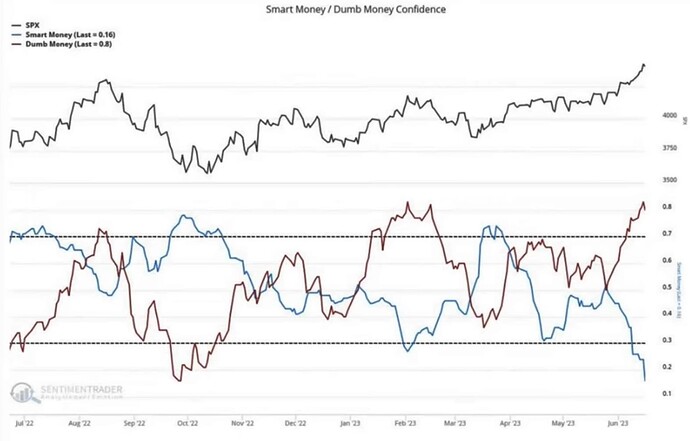

TLDR: Still low momentum and breath, but all dips are getting bought up so play the trend.

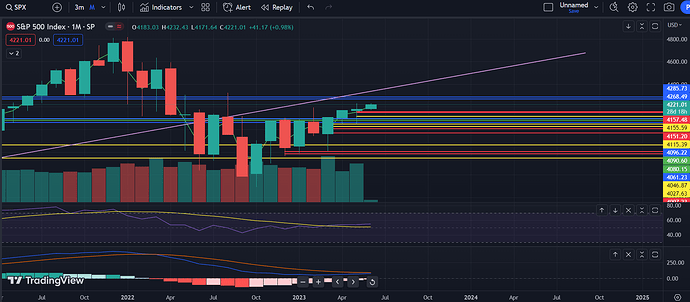

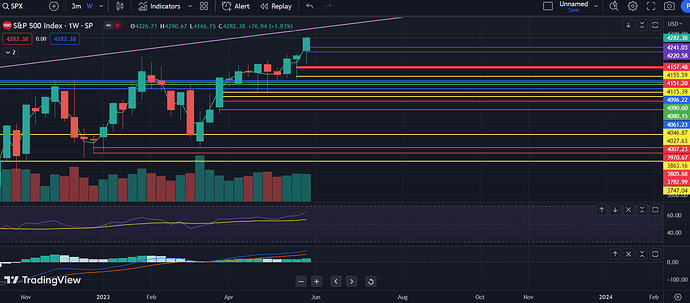

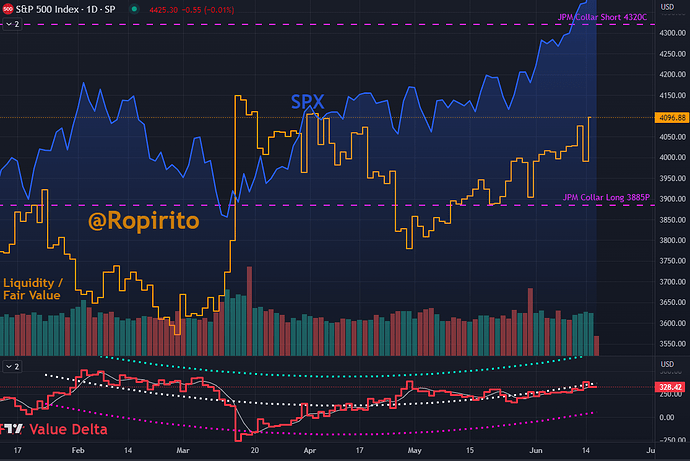

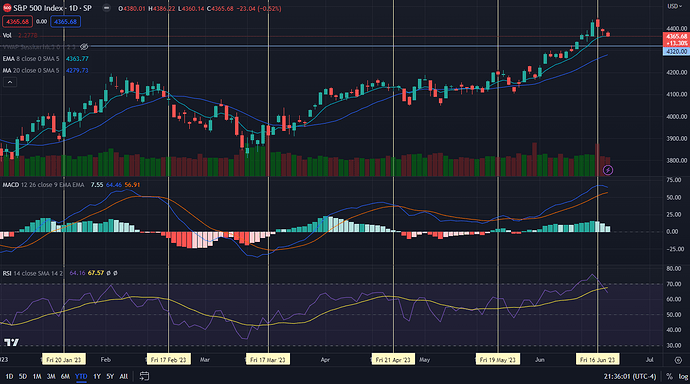

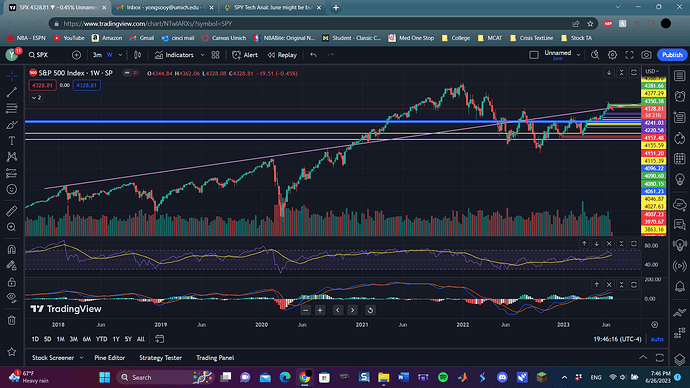

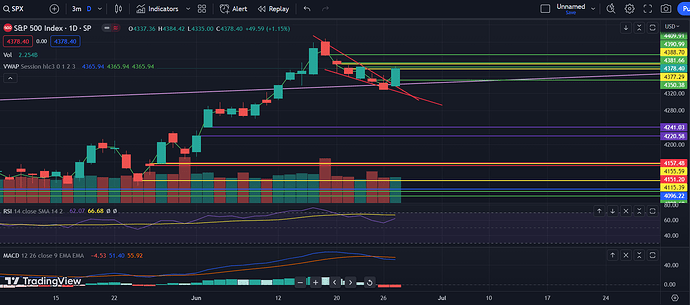

The monthyl chart is looking bullish as every dip was bought up and we had increasing volume on this grind up. The RSI and the MACD aren’t as bullish and strong as I would like, but still a strong uptrend. Nothing much else to say.

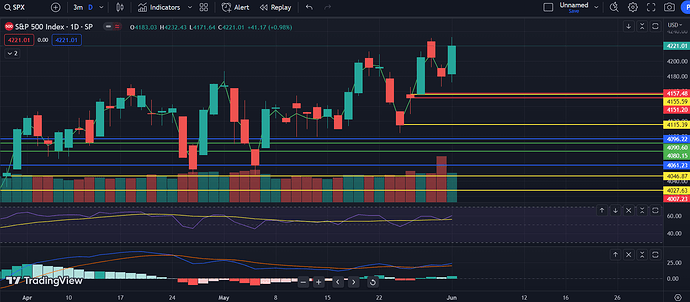

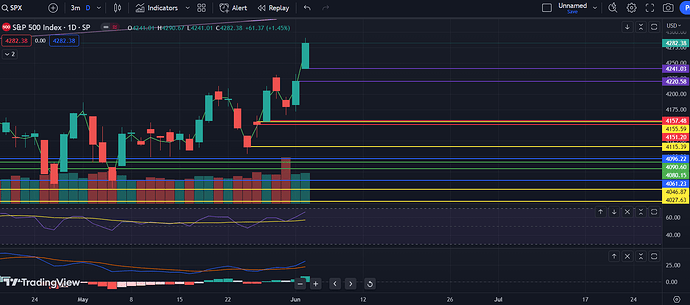

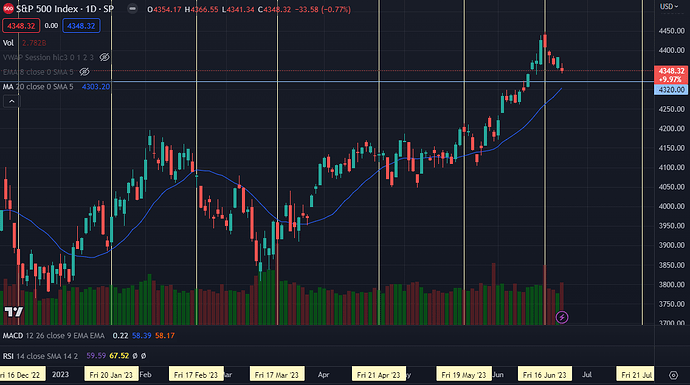

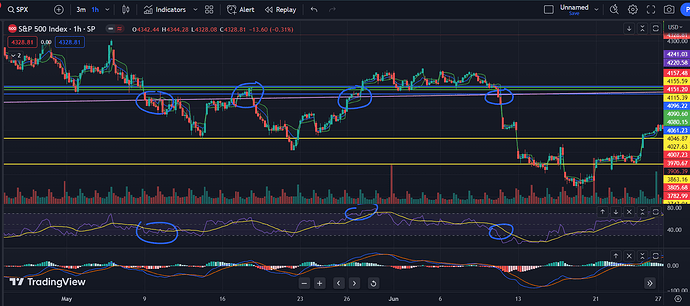

On the daily chart, we filled the gap and retested the high. There’s a chance that this plays out to be a double top, but on the daily, it’s too hard to see if there’s a bearish divergence on the RSI and MACD. Not much else to say on the daily other than lower volume than yesterday, but a strong green candle.

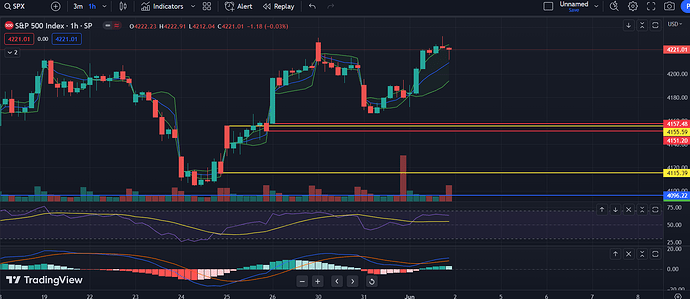

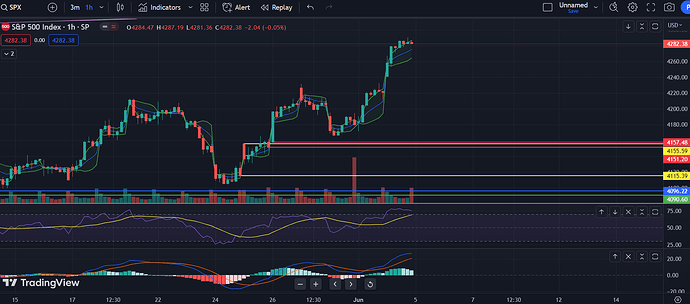

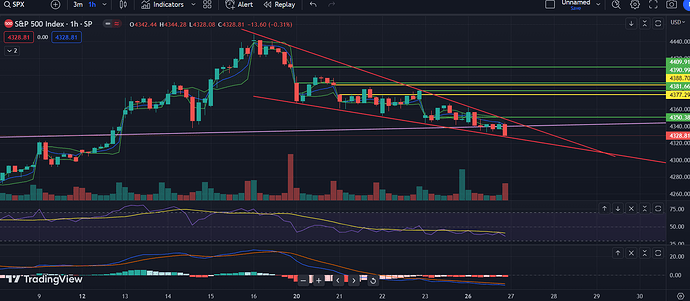

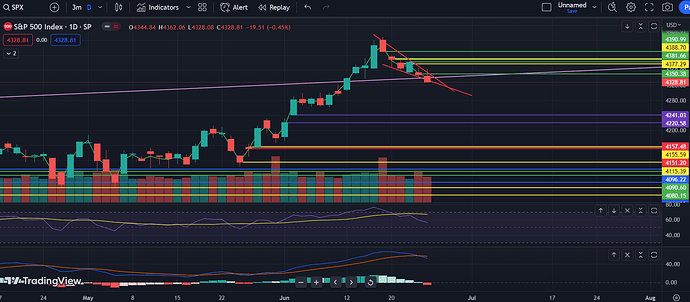

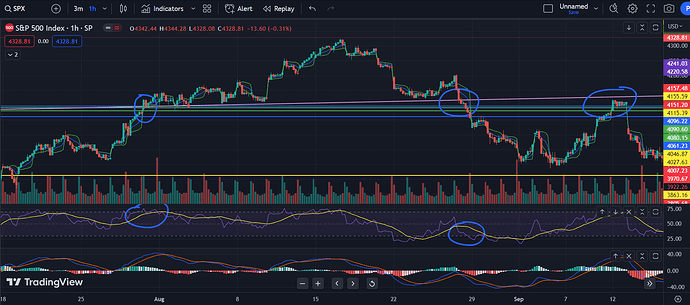

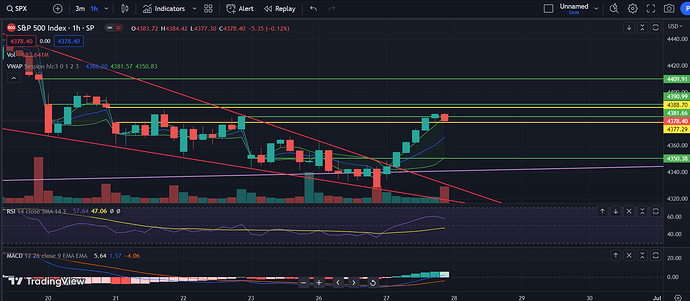

On the hourly, we have a bearish divergence on the RSI and MACD so maybe there’s another dip incoming, but we’ll see. So far, all dips have been bought and we’re bouncing off the gap fill level.

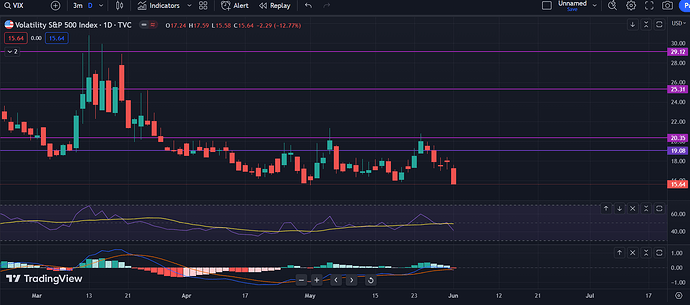

One thing that adds to the sentiment that another dip may come is that the VIX moved 10%. Because it moved down 10%, there’s a good chance that markets go down within 2 trading days.

The yields are going down which is good for bulls and tech, which is leading the charge up.

The dollar also went down a little which is good for the markets, but we’ll see if this is just setting up a higher low to head to higher highs.

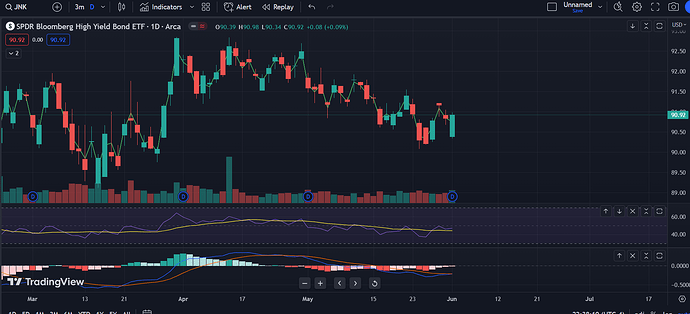

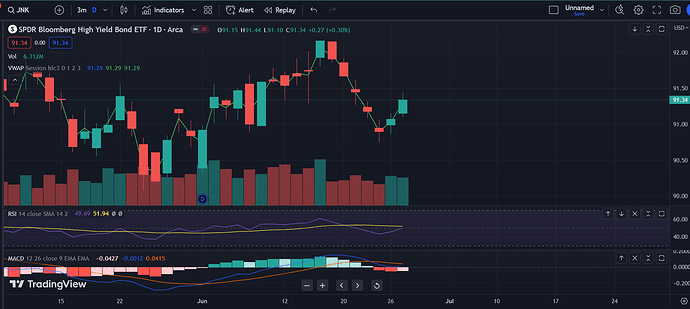

The junk bonds are looking strong, but still not making higher highs so there’s a bearish divergence with the SPX. Not a good sign for the markets, but each dip has been bought up so who knows if this even matters at this point.

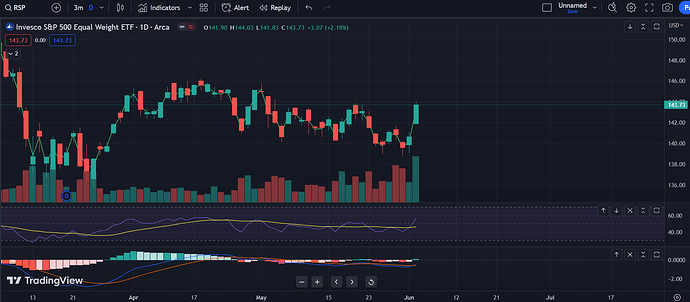

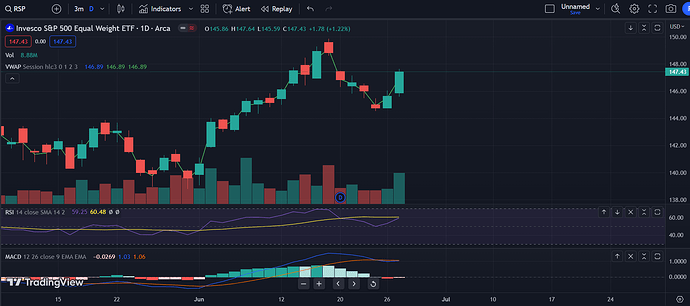

The equal weight SPX is also making a lower high. It’s been making a lower high for the last 3-4 tops though, so we’ll see if this ever plays out or if I’m just drawing crayons.

Overall, still bearish signs, but since every dip is getting bought, there’s really no reason to enter bearish positions right now. Good luck all on this new month.