This expectation materialized, and worked out well. Now that we are on the other side of opex, options don’t really have much “power” anymore, so market is free to move without all that gamma interference.

Not sure on likely direction now, will give it till the end of this week for more clues.

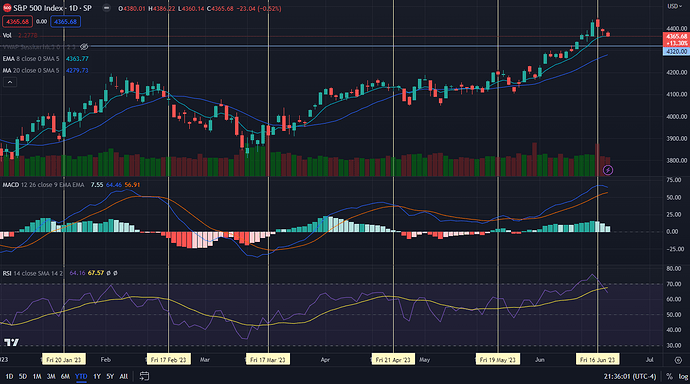

Bullish reasons are: a) SPX Call Wall has now moved up to 4500, b) vol trigger is around 4310, so we’re in comfortably positive gamma territory, and c) there isn’t actually any good immediate reason to be bearish.

Bearish reasons are: a) market still seems overextended - cleanly over 20SMA, and resting above 8EMA, and b) SPX gapped down at open both yesterday and today and did not close the gap fully, though almost did so today.

There is the JPM collar at 4320 that expires on 6/30 - if we get close to that, that could end up being a magnet into the end of next week. (Have position for this possibility already)

Otherwise, if we close Fri over 4400, I’ll likely take bullish positions into end of the month.