Got the following:

- 6/23 (8DTE) 4360P/4350P SPX bearish put spreads for $1.25 - on expectation that post-opex dehedging adjustment will bring us down about 1% sometime mid-next week.

- 6/30 (15DTE) 4335P/4325P SPX beariish put spreads for $1.25 - on possibility that the adjustment converts into a correction and ends the month where the JPM collar strike is, which is at 4320.

Relatively small positions, because:

- This is going against a strong trend.

- Similar previous plays listed above have not worked out so far, and will likely expire worthless in 2 weeks.

- This is primarily based on the option-based positional analysis, and secondarily based on the fact that markets are overextended by most metrics.

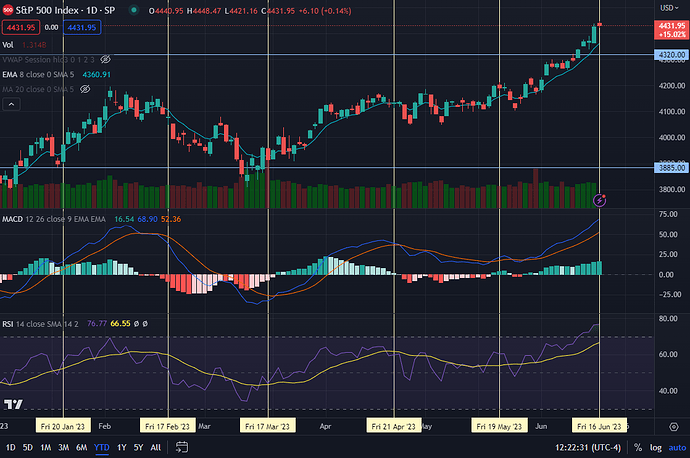

Possibly an error not to embrace the bull run, but I just can’t yet, with a chart that looks like this: