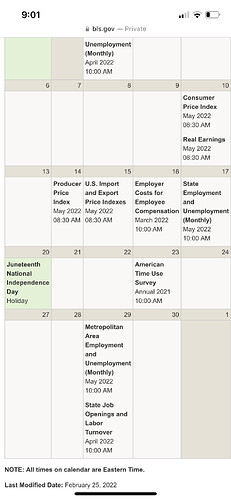

TLDR: I do expect some more downside to the 350-360 range before we go back up. Because quad witching didn’t produce the rally, I’m expecting a little more downside before we start to go back up as Powell starts to talk Wednesday so I don’t know if people want to buy in starting Tuesday. Overall, I do expect markets to bottom and have a rally sometime Wednesday/ Thursday after markets digest what Powell says.

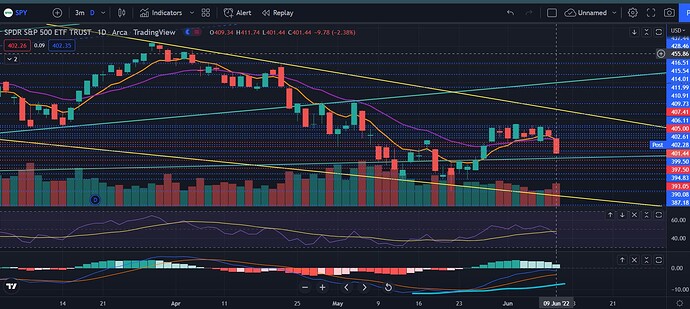

Looking at SPY hourly, we are forming bullish divergences and now the RSI is holding above the MA which is bullish. Another thing to note is that we are trying to break above the 8 EMA. This is slightly bullish, but because it’s unable to truly break above the 8 EMA, I wouldn’t call it super bullish yet. The EMAs are starting to flatten and there are bullish divergences, but until these play out, there’s no reason to be bullish based on the chart.

On the daily, we are forming MACD bullish divergence and the RSI is flattening even though we’re going down lower. Something to note is that we’re still below the trendlines and right at the bottom bollinger band. Daily looks bearish and we formed a doji candle. This is an indecision or maybe just sellers getting tired and unable to push the prices too much further down. Looking at how extended we are, I do expect some kind of rally soon.

Looking at the weekly chart, we still have a bullish divergence on the RSI and gaps to fill. Having gaps above is bullish, but I do remember seeing a chart posted on the forums about how in 2008 we had a weekly gap, we shat the bed. Whether we do the same, we’ll see, but I actually expect a rally. The weekly is almost at the 200 MA which is when bear market rallies usually start. The 200 MA is at 350 right now, whether we go down that much or not is to be seen.

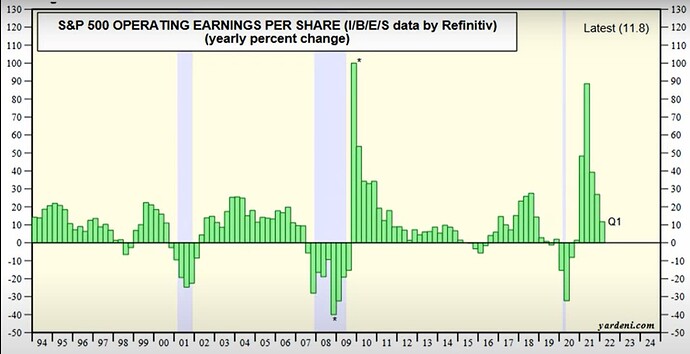

Some things to note is that recessions start when earnings start to go negative. We’re still in positive earnings so I don’t think we’re about to enter a recession as everyone is looking for it, earnings is positive and everything is extended to the downside similar to the bottoms of bear markets and major corrections. Until we start to see earnings go negative, I’m hesitant on saying that we’re in a recession or heading straight into a recession without a rally.

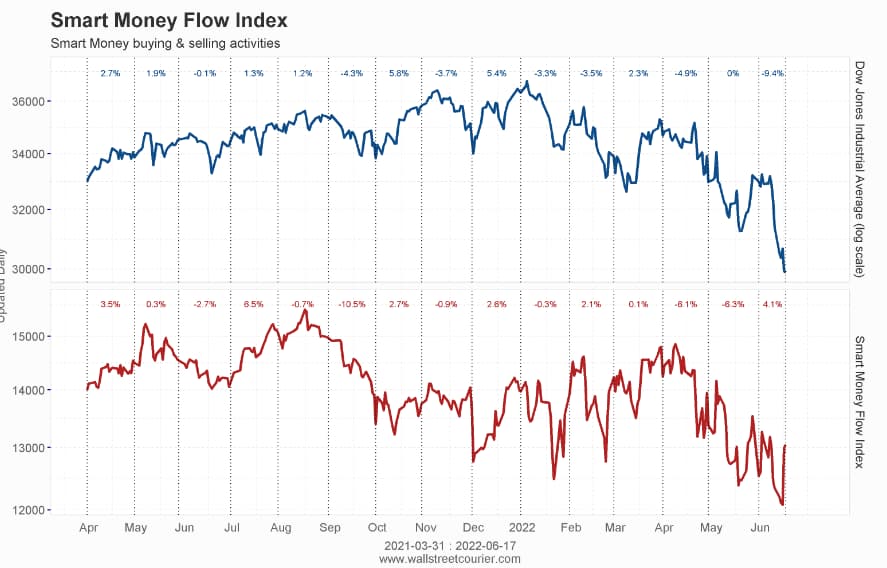

Another thing to note is the smart money index where we can see what smart money is doing (red line). We can see that although prices are going down, big money are buying. This divergence typically marks an uncoming rally. Something to note is that although the SMI is going up, there isn’t a bullish divergence looking at the 2 recent bottoms. Maybe this is just a false signal, but it’s something to note that big money looks like they’re buying the dip.

The VIX got crushed again, but it’s right at the trendline. I do expect it to bounce from there and if there is to be a rally, I expect it to make a lower high than it’s previous 2 highs. If not, then I’ll start to reassess whether a rally is to come soon. Looking at the trendline and the 8 EMA, I would expect VIX to try another high and then form an upwick showing bullishness if a rally is to happen. One thing to note is that the VIX still isn’t spiking and holding above 35 which makes me hesitant that we’re in a recession or about to tank to the depths of hell.

The 10 year yields currently has 2 upwicks and is looking bearish. It’s looking like it’s going to continue to roll over and give markets the boost it needs.

The dollar is up massively which is worrying, but we’ll see if it continues to track down as it’s still down overall for the week and was near a strong support. As the yields and dollar comes down, it should give markets the fuel and boost it needs to have a rally, but I want to see further continuation of them rolling over to confirm that this isn’t just a pullback.

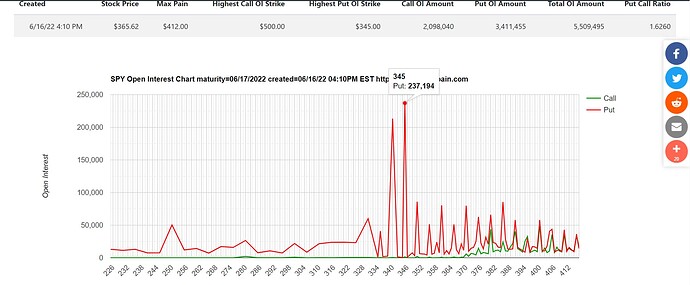

Put call ratio is strangely showing that less puts are in the market. Whether we see another spike will be seen, but it’s interesting that puts are exiting the market, possibly marking the start of the bottom.

Something big to note is that oil such as crude oil and natural oil are rolling over hard right now. Is this possibly marking the peak of inflation? Who knows, but the markets seeing oil rolling over should give a big positive sentiment.

Overall, these indicators are showing a possible rally as the things that put markets in a tight situation (yields, dollar and oil) are starting to roll over and possibly confirm tops of these. If on Tuesday, we see these indicators continue to roll over, I’m going to start to build a call position as I expect a huge short squeeze rally like in March and the last 2 rallies from the 380 level.

The summarize, charts are looking bearish and because of Powell speaking and no rally on quad witching, I’m going to expect Tuesday to be red and then starting from Wednesday/Thursday, I’m going to expect the start of a rally, assuming that the other indicators continue to roll over. Even if we’re in a bear market and a recession, most of these huge bear market rallies start from the 200 MA on the weekly so we should be starting to expect a rally rather than a 50% crash from here.