I am sober for the first time this week so here’s some good TA for yall next week.

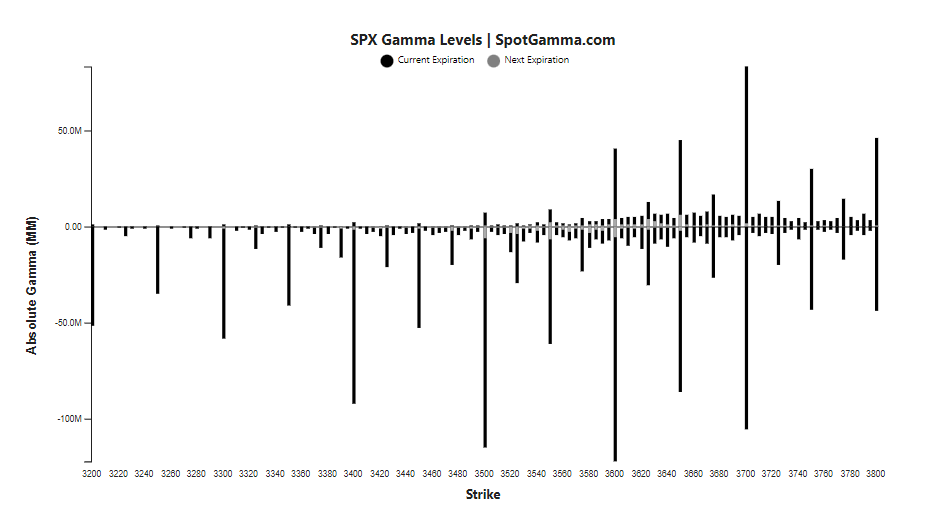

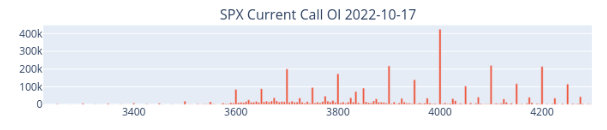

TLDR: I think that this rally is a bull trap and we’ll get another dump - whether it’s a higher low or a lower low, we’ll see, but I am not convinced of this rally confirming a bottom.

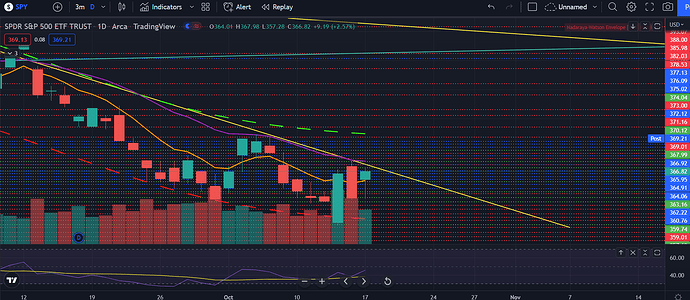

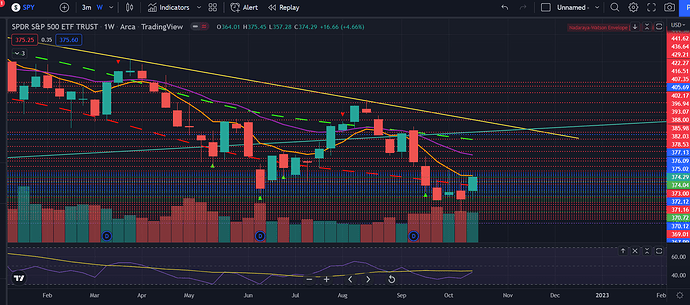

Starting off with the weekly chart, SPY moved back towards the 8 EMA. We are not oversold anymore on the weekly, giving me more reason that we’ll have enough tank to take another leg lower. We’ll see if the rally continues on higher to test the 21 EMA on the weekly, but right now, nothing on the weekly is bullish enough for me to say that this is a bottom. No bullish divergence on the RSI, RSI isn’t above 8/21 EMA, and the volume isn’t showing the capitulation move to mark it a bottom.

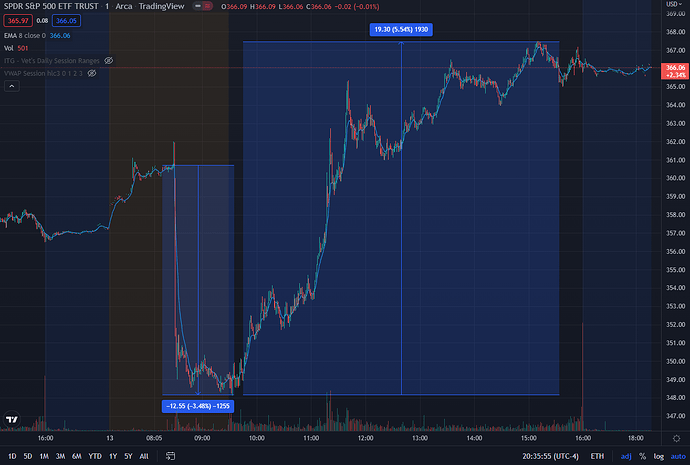

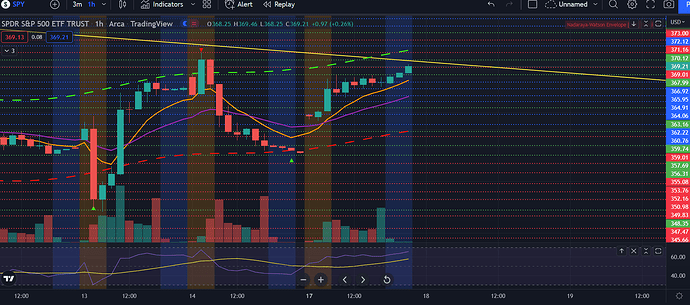

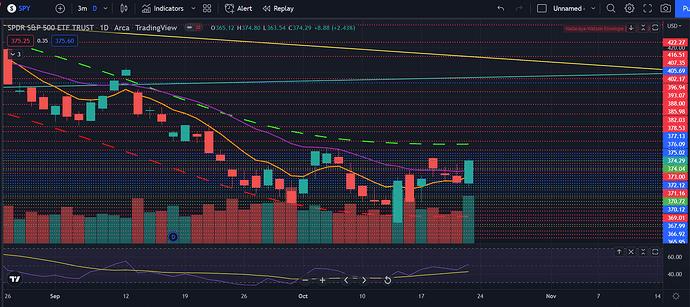

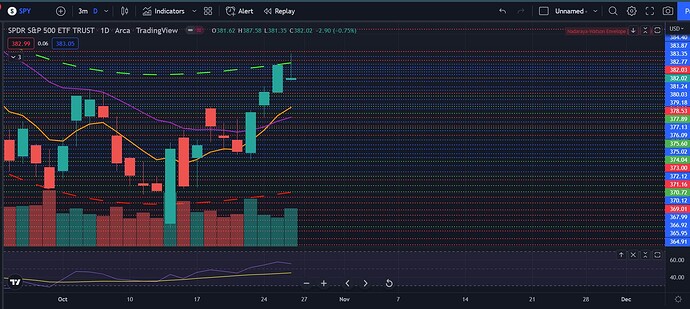

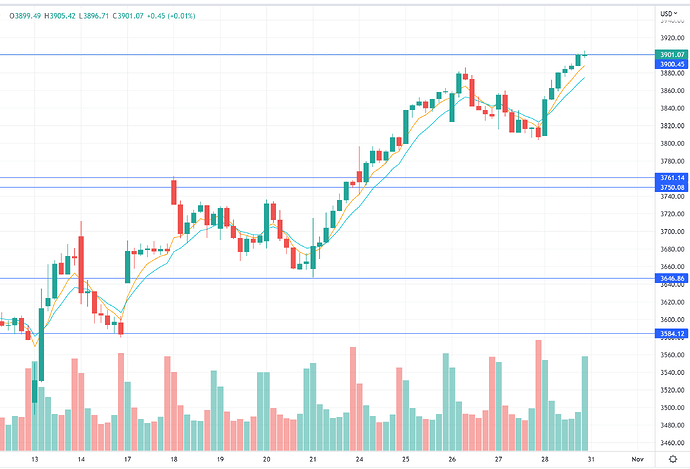

On the daily, we have a huge volume, likely showing a short squeeze. We still haven’t made a higher high on the daily though and it just seems like we’re in a range trade. We’re also right at the 50 RSI and we can shit down from here. The charts on SPY are showing bullish, but everything else is not.

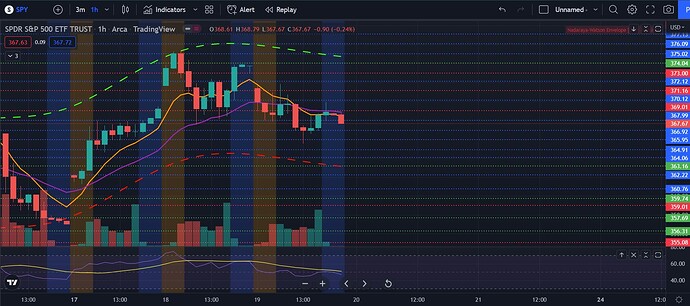

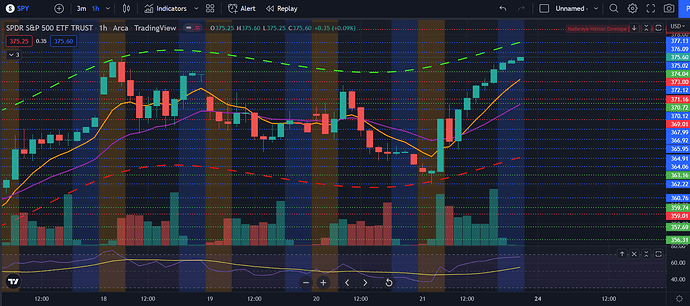

On the hourly, we are getting close to overextended. Either we go down to test the 21 EMA and make a bearish divergence or we start to turn here. Either way, very very bullish on SPY hourly.

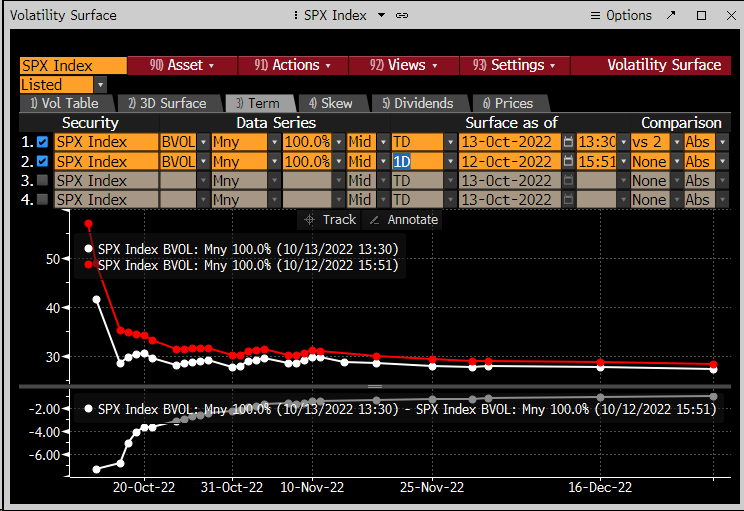

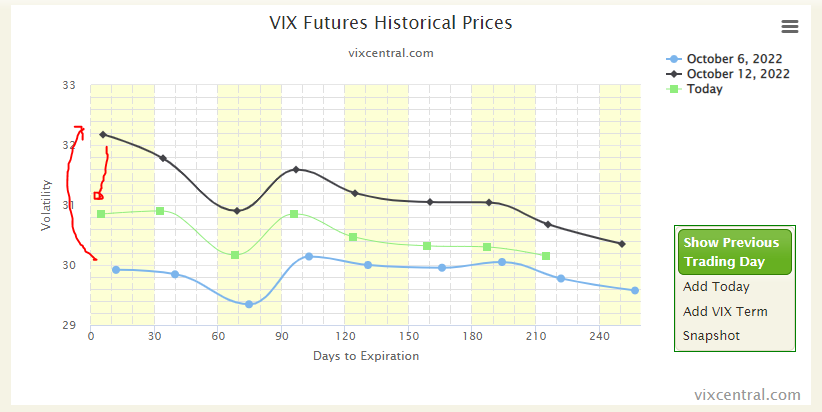

Now looking at VIX, it’s still holding above 29 very strongly. It’s showing that fear is still in the market, even with all this green. For the huge green day that we had, we should have moved lower down, but we didn’t. Not a good bullish sign.

Another sign that I’m looking at are the small caps such as IWM, JNK (junk bonds), and TLT. These are all making way less gains than SPY, showing weakness in the markets. This is not a good sign. If this was a bottom on SPY, these small caps should be making as higher or bigger gains than SPY.

The 2 year did come off a little, but zoom out and you see how far it’s run up. This is just a very very minor pullback and not big enough to really say that this is bullish.

The dollar did come off strong as well, but it’s still holding that support level. I don’t think that the dollar is weak enough right now to cause us to dicks up rally.

Overall, I am not seeing enough signs to say that bull season is back. Maybe we drift up higher, but I do think we’ll eventually fall back down. Maybe earnings this week will shit it or fear leading into the FOMC meeting will. Who knows, but small caps are lagging behind hard and each time that it has, it has marked the next leg lower this entire year. Earnings next week could also shift all my TA here. If earnings all come in surprisingly good, then maybe we did see a potential bottom for the short term and rally hard. But until CPI reports show that inflation has peaked and Fed is giving signals that they’re about to pivot, I do not see this as a bottom and we’ll either retest the lows or make new lows.