TLDR: if we don’t start bouncing here, very good chance that we just fucking drop another 20% ngl.

Now let’s look at the monthly chart for SPY. We are at the 50 MA (green line). This has been typically a strong support for SPY throughout the years. There is a good chance that we bounce off here, but that would still just be a bear market rally, rather than an actual reversal. Another thing to note is that we did not get a bullish divergence on the monthly, possibly hinting that we might not be at the bottom yet. Also since we’re starting to head lower than the 50 level on the RSI, we might be starting another 20% leg down from here. Not good, esp with these huge monthly volume red candle showing follow through on the last red candle.

On the weekly, things aren’t looking too much better. We’re right at the 200 MA. This has acted as a strong support throughout the years so it wouldn’t be surprising if we started to rally from here. One thing to note is that there is a bullish divergence on the RSI and the MACD and we’re very very overextended to the downside using my indicator. All these signs lead me to think that we’ll have some kind of bear market rally, but the selling strength is very very strong right now. For me personally, I am looking at bullish positions, but very small positions until it actually plays out.

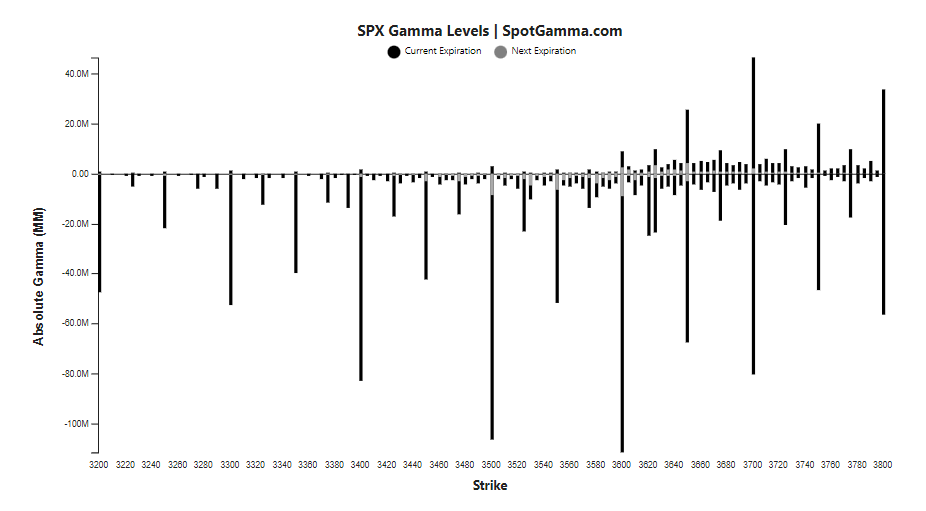

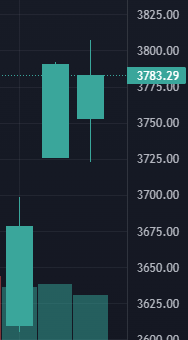

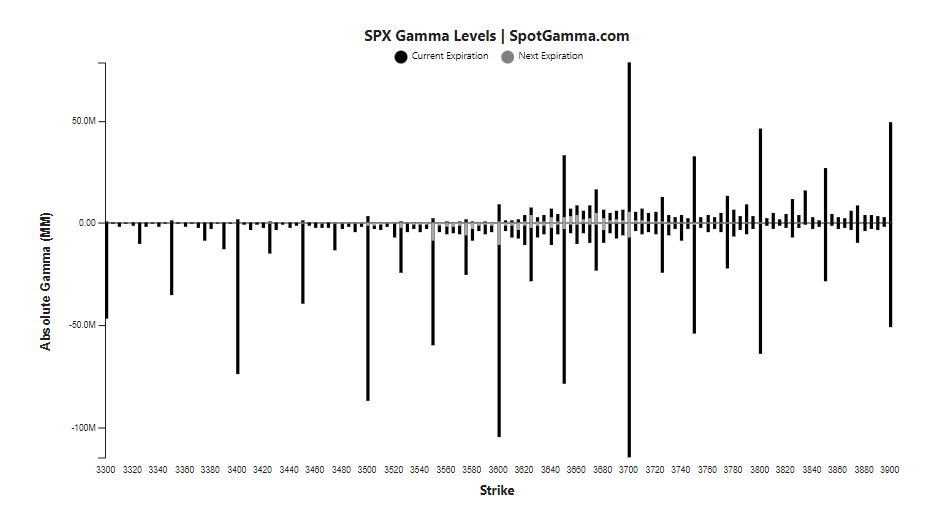

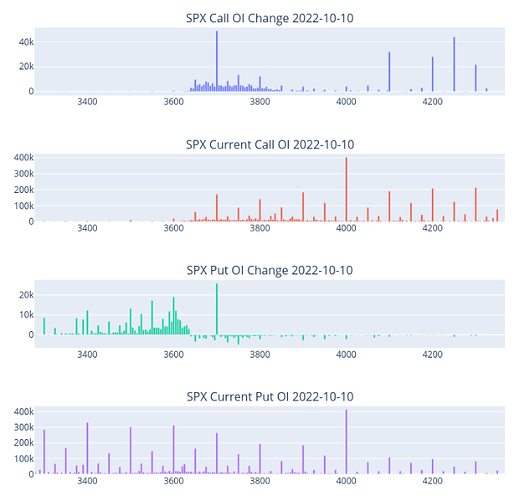

Yeah so the daily isn’t giving good hope either. Look at the huge volume today. I think that’s kinda proof that we broke through the huge support at the 360 level, but we’ll see if that’s the case or if this was a bear trap. Because we do have a bullish divergence on the RSI (none on the MACD), and overextended to the downside, right at supports. This might be just hopium though, who knows. But not looking good and we might be going straight to 350 here if the support did get broken and we’re out of our consolidation range.

Now looking at the hourly chart, yeah buyers are not stepping in boys. Constant fails to stay over the 21 EMA and rejections at the 8 EMA. We’ll see what SPY does, but on the shorter timeframes, seems like we’re still not bottoming and have more room to go lower.

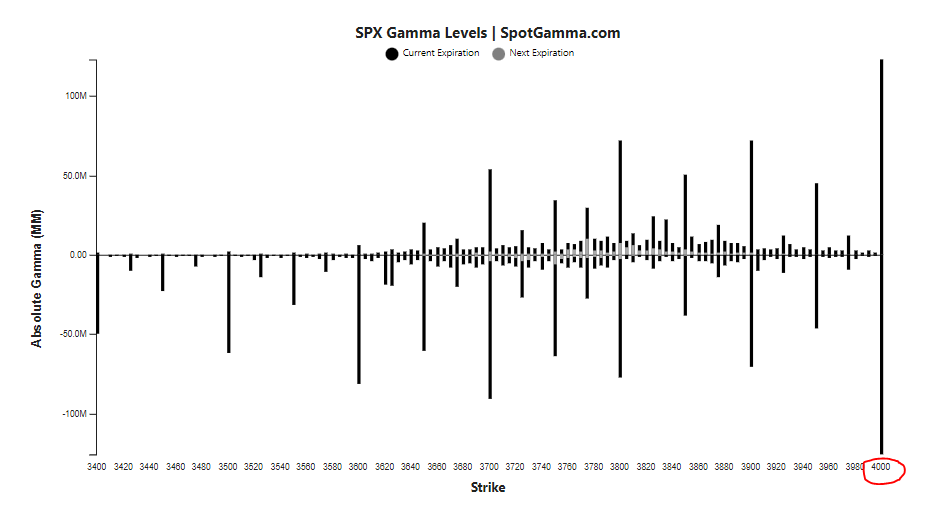

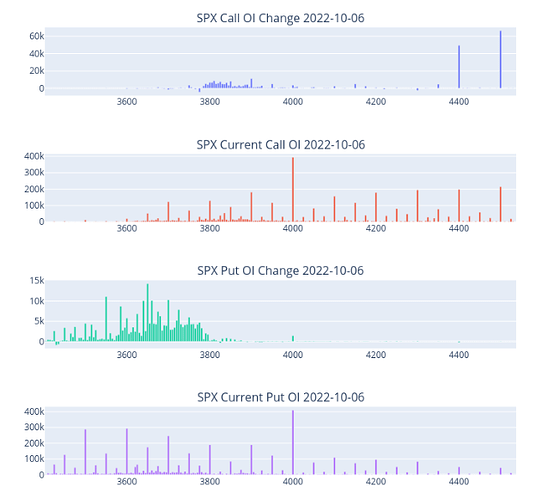

Now one thing that confuses me is that although the charts are very bearish, the other indicators aren’t too bearish. VIX just stayed flat (was actually down for Friday) and isn’t really spiking. Could this be a sign that the move on Friday was due to monthly expiry volatility and a bear trap? Who knows. But weird not seeing VIX spike over 35 by now.

One thing I am looking at also is IWM - the small caps. They did not make a new low, so did HYG. If small caps aren’t making new lows, could it be that the move we’re seeing on SPY is a bear trap? If this move was not supported. Another thing to watch is the Dow Jones Transportation Average. Apparently, that and SPY are closely correlated and SPY tends to follow the DJTA. And on the DJTA, we also did not make a new low. Very interesting to see that small caps are not shitting down more than SPY right now. Stay cautious bears.

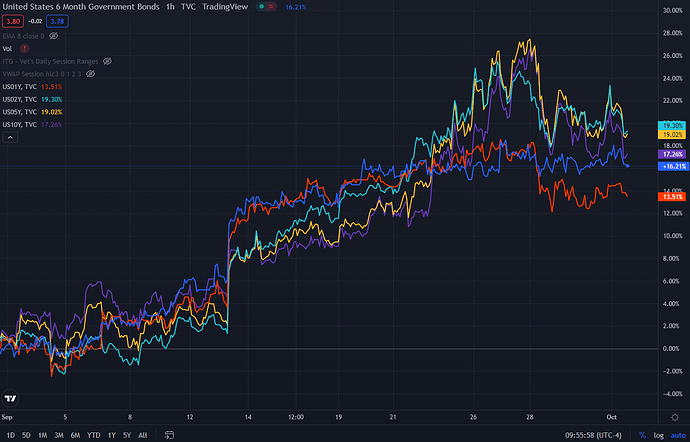

The 2 year yields are turning back up after a little breather. Not surprising, but could we be setting up a lower high or a bearish divergence to form and give SPY more room to rally? Either way, 2 year will be on an uptrend for a while longer.

Another interesting thing I noticed. The dollar did not spike really at all Friday. Another sign that this could be a bear trap. Even if we had good pullbacks the past 2 days on the dollar, it’s weird that it didn’t go up much at all, and even had a good sized top wick. Interesting to see and curious to see how it’ll play out.

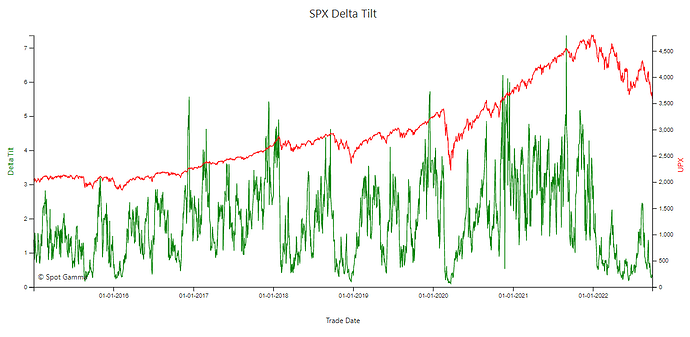

Now for the other indicator, the market breath. This is the percentage of stocks in the S&P that are above their 50 day moving average. We are at historic lows where we typically make bottoms or start bear market rallies. I’d be surprised if we continue to stay at these levels for much longer unless we have full on capitulation and have a circuit breaker. The risk reward for swing puts here is not good at all according to my system.

Overall, SPY charts are screaming bearish, but my other indicators are not really agreeing with this move down. I am leaning towards a bear market rally right now, but I’m not staying in any plays for now. I do think we will continue lower until CPI comes in better than expected and the Fed changes their tone, but the r/r here for spy to go lower is not good. So be careful to the people holding swing puts here and stay green