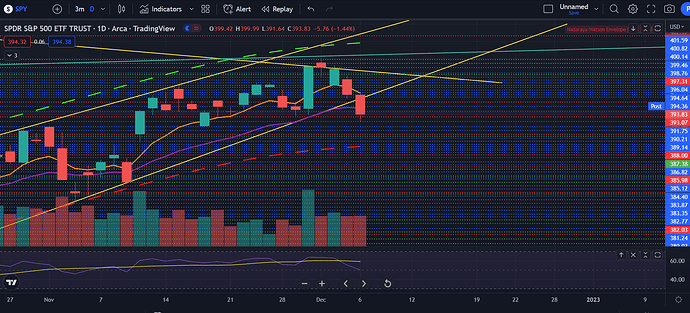

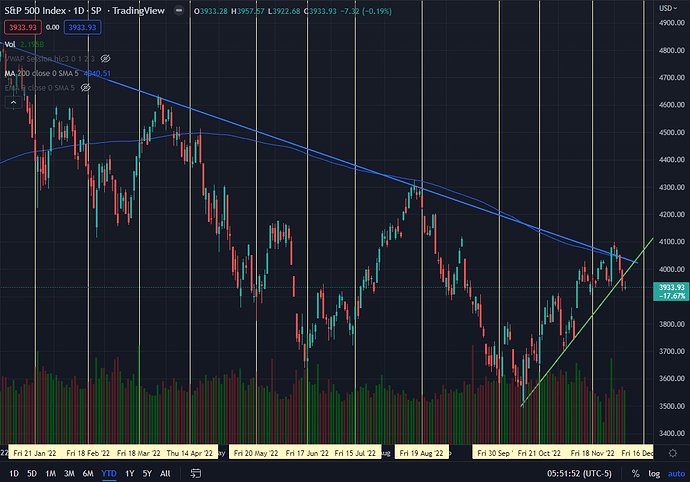

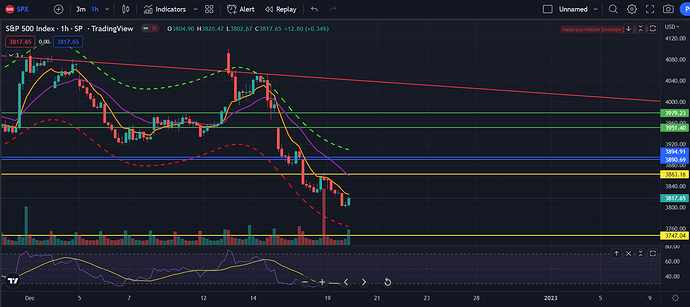

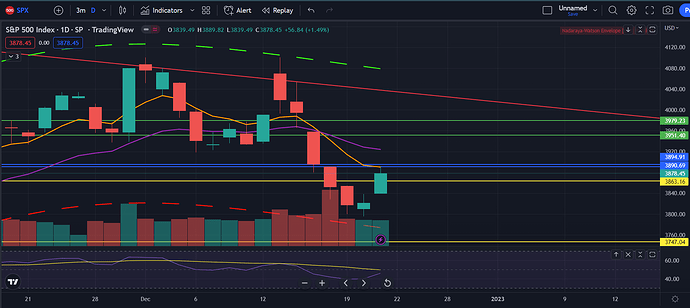

TLDR: I personally don’t think we’ll see a drastic drop this week and markets are gonna dick around until next Tuesday/ Wednesday for CPI and FOMC

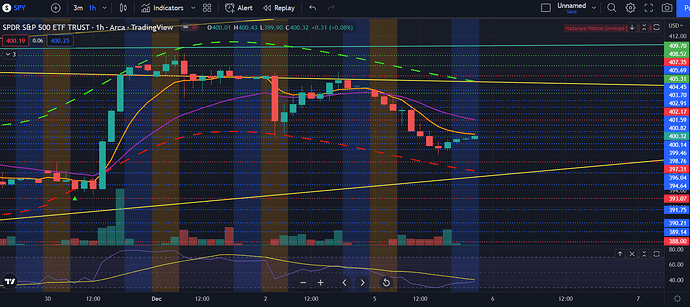

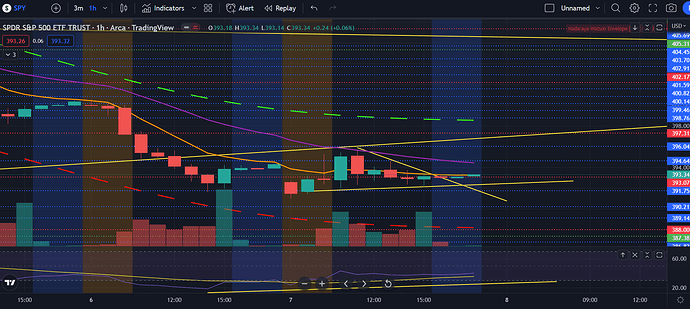

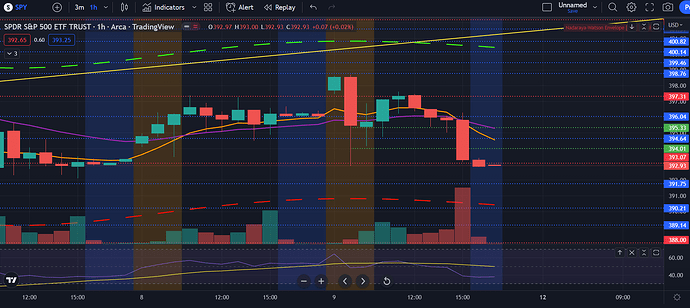

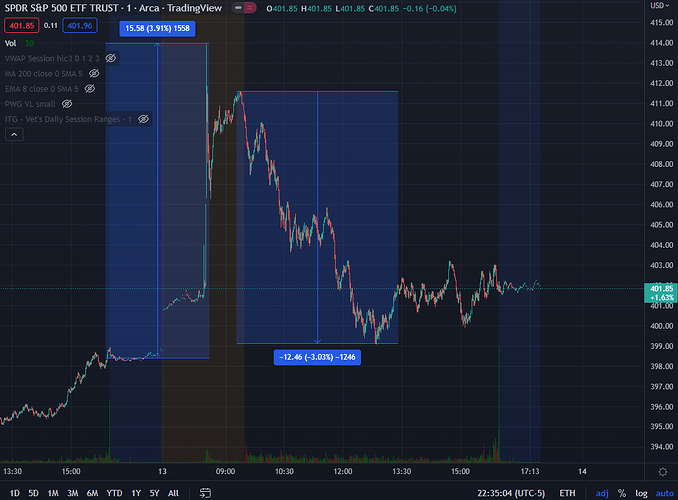

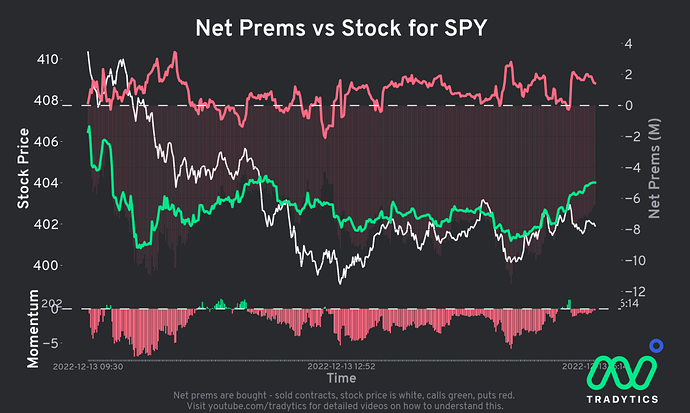

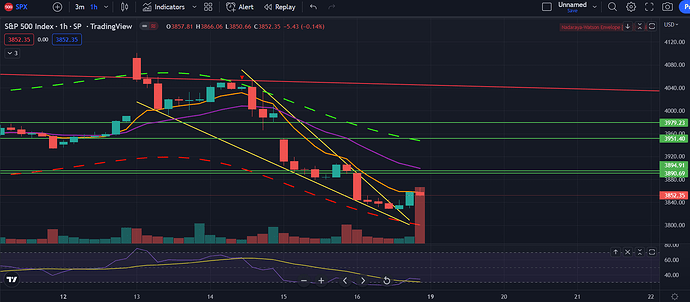

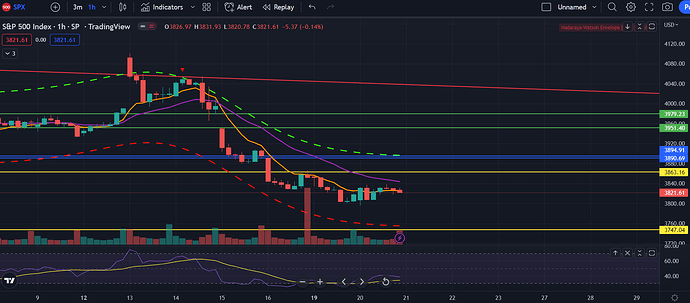

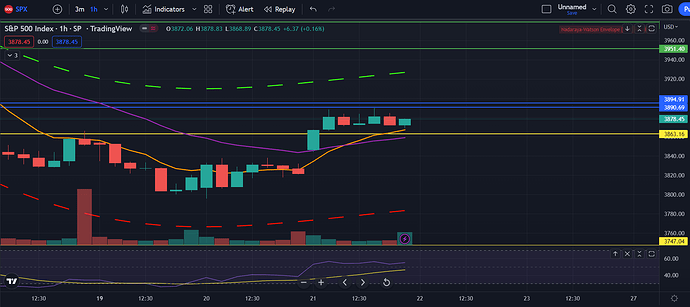

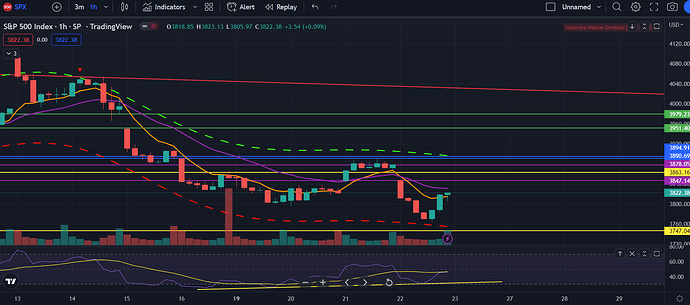

SPY on the hourly broke below the 2 EMA lines and is just drifting lower. We did move up a good amount in AH, maybe just a retracement. I am looking for a bullish divergence to set up on this wedge and dick around in the 398 - 410 range for a bit. Anyways, seems like a change of trend, but we’ll see if this move is with conviction and bust through the wedge.

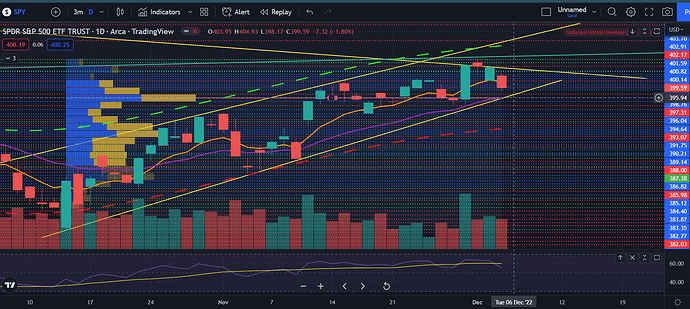

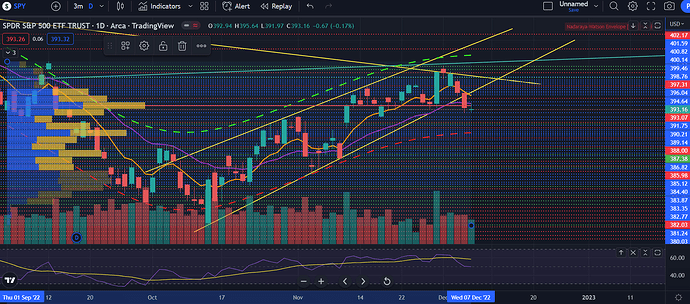

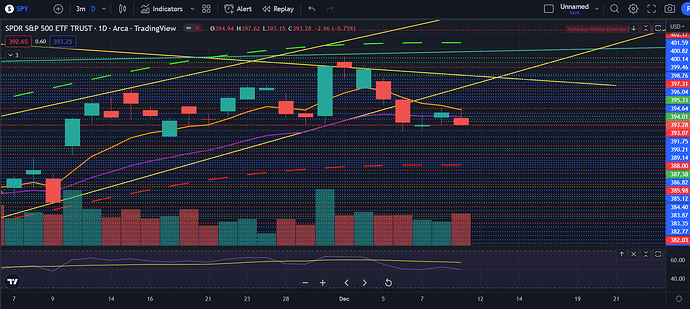

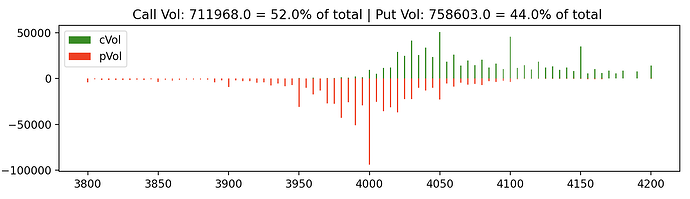

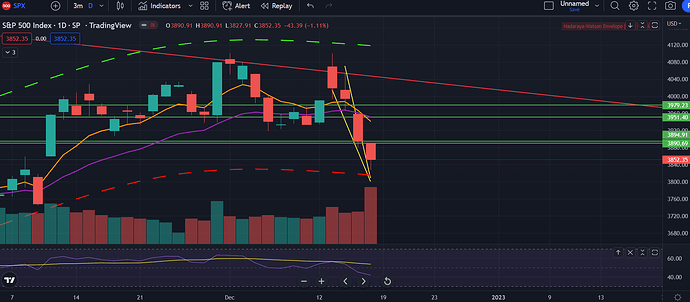

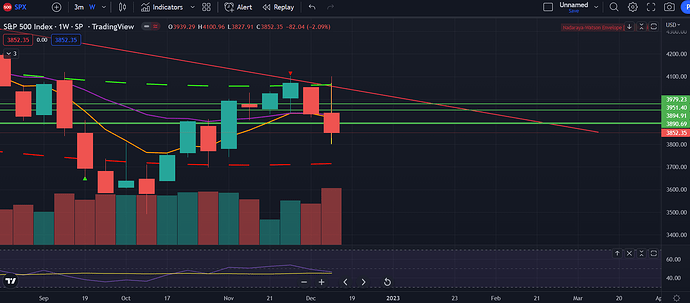

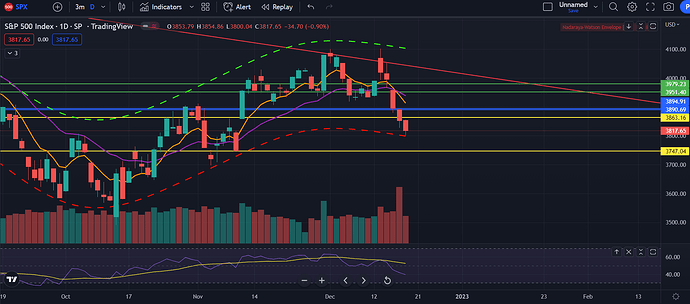

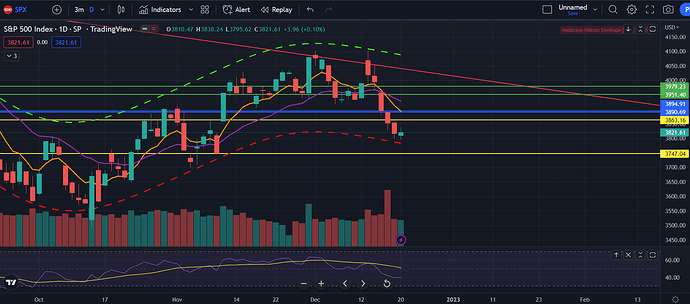

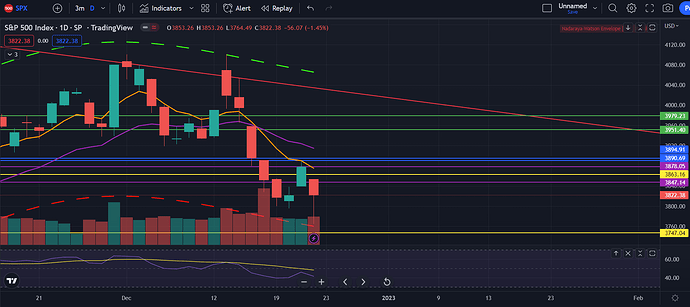

On the daily, we can see the wedge that we’re in right now. One reason that I don’t think we’re gonna go dicks down is because the volume profile. We can see the huge volume point of control right near the bottom of the wedge and the 21 EMA. Good supports there and I think there are buyers lurking in this area as there are good amount of wicks here. I am personally I think that we’ll bounce off near here and then set up a lower high to get dicked down with news but who knows.

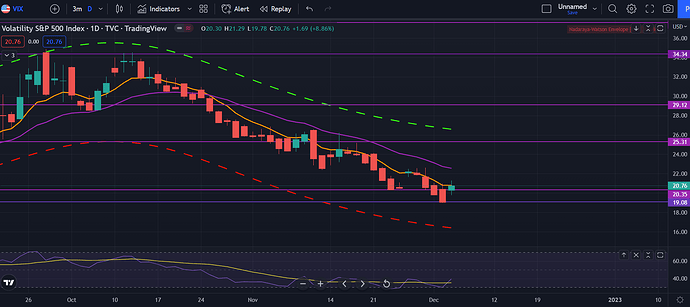

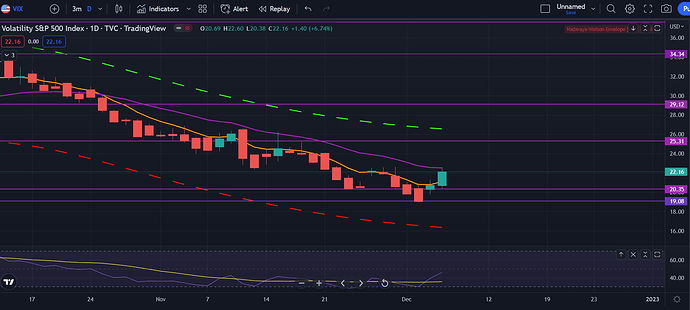

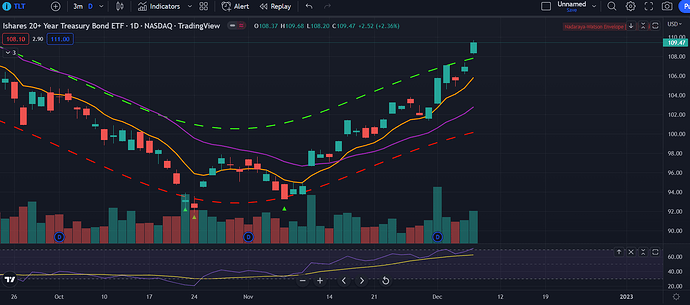

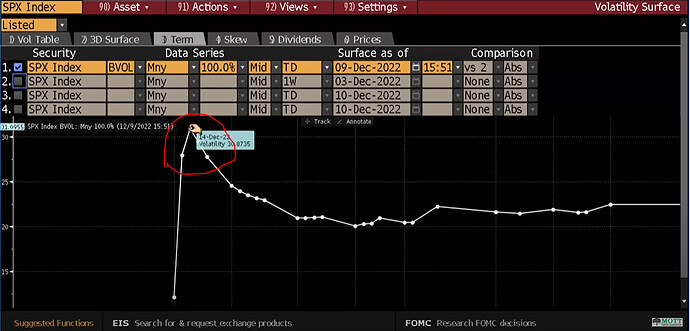

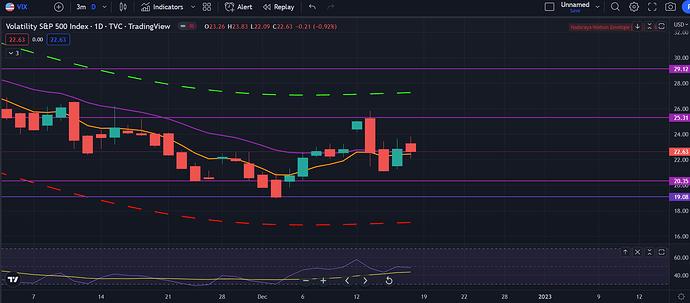

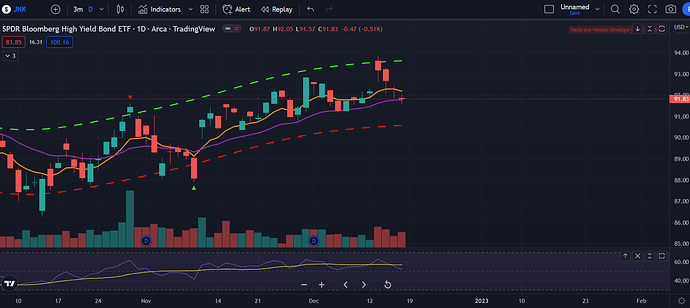

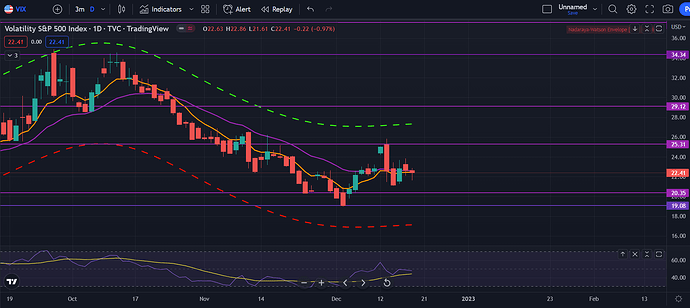

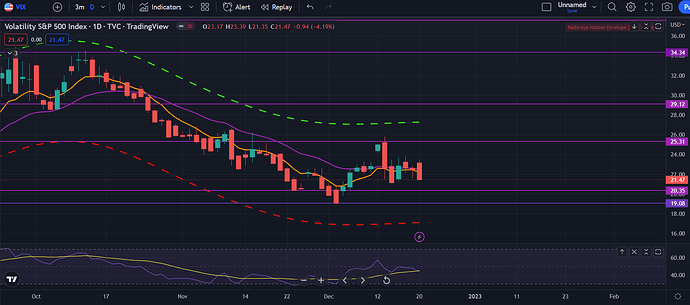

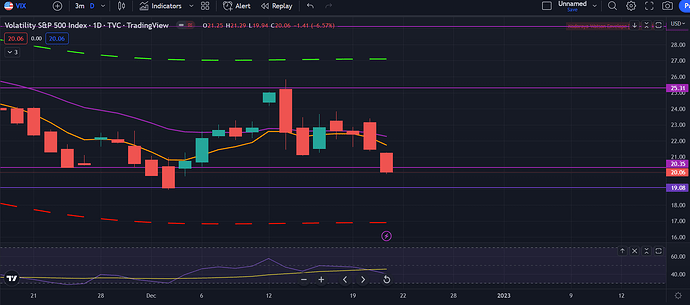

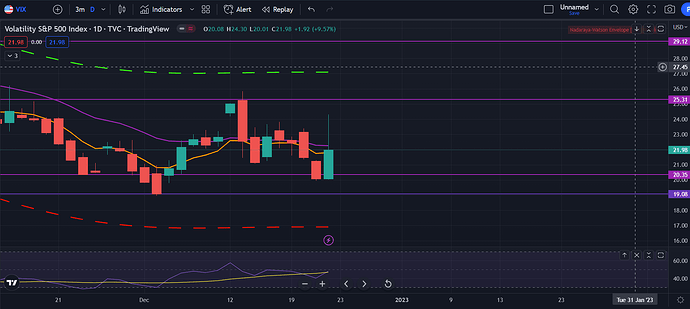

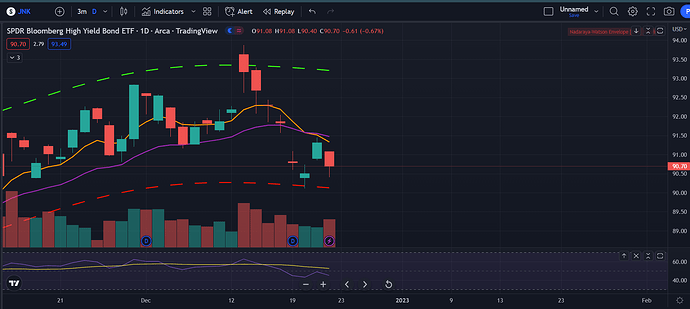

Not much happened in the other indices such as the the 2 year and dollar, but those are looking like they want to turn up while VIX is looking like it wants to turn up too. All bearish signs and I wouldn’t be surprised if we do break down the wedge tomorrow and drill to my asshole, but again, non real strong moves to really warrant that.

Overall, I am bearish, but I am waiting for a lower high to set up in this wedge before breaking down. Good luck all