Vega play around FOMC/CPI

Played around with a calendar spread last week to take advantage of IV shenanigans around CPI+FOMC+opex, journaling that here.

Setup

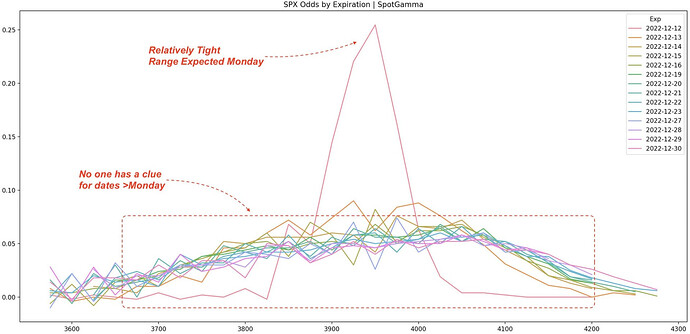

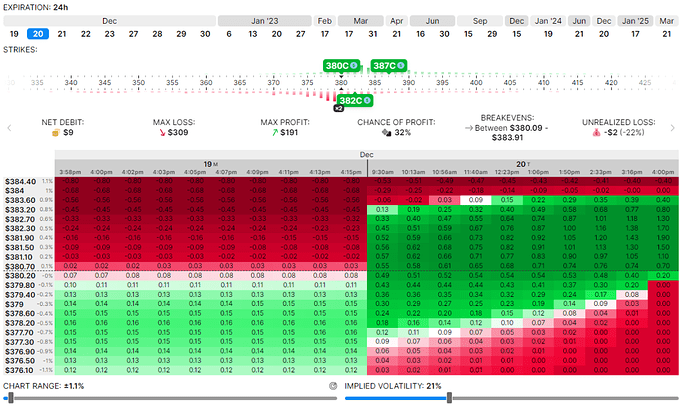

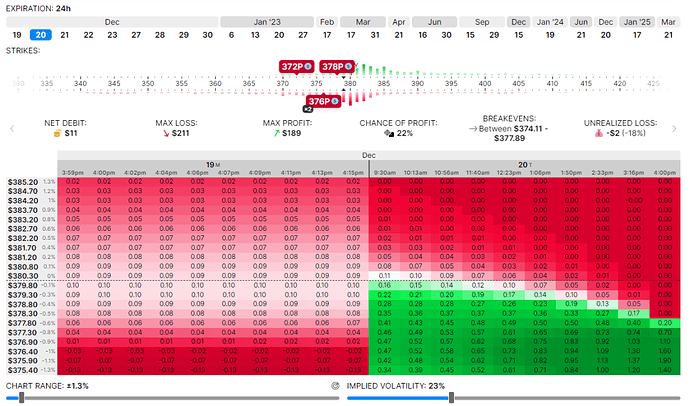

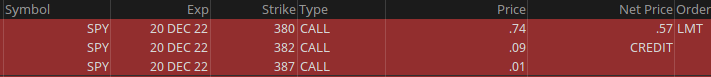

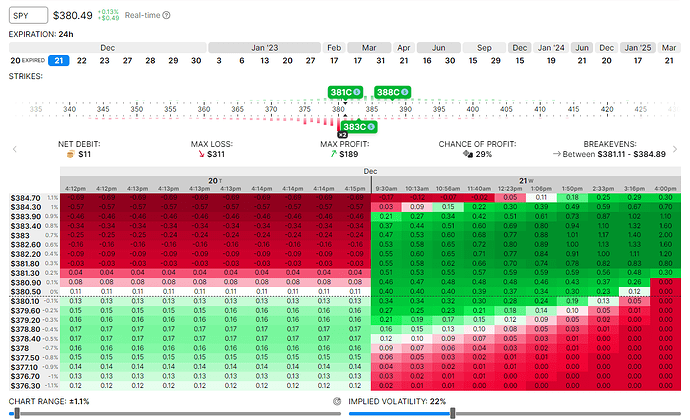

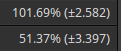

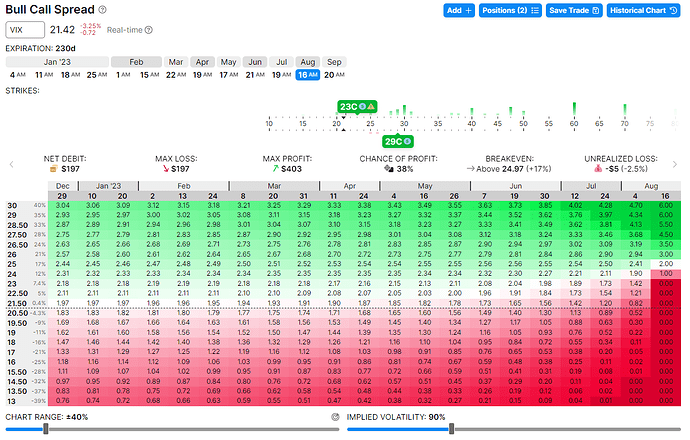

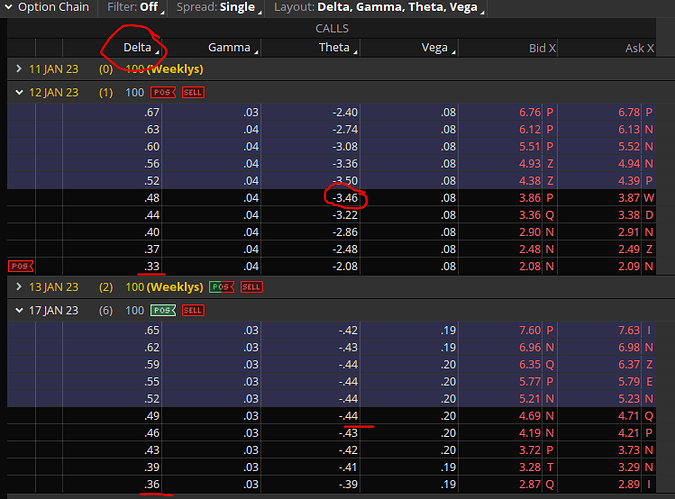

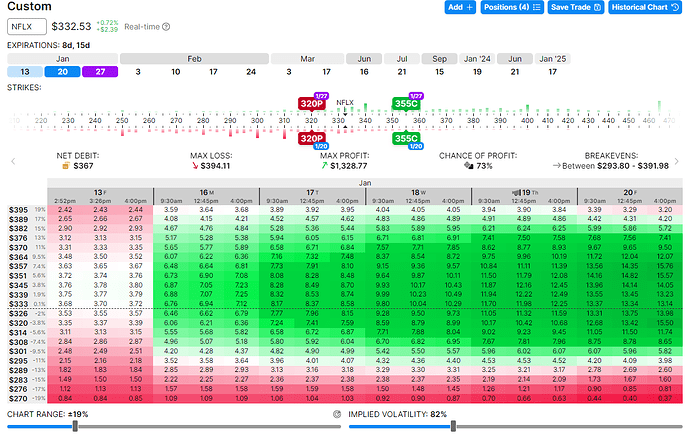

The IV for options expiring last week were extremely high (below), where calls and puts expiring on Friday were very close in value to those expiring on Monday.

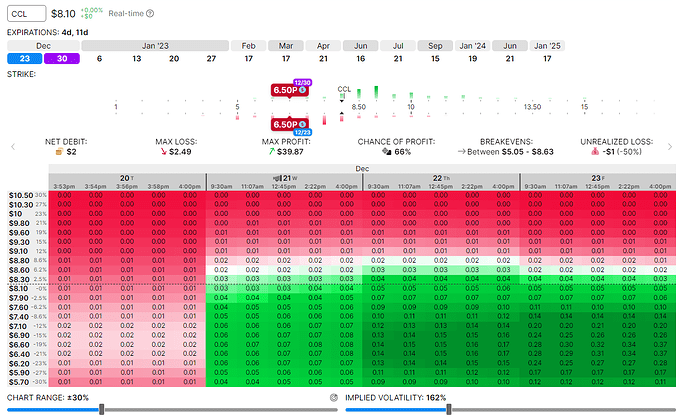

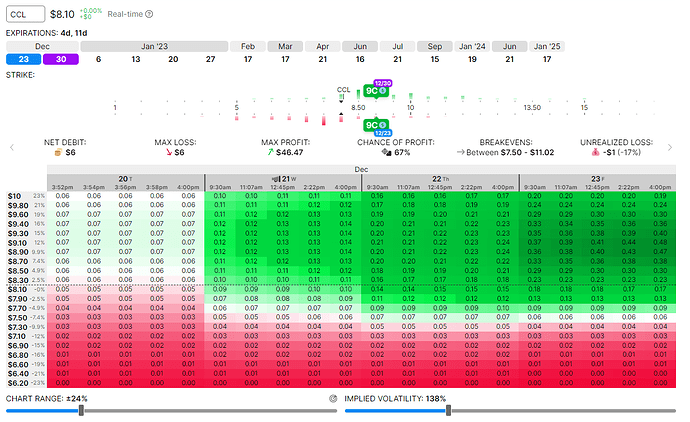

IV had jacked up the premium to account for a wide range of movement from CPI+FOMC. This set up a nice vega play.

My bet was that on Friday, there would be sufficient IV crush that the extrinsic value would decline to result in a nice spread between the Fri (12/16) and Mon (12/19) options. Theta would also hopefully contribute, as at that point it was 0DTE vs 3DTE.

Dec 12, 10.05am

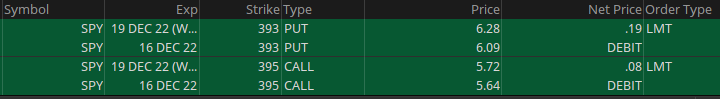

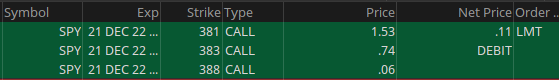

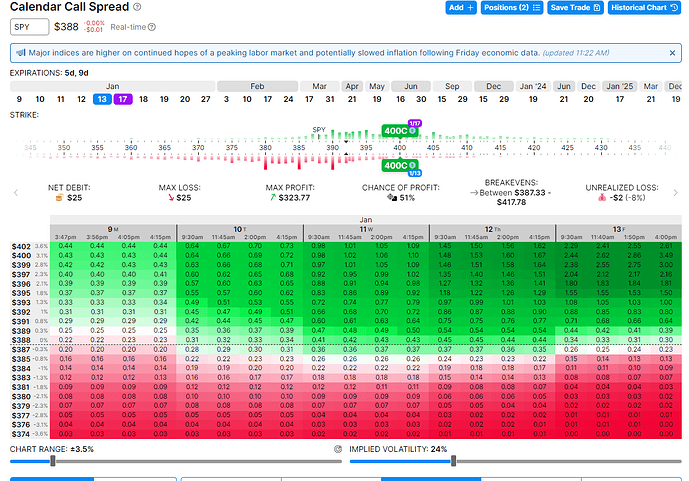

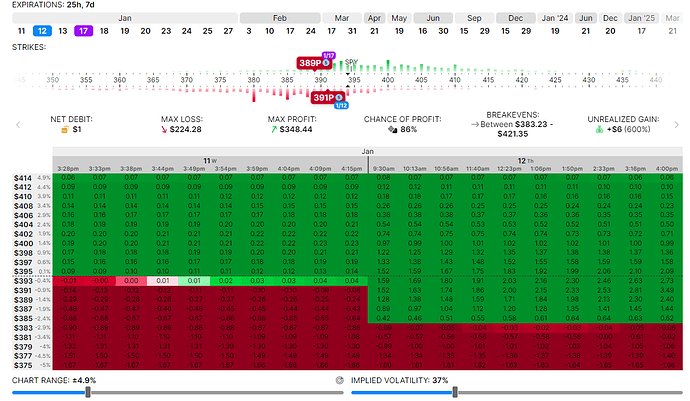

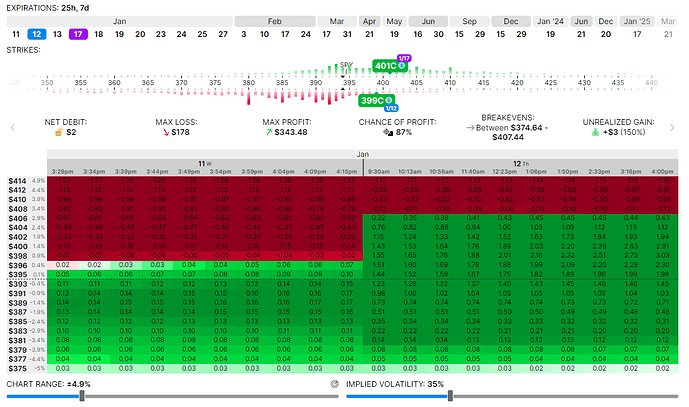

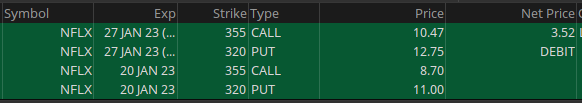

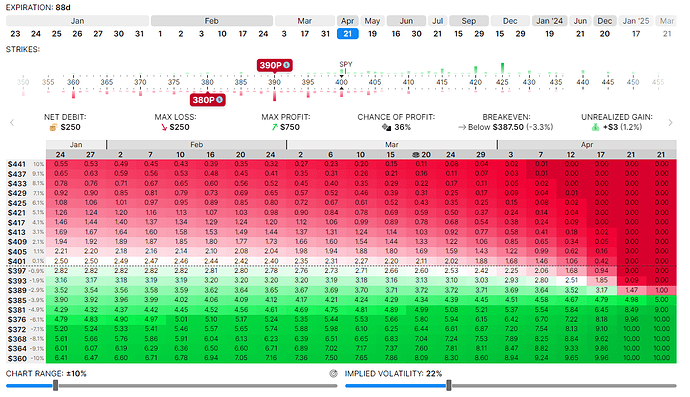

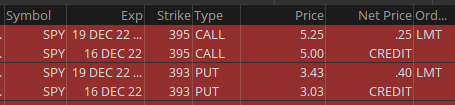

I got 395C calendar spreads for 0.08 and a 393P calendar spreads for 0.19. They were both 5DTE/8DTE spreads.

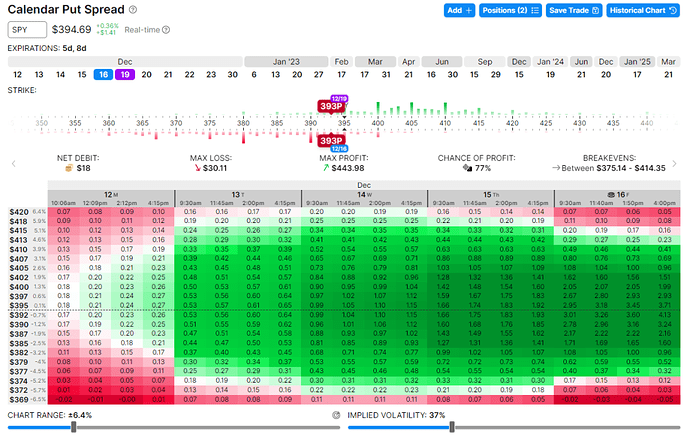

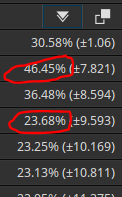

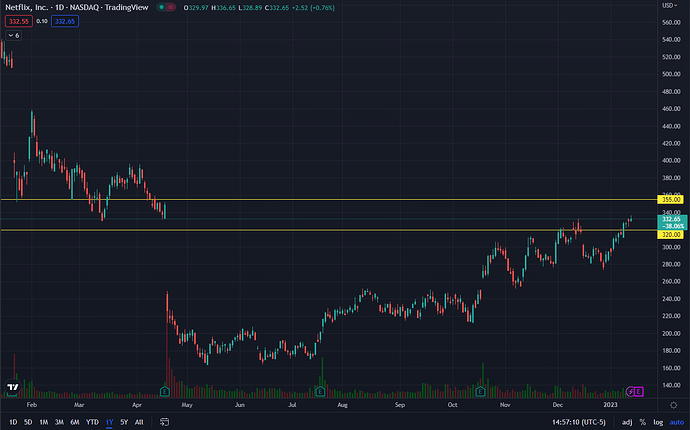

As we can see below, the potential returns were astronomical if the market ended up in the goldilocks zone. I didn’t really expect it to be dead center in that zone, but as long as SPY ended up over 375, I was going to be ok. SPY was at ~394.50 when I took these trades, so it seemed like a very safe bet.

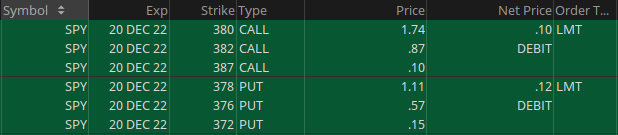

Dec 14

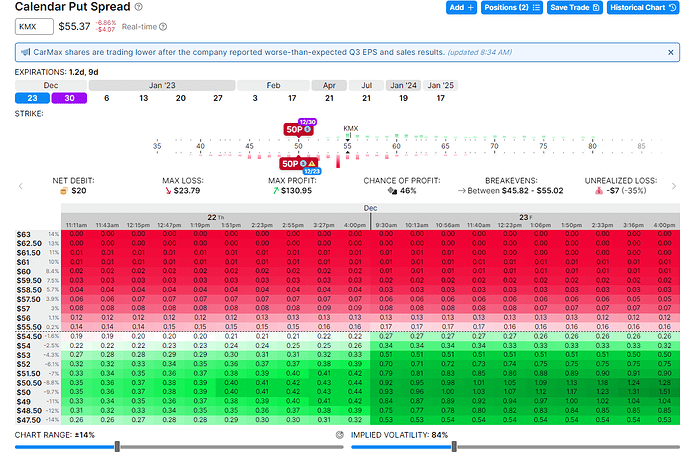

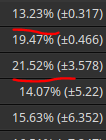

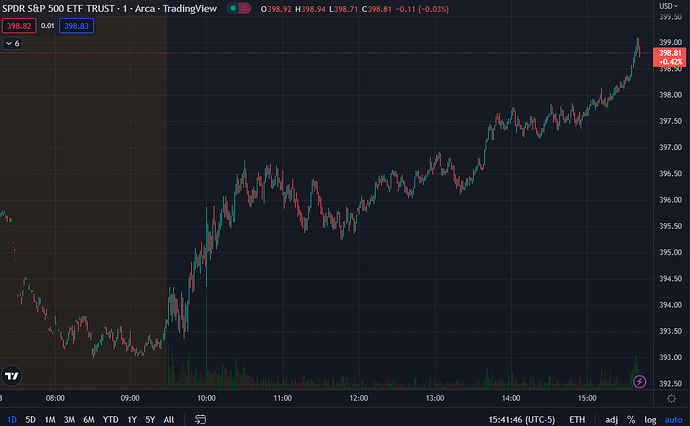

Closed half the spreads right after FOMC. Calendar put spreads closed at 2.42pm for 0.40 (buy price 0.19), and calendar call spreads closed at 3.39pm for 0.25 (buy price 0.08). IV had done down some, but not too much. Still, was able to recover initial capital and then some. Plan was to hold the other halves into EoD Thu or maybe even Fri to see how much I could milk out of this.

Dec 15, 3.03pm:

Closed out the other half of the 0.19 put calendar spreads for 0.50. SPY was at the 389 handle, so the 393P was ITM, and didn’t want to deal with assignment overnight.

Dec 16, 9.41am:

Closed out the last of the 0.08 call calendar spreads for 0.24. 395C were deep ITM as SPY opened at the 385 handle. Deep ITM calls don’t do the extrinsic decay thing that well, so returns were much less than it could have been as a result of SPY crapping 4% in 2 days…

Reflections:

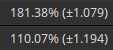

Can’t complain about the results, though they could have been so much better had SPY not moved so much - 200% return on the calls, and 136% return on the puts.

I wasn’t sure how this would work out and how much I’d have to actively manage it. Seemed to work reasonably well and management was low effort, so will share the setup as I enter it, next time.