We’re all eagerly waiting for PCE numbers to drop tomorrow, but just wanted to make sure we don’t miss the other, perhaps even more important source of market movement - positional flows.

It is important that we recognize, and thus play the two pieces in their own right.

Here’s why positional flows matter so much tomorrow:

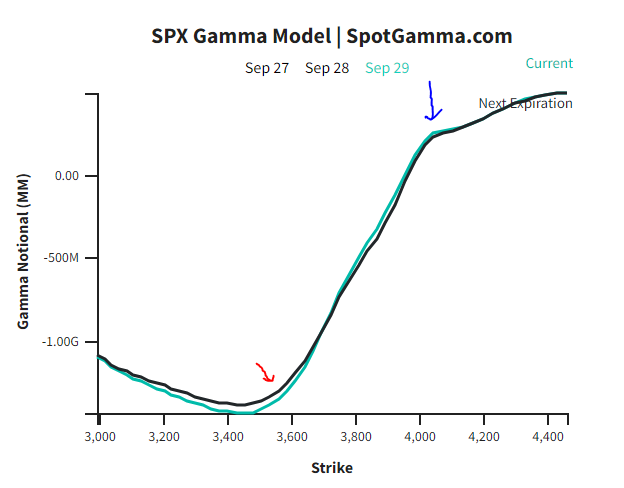

- VIX is quite high right now. (Image 1) Much of this is event vol tied to PCE, and will unwind. When vol unwinds, its tailwind. With vol this high, VIX falling to 25 will be a significant tailwind. Some of it as related to the situation in the UK, but I’m assuming most of it is not.

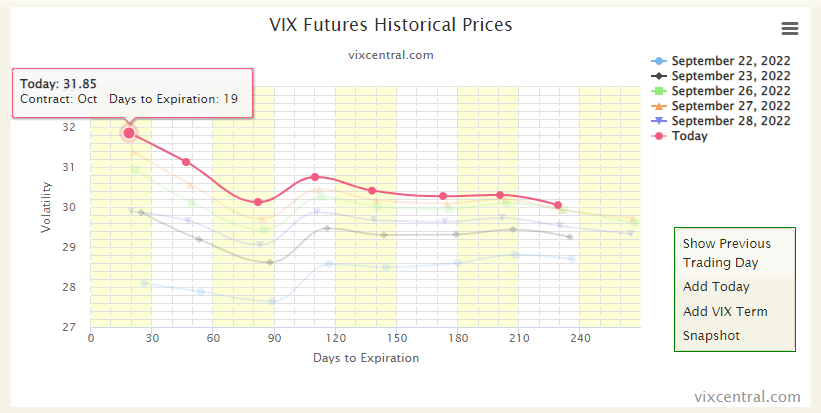

- Folks bought a TON of puts today, hoping for a gap down tomorrow. (Image 2) Note that IV is high enough that one really needs a gap down to make money on these. If there is no gap down, those that were hedged will now be de-hedged. This is the second source of tailwind.

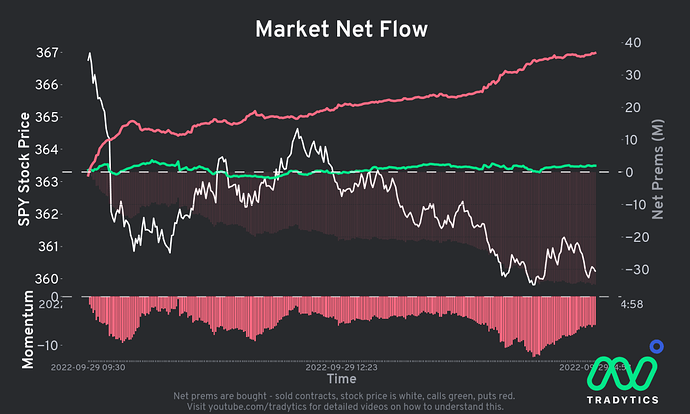

- There is were a ton of puts already when we started off today, with significant amount of gamma at them. (Image 3) These will also be de-hedged if we have a rally. This is an extension of above.

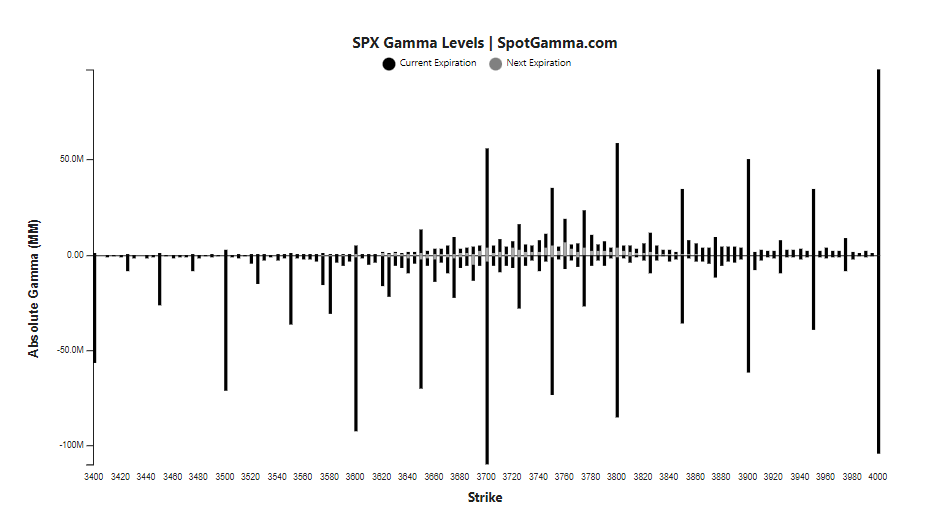

- We’re deeeep in negative gamma territory, with vol trigger at SPX 4000. This means that as the movement upward begins, MMs will fuel the move in that direction. This is the third source of tailwind. This tapering off of MM support at the 4000 level is evident in image 4, where the blue arrow is.

Thus, if PCE does not elicit heavy sell-off, we could have a glorious rally tomorrow! ![]()

Now… where could this go wrong? A few ways:

- PCE is bad enough that the sell-off is extremely strong - strong enough to counteract the vol unwind, and then some more. In that case the negative gamma setup makes MMs fuel the dive downward.

- Putin or Kwarteng get bright destructive ideas overnight.

- Quarterly rebalancing. While we don’t know that this will necessarily be negative, its likely that there will be a rotation from risk to value, and also to safety. I.e. bonds which are yielding > 4%.

If any one or more of these come to pass, we’ll have a spectacular dive instead. ![]()

Silver lining… the 3600 support level is quite strong, and there’s the 43,000 OI-strong JPM collar right under at 3580. We can see this in Image 4, at the red arrow. That should arrest the fall for tomorrow. For a bit, anyway.