TLDR: I expect a move to the 200 MA on the weekly on SPY, which would be around 359, then have our relief rally.

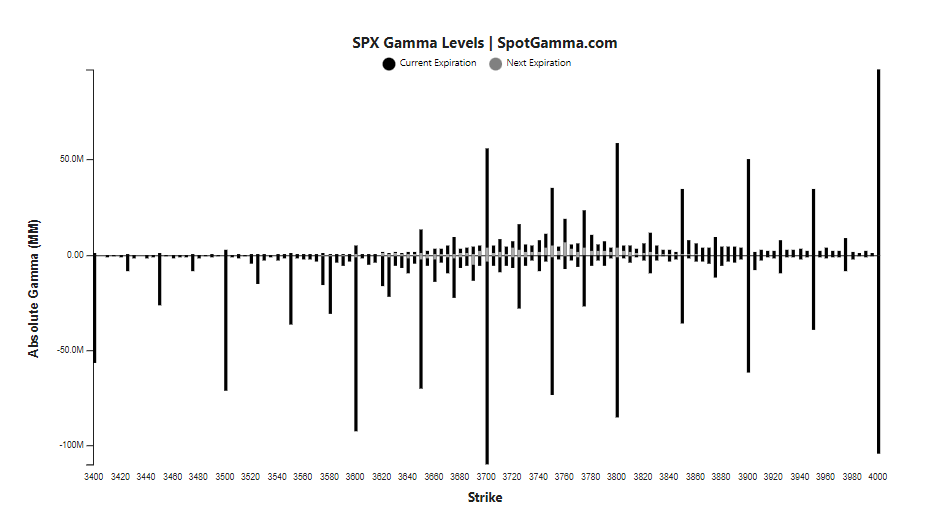

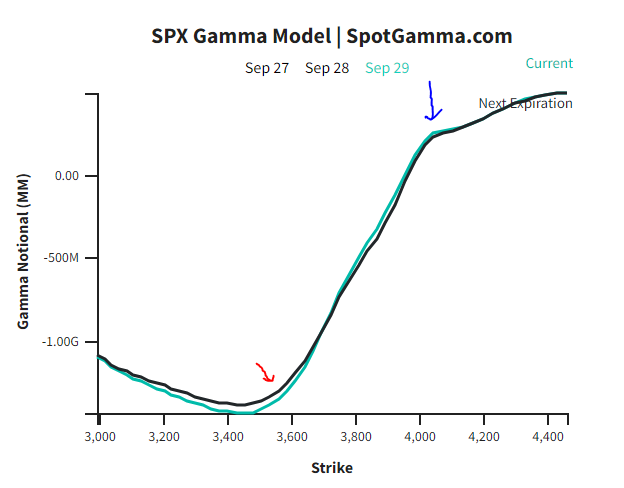

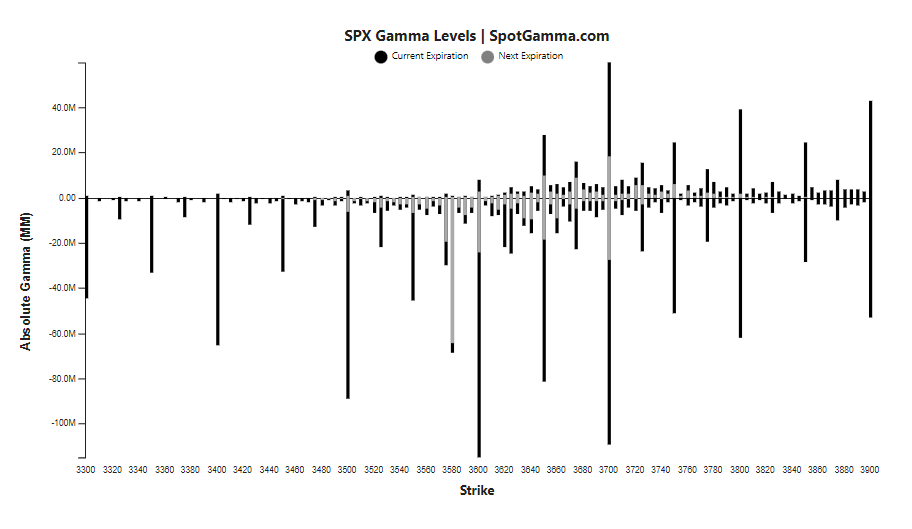

So SPY did make a move to the 371 level and then died right after. Today had 2 huge moves, but int he grand scheme of things, it was mostly just consolidation. I think this is the consolidation before the next leg lower to the 200 MA on the weekly which would be 359. That’s around little over 1% move down from here. Very likely to happen, even with us being this overextended to the downside. SPY on the hourly has a bullish divergence on the RSI and MACD, but I think we’ll make another leg lower to form a bigger bullish divergence. The trend is clearly strongly down as we can’t hold above the 21 EMA and riding down along the 8 EMA.

On the daily, we are very overextended to the downside and I don’t think that we will stay this overextended for much longer. The sell volume has decreased and there does seem to be buyers coming in at these levels. Also, the RSI is reaching oversold, which on a daily timeframe, usually leads to a rally or a bottom. Either way, I’m expecting us to rally back towards the 8/21 EMA on the daily before running back down to make a new low or retest the lows that we make. There are no bullish divergences on the RSI or the MACD on the daily, so I’ll be expecting us to form one when we form a bottom.

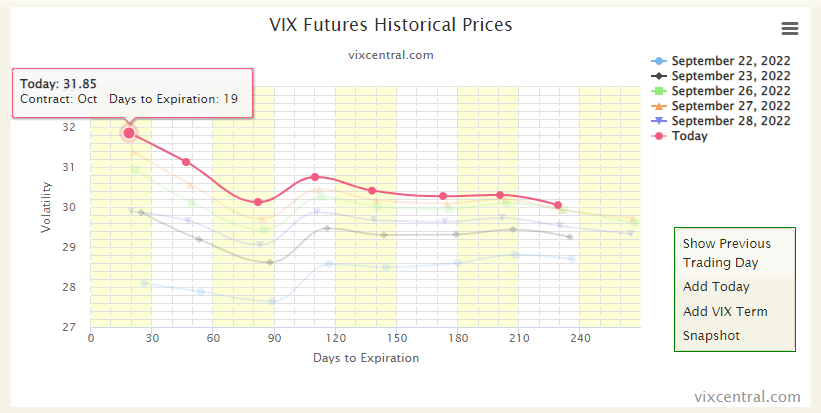

VIX is blasting off again. I think that we’ll make a new low because VIX isn’t right at the levels where we do see bottoms, which would be near the 34 range. We still got some room to go up so I’ll be expecting stocks to shit lower.

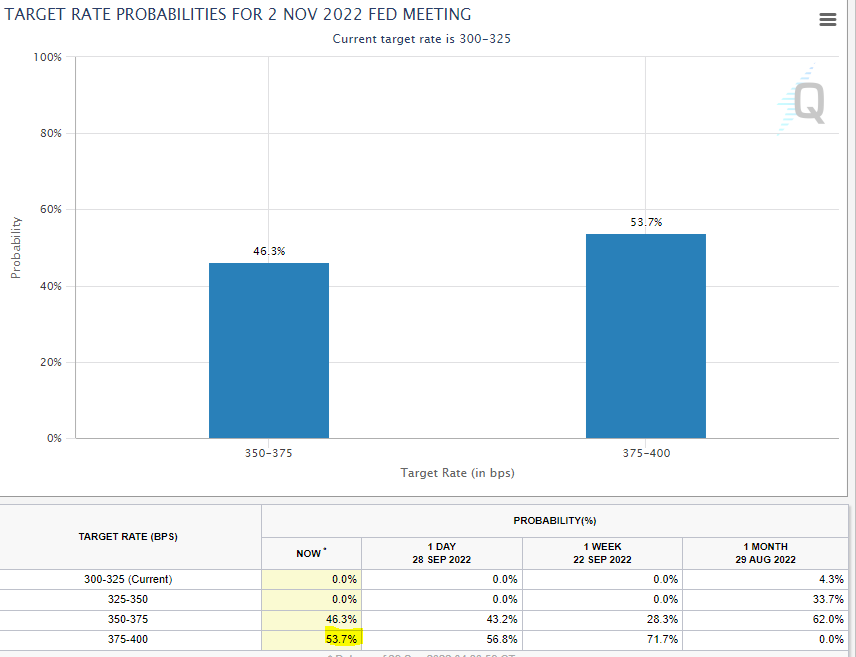

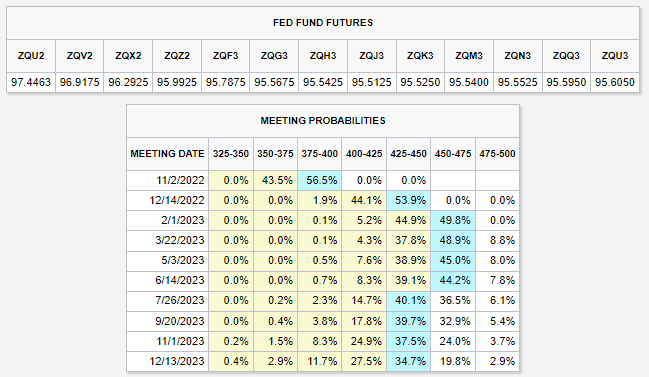

Another reason why I think SPY will move lower right now is because there’s no signs of the 2 year yields even taking a break. Shits just rocketing higher and higher. I do believe that it will cool down for a couple days allowing stocks to take a breather rally, but until this makes the top in the bigger timeframes, stocks will continue to track lower.

The dollar also shows no signs of slowing down, which is bad for stocks. Very overextended so I expect some cooling down, which can help the markets rally a bit. Dollar is bearish because of how they affect earnings or whatever nano said.

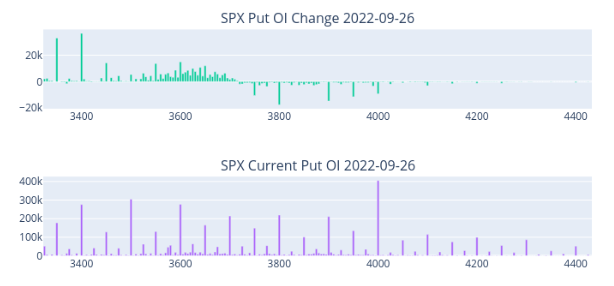

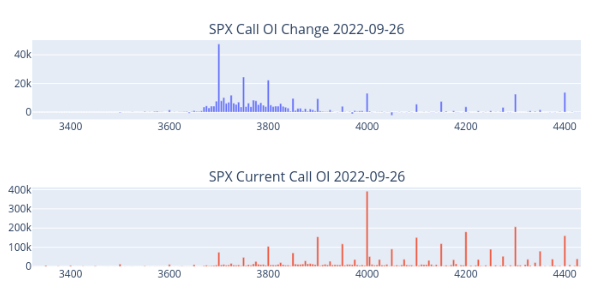

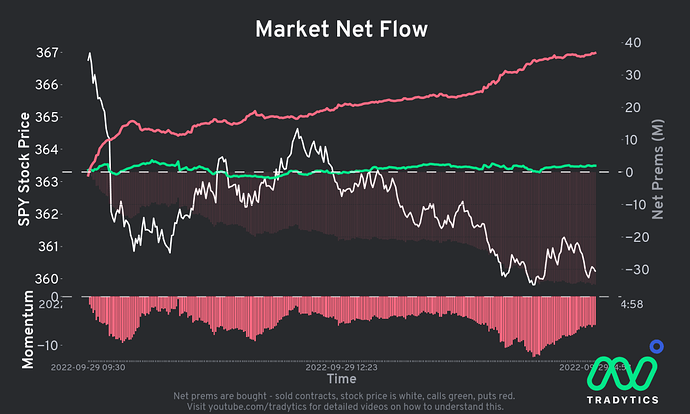

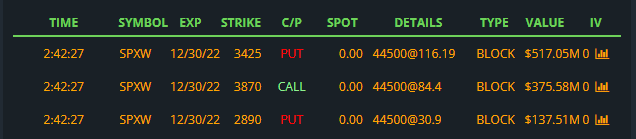

Now here are the bigger reasons why I’m expecting for a rally. A ton of puts got closed or a ton of calls were bought today. The PCC is showing that we’re potentially seeing a bottom carve out right now. We were at the levels where we do typically see bottoms form, and seeing how the PCC shat today, makes me believe more that we will rally soon

The bigger reason why I’m looking for a rally is because of the market breath. Shits at historic lows. It’s at the same lows as the other big bottoms we had this year. Only around 3% of stocks are above their 50 MA. This is when markets typically tend to have a rally or a bottom. Combined with the other overextensions I’m seeing, I think there is a good chance that we do see a rally coming soon.

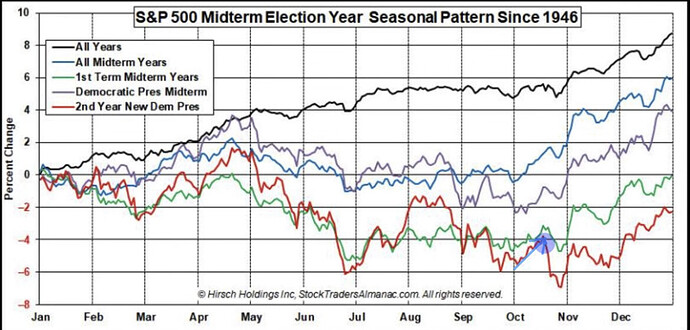

Overall, markets are in a bigger downtrend and I doubt that’ll stop until the fed changes their tone. I’m looking for a test of the 200 MA on the weekly on SPY to enter calls and then cut probably in the 375 level. But afterwards, I’m still expecting a retest of the lows or even make a lower low. Good luck everyone