A quick post-mortem on Friday, which turns out to be another one of those very instructive days for anyone studying the markets.

The expected that happened: The initial vol crush happened, which was accompanied by a rally into about 11.15am. I got QQQ calls at open, and doubled down around 11am.

The unexpected: Neither a clear rally nor an organic sell-off happened after the vol unwind had cleared. Yes, there were bouts of sell-off but they seemed to be driven by idiosyncratic triggers:

- First, DXY fired up around 11.30am (yellow arrow). I don’t know why, but it did, from 111.9 to 112.4. This took equities down a full 1%.

- There was a second trigger that caused selling at 1.30pm (teal arrow). I couldn’t find what happened then to move markets down ~ 0.5% - perhaps its Wall St coming back from lunch =P

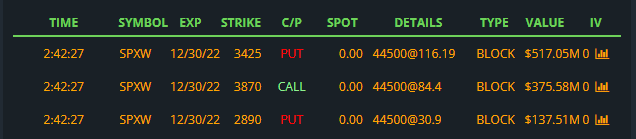

- Third, JPM started rolling their call around 2.40pm (red arrow). This caused some volatility, and a 0.5% selloff. Strikes are in second image.

- Finally, 10 mins before close (green arrow), a decent 0.6% sell-off saw the 3600 line breached, with prices falling close to e old JPM collar strike of 3580.

I have held the QQQ calls through all this, because I did not see signs of organic sell-off, which is sustained, high volume selling. Rather, there seemed to be prolonged periods of consolidation between each of these idiosyncratic triggers.

This could turn out to be a costly mistake, and am prepared to roll on Monday, but will likely let the calls in either form run before taking them off completely.