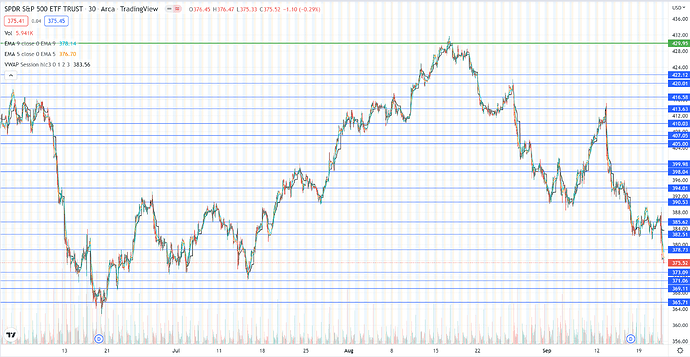

No TA on Thursdays bc I’m busy as shit and don’t get home until 11pm. But shit looks very bearish as the daily candle broke the uptrend line from June lows

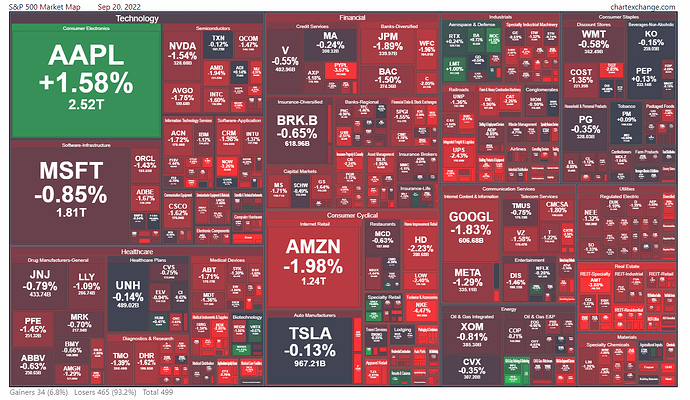

Quad witching day is here! Woohoo! ![]()

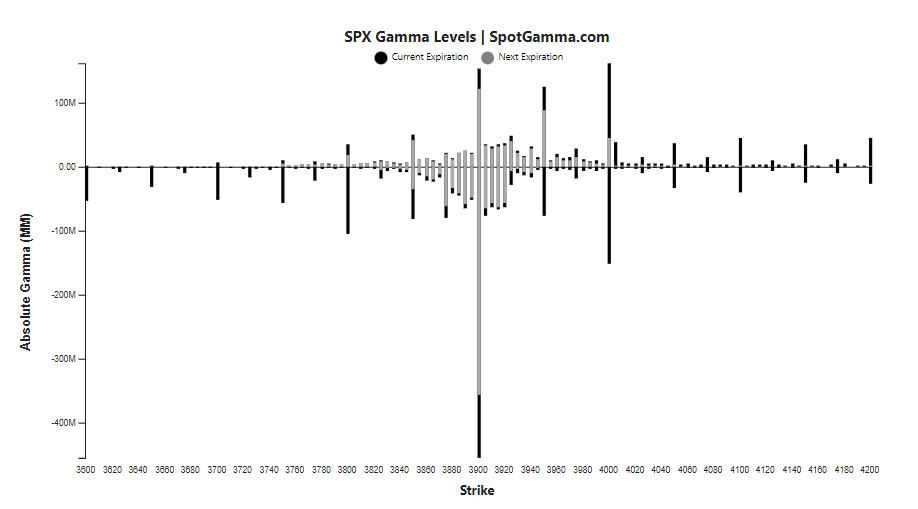

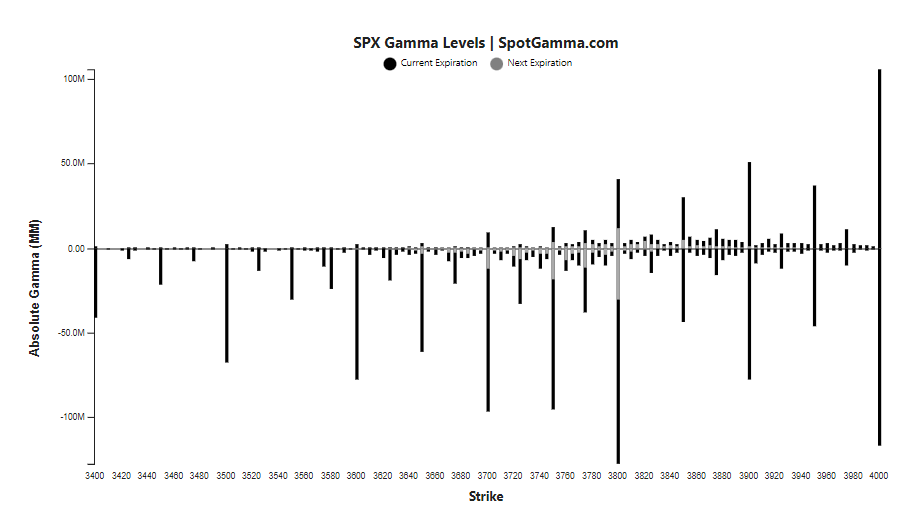

The gamma complex has shifted lower to 3900 being the strongest level. Vol trigger is 3920 (where gamma shifts from positive to negative).

Looks like we will start the day down a bit. If the selloff is organic, i.e. institutions are selling off, then there is little support below 3900. In fact, because we are in negative vol territory, MMs will fuel the selloff into the 3800 level, where their hedging needs taper off. Market could, of course, continue to sell off more, but without more gas added to it.

If the selloff by market participants dies off earlier in the day though, and VIX calms down, we could move back up to the 3900 level. Unlikely we will punch through it though.

In sum, MMs will exacerbate selloff into 3800 and then cool down. Left to its own devices, markets will move back up toward the 3900 level.

Tough play, this!

Nasty gap down to end the week. Today is going to be pretty simple but with a twist…the twist being that $3 trillion worth of options/futures are expiring today. Given the magnitude of this, is it possible that we see some goofy price action? YES!

I think if we open below 3874 & reject it, we could see a move back down to 3822/3800. If we fail to go lower below that level, we could see a move back up to 3900 then most likely chop the rest of the day.

Expectations need to be low today.

Well, that was a muted opex - quad-witching one, no less.

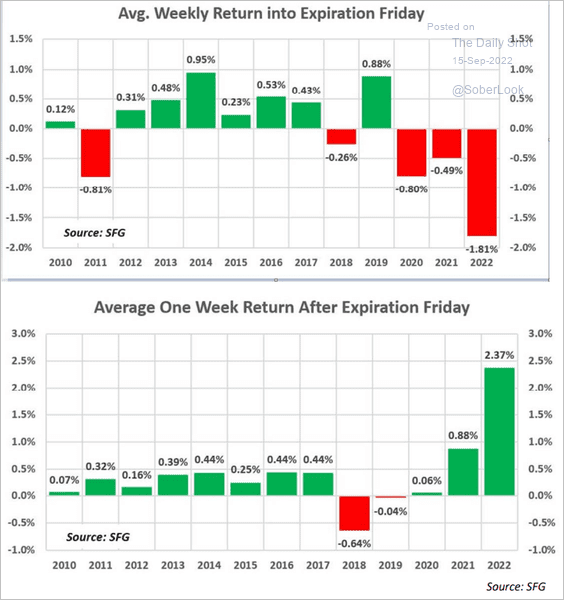

We certainly didn’t get to 3700, but we did fall nicely into opex, as tends to happen more often than not. Those four green bars, two of which were gap-ups, are a reminder that trying to flesh out price points is a fool’s errand as the market … does things.

Nevertheless, I find it a good mental exercise to work through the different options, so sharing the following in that spirit. I’m not saying we’ll go to 3700 per se, per more that I expect the following path. That is the mental model I’ll go into next week with, and adapt based on what market is going.

The components are as follows:

- We’ll likely drift upward on Mon and Tue. We ended in deep negative gamma territory, with a brickton of puts expiring. On Monday, de-hedging will entail closing of short positions that accompany these puts (assuming MMs are net long puts) which then results in a tailwind for the market.

- We are unlikely to see significant vanna effects, as FOMC will keep VIX elevated. So the “rally” will likely be muted. We might even move sideways with a slight upward slope.

- Wed is, of course, when the fun starts. I think we go up after FOMC. Reason is, market is already pricing in 75bps, then 75bps, and 50bps with ~50% probability. I cannot imagine what JPow could do, short of taking the most bearish Fed governor and shooting them at the press conference, that would induce more fear. VIX will go down after, and then we have a vanna rally. Maybe all the way up to 4000 by the end of the week.

- After next week though, I expect the general negative sentiment in the market to come back. Helped by some data point or other that reminds us that the worst is still ahead of us. And people sell off… into 3700 by Oct opex?

Again, the price points are not important, but the reasoning is. Please do critique what I’ve shared, so we can create our own probabilistic model of different outcomes.

Love it all and share the same however feel October may be that hover point where we are stuck between 3700 and 4000 therefore looking a little further into November and maybe even December to help my collection of puts. Look forward to the rally to help capture better put entries. However alternatively playing the trends to make some money. Some really good forum posts too on specific tickers impacted by industries too therefore I’m looking backwards and forwards with all of you. Thanks Ni and the community for helping get these discussions out. Have a great weekend

If JPow hikes rates by 100 bps on Wednesday based on the latest economic data, that could be a reason for market plunge rather than upwards “priced in” motion of 75 bps. I wonder if we might see red action leading into Wednesday based on this uncertainty?

Thinking the same. Unfortunately, I bought my puts towards the low of the day. I thought we’d continue this trend until Wednesday. Boy, was I wrong…

TLDR: I think we’re going to be flat/ slightly go up heading into the Fed meeting, but anything beyond that is a gamble.

SPY on the hourly is looking to break the downtrend by testing the 21 EMA right now. If SPY can break the 21 EMA, which is around 388, and break above the 50 level on the RSI, then there’s a good chance that we go into the 390’s. Overall though, looking bearish on the hourly and just looking for a lower high to form. But since this is such a strong downtrend, I expect SPY to fail the test and continue lower. During these strong downtrends, we peak at the 21 EMA and the 50 level on the RSI.

Looking at SPY on the daily, it’s interesting to see the amount of volume. It was opex so there was a lot of volume, but considering how many options were expiring, it was a pretty non volatile day. We did also form a hammer candle with great volume. Could this be a sign for a short relief rally before the fed? We do have a big gap to fill above and also since we broke down the uptrend line, it would make sense to go retest it and then reject off to confirm the downtrend. Overall, daily is bearish.

The weekly candle is super bearish. Failed to break above the 50 level on the RSI and a bearish engulfing - the current candle body encompasses the entire previous candle. This typically means a continued downtrend, especially when the volume this week was very high. I’m expecting another red week based on TA, but the fed could change this by being dovish for some reason or the markets just being like “Fuck your puts.” But yeah, weekly is super bearish and I expect another red week coming up.

VIX is still just dicking around around the 26 level. Not much to say other than I’m expecting another VIX outbreak.

Another reason why I’m bearish on the markets is because the 2 year yield is just going ballistic. The 2 yield is typically a good indicator for the market’s view of the fed’s rate raising hikes and inflation in general. The bear market won’t be over until the 2 year yield actually peaks and rolls over. But currently, it’s continuing to track up and all this means is that we need to keep preparing to go lower and either test the lows or make a new low. Looking at the weekly, there is a huge bearish divergence, but there’s no point staring at it if the yields keep rising higher. Until the next 2 CPI reports actually shows inflation peaking, we should expect market to stay flat or go lower.

One thing to note is that the dollar hasn’t made a new peak, maybe pointing to a short term relief rally, but still overall, I think we’re going down.

The PCC actually did something after hovering around the middle zone for a while. We’re nearing the extremes for the amount of puts in the market. I don’t think it’s at the extreme right now to expect a rally, but it does show that the risk/reward for swing puts are going lower. Although, the PCC at these levels has sometimes caused a small relief rally, so we’ll see if we do rally into the fed meeting.

Overall, I’m thinking we go flat into the fed meeting with a slight uptrend, but still overall bearish. I think the Fed will come out with the 75bp and stay hawkish given that the core CPI came in hot and cause the markets to shit the bed. If the Fed randomly goes ahead and does a 100bp hike, well get ready for some pain. Good luck everyone, don’t get caught on the wrong side and have a good weekend.

The 2Y yield creeping up is significant. Algorithmically it suggests that stocks should creep down because a higher short term bond yield means more people can rebalance their portfolios with more weighting in safe bonds providing a decent return.

But yeah this is just one of many factors that impact passive market movement, as you’ve noted! DXY coming down in the short term, or the billions in puts unwinding from Friday could be what bulls need for a small relief rally.

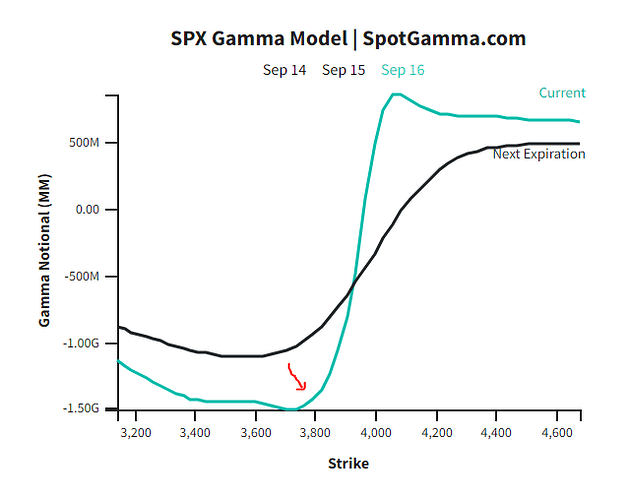

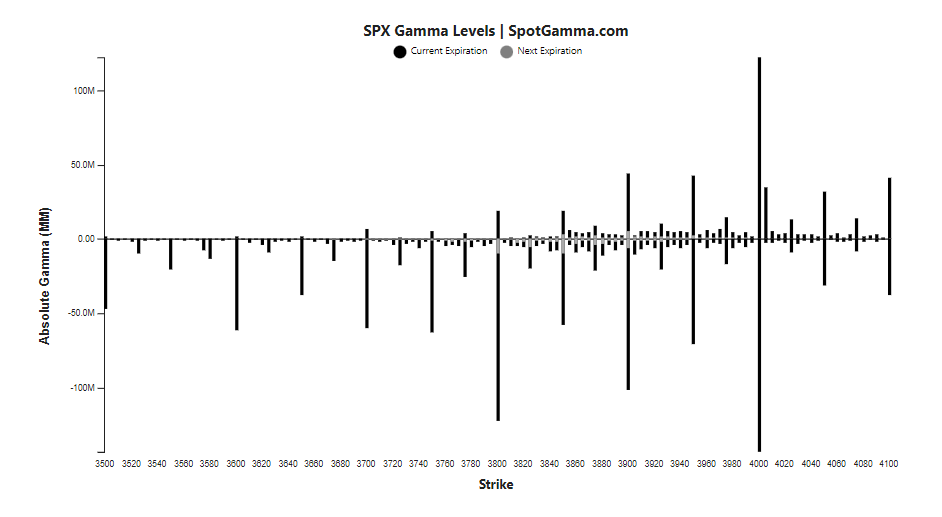

SG gamma profile suggests a solid shift to a bearish stance post-opex. All that put gamma… 3800 should act as strong support though. Vol trigger is 4000, so we are solidly in negative gamma territory - any move will be exacerbated by MMs. Doesn’t necessarily mean this will pull markets lower - yet. De-hedging from opex should provide tailwind for the next day or two.

They also shared this chart, which is interesting and consistent with our general observations around opex from this year. Most opexes were negative gamma events, and so fell into opex, followed by a rise the week after. In a market supposed to be filled with random walks, this is a rather strong signal.

TLDR: SPY looks like it wants to have a rally into the FOMC meeting. I’m looking at 393 at the highest tomorrow.

The hourly looks bullish. After testing the 21 EMA all day, it finally broke through during power hour. We also moved above the 50 level on the RSI. One thing to watch out is that the MACD is still below the 0 level. This indicates that this rally is just a relief rally and not the actual reversal. But, we did break above strongly and it seems like we have the momentum to continue on rallying.

SPY on the daily looks very bullish in my opinion. After a huge premarket shit down, we recovered that all and even ended the day 0.78% higher. The candle formed a bullish engulfing, which means that this current candle’s body encompasses the entire previous candle. This typically means a bullish momentum and bullish move incoming. Another thing to watch out is that the volume wasn’t feeble either. This had good volume with it. But I don’t think this is a reversal because although the RSI did make a bullish divergence, the MACD did not. Also the RSI is still below the MA which isn’t really convincing for me. The reason why I see 393 as the top for tomorrow is because that’s where the uptrend line is currently. I think this rally will at most just retest the breakdown of that trendline and continue lower towards the June lows.

Looking at the VIX, it has a bearish engulfing. Not a good sign for bears because this probably means that the markets will move up higher.

One more thing to note is the 2 year yield. Shits going ballistic. So even if this rally does turn into something bigger with the Fed, I’m still going to bet that the markets will move lower until the 2 year yield rolls over. Maybe the 2 year yield peaks with the FOMC meeting, but until I see the 2 year rolling over, I’m not convinced that we are going to reverse and see the end of this bear market.

Overall, short term it does look bullish. I am looking at the rally heading into the FOMC meeting and then judging what happens from there. So good luck everyone and stay green

To backup @Yong in his detailed analysis above. Based on today’s movement and the fact that we are probably not going to get to a 4.25% interest rate by the end of the year that we are headed into a bullish FOMC decision which most likely ends in a 75bps increase which is already priced in.

One of the only things that would reverse the market is a 100bps rate hike. This isn’t out of the question since inflation is still very high. https://www.leadertelegram.com/ap/business/the-week-ahead-bracing-for-a-1-percentage-point-surprise/article_e05ffc7b-8b4a-5e0c-8ce7-95d85725f88c.html

My current thesis is that we will rip until FOMC and then the market will pick it’s direction based on the data. I may end up taking a straddle going into FOMC. My theory is no matter what the decision is the market will move dramatically in either direction. 75bps and under we rip. 100bps we plummet. Hope this helps in y’all decisions as we approach D-Day

TLDR: Just watch out for FOMC meeting at 2:30pm tomorrow.

Yeah so them bullish signals yesterday just didn’t do jack shit. Anyways, a triple bullish divergence formed on the RSI. Something to watch out for. Possibly another rally heading into FOMC decision? We’ll see. Overall nothing really to say here other than we’re flat as fuck.

We formed a hammer candle on the daily. Pretty good volume, but this could be also seen as a continuation towards the downside since volume did pick up on this red day. Either way, shit’s flat and no one really gives a shit until the FOMC decision.

VIX was flat.

Overall, literally nothing to say because we’re just consolidating. When we break out of this range, it’s going to be a huge ass move so be prepared for that. Other than that, just watch out for the FOMC meeting. Good luck all.

Apple said fuck your consolidation and has been running the past couple days. I think it is mostly a flight to safety as Apple is the elephant in the market and is also cash heavy so…

I do expect it to fall though if FOMC makes the market turn sour.

Yeah to add onto this, if you’re going to short the market because the FOMC makes it bear szn again, don’t fucking short Apple. Apple is one of the best and safe stocks in the market. So if you’re going to buy puts, buy it on a shitty stock that will actually fall more like ARKK. Don’t try to buy puts on Apple where the downside is going to be more limited than something like QQQ or TSLA

TLDR: I think we’re gonna continue to go lower for a bit. Also here are my S/R levels if anyone wants to use them

SPY on the hourly looks very bearish. Just completely ignored the downwick and continued down. There are bullish divergence on the RSI and the MACD, which could provide a small pump, but I think we’ll still be overall down. Maybe go retest the 380 level and then die again. One thing to note is that using my overextension indicator, we are over extended and everytime we are this overextended, we have rallied back into the zone. So I’m honestly betting on some kind of upside before we continue lower.

Looking at my LED light indicator, we are again overextended on the daily and the hourly. A sign that we might consolidate or have some rally to the upside. The sell volume today was big so this move will probably continue lower. No bullish divergence on the RSI and the MACD which makes me not believe that we’ll have a meaningful run up. Also since the markets have not priced in the EOY projections for the rate hike, we should continue on lower. I’m looking at the 370 level for the next bear market rally.

VIX was up overall today but formed a huge ass doji. Nothing to see, but I am willing to bet we see VIX back over 30. Goodbye reasonable option prices.

The dollar is going ballistic again. Not a good sign for stocks boys.

The 2 year is also going ballistic. Not good boys. This is not rolling over anytime soon and this makes it pretty clear that we’re not done making lows and I think we’ll see 350 before the year is over. Sad to see.

Overall, markets are looking bearish right now. Might be a good time to go into swing puts, but who knows if we’ll just get a random rally up. Even if we get a rally up, we should make another leg lower. Good luck everyone and stay green.

380 is a pretty strong support and was tested many times today before breaking under. Thinking a retest of 380 would be a good entry on puts, as you also pointed out.

I think we’re on the way to testing the June low absent any fundamentally bullish catalysts, on a TA and psychology basis. It’s “short any rallies” territory.

DXY and the 2Y yield are holding their gains.

“TNA, There’s No Alternative” argument is falsified by the 3 month, 6 month Treasury Bills, short term bond yields offering decent safe returns in the bear market.

Seems like the only gas for going up is the automatic DCA’ing in long-term accounts, and with bears all over the Wall Street media lately, I wonder if people are pausing these buy-ins where they can.

Bulls could argue that despite the action today, VIX did not pop higher. Perhaps this means peak fear is in.

Below I have 373, 371, 369, and 366 as key support areas.

We’re opening in areas with little option gamma support (SPX now 3710), and are in deep, deep negative gamma territory. (Vol trigger = 4000). Has the marks of being a very toasty day.

TLDR: There is a good chance we get a oversold rally starting next week, although I don’t believe that we’ll go have a 10% rally or whatever. At most, I think we go to 380, although I would bet on just a rally to around 375 and then make the next leg lower to the 200 MA on the weekly chart which is 358, although I think we’ll head lower.

SPY on the hourly shows a massive oversold reading which led to a rally EOD - probably people taking profits and derisking heading into the weekend. I think that if this rally is just a weak rally, we should stop at the 50 RSI level and at the 21 EMA which would be around 371. If we do continue to rally more, the next levels I’m looking at is 375 and 380 to top. Overall though, SPY hourly is largely bearish and all I’m looking for at this point is a better entry for swing puts.

On the daily, we had a huge volume day and way under the extremes on my indicator. The last time it was this overextended, it was the May bottom, June bottom and the July bottom. Each led to a huge rally, although I don’t think this will be the case this time. I’m looking at this rally to top at the 8 EMA on the daily, which would be at the 382 level. If this rally is strong, maybe we top at the 21 EMA which would be 390. I highly doubt that, but we’ll see what happens. Overall, SPY on the daily is on a down trend and for my system, very bad r/r for swing puts here.

Another reason why I’m looking for a rally. My indicator shows us very overextended to the downside. You can see the last times this happened. It was the May and June bottoms. We do not stay this overextended for long. Also the RSI on the weekly is basically showing a bullish divergence. I’m not saying that we reverse and head to 500 here, just saying that we sold off hard and there is a good chance we rally.

VIX shot up today, but had a huge upwick. Possibly a bullish sign? Who knows, but volatility is back in full force and we’ll continue to get huge whipsaw moves for a bit. Another thing to note is that although we didn’t hit 10%+ on VIX today, it was at 9.4% so based on correlation, might be a green day rally coming soon for SPY.

Why I think we’ll make new lows? Because the 2 year yield is hulk dicking up without any rest. There is a big bearish divergence on the weekly, but until it plays out, there’s no point looking at it as a bullish sign. Until the fed becomes dovish, the 2 year yield will continue to spike and markets will continue to head lower.

The dollar is also hulk dicking up. Triple bearish divergence on the weekly if that even matters. But yeah not looking good for stocks right now.

My final reason for why I’m expecting a rally. The PCC ratio is at the same levels as the May and June bottoms. When everyone is bearish like this, it typically leads into a rally, fucking everyone over. Just be careful.

Overall, I don’t think we’ve bottomed yet. I think we’re going to have a rally, but I think that’s just a good place to reposition into puts or enter swing puts, not to go long. This is going to be a long and painful year, but let’s hope to end green. Stay safe and make sure to capture profits and good luck everyone.