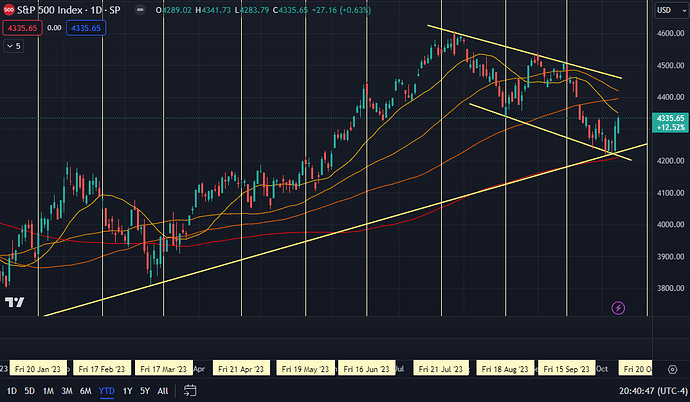

Well, a war couldn’t keep SPY down. And so it looks like we won’t be getting tongue.

Many bullish signals, pointing out the ones that stood out to me:

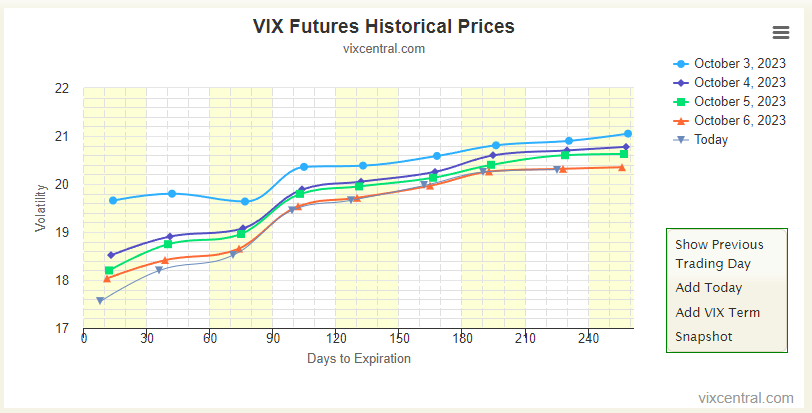

- As noted yesterday before market open, vol would be the primary tell. And vol went down quite a bit, despite escalation on the ground. (Image 1)

- Bond yields are retreating. The 10Y is almost a full 25bps lower from its highs from just 2 days ago. The Fed speeches today could have something to do with it, or it could just be overstretched. Either way, this reduces pressure on equities. (Image 2)

- Breadth is returning - though nowhere near even yet, more than twice as many S&P stocks are over their 50DMA. (Image 3)

Finally, we are in positive gamma territory (4325), so things should be less volatile. As always macro can prick the ![]() , but for now … 4450 by opex (10/20)?

, but for now … 4450 by opex (10/20)? ![]()