With earnings coming to an end, thought I’d post the summary of the updated earnings trends (continued from the earnings trends I posted a few weeks ago):

Highlights:

- Earnings Scorecard: For Q1 2022 (with 97% of S&P 500 companies reporting actual results), 77% of S&P 500 companies have reported a positive EPS surprise and 73% of S&P 500 companies have reported a positive revenue surprise.

- Earnings Growth: For Q1 2022, the blended earnings growth rate for the S&P 500 is 9.2%. If 9.2% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q4 2020 (3.8%).

- Earnings Revisions: On March 31, the estimated earnings growth rate for Q1 2022 was 4.6%. Ten sectors have higher earnings growth rates today (compared to March 31) due to positive EPS surprises and upward revisions to EPS estimates.

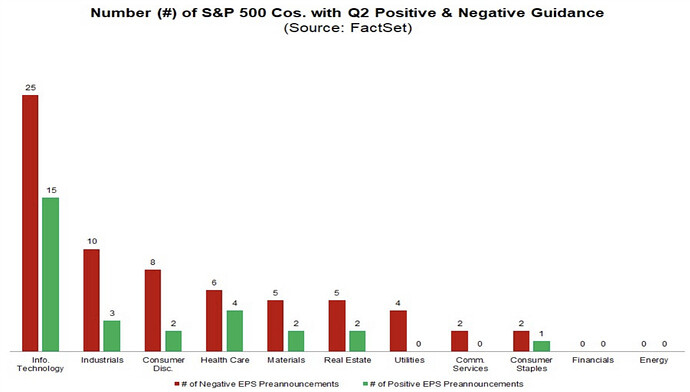

- Earnings Guidance: For Q2 2022, 67 S&P 500 companies have issued negative EPS guidance and 29 S&P 500 companies have issued positive EPS guidance.

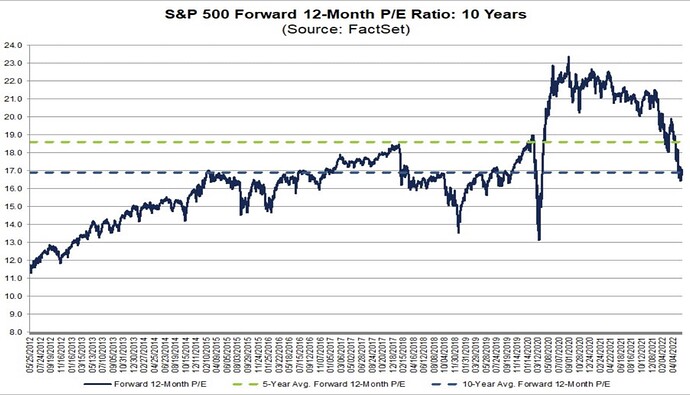

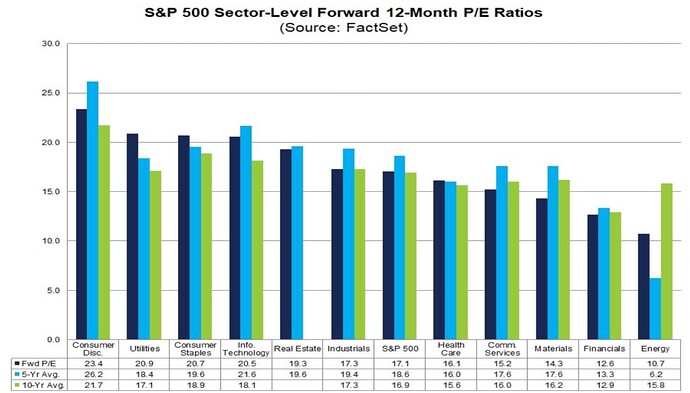

- Valuation: The forward 12-month P/E ratio for the S&P 500 is 17.1. This P/E ratio is below the 5-year average (18.6) but above the 10-year average (16.9).

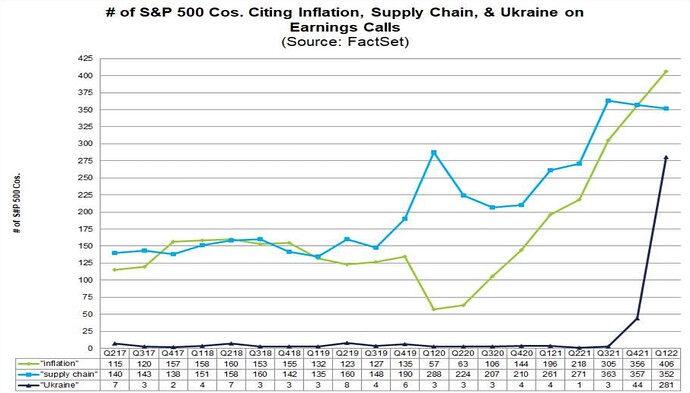

The first quarter marked the highest percentage of S&P 500 companies citing “Ukraine” on quarterly earnings calls going back to at least 2010 at 59% (281 out of 476). By comparison, 85% of S&P 500 companies (406 out of 476) have cited “inflation” on earnings calls for Q1, while 74% of S&P 500 companies (352 out of 476) have cited “supply chain” on earnings calls for Q1.

“As a matter of fact, although we saw a bit of a slowdown focused mostly on Europe at the onset of the invasion of Ukraine, we saw a bounce back and we really exited Q1 with momentum. -Autodesk (May 26)”

Overall, 97% of the companies in the S&P 500 have reported actual results for Q1 2022 to date. Of these companies, 77% have reported actual EPS above estimates, which is equal to the 5-year average of 77%. In aggregate, companies are reporting earnings that are 4.7% above estimates, which is below the 5-year average of 8.9%.

The index is also reporting single-digit earnings growth for the first time since Q4 2020. The lower earnings growth rate for Q1 2022 relative to recent quarters can be attributed to both a difficult comparison to unusually high earnings growth in Q1 2021 and continuing macroeconomic headwinds.

The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report) earnings growth rate for the first quarter is 9.2% today, compared to an earnings growth rate of 4.6% at the end of the first quarter (March 31). Positive earnings surprises reported by companies in the Health Care, Information Technology, and Financials sectors, partially offset by a negative earnings surprise reported by a company in the Consumer Discretionary sector, have been the largest contributors to the increase in the earnings growth rate since the end of the first quarter (March 31).

If 9.2% is the actual growth rate for the quarter, it will mark the lowest earnings growth rate reported by the index since Q4 2020 (3.8%). Nine of the eleven sectors are reporting (or have reported) year-over-year earnings growth, led by the Energy, Materials, and Industrials sectors. On the other hand, two sectors are reporting (or have reported) a year-over- year decline in earnings: Consumer Discretionary and Financials.

In terms of revenues, 73% of S&P 500 companies have reported actual revenues above estimates, which is above the 5-year average of 69% (hehe nice funny number). In aggregate, companies are reporting revenues that are 2.7% above estimates, which is also above the 5-year average of 1.7%.

Due to these positive revenue surprises, the index is reporting higher revenues for the first quarter today relative to the end of the quarter. The blended revenue growth rate for the first quarter is 13.6% today, compared to a revenue growth rate of 10.7% at the end of the first quarter (March 31). Upward revisions to revenue estimates and positive revenue surprises reported by companies in the Energy and Health Care sectors have been the largest contributors to the improvement in the revenue growth rate since the end of the first quarter (March 31).

If 13.6% is the actual growth rate for the quarter, it will mark the fourth-highest revenue growth rate reported by the index since FactSet began tracking this metric in 2008 (These are my own thoughts, but I would guess revenue is being inflated by 40-year high inflation given Energy is the biggest contributor in revenue & earnings growth, per the article). It will also mark the fifth-straight quarter of year-over-year revenue growth above 10% for the index. All eleven sectors are reporting (or have reported) year-over-year growth in revenues, led by the Energy, Materials, and Real Estate sectors.

The blended net profit margin for the S&P 500 for Q1 2022 is 12.3%, which is above the 5-year average of 11.2%, but below the year-ago net profit margin of 12.8% and below the previous quarter’s net profit margin of 12.4%.

If 12.3% is the actual net profit margin for the quarter, it will mark the third straight quarter in which the net profit margin for the index has declined. On the other hand, it will also mark the fifth-highest net profit margin reported by the index since FactSet began tracking this metric in 2008, trailing only the previous four quarters.

Looking ahead, analysts expect earnings growth of 4.1% for Q2 2022, 10.2% for Q3 2022, and 9.9% for Q4 2022. For CY 2022, analysts are predicting earnings growth of 10.1%.

The forward 12-month P/E ratio is 17.1, which is below the 5-year average (18.6) but above the 10-year average (16.9). It is also below the forward P/E ratio of 19.4 recorded at the end of the first quarter (March 31), as prices have decreased while the forward 12-month EPS estimate has increased over the past several weeks.

To date, the market is not rewarding positive earnings surprises and punishing negative earnings surprises more than average.

Companies that have reported positive earnings surprises for Q1 2022 have seen an average price decrease of -0.3% two days before the earnings release through two days after the earnings release. This percentage decrease is well below the 5-year average price increase of +0.8% during this same window for companies reporting positive earnings surprises.

Companies that have reported negative earnings surprises for Q1 2022 have seen an average price decrease of -5.1% two days before the earnings release through two days after the earnings. This percentage decrease is larger than the 5-year average price decrease of -2.3% during this same window for companies reporting negative earnings surprises.

At this point in time, 96 companies in the index have issued EPS guidance for Q2 2022. Of these 96 companies, 67 have issued negative EPS guidance and 29 have issued positive EPS guidance. The percentage of companies issuing negative EPS guidance is 70% (67 out of 96), which is above the 5-year average of 60% and above the 10-year average of 67%.

Visuals:

Source: