Powell has been as hawkish as it gets these past few days:

FED’S POWELL: WE HAVEN’T HAD A TEST LIKE THE CURRENT INFLATION SITUATION, THIS REINFORCES OUR DESIRE TO MOVE EXPEDITIOUSLY ON RAISING INTEREST RATES.

FED’S POWELL: I WOULD BE RELUCTANT TO CUT RATES.

FED’S POWELL: WE HAVE UNCONDITIONAL COMMITMENT TO FIGHTING INFLATION.

FED’S POWELL: THE US HAS A VERY STRONG AND WELL RECOVERED ECONOMY.

FED’S POWELL: THE FED WILL TAKE WHATEVER STEPS ARE NECESSARY TO RESTORE PRICE STABILITY.

FED’S POWELL: WE MAY WELL NEED TO SELL MBS AT SOME FUTURE DATE.

(!!!)

You get the point, theres much more.

But….

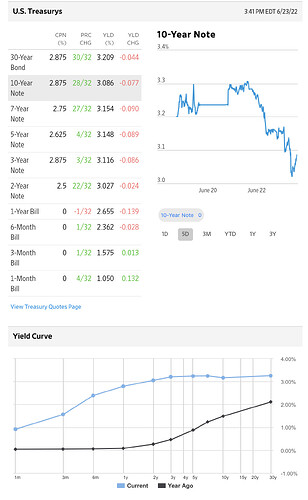

For the first time in a while, the bond market is rallying instead of accenting Powell’s hawkishness, as it’s done before. Like we’ve talked about before in the thread, Eurodollar curve and interest rate swaps are pricing in a Fed Pivot and now Treasury assets are calling Powell’s bluff. Going to hike till something breaks and then money printer go brrr