Well, after today’s hot CPI numbers, it looks like bonds are in even more of a tizzy.

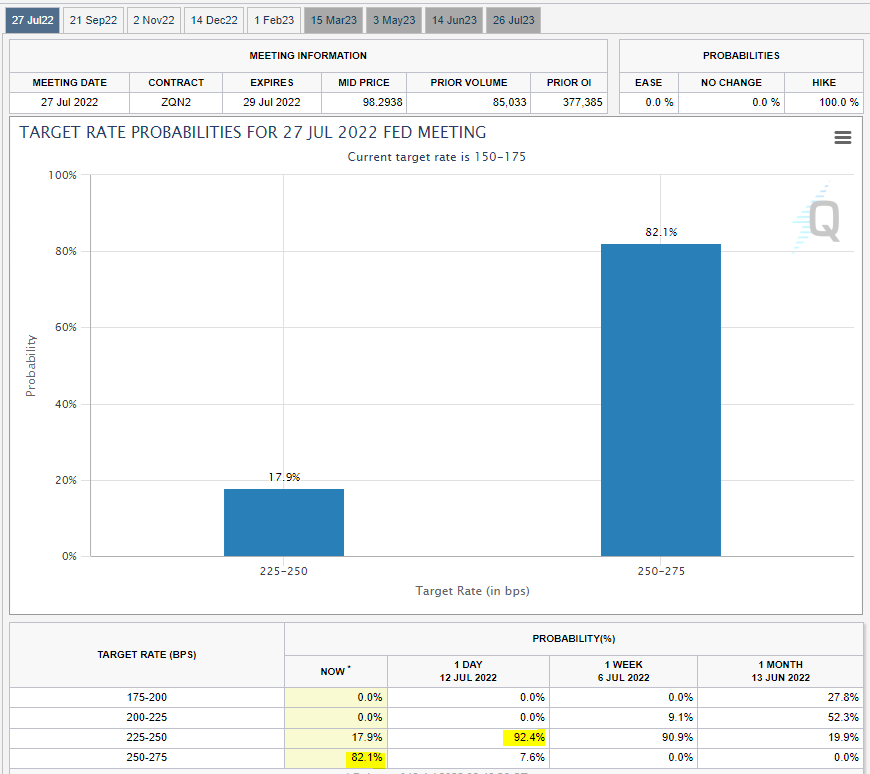

Markets were super convinced that it would be a 75 bps hike in July. With the CPI print, it is convinced that it will be 100bps:

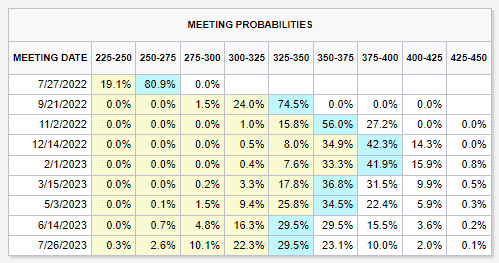

What is weirder is markets are pricing in rate hikes to Dec 2022, and then actually rate drops from Mar 2023:

(Source for both: CME)

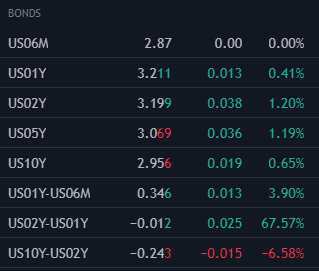

This is reflected in bond yields, of course. Check out that 2Y-1Y inversion…

I find it a little hard to envision how inflation will be low enough by year end for the Fed to consider rate cuts. We just saw how inflation is pervasive in the sticky parts of the CPI, and how inflation is also more broad-based than last month.

Irrespective, the change in probabilities between 75bps and 100bps, and inversions all over the place, suggest the smartest of money is suffering from repeated whiplash. Dangerous times…