The new thread I am working on (trying to get it done, life like everyone else has been crazy) I am organizing some of the indicators we have been tracking this year in a MoM “leading” vs “lagging” indicators style.

I do want to post IMO one of the strongest leading indicators.

PMI - US Manufacturing Purchasing Manager Index.

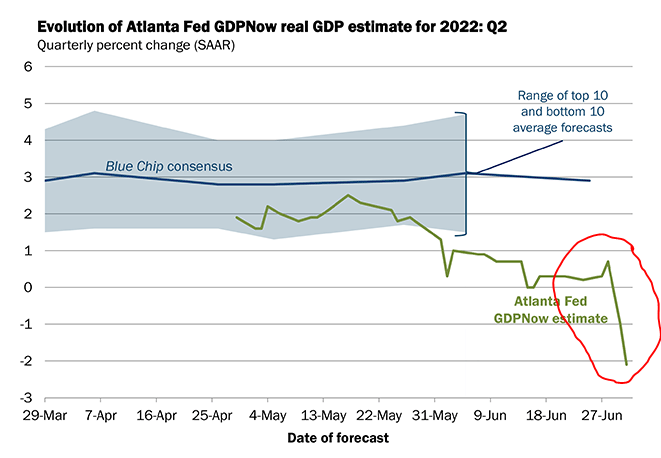

We saw a pretty significant decline in June, and was the lowest reading reported since July 2020.

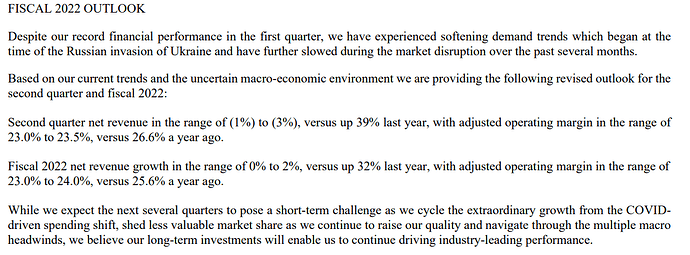

As mentioned by a few people in this thread, this is seen as a leading indicator due to the ripple effect down the chain, ultimately effecting corporations bottom line then potentially the labor force, businesses need goods to sell, then they need to turn them. This rate of turn is how business make money, having inflated paid for inventory on a balance sheet that isnt moving fast enough is a precursor for weak revenue, gross profit, and cash flow.

As we know inventory levels raised significantly the last few months and with orders still slowing down at the manufacturing level, this will continue to show up down the chain. I would expect aggressive holiday type sells will start showing up at retailers across the country. Everyone will be doing everything they can to get rid of this depreciating “asset”.

If this trend continues you will start to see more “tough descisions” from US companies, not limited to labor force reduction. Broad market labor force reduction historically is the last indicator to point to a recession and lags so much that in most cases doesnt start to look ugly well into a recession.

For instance, when Leiman brothers fell in 08, unemployment was at 5.6%, it wasn’t until nearly 2010 until we saw 10% unemployment for the first time in the GFC. This is why imo the fed loves using this as a benchmark for the current health of the economy, it gives them time to try to tackle inflation while guiding people to look at the last significant indicator to move.

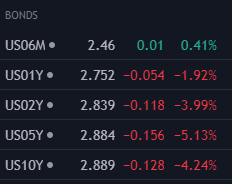

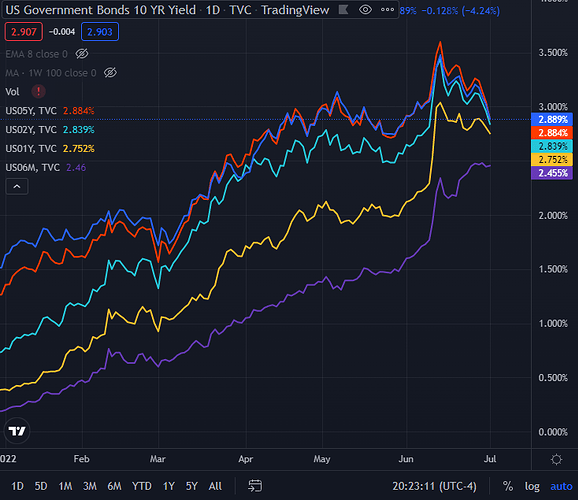

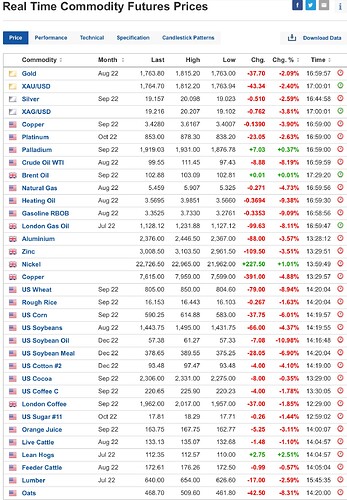

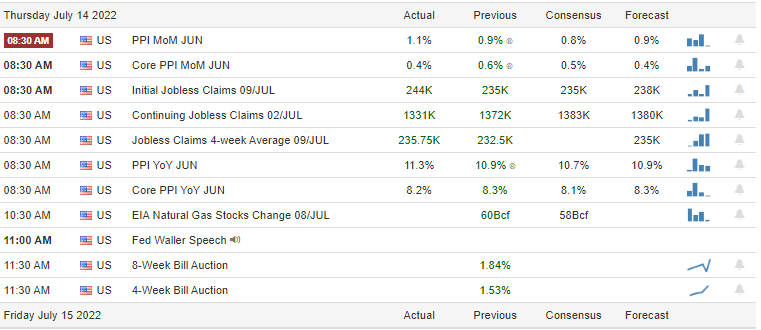

Lots of Macro data coming out this week as well as heavy hitting earnings, Ive also got my eye on what commodities are doing.

Also, Im going to move the macro conversion over to the new macro discussion thread and will be looking forward to the last chapter in the Kodiak series : The Kodiak Bear Recession Plays thread coming soon.

I appreciate everyones work on this thread, crazy to think we have been at it since March, February if you count the first thread.

I have learned a ton from so many people.

This work and the collaboration process (big shoutout to @Kevin @The_Ni @juangomez053) has been a true highlight for me and I cant thank everyone enough. This type of collaboration is what gives us an edge. We really do have something special here in Valhalla.