I like checking in on what Bernanke has to say, I came across this video from a month ago with all of 1.4k views. If you want to know how the fed uses “attentive” investor psychology as a tool to satisfy both of thier mandates, Mr. Bernanke in this video will walk you through it.

Im holding DAL puts and a calander strangle on IWM, had some spy calls from yesterday’s strangle that paid well, then with a little bit of positive scalping I ended the day -$700, which im okay with given how much we ripped, Roughly +5k on the week.

I think their could be more life to this rally but I dont think the market is anticipating weaker than expected earnings the rest of the month. This will be a good test to see how much current evaluations are priced in. If heavy hitters earnings surprise to the down side without a broad market reaction, then that would tell us it is.

As mentioned throughout this thread I believe earnings is where the rubber meets the road for equities, I think we are heading into a period where fundamentals will lead the market. Fiscal and long term global monetary poIicy created inflation. Inflation created jobs, companies expanded and grew, then hired more workers and grew some more. The standard of living was raised all over the world.

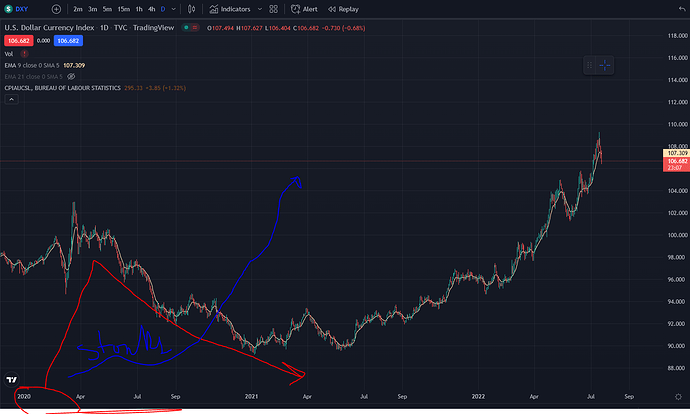

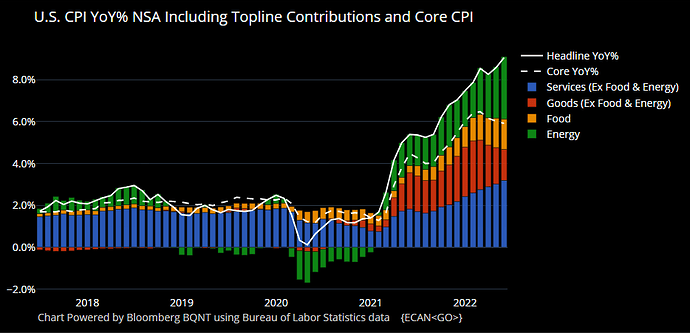

The global market inflated, fueled by long term accommodating monetary policy, windfall fiscal policy, and an American population’s unsustainable appetite to consume. When covid money went out, it was spent, and fast. Then it just kept coming. This was always going to be short lived but when the Trump then Biden bucks stopped, American’s in masses didnt lower thier standard of living. Instead of cutting back, they bought on credit, then more, then more.

This is why I think of credit as spending future dollars. And globally, everyone has been spending alot of those future dollars. Countries and people alike.

This is the mechanics of inflation. Introducing more dollars into the system through fiscal policy, or give people access to more credit, or “future dollars” through monetary policy. Since everyone had money or access to it demand went everywhere. Artifically propping up evaluations all over the stock market while creating asset bubbles like housing or crypto. This creates a credit flywheel since quickly appreciating leveraged assets can be used as collateral towards more quickly appreciating leveraged assets.

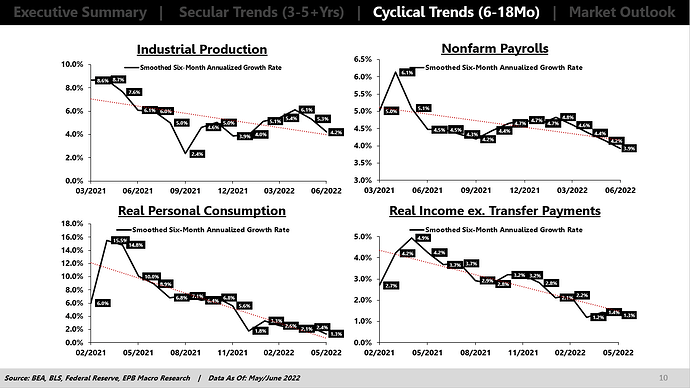

Inflation coming down has the opposite effect. It slows demand and takes away the ability to spend more through credit. When money is everywhere and intrest rates have been near zero for so long you forget how much money was out there. A significant amount of people had access to credit to start a business the last 5 years, and the strong demand allowed them an easier first few years than in the past, especially post covid, the stat used to be 20% of businesses fail within their first 2 years. I just haven’t seen that many business close their doors lately.

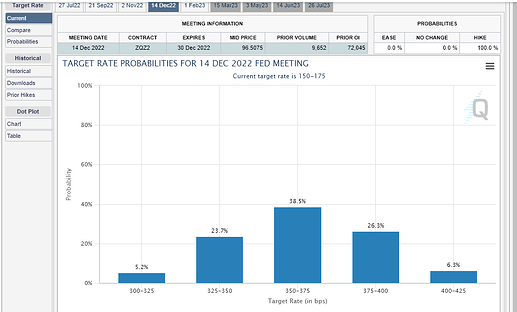

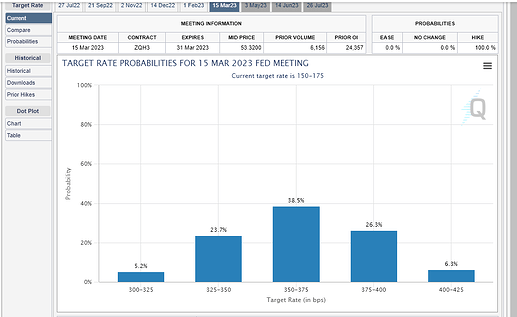

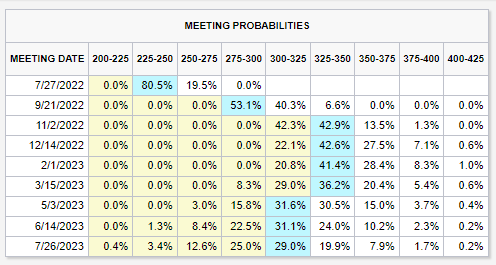

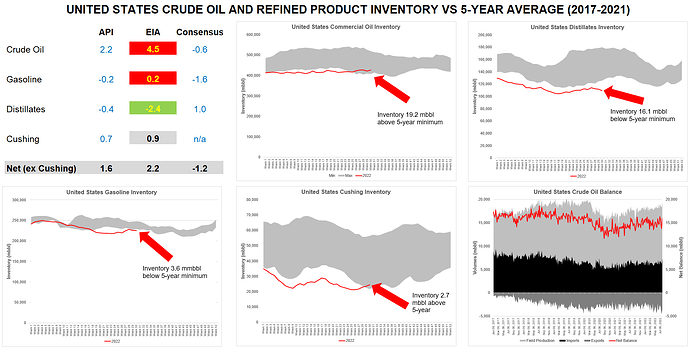

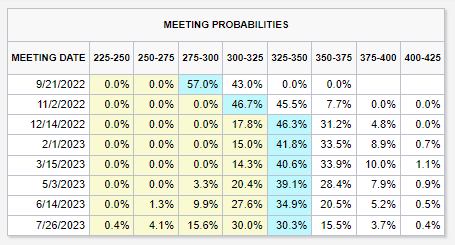

Inflation at 9.1% is very high but we all think next CPI print is lower right? Okay, if its lower, and CPI is a lagging indicator of demand. Rate hikes carry a 3-6 month lag, that means we have just recently started to feel the actual credit expansion slow down. So demand coming from credit will undoubtedly be less well into at least next year, even with a rate cut in December. The flywheel reverses. And now the tightening of credit tightens credit.

But remember, the consumer still has to pay those elevated obligations well into the future regardless of where demand, inflation, or wages might be. 72 Months, $700/month payment is the average for a new car in the US. Credit card debt breaking 3 new all time highs within the last 3 months.

Now if demand is going down and some businesses cant afford the elevated wages, which do you think is more likely or comes first?

1: A landlord needing to lower rent?

Or

2: A company needing to lower wages or staff?

The labor force is in charge of wages so long as demand stays high, and labor stays scarce but either one of them change and companies are making “tough descisions” laying off workers, pay freezes, hiring freezes, cutting hours, cutting wages, etc. But even then, the employee that starts to feel these pains still have elevated rent, Food, and gas. Those dont turn around over night all the way down the chain.

This perpetuates the problem until the weakest bussinesses close their doors, and everyday americans figure out how to pay that $700/month car payment coming up. Thats what a recession is.

So although im actively trading this months earnings through IWM, more than anything Im looking forward to seeing what the financials say, they will say more about a recession than a fed presidents 30 sec clip on cnbc. Both who have a tendancy to be wrong more than right.

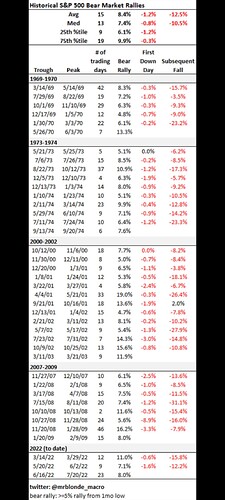

I am not saying we see a market crash, I really dont have a clue. I think collateral issues could cause some problems and its possible but who knows, but Im not playing a crash, Im playing a recession. So the trades I am making are for trends down. This is why I havent been trading green days as much and if I do its limited capital.

This is slighty different than just playing the day. I say this because if im trading red trends or days that are assumed to be in line with my macro views and data coming out that has given me an ever so slight edge ytd and sometimes thats all you need to make a little money.

I think right now im as bearish as ever but that doesnt mean I dont expect green days and sustained bear market rallies. Bulls or Bears we all need to be thinking about risk management and capital preservation at all times. Hope everyone has a great weekend.

One more thing, I think the real opportunity right now is strategies on trading this chop. Bulls and bears should be making money right now we just need to keep figuring out what works best

![]()