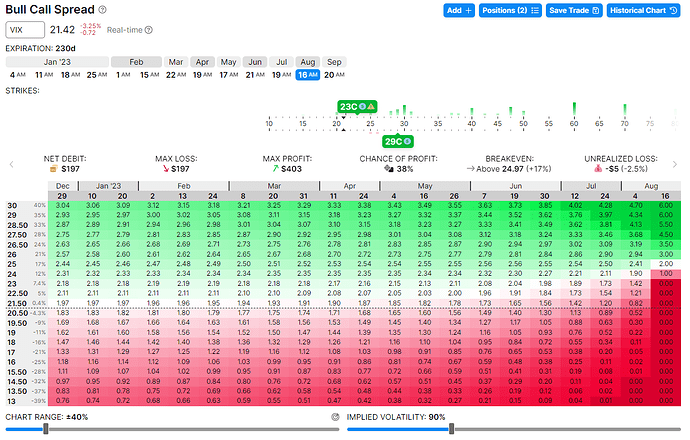

Took a looooong 8/16/23 (230DTE) VIX 23C/29C call spread:

Something should go bump in the next 8 months, right? ![]()

This is sort of like a base position so that I capture any increase in volatility in general.

The main downside of this long DTE is the returns; oddly enough, anything beyond April seemed to have the same cost basis of around 2 per contract.

Will play vol more closely with shorter DTE when it actually happens. Setting limit sell at 3.00.