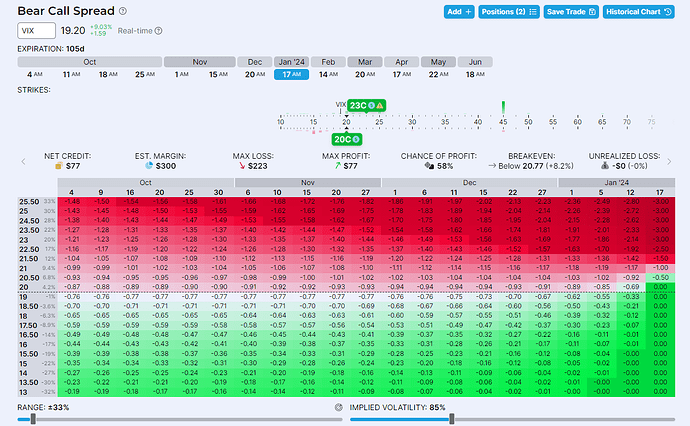

Thanks for sharing your thoughts, Kevin and DankeDeNada! Generally am in agreement with what you said.

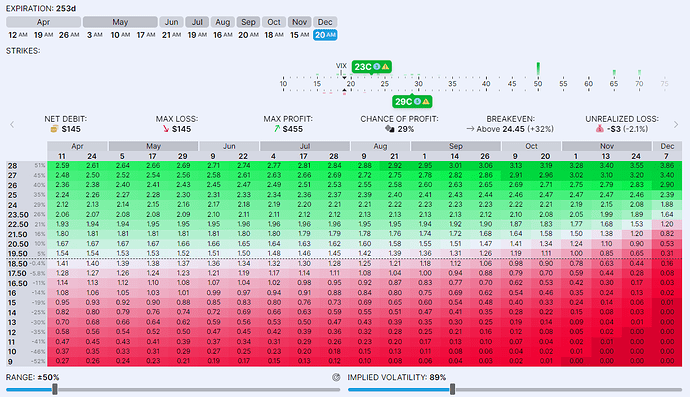

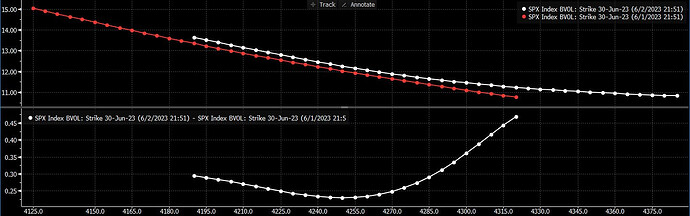

The most glaring thing for me was that they are looking at gamma alone, and not delta. Gamma is the second derivative, but it’s the first derivative is delta. It’s like talking about how a car decelerated at 10mph², but whether it does it from 10mp or 100mph makes a big difference in terms of stopping distance.

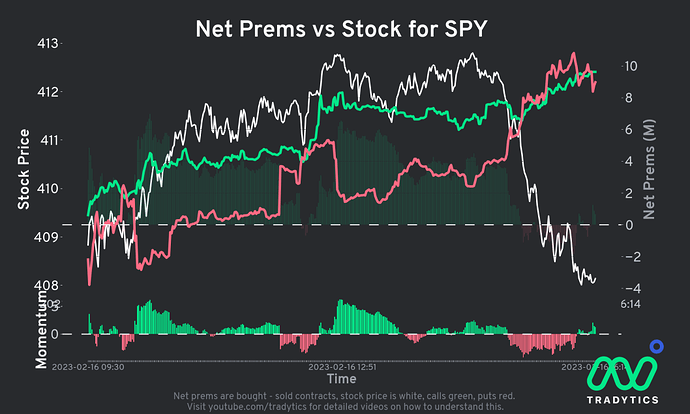

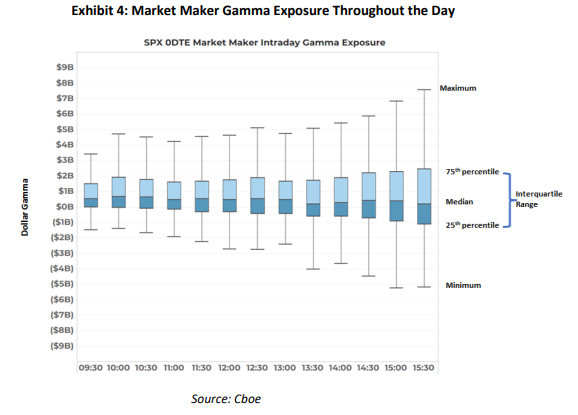

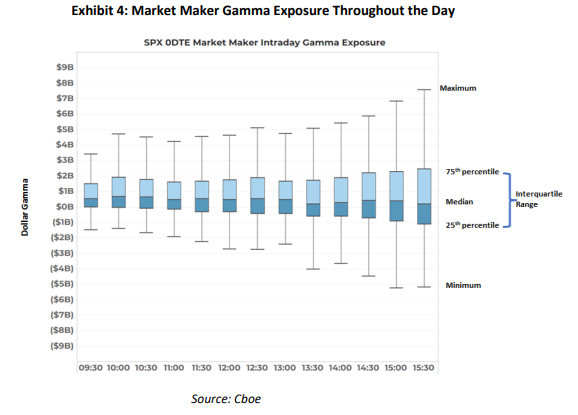

Second, they seem to rely too much on averages - they say the following, even thuogh we can see the range to be in the millions:

On average, market maker positioning is fairly de minimis, with net gamma exposure ranging from $170mm to $670mm throughout the day

This is how people drown in fords that are, on average, just six inches deep.

Third, they only take a day-long window. But that’s not how MMs hedge - they do so dynamically and usually fully, since this is: a) the SPX complex and b) the 0th day. Imagine the extremes of the flows below happening in a 30 minute window (which we have seen on some days) vs the full 6.5 trading hours. That immediately shoots up the 1.3%-1.9% below to ~20%. 20% of notional will move markets, no?

Even if we focus on the “whiskers” on the box plot, the range of -$5bn to

+$7.7bn represents just 1.3% to 1.9% of the S&P futures daily notional volume. Hardly the tail wagging the dog.

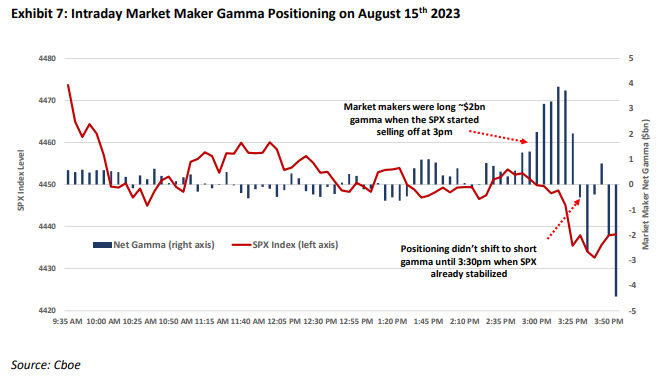

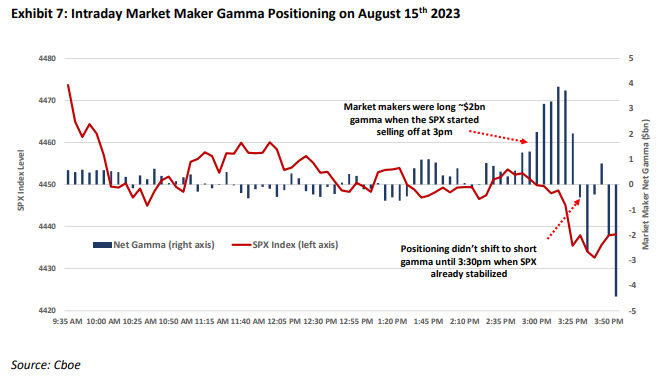

Finally, their take on what transpired on Aug 15 seemed a bit myopic. They note that markets were in positive gamma territory just before the dump started. Yet note how there was a positive spike in gamma just when the alleged 100K 4440P contracts hit the market. A spike that was concidental to the trade.

SG has one explanation for this in the following video, around the 10 min mark. And talks about the delta drop from these puts around the 11:35 min mark - they track the negative delta while CBOE reported on the positive gamma.

Generally this video is worth checking out, though Brent is clearly trying not to bite the CBOE hand that feeds him. Which, on top of his signature mumbling, waters down some of the underlying points he’s making.

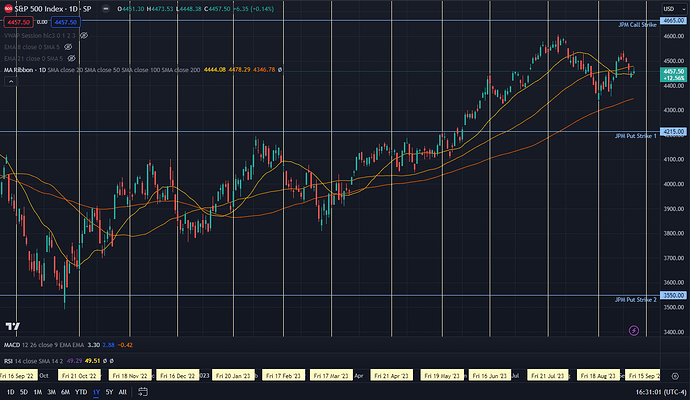

Overall, I don’t find the CBOE paper convincing enough to walk away from continuing to rely on this delta/gamma hedging stuff, especially around opex. The pivots around opex have worked out too often (yellow lines). But it is a call to be more discerning as not delta/gamma is created the same, and folks orders of magnitude more sophisticated that what we can track are likely front-running this stuff more than ever.