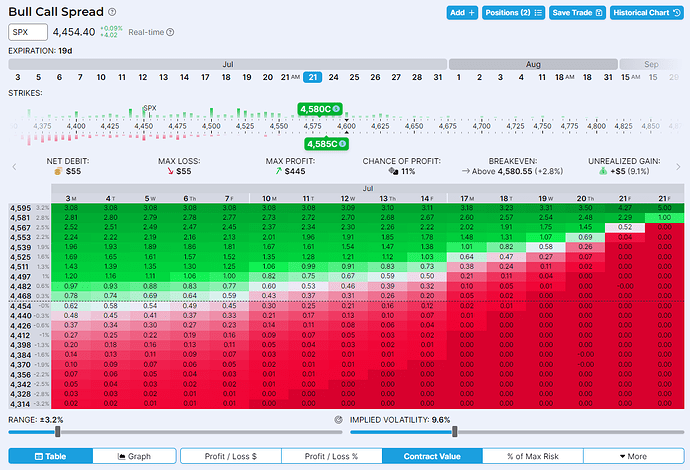

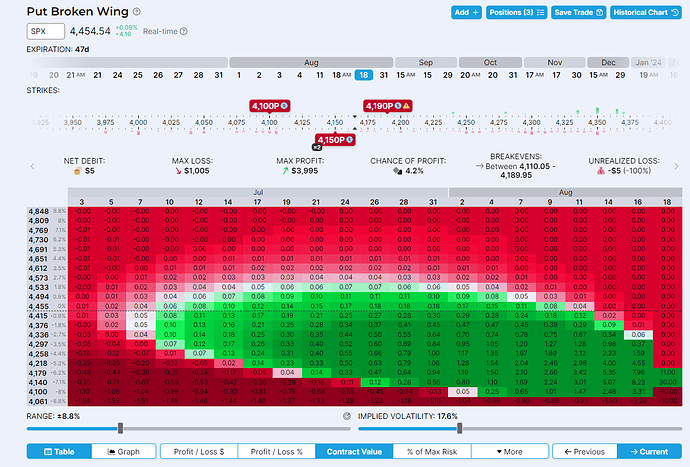

Got the following:

- The melt-up rider - 7/21 (19DTE) 4580C/4585C bullish call spread for $0.55, that profits if SPX moves ~1% this week, or ~2% by end of next week, or ~3% by opex. Aggressive, but we’re supposed to be in a melt-up!

- The insurance - 8/18 (47DTE) 4190P/4150P/4100P broken wing put butterfly for $0.05. Goes green in the 4200-4450 range, as long as IV does not spike too hard. Since Aug expiry, covers ground if we keel over on the other side of opex too.