You could use something like $SVOL to hedge this in case there is absolute peace.

Thank you for this advice, @notmisa ! Have gotten a chunk of $SVIX as a hedge. $28.18 buy, $25 stop.

Looks like there is no fear in the markets, and VIX could go to 12 or lower over the summer. At least into vixpiration on July 19th.

Chose SVIX over SVOL because SVIX seems to be running more, even as VIX slowly bleeds down.

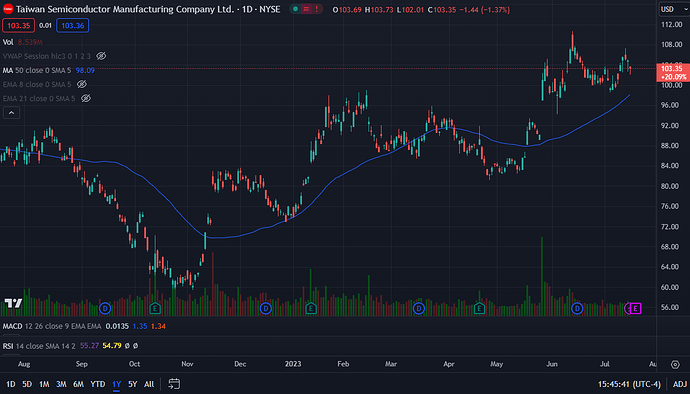

Expecting TSM to correct somewhat after 7/20 earnings, so initiated small positions today:

- 7/21 96P/95P bearish put spreads for $0.20

- 7/21 91P/90P bearish put spreads for $0.10

Choice of the strikes are based on this $90-$97 gap (ignoring the wick…):

Keeping size small because there is no margin for error as the options expire the next day. This will work well whe TSM adds color to previous negative guidance, or will go to $0 as it confirms market sentiment. Thus, treating as lotto.

Got it this early because IV is still low enough - has not spiked pre-earnings, like it will. So feels like getting as decent a price as I would one week out, with IV around 50% vs 35% like now.

Got the following:

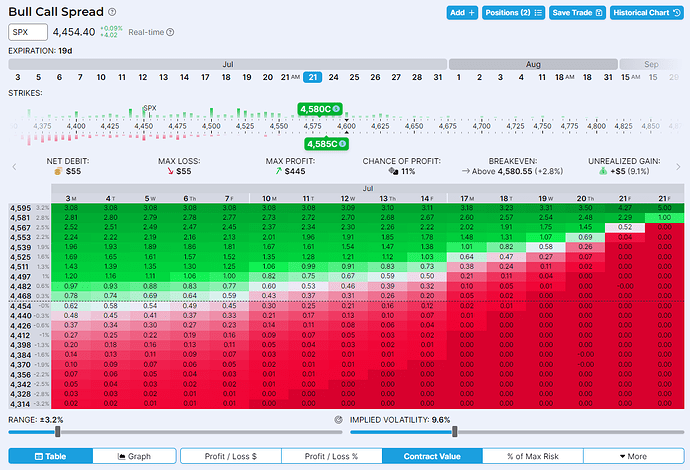

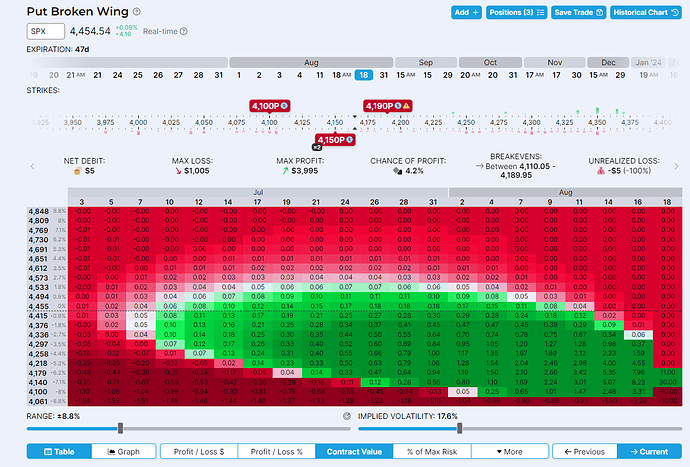

- The melt-up rider - 7/21 (19DTE) 4580C/4585C bullish call spread for $0.55, that profits if SPX moves ~1% this week, or ~2% by end of next week, or ~3% by opex. Aggressive, but we’re supposed to be in a melt-up!

- The insurance - 8/18 (47DTE) 4190P/4150P/4100P broken wing put butterfly for $0.05. Goes green in the 4200-4450 range, as long as IV does not spike too hard. Since Aug expiry, covers ground if we keel over on the other side of opex too.

This little sh*t that is an embarassment of a company went up 60%+, so couldn’t not help get some puts:

- 7/21 (16DTE) $0.50P for $0.37. B/e below $0.14.

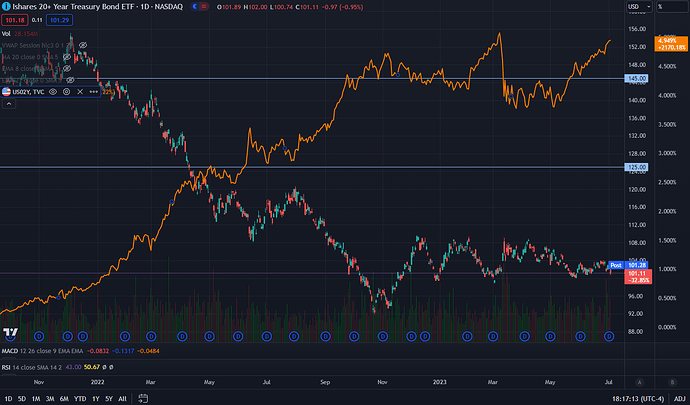

Given that we are expecting minimal rate rises over the next few months, followed by a plateau, TLT shouldn’t fall much more. On the other hand, if something breaks badly, Fed may be forced to cut rates fast in Q1 or Q2 of 2024.

Hence, grabbed some of the following:

- TLT rises back to the 125-130 range, which will happen if rates fall by half, to around 2.5%: 4/19/2024 (289DTE) 125C/130C bullish call spreads for $0.35.

- TLT rises back to the 145-150 range, which will happen if rates fall massively, to around 1%: 6/21/2024 (352DTE) 145C/150C bullish call spreads for $0.10.

To reiterate, these are hedges if bad things happen. As of now, I expect them to expire worthless.

Sold these:

- 0DTE 4445C/4450C credit call spread for $4.80

Betting SPX closes the gap by the end of the day. Worst case scenario, I lose $0.20 per contract.

End-of-day Edit: RIP - paid the market gods the $0.20 per. Was a bust.

Picked up this lotto position for Monday, in case the dump at the end of the day today was a false alarm =P

And this, last minute, just in case the dump was a precursor to something going bump over the weekend!

RIP.

Market decided to thread this needle perfectly and remain within 10 points of 4400. ![]() Also, they were for today, not 7/11 - wrote that wrong.

Also, they were for today, not 7/11 - wrote that wrong.

These filled yesterday at some point - just noticed now.

It’s a custom strat where I bought a call debit spread by selling a put credit spread. Works out well if SPY closes over 447 on July 19th. Max profit over SPY 448, max loss of the same amount under SPY 446.

![]()

Just got a similar trade - 7/19 448P/449P/449C/450C for $0.02.

Symmetrical R/R as above, trade works if SPY closes over 449.02 that day.

Sell order for these hit in the morning for $0.51 (+50%). (Considering this +50% even though contracts went from $0.01 to $0.51 because max loss possible was $1.01.) They are currently ~$0.80 (out of max value of $1), so was a little early.

Also sold these for $0.51 ($50%). Also had $1.02 max risk per contract.

Only remaining bullish play is the still-far away 4580C/4585C call spreads.

Topped up on these a bit, cost basis for the 96P/95P is now $0.115, and for the 92/91P is now $0.06.

Price action pretty muted, with lower highs, so … there’s a chance. Earnings on Thu, pre-market.

Edit: In case I am wrong, got these 10DTE calls to cover money deployed in puts. A week further out as cost was almost the same for 2DTE and 10DTE because of earnings on Thu. So giving it a bit more time to drift up.

- 7/28 109C/110C bullish call spreads for $0.20

Since VIX option is tomorrow and that can unpin it a bit, sold the SVIX for $29.50 (+5%). Will buy again on the other side of a VIX increase, if it happens.

VIX call spreads are not doing so well - both Sep and Dec set down 50%.

Hedge played out nicely ![]()

Small lotto position, in case we have a closing-the-gap situation later in the day:

- 0DTE 4535C/4530C for $4.90 credit.

Worst case scenario, I lose $0.10 per contract. Long shot, as can be seen from the chance of profit of 2%.

I lost that $0.10 per contract. RIP lotto.

Missed this earlier - thank you for that suggestion - was nice to have it riding in the background. Now that Fri ended up pretty tamed, might ver some SVIX again on Mon as VIX contiues to die.

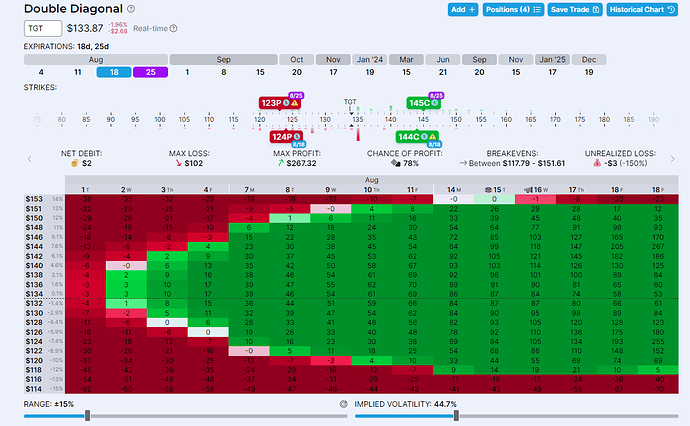

Ended up paying $0.02 for the double diagonal calendar spread we were discussing in the TGT earnings thread instead of getting it for a credit - the price for being 2 days late to an idea… It’s a combo of two calendar spreads, and one of them will expire worthless.

Risking $102 for up to theoretical max profit of $267, but realistically (based on previous rounds with these diagonal) will close if I get 50% or so. The profit frontier is below. This is also a positive vega play - as IV goes up into earnings, profits should increase.

Took advantage of the VIX spike over the last few days to roll all VIX calls into:

- 12/20 20C/23C bullish call spread for $0.61

Still down ~50% on combo of earlier Sep and Dec VIX calls that I liquidated as part of the roll, so still a long way to claw back out.