The_Ni

May 6, 2024, 4:30pm

163

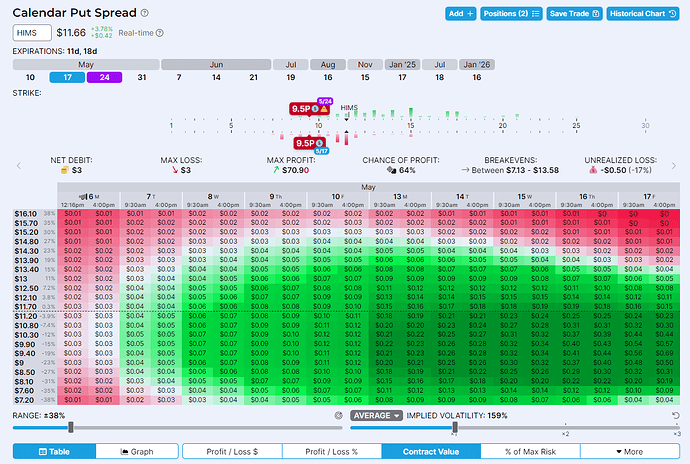

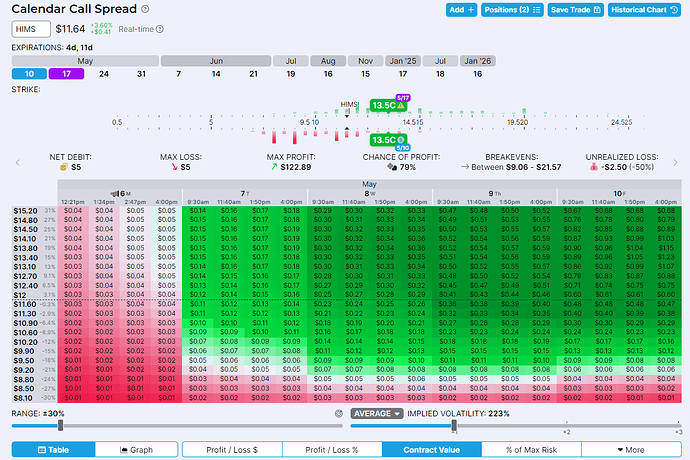

Got HIMS put and call calendar spreads, taking advantage of the high9.5 IV.

9.5 calendar put spreads for 0.03:

13.5 calendar call spreads for 0.05:

The ideal situation is when the nearer dated strikes expire with price close to them, but not with them ITM. Which leaves enough extrinsic on the farther dated ones to sell and profit from.

The_Ni

May 8, 2024, 6:28pm

164

Sold 5/17 AMC 3Cs for 0.50 ea. Earnings today after hours. Here’s to not getting blown up!

1 Like

The_Ni

May 9, 2024, 2:02pm

165

Closed these 3Cs out for $0.24 - locked in 52% profit.

The_Ni

May 10, 2024, 1:55pm

166

Closed all positions out for $0.42 - 50% profit locked in.

The_Ni

May 10, 2024, 2:56pm

167

Took this 10-wide inverse IC because options are quite cheap today, and I’d like to think we close ~10 points away from 5225, which is what this is centered on. Price: $5.55.

Calculate potential profit, max loss, chance of profit, and more for inverse iron condor options and over 50 more strategies.

The_Ni

May 10, 2024, 3:20pm

168

Closed these out for 5.75 (+4%) as market moved quite a bit, and I could move center without losing money.

Opened these IIC for $2.50 ea: Inverse Iron Condor | OptionStrat Options Profit Calculator

The_Ni

May 10, 2024, 6:09pm

169

I don’t HYMC much, but difficultly to see the dilution news as anything but bearish.https://new.reddit.com/r/amcstock/comments/1covvpp/implications_on_amc_of_impending_2x_dilution_of/

The_Ni

May 13, 2024, 2:59pm

170

Got these AMC calendars for $0.03: Calendar Call Spread | OptionStrat Options Profit Calculator

It is very likely that prices don’t go up to the levels for the multiples of profits. But given that this holds value nicely around the $3 level for a week or more, feels like a nice risk/reward setup for "just in case"

The_Ni

May 13, 2024, 3:44pm

171

And now got these put calendars for $0.05 ea: Calendar Put Spread | OptionStrat Options Profit Calculator

Works out if price falls to $2-$3 by Jun 7, and anything below $2.5 between Jun 7 and Jun 21. Max loss is the 0.05.

The_Ni

May 13, 2024, 3:44pm

172

And now got these put calendars for $0.05 ea: Calendar Put Spread | OptionStrat Options Profit Calculator

Works out if price falls to $2-$3 by Jun 7, and anything below $2.5 between Jun 7 and Jun 21. Max loss is the 0.05 per.

The_Ni

May 13, 2024, 6:57pm

173

Doubled this HYMC put position for 0.95. It’s trying to look spirited with the AMC rally.

The_Ni

May 14, 2024, 1:42pm

174

Sold half of these HIMS calls for $0.20 - 300% return.

1 Like

The_Ni

May 14, 2024, 7:12pm

175

Closed the other half for 0.50 (+900%).

The_Ni

May 15, 2024, 1:56pm

176

Closed these 0.03 calendars out for 0.20 (+566%). AMC is falling quite a bit and might not hold these levels into next week… so decided to close out.

1 Like

The_Ni

May 15, 2024, 6:00pm

177

Got more AMC - 5/17 6C/6.5C for 0.06 ea: Bull Call Spread | OptionStrat Options Profit Calculator

We didn’t tank completely, even with the 20M+ shares of issuance in the morning. Maybe we end up 5% higher on Friday.

The_Ni

May 15, 2024, 6:01pm

178

Missed to add the P/L frontier.

The_Ni

May 16, 2024, 6:37pm

179

Took these trades on ZIM yesterday - forgot to update:

The_Ni

May 16, 2024, 7:04pm

180

Added these GME Iron Flies for $0.96 credit. Max I can lose is $0.04, unless some overnight assignment shenanigans happens. Counting on a 30 pin tomorrow.

The_Ni

May 20, 2024, 5:44pm

181

Got these HIMS call calendar spreads because it’s erecting today for some anti-obesity reason: Calendar Call Spread | OptionStrat Options Profit Calculator . Max loss is the 0.05 I paid for each contract. I have two weeks for HIMS to erect some more into the 22-25 zone.

The_Ni

May 20, 2024, 7:40pm

182

Got these HIMS put calendar spreads for 0.05 ea in case it can’t perform under pressure, and goes flaccid.

Calculate potential profit, max loss, chance of profit, and more for calendar put spread options and over 50 more strategies.

Half position size as the call calendars, and intended to be a hedge against non-performance.

1 Like

)

)