Starting a placeholder for ideas/DD related to the rebound from Russia economic moves.

Here’s a collection of tickers that we could keep an eye on:

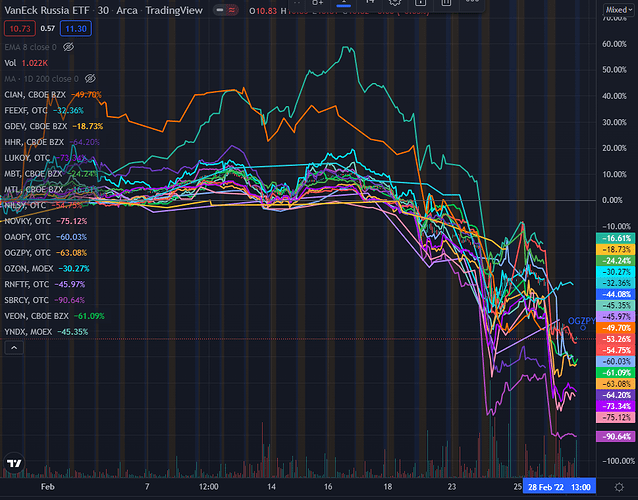

CIAN, FEEXF, GDEV, HHR, LUKOY, MBT, MTL, NILSY, NOVKY, OAOFY, OGZPY, OZON, RNFTF, SBRCY, VEON, YNDX

In addition to the ETFs:

ERUS, FLRU, RSX, RSXJ, RUSL

And here are some fundamentals on these tickers.

The 1-month squiggly lines are not that helpful because there are so many, except to illustrate that there is a wide range of price reduction so not tickers went into a tailspin.

It’s likely way too early to even think about taking positions, but perhaps this will help us keep an eye on all the relevant tickers.

Here are the company names, sectors and industries:

Cian PLC (CIAN), Sector: Real Estate, Industry: Real Estate Services

Ferrexpo plc (FEEXF), Sector: Basic Materials, Industry: Steel

Nexters Inc. (GDEV), Sector: Communication Services, Industry: Electronic Gaming & Multimedia

HeadHunter Group PLC (HHR), Sector: Industrials, Industry: Staffing & Employment Services

PJSC LUKOIL (LUKOY), Sector: Energy, Industry: Oil & Gas Integrated

Mobile TeleSystems Public Joint Stock Company (MBT), Sector: Communication Services, Industry: Telecom Services

Mechel PAO (MTL), Sector: Basic Materials, Industry: Steel

Public Joint Stock Company Mining and Metallurgical Company Norilsk Nickel (NILSY), Sector: Basic Materials, Industry: Other Industrial Metals & Mining

PAO NOVATEK (NOVKY), Sector: Energy, Industry: Oil & Gas E&P

PJSC Tatneft (OAOFY), Sector: Energy, Industry: Oil & Gas Integrated

Public Joint Stock Company Gazprom (OGZPY), Sector: Energy, Industry: Oil & Gas Integrated

Ozon Holdings PLC (OZON), Sector: Consumer Cyclical, Industry: Internet Retail

Public Joint Stock Company Rosneft Oil Company (RNFTF), Sector: Energy, Industry: Oil & Gas Integrated

Sberbank of Russia (SBRCY), Sector: Financial Services, Industry: Banks—Regional

VEON Ltd. (VEON), Sector: Communication Services, Industry: Telecom Services

Yandex N.V. (YNDX), Sector: Communication Services, Industry: Internet Content & Information

Wondering if there is a way to profit from the increased trade volume between Russia and China but i could not find any asset that represents the relationship.

I’ve started adding small share positions in SBRCY. I’m looking at it kinda like I see FNMA/FMCC, willing to let it go to zero but hopeful on an upside. Cost basis 93 cents.

TDA restricting buying of SBRCY.

Also FYI if you’re buying SBRCY on Fidelity apparently they charge you $50 a transaction :insert guh here:

Maybe we can look into consumer electronics? Is it possible that China ups its Russian advertisement in wake/ expectation of sanctions from previous US competitors (and perhaps a more forceful approach from the Russian government in a bid to separate from the West)? I don’t believe that Russia has much, if any, footing on that market globally so may pivot more towards Chinese brands if they’re already reliant on foreign companies.

Mercedes Benz group DMLRY is headquartered in Moscow. Had a similar drop into this past Monday like the other Russia tickers. Could be a nice discount to keep an eye on here.

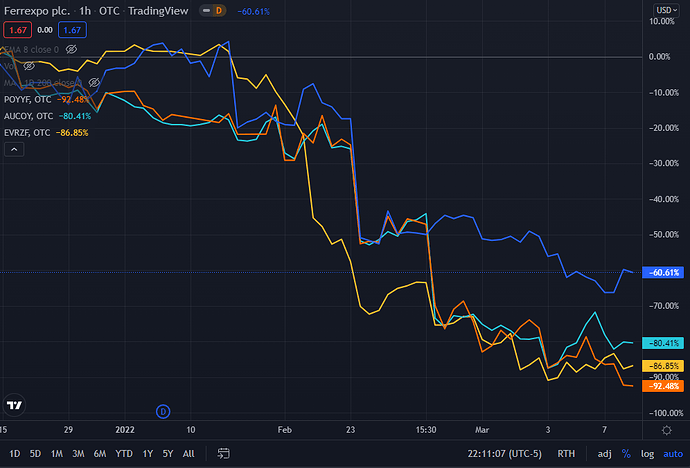

Three of these are not like the others; may rebound sooner

Two of these are companies with significant Russia exposure - Polymetal and Evraz - have managed to evade sanctions by being incorporated somewhere other than Russia. The third - Ferrexpo - has operations in Ukraine but is registered in Switzerland. All of them have LSE tickers as well as US OTC ones. No options.

Yet share prices for all three have plummeted with the war.

They are solid businesses with intrinsic values that exceed the current market cap, even allowing for the war. They are probably still too hot to handle as they may fall more, and two of them could still be brought under the purview of sanctions. Nevertheless, sharing to keep in mind because when relations start to normalize, these are the ones that may be immediately investible, unlike SBRCY, NILSY or RNFTF which may still face some combination of restrictions by Russia, international sanctions, and/or delisting.

| Ticker | Name | Registered | LSE Ticker | Description from SeekingAlpha |

|---|---|---|---|---|

| FEEXF | Ferrexpo plc | Switzerland | FXPO | Ferrexpo plc mines for, develops, processes, produces, markets, exports, and sells iron ore pellets to the metallurgical industry. It operates two mines and a processing plant near Kremenchug in Ukraine; a port in Odessa; a fleet of vessels operating on the Rhine and Danube waterways; and an ocean-going vessel, which provides top-off services. The company also offers finance, management, procurement, transportation, marketing, shipping, barging, and port services. It has operation in Central Europe, Western Europe, North East Asia, China, South East Asia, Turkey, the Middle East, India, and others. The company was incorporated in 2005 and is headquartered in Baar, Switzerland. Ferrexpo Plc is a subsidiary of Fevamotinico S.a.r.L. |

| AUCOY / POYYF | Polymetal International plc | Jersey (HQ in Russia) | POLY | Polymetal International plc operates as a precious metals mining company in Russia, Kazakhstan, East Asia, and Europe. The company operates through five segments: Magadan, Ural, Khabarovsk, Kazakhstan, and Yakutia. It is involved in the exploration, extraction, processing, and reclamation of gold, silver, copper, zinc, and platinum group metals. The company’s flagship project is the Kyzyl property located in the East Kazakhstan Region, Kazakhstan. Polymetal International plc was founded in 1998 and is headquartered in Saint Petersburg, Russia. |

| EVRZF | EVRAZ plc | UK | EVR | EVRAZ plc, together with its subsidiaries, engages in the production and distribution of steel and related products in Russia, the Americas, Asia, Europe, CIS, Africa, and internationally. It operates through four segments: Steel; Steel, North America; Coal; and Other Operations. The company offers steel and value-added products, including infrastructure steel, rails, large-diameter pipes, and oil country tubular goods. It also extracts vanadium ores; processes and produces vanadium products; and mines and enriches iron ore and coal. In addition, the company engages in the energy-generating, shipping, and railway transportation businesses. It offers its products for use in infrastructure and construction projects; and rail, energy, and industrial end-user markets, as well as coke and steel producers. The company was formerly known as Project Savannah PLC and changed its name to EVRAZ plc in October 2011. EVRAZ plc was founded in 1992 and is based in London, the United Kingdom. |

Two caveats to note:

- AUCOY and POYYF are both Polymental tickers, but they have showed differentiated performance recently. AUCOY is an ADR while POYYF is derived directly from LSE’s POLY. I don’t understand the difference beyond that, nor the implications.

- Evraz did a demerger of the coal miner Raspadskaya involving special dividends on Feb 15, 2022, which resulted in a large drop in share price. It seems to have gotten halved from $8.x to $4.x. So the 92% fall is overstating things; it’s more of a ~70% fall.

And then there were two.

Evraz got suspended today on LSE, even though they were explicitly spared earlier.

Trading in shares in Evraz, the London-listed steel company controlled by Roman Abramovich, has been halted following news that the UK was imposing sanctions on the Russian oligarch. The Financial Conduct Authority said it was suspending trading in the shares “in order to protect investors pending clarification of the impact of the UK sanctions”. Shares in Evraz fell as much as 14 per cent on Thursday before the suspension.

…

The London Stock Exchange, which has suspended a number of Russian-linked stocks, has said previously that Evraz had been allowed to continue to trade because it is a UK incorporated company, not a Moscow one, and because Abramovich was not under sanctions at the time.

(Source)

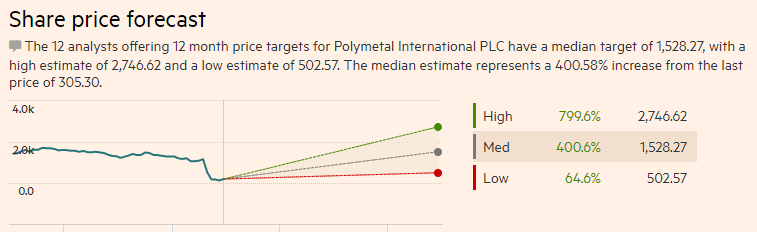

Of the three that did not get struck by the wrath of sanction gods, one still remains in a tradeable form: Polymetal (AUCOY / POYYF). Stock price has actually doubled since bottoming. Wondering if it is time to take a small position.

There are multiple moving parts that still add significant risk; would love to hear what you think.

Developments since the last post:

-

It is still trading both as an ADR (AUCOY) and as a print of the LSE’s POLY (POYYF).

-

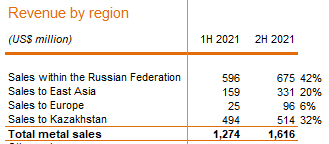

At no point have they been considered for sanctions, even though it is HQed in Russia and its operations are in Russia and Kazakhstan

-

European exports are currently halted; no disruption to E. Asia. Its European exposure is limited, and even with E. Asia following suit (unlikely?), the impact would be contained and not catastrophic.

-

It has recently talked about a demerger where its Russian and Kazakh businesses split, and the market liked it - the price doubled precisely as a response to this. (Behind FT Paywall, so don’t know details) The Kazakh mines are about a third of their revenue.

-

Analysts continue to think favorably of this stock (though some have stopped coverage).

-

Even the “Low” price estimate is 64% higher than where it is now. (Prices in GBP for POLY on LSE)

-

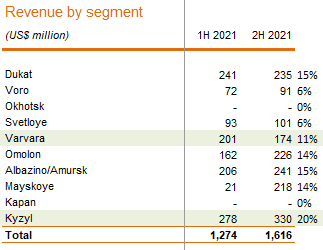

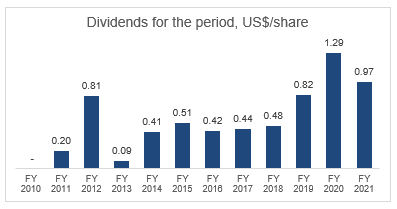

At current prices, once (if?) dividends return to former levels, yields will be in the 25% range on cost basis:

-

I have been unable to find any evidence that the performance of this company would be materially impacted if nothing else changes from how things are now.

Looking a year or two out, here are the scenarios:

- Worst case scenario: POLY gets sanction-shafted from LSE and price goes to 0 for it, and AUCOY / POYYF

- Best case scenario: It remains untouched by sanctions, E. Asia and prices reach 4x (pre-war level) or even 6x (ATH)

- Middling scenario: It splits its Russian and Kazakh operations. The Kazakh operations continue to be listed with LSE; the Russian one gets shafted. Assuming the parts are priced in some proportion to revenue, even if the Russian 2/3 goes to 0, the Kazakh 1/3 has a 33% to 100% price appreciation in this timeframe. (1/3 of 4x or 6x respectively.)

Important to note that Polymetal is a top-10 global producer of gold and silver, and the second largest in Russia. It’s not going anywhere. What we are considering, rather, is the market’s continued access to part or whole of this company.

What do you think? Which scenario is most likely? And are there better ways to think about #3?

Got AUCOY and POYYF commons as starter positions in equal sizes.

AUCOY @ 4.29, POYYF @ 4.15 (London is being priced lower than ADR, presumably to incorporate risk)

Liquidity is extremely thin - needed a bit of time for limit orders to fill.

Please note - this is an [size=4][color=#E26B0A]extremely risky[/color][/size] play:

- The price will go to 0 if either or both are delisted.

- Even if they are not delisted, sanctions can lock them out of markets for a long, long time.

- If demerger happens, Kazakh unit will probably get 1/3 of EV and Russian unit will get 2/3 of EV. There is massive uncertainty around this as we have no idea how it will be structured, what listings will remain, how stockholders will be compensated etc.

- I’ve tried to diversify by getting both OTC tickers but it may end up being a distinction without a difference as both sides of the Atlantic usually pull triggers in a coordinated manner

Reason for buying now - price has come to rest on VWAP. Perhaps that’s more of a excuse to justify this move to myself, than technical having actual value in these speculative/volatile situations.

Not in this Ni but your trade has its fans

Well, looks like the “extremely risky” eventuality has come home to roost for the AUCOY/POYYF play. Will dump at open.

https://twitter.com/philrosenn/status/1516417873203367951

Prob a tit tat for:

But these tweets were from this morning?

It is likely that this has been in the works and each party knows about the other’s intentions. There are backchannels, always. Even at the height of the Cold War, saner heads tried to keep each other in the know as powerful people do weird stuff when they are surprised when cornered. I can almost imagine the news releases being synced too, so that both can claim they were the one who took ‘bold action’ and not reacting.