For anyone looking into entry into military contractor stocks and can’t find it for $LMT, other alternatives to watch are $RTX $NOC and $GD.

If the theory is that RSX is going to be delisted, then the play should be to get far OTM puts. Those could be 10x-20x returns, and are cheap to get a couple to gamble with.

“We’re not gambling enough”

Stick with ITMs champ, we don’t know what’s going to happen.

Speaking of which, after going through it a little more I’m actually not 100% convinced these stocks will be delisted, I would actually except these halts to be lifted tomorrow, but we’ll see. Between now and then I’d say that RSX should continue it’s slow bleed.

Thanks for sharing! Comparing to RSX makes good sense!

If you don’t mind, perhaps we could share the tickers more connected to plays after the worst of the conflict is over in this thread @thots_and_prayers started?

Since this one is more for the plays while the conflict is ongoing. Thanks!

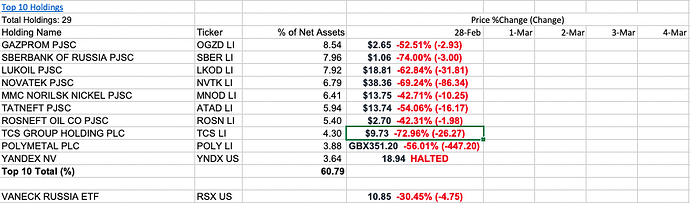

Wall Street Millenial makes a case for Norwegian oil and natural gas company Equinor ($EQNR) here at 7:40: https://www.youtube.com/watch?v=PKRHCl3DmAI

Norway is the 2nd largest natural gas exporter in the EU after Russia, accounting for 20% of total imports.

Equinor is the largest oil and gas producer in Norway. It is majority owned by the Norwegian government. In 2021, they generated $29B in cash flow from operations, which is more than double the average over the past 5 years. This was driven largely by sky high natural gas prices. The insanely high European gas prices are not sustainable. However, if you believe Putin will continue to rampage across Ukraine, the potential for upside could be tremendous.

It’s been on a strong uptrend with resistance at $32.

Equinor rallies more with the Brent Pil price than with gas price, and Im not sure if its the unlikely beneficiary… Its just us Norwegian winning a lottery again ![]()

If you check the EU stock exchanges the past 14 days, you can easily see which one is held up by oil !

For Equinor there will be some upside, but its almost at all time high only exceded by its high in -08.

They have a lot on cash on hand now, as there have been halted a lot of development projects.

For UNG, is anyone thinking that the Ukraine catalyst is being eclipsed by Biden’s plans to call congress to action and send him clean, renewable energy legislation tomorrow night? Word is that it’s supposed to be a large focus of his SOTU address, outside of the conflict happening now.

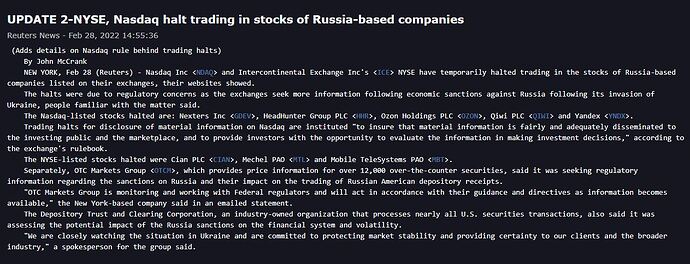

I will post the ticker in Thot’s thread. However, from the top 10 holdings, YNDX is the only one traded in the US Exchange.

Prices for the other tickers are provided by the London Stock Exchange.

OZON SEC filing.

Just saying what we already know. They believe they shouldnt be on the sanction list. They can use swift through partner banks, however they expect that they would be affected in various ways by sanctions if they have continued impact on russian economy, inclusing marerial impact to activity on their platform, and difficulty raising new capital. They say they have 80% foreign exchange liquidity (note: aren’t rhey reuired to sell this for ruble based on new rules by russian central bank?)

https://www.sec.gov/Archives/edgar/data/0001822829/000119312522058347/d288048dex991.htm

I expect trading to resume today.

They will also release 2021 earnings details on April 5 with more on the outlook, could be another play if we see some recovery, that has to be a shitshow

[size=1]Disclaimer: Don`t take the price target provided here as a realistic price target. The below just shows the scenario in which the individual companies in RSX are priced correctly as of yesterday. Obviously they are extremely volatile, if you check their charts, most of them had days last week with recoveries of 30-50% intraday. The below just highlights the discrepency between RSX share price and the value of their holdings. Normally in case of an ETF this difference should be negatable. Obviously ceteris paribus, the ETF would follow the individual values.[/size]

For RSX: their current market cap as of closing price of $10.85 is $959,140,000, while their Total Net Assets is $692M as of 28 February (https://www.vaneck.com/us/en/investments/russia-etf-rsx/holdings/). This suggests there is a potential for a 28% further drop for a PT of $7.82, or potentially an expected recovery of 39% of their holdings is priced in the current share price.

As per their 25 February holdings, on Monday 6 of their holdings traded (in this case did not trade) on MOEX. As of 25 Feb, these were worth $162M, or 11.5% of their assets.

Now the value of the individual stocks trading on Monday lost a mind blowing 57% from Firday close. (i don`t highlight NASDAQ halted stocks since they still dropped). Using the % of drop of the trading stocks (not entirely accurate i know, just estimating), a similar drop on MOEX traded stocks would result a further loss of $93M of RSX Net Assets bringing the total to $623M, which if Market cap = Net Assets for an ETF would translate to a further drop of 10%, totaling a drop of 35% from the current price to a share price of $7.05.

This of course assumes that the market priced the individual shares correctly on Monday, and not RSX and a similar drop in MOEX traded stocks. This also doesn`t account for the fact that market open on MOEX could and likely would bring down the price of currently traded holdings too. The individual stocks could of course recover or drop further, and NASDAQ halted stocks could also impact this, but this is an estimation based on closing prices for the potential target of RSX.

I will keep an eye on their updated holdings as of yesterday close, currently only 25 Feb is reported on their website

edit: Early morning movement on London exchange in the top 10 holdings. Volatile, seem to roughly avg out to no significant change overall in value without going into details.

edit2: nvm, mostly down again

Heads up at Equinor, last night they were in talks with the departement.

They have assets/projects in Russia estimated worth of $1.2B at year end -21.

They will pull out of their russian operation, the only comment they had about it, we expect to take some losses.

This might not be bad news though, as it seems the board has looked for an excuse to exit the russian assets.

Good point

XOM also has a large investment in Sakhalin-I with 30% of the project in their ownership, and plans to invest further $5B in the next 5 years, curious to see what happens with that.

Really appreciate this insight. It certainly felt like RSX hadn’t dropped proportionally to the holdings and now I can definitely see that’s the case. Crazy to say but we definitely stumbled on worlds most obvious puts play lol.

Thank you for all the hard work my friend. ![]() absolutely incredible.

absolutely incredible.

What about COIN or GBTC? It looks like the sanctions are breathing some life into these.

Probably a little longer term, but seen several articles regarding Cummins and CAT again and their ties with Russia.

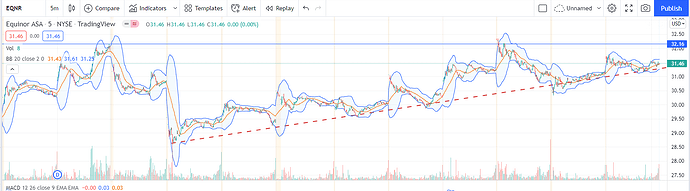

for anyone worried on this push, see below the data for the past weeks for Last trade price/NAV

| Date | NAV | Last Trade | ratio |

|---|---|---|---|

| 2/28/2022 | 7.82791 | 10.85 | 139% |

| 2/25/2022 | 15.92861 | 15.6 | 98% |

| 2/24/2022 | 13.30982 | 15.39 | 116% |

| 2/23/2022 | 19.4197 | 19.02 | 98% |

| 2/22/2022 | 20.29509 | 20.97 | 103% |

| 2/18/2022 | 23.11147 | 23.02 | 100% |

| 2/17/2022 | 24.19876 | 24.18 | 100% |

| 2/16/2022 | 25.52308 | 25.5 | 100% |

| 2/15/2022 | 24.9744 | 25.17 | 101% |

worst discrepancy was the day of invasion which closed the next day.

People buying RSX right now are paying a 30% premium for the basket of stocks they are getting in RSX

For anyone holding oil (USO, BNO, etc.) be aware that the US still hasn’t made announced they’re releasing oil from reserves and that is absolutely coming:

https://twitter.com/DeItaone/status/1498684555263451142

When announced I’d assume oil will be knocked down, at that point a reentry is probably warranted since releases are only a temporary fix.

Puts until then? Wondering if it’ll be a SOTU mention as well?