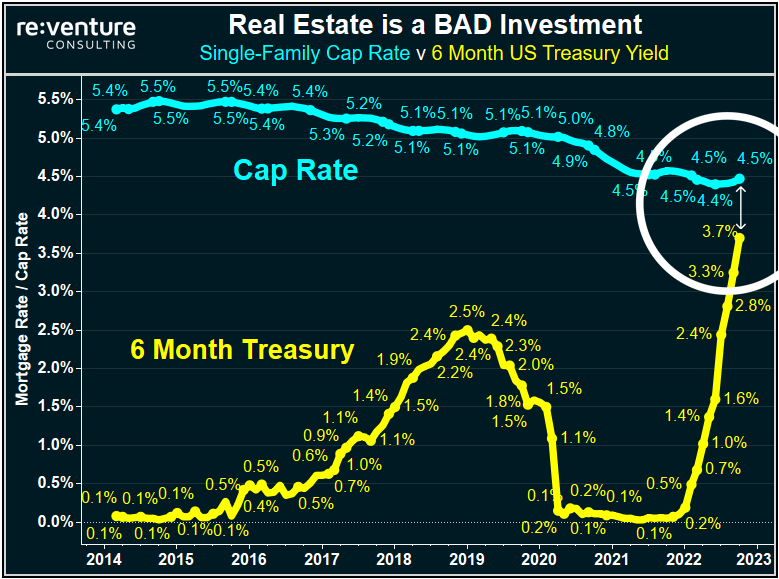

As rates rise, bond yields become a viable alternative source of returns again. At around 4%, it really starts to become real. We’re starting to see that confluence in real estate investments now (below); equities may soon follow.

The 6-Month US Treasury now yields basically the same as Buying & Renting Out a House in America (aka Cap Rate).

Translation: big Real Estate Investor selloff coming. Especially among Wall Street owners.

(Source)

Note that this doesn’t really apply to individual buyers, but much of the recent boom was from Wall Street fueling the price bubble of all kinds of homes, including single family. This applies to them greatly. May also apply to discerning folks who have investment properties and optimize based on cap rates.

Likely relevant to the Homebuilding stocks - for what is falling must rise again (XHB, ITB, NAIL) thread.

Not sure if relevant to the Housing Data think tank (previously HD DD) thread given HD’s target segment(s), but perhaps someone closer to the industry can comment.