This thread is for general discussion about TSLA stock.

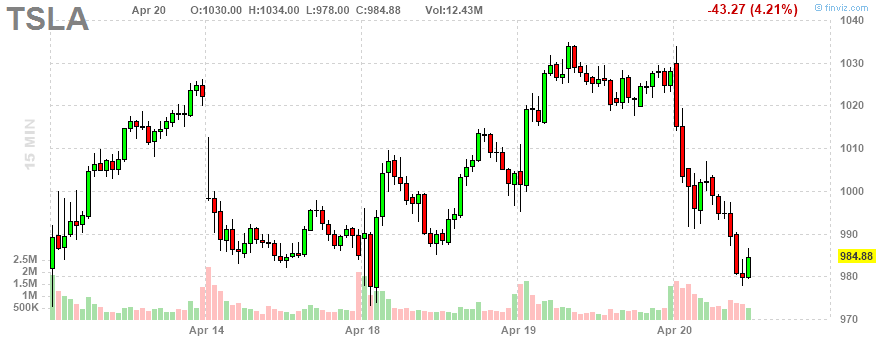

TLDR: TSLA next stop is most likely 940 and back to 1000-1025 if it decides to bounce here

TSLA 1 hour shows bearishness as it’s riding the 8 EMA downwards. The rsi seems to be bottoming, but TSLA doesn’t really care about RSI so I won’t say much about it. 1 hour just shows a bottoming and I wouldn’t say it looks like it’s the bottom. There’s no real major support here.

Looking at the daily, the sell volume has been pretty low and there’s really no major support until 940 on my chart. The blue line going up across the screen is the uptrend line ever since the 700’s and that’s also near the 940 range. Most likely TSLA is going to bounce off of this level, although I wouldn’t say that this means a back to bull trend. Earnings are in 2 weeks so maybe calls for the earnings run up wouldn’t be bad.

Overall, I don’t see TSLA going back up, I see it going back down to 940 before a bounce or a return to the bull trend. But TSLA does TSLA things and I don’t have much confidence in this TA, esp a counter trend play.

Tesla looking for geologists. A few days back, Elon Musk had tweeted something along the lines of getting into the business of mining their own Lithium…

https://twitter.com/unusual_whales/status/1514099251453734914?s=20&t=-MviPsOo1-U1TXcCwttLtw

https://twitter.com/elonmusk/status/1512505545416224783?s=20&t=-MviPsOo1-U1TXcCwttLtw

Just a reminder TSLA earnings 4/20/22

Tesla Purchased a miner today…

https://twitter.com/unusual_whales/status/1514268745010597889?s=20&t=J6IOBqmcqgi8sy1kpDC9hQ

EDIT - Apparently the news was faked, Unusual Whales has since released an update saying so

Maybe not.

Adding some various 6/17 calls to my watchlist to see if I could possibly enter one soon. The annual shareholder meeting is supposed to take place early June this year, where they are voting on increasing the authorized shares for the stock split. If they approve it, the split should happen shortly after so I’m hoping to get in to one of these calls before the possible rally.

TLDR: TSLA looks primed to run to fill the gap from 1070 to 1088

TSLA has earnings on 4/20. Typically, TSLA has a little rally into earnings even during bear markets as you can see for yourself during the last earnings. Typically TSLA starts to run 2 days before to be sure, but with this market conditions, us looking like we’re about to go bullish again, I wouldn’t bet that the pre-earnings run starts soon.

Looking at the 1 hour, TSLA is showing strong bullishness with the 8 and 21 EMA crossed, traveling along the 8 EMA with no huge divergence from the MA to suggest a pullback. Everything looks bullish on the 1 hour, even more so than the major indexes. We’re right at the 1022 resistance through so look for a break there for a impulsive rally up.

On the daily, we closed at the 1022 resistance and right at the 8 EMA. If we do run tomorrow, it’s going to be very bullish for TSLA and most likely going to see a gap fill from the 1071 to 1088 range. TSLA’s red days weren’t even that bad compared to the indexes with very low selling. This is primed for a run and if TSLA breaks 1022, I would look to get 4/22 1100 to 1200 calls and look to cut at around 1088.

Elon Musk being sue by Twitter investors. Do you think this will be an issue for TSLA rally?

TSLA is too retarded for that in my opinion. As long as the price action is bullish and we’re above 1000, I doubt it’ll cause TSLA to go to the shitters. At most it’ll just create a dip buying opportunity

I’m sure it will be huge buying volume coming Monday for the earnings. People would not probably buy tomorrow with 3 day weekend ahead, theta will love it.

Elon offers to buy Twitter to take it private. Of course TWTR jumped in PM and TSLA went down… Who knows if this will lead to anything.

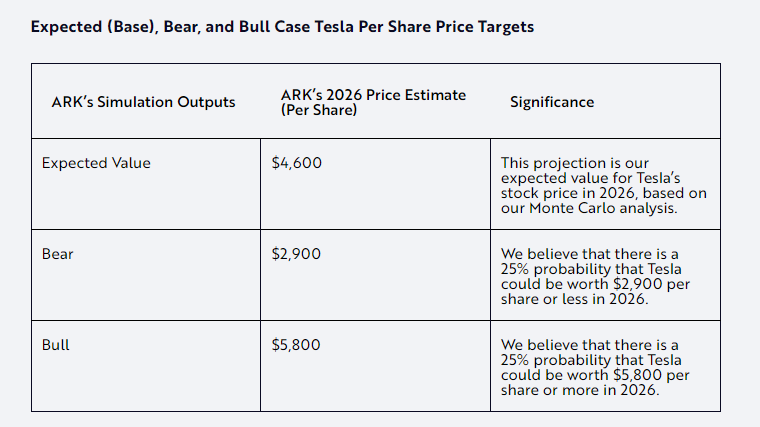

ARK just put out their new PT of $4600 in 2026. The PT seems to rely heavily on the launch of robotaxi.

For more info: https://ark-invest.com/articles/analyst-research/arks-tesla-model/

all in jan 2024 2275c at monday open

You’ve convinced me. I’m getting 700p 4/22

TSLA has earnings in 2 days. Typically, TSLA has an earnings run up, regardless of the market, as you can see today when it was basically green all day despite the market being deep red at most times.

On the 1 hour, we can see that there’s a gap to fill from 1013 to 1022. We’re most likely going to see that gap fill tomorrow. If we do end above the 1022-1025, we’re going to probably run to 1080’s.

TSLA got rejected off the 8 EMA today, but I doubt it doesn’t get past it tomorrow. If it does go back above the 8 EMA, it’s back to bull for TSLA and probably a good swing trade to lead up to earnings.

TSLA has earnings after hours.

Couple of interesting things for context:

- Price action is negative today:

- EVs are generally dumping today, but it’s not clear if that’s because of TSLA or TSLA is in for the ride

- Musk will join the call - there seems some chatter about this

- There are multiple recent lawsuits or investigations by the SEC

- Musk has generally been antsy recently

- According to SpotGamma, the level at which TSLA should default to is $1,000 as that is around zero gamma. 4/22 is not a big expiry though - just 5% of delta there, so options unlikely to play a key role unless there is a major disconnect tomorrow and then options pile in one way or the other.

Makes one wonder if there is some rather material bad news coming down the pipe. Any one of these things could make the stock tank:

- Anticipated sanctions by the SEC on Musk - could be more than a fine, given that he is a habitual offender

- Weak guidance given supply chain issues and covid in shanghai

- Unlikely, but something connected with TWTR that affects TSLA in a significant way, such as him reducing the time he will give TSLA

Generally bearish for the earnings. And curious to see if Musk brings additional fireworks.

This tweet just came through on the feed. Seems somewhat relevant.

https://twitter.com/spectatorindex/status/1516824016769720329

This aged quite well. Especially wild considering it shot up nearly $100 from when you made this post then returned to ~1005 at market close and ended PM at 1000 on the spot

Rumours of a 20-to-1 stock split being described in some JPM documents being passed around on the interwebz. Again, these are currently rumours and unconfirmed: https://twitter.com/WholeMarsBlog/status/1518816561632403456?s=20&t=acpTBK8QGoqdRiZbGh11Ew