It was $6.53 10 minutes ago.

Easing into WEAT 9c. Small starter in case it runs all day like yesterday.

Some quick clarification about NAV, because I think there is some confusion about it since a lot of people are associating the term with their experience from ESSC.

NAV is Net Asset Value, in case of RSX it’s very different than ESSC, since it is not fixed. The reason it is important here, is because RSX is an ETF, meaning they don’t have revenue generating activity, they have holdings which try replicate the movement of an industry/country etc. In this case country. NAV roughly equals the market value of their assets or in other word stocks they are holding. Since prices are moving on the market, this is constantly moving too. Now since they don’t have any revenue generating activities, the value of the stock should only be the value of their holdings, because there is just nothing else worth anything. Therefore NAV sould equal share price, or close to it. This is where we currently have a large discrepancy, and this is why this play is especially interesting.

RSXIV should be the ticker to check intraday NAV, but i don’t have it in my broker as far as i know, it might be a bloomberg thing. other than that I just have a watchlist with most of their holdings and look at that for an idea of the movement, so not exact at all.

@The_Ni did point this out in the Russia re-opening thread, but a friend of mine just pointed out the RUSL ETF which is a 2x leveraged Russia bull ETF. Here’s a good article on it, https://www.etf.com/RUSL.

It is currently down 53% on the day, so it appears to be moving more than RSX but is riskier, of course.

I think currently the premium on the (RUSL) puts you can get would put you near breakeven or potentially at a loss in case of the liquidation

Rather than start a new thread I’m adding to this one since its related. I’ve been playing BTU the last couple days and with news that coal reached an all time high it might be worth playing some more. The last couple days BTU has opened up, run higher until 10:15ish, pulled back and then pushed higher into close. It hits resistance at 19, so may be worth watching to see if it can break through that today/tomorrow. It looks like a cup with handle on the daily, but the handle is a bit messy. If it breaks above 19 I think it continues to run.

I currently hold no open positions in this, but might look for a re-entry end of day if it can show some more momentum into close.

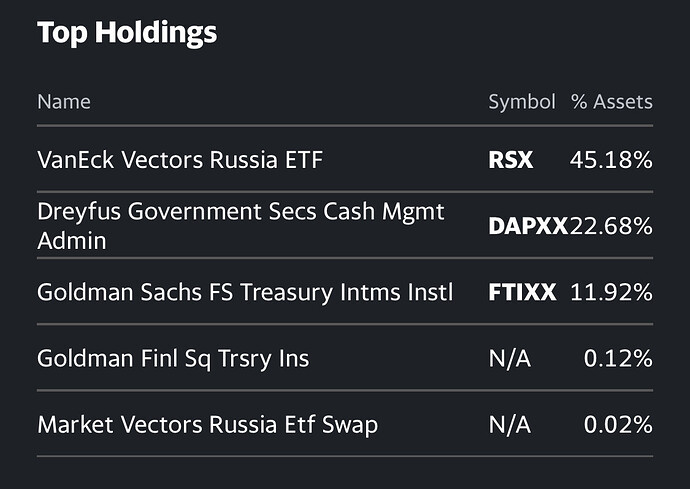

I decided to put a very tiny amount into RUSL puts because my broker does not allow trading of RSX anymore. Here are the top holdings of RUSL with RSX at the top. No reason for this not to drop into an abyss with the ETF arbitrage theory.

holup, if RUSL gets liquidated, they will sell 1,144,065 shares of RSX? hmmmmmmmm

VTB was on the list of the 7 banks for the EU SWIFT ban.

A bit over 5% of RSX’s holdings as per their 2/28/22 holdings upload. So would not be too out of line to guess that VTB would go down further?

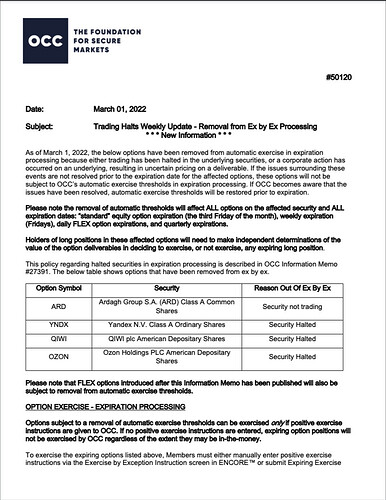

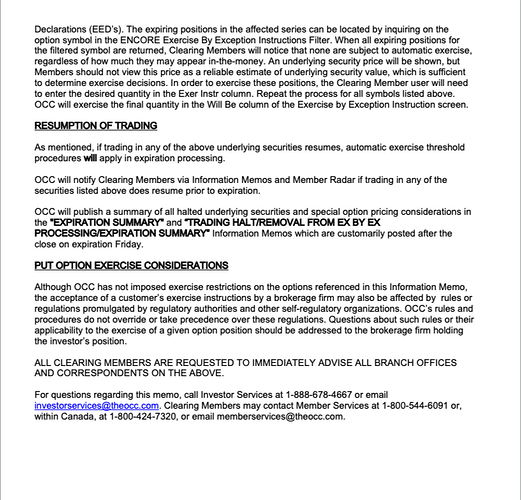

Looks like it’s saying that since the stocks are halted, there can be no assigning option contracts on expiration day.

But it says you can exercise if you enter “positive exercise instructions”. I don’t find this answer helpful at all bc how can you exercise a contract when the underlying isn’t trading.

March 1 (Reuters) - The Russian government has ordered the finance ministry to channel up to 1 trillion roubles ($10.3 billion) from the National Wealth Fund to buy shares in Russian companies, a source close to the government told Reuters on Tuesday.

($1 = 96.8050 roubles)

If this is true, I think the RSX put play will be over by the end of this week since the Russian markets are opening on March 5.

$10.3 B might not be enough to save their markets, but this kind of news could cause a reversal in sentiment where retail investors believe this is as far as the dip goes and start buying in, causing an increase in buying pressure.

RSX could be over tomorrow. This absolutely could push sentiment into BTFD

Everyone is way overestimating retails power. They don’t possess the ability to hold up RSX.

Anything on google or anyone have a fast way to see the float on the major Russian stocks/etfs and compare it to the amount Russia is saying it’s going to buy. Wonder how their worthless dollar would effect this too and most countries freezing assets, while other large groups are liquidating their Russian positions. Might just have to wait a week and see but I am sure there is some data out there to help us.

We have no idea what is going to be purchased and this could simply be a ploy to appease the higher ups and oligarchs that are likely shitting bricks right now.

It’s worth noting that Russians market capitalization is around $700 Billion. So $10 Billion is about 3% of the market and with all of this selling pressure makes the entire move pointless.

Why do you say that? Sanctions are still in effect. Only because they are using some of the reserve funds to buy their own stocks doesn’t mean this is over. They need the funds to sponsor the war and their army. The Russian economy & market is still in decline. We have a long way ahead of us. Is far from over. As per WSB, we are used to their diamond hands bag holders. This is not a war against the market shorters & hedgies lol

Russia is organizing a russian market wide pump and dump ![]()