$IAIC Was a dotcom winner but can it’s new management transformation take it for another run…?

Overview

I started following this ticker over the summer as an uplisting was on the horizon. Fast-forward to November 26th and this is now traded on the Nasdaq and new management is making aggressive moves.

This was a Y2K Play back in 97. It went to a pre-spit equivalent of $300. Still hardly any shares outstanding…

What It DO?

Information Analysis, Inc. provides information technology services. The firm engages in the business of modernizing client information systems, developing and maintaining information technology systems, and performing consulting services to government and commercial organizations. It specializes in legacy systems modernization, ebusiness solutions, enterprise portals, system migration and re-hosting services, and enterprise application integration. The company was founded by Sandor Rosenberg in 1979 and is headquartered in Fairfax, VA.

They mainly provide system modernization services that will help agencies and enterprises prevent cyberhacking (Modernizing legacy computer systems that operate on outdated languages such as COBOL).

They have been capturing the huge opportunity with state and local governments operating off of antiquated software that had proven to be extremely stressed during the COVID shutdowns. (this isn’t a COVID play) Existing & future Gov’t contracts are going to be an annuity payment…

The Numbers:

- Market Cap: $38M

- PPS: $2.75

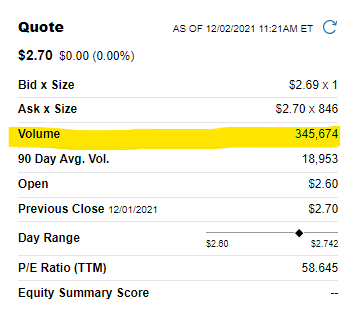

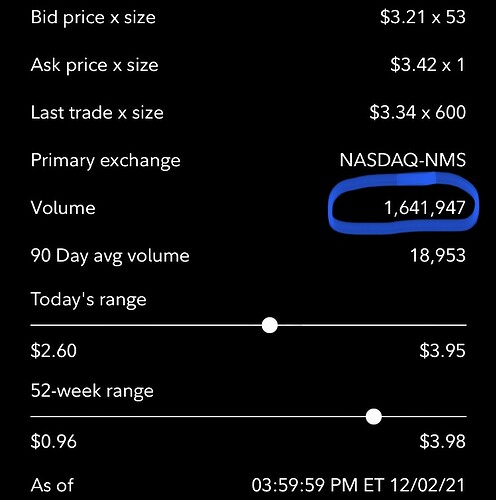

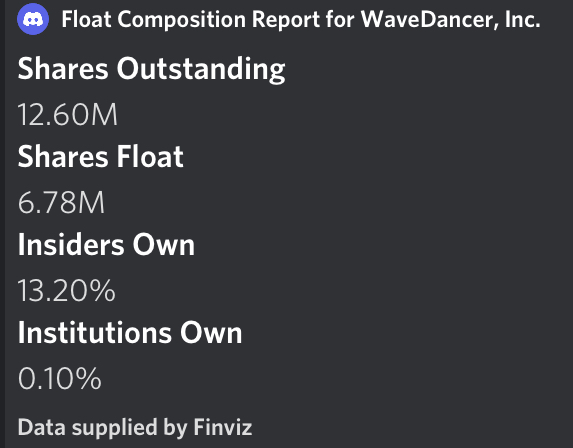

Shares Outstanding: 13.5MCurrent Float: 5.3M- 90-Day Avg. Vol: 16,356 (Includes OTC but now that this is on Nasdaq recent vol is 40k+)

- Options IV: N/A

There has been a clear transformation over the last few years as they look to leverage their foothold on government contracts as well as their recent acquisition of Gray Matters, Inc which is a player in crypto.

The CEO & there entire board floated its own offering…

The Play

This is a 3-12 month swing play as I see 2022 being a huge growth year. There is a low float, they just listed on the Nasdaq using only the ($3 price entry which is harder to accomplish for an uplist than the normal $5 min price requirement).

Short interest was essentially all but completely wiped out in November with only 100 shares short (LOL). Add the extra daily volume we are seeing and the SPY correction this is a nice entry sub $3s. (I’ve been accumulating under the $3s since early summer)

Catalysts?

Company is aggressively transforming with recent acquisition(s) and adding strong members to their team with proven track records:

Latest financial highlights from Q3 2021:

Information Analysis Releases Third Quarter 2021 Results Highlighted by Continued Growth in Higher Margin Professional Fee Business

Third Quarter 2021 Financial Highlights (all comparisons to prior year period unless otherwise noted)

- Total revenues increased 9.6% to $4.3 million, compared with $3.9 million.

- Professional fees increased 77.0% to $2.8 million up from $1.6 million.

- Gross profit improved 59.3%, with gross margin expanding to 22.8%, compared with 15.7%; higher-margin professional fees accounted for 65.1% of revenues.

- Net loss of $(95,527), compared with net income of $214,703.

- Adjusted EBITDA1 of $126 thousand, compared with $225 thousand.

Nine Months 2021 Financial Highlights (all comparisons to prior year period unless otherwise noted)

- Total revenues increased 15.2% to $12.5 million, compared with $10.8 million.

- Professional fees increased 155% to $8.6 million up from $3.4 million

- Gross profit expanded significantly, increasing to $3.0 million, or 23.7%, compared with $1.3 million, or 11.9%; higher-margin professional fees accounted for 68.8% of revenues.

- Net income of $218,445, compared with net income of $53,744.

- Adjusted EBITDA of $876 thousand, compared with $67 thousand.

Previous acquisitions in 2021:

Information Analysis Incorporated Announces Acquisition of Tellenger, Inc.

New Management:

Information Analysis Continues Building for Transformation

Information Analysis Appoints Tim Hannon Interim Chief Financial Officer

Gov’t Contracts:

Information Analysis Plays Critical Role in Modernization and Enhancement of SBA’s Largest Loan Program

Here’s a link to their investor presentation back in June 2021

Highlights:

- IAIC is attacking a modernization market opportunity of $1 Trillion at an assumed cost of $5 per line of code

- Information Analysis Incorporated (IAI) has a 40-year history delivering IT-related professional services to enterprises, including over 25 key government agencies as well as commercial customers

- IAI has demonstrated a core competency in modernizing legacy computer systems that operate on outdated languages such as COBOL, with over 100 million lines of code updated to date

- IAI intends to leverage this experience by expanding its solutions set and customer base, as exemplified through its recent acquisition of Tellenger, Inc. which added significant capabilities in cloud solutions and cybersecurity

- Recent additions to senior management and the Board of Directors: Implementing an aggressive organic growth plan and a robust acquisition strategy

Forward looking:

- Experts estimate there are approximately 220 billion lines of COBOL code that are in need of upgrade to more modern programming languages. This creates a modernization market opportunity of $1 Trillion at an assumed cost of $5 per line of code.

Holding shares @ $2.79 Holding 1,111 shares at $3.06

I’d love to see some options added on this…