I bought 2 of the 5/20 30c as SNAP has dropped to $30.73 this morning. I’m going to wait for Fed news before adding to that position. I’m generally pretty bullish on SNAP, especially after reading that average rating is a buy with PT of $56.

I have some limit orders in for the 35c and also plan to make monitor after Jpow.

Good luck!

$LULU is selling off. Some bearish PTs but also bullish ones so not sure why. Breaking through 384.50 support right now. Next support around 378 so still has a way to go. If there’s no bullish turnaround after Fed talks and SPY still green, may abandon this trade.

I bought 1 190c 4/22 for AXP yesterday to start monitoring. They have earnings tomorrow PM. Will probably cut here for 40% gain and reposition. But AXP call should include interesting insight into consumer spending.

ATVI has earnings Monday. They are a shitty company and have been pumped bc MSFT bought them out. I see no reason for them to continue being in the 70’s. I see a tank on them especially because Call of Duty is dying, cheating is rampant and people are playing it less and less

I am illegally retarded. Ignore this

I found this interesting.

With the VIX mooning today, OVX (Oil Vix) vs VIX has dropped 14%. VIX catching up with OVX which has been high through 2022 so far. I am curious if there is some sort of mean reversion play (or some feedback loop to propel OVX) developing here, but I don’t know how to play it.

Going to be keeping an eye on SPY tomorrow and the next few days if I don’t get in - My Target

5/20 Puts $420

My reasoning is I think SPY sooner or later will tank - Fed Expected Rate Hikes May 3/4 -

Considering today’s Swing - which was about $10 - from low to high - might go with more of a @thots_and_prayers style and scalp it for quick gains.

If I see it pumping hard upwords - will look for a better price if it shows decent signs of dying will jump in.

Same. I’m looking at 437c day trade tomorrow with a wick to 438. Followed by puts same day for 426 thinking by Wednesday or Thursday) for the weekly and 5/6 415p

Looking at ARKK, it’s been riding down the 21 EMA on the 1 hour on webull. I’m looking to enter puts at around the 48.8 area if ARKK gets rejected off the 21 EMA again. Either way shits gonna go down even if it goes past 49. Always bet against cathy

Spy on the 1 hour is in an upwards channel. If the channel holds, the top is in the 427-428 area. Most likely we’re gonna see a sell off before close tho bc of appl and amzn earnings AH

Scalped some otm spy 450c for 80-90% sold on the first red.

Added a vuzi call earlier and another bbai call(on sale but very risky)

Have a wide hood straddle (super cheap- probably a money burner)

Have 320 xela shares and 10 june 1c but again a super cheap play.

Looking at these plays last month or so, I really need to just scalp daily again. Too diversified and the huge spy percentage scalp makes all my other plays look like missed opportunity costs.

Going to watching - ACCD for the next few days for possible scalps

Keeping an eye on HOOD - noticed the last few days when it drops below $10 it bounces back up -

Could we short-lived - not holding for long-only doing shares - but pennies add up

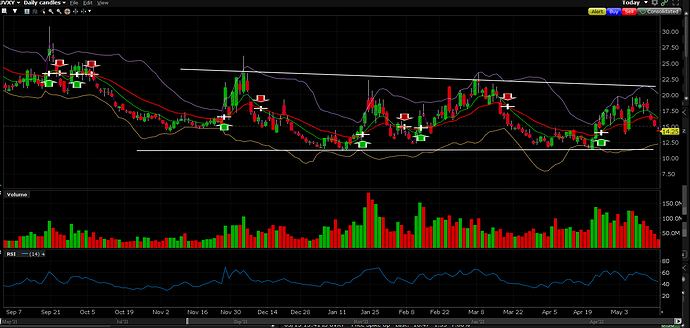

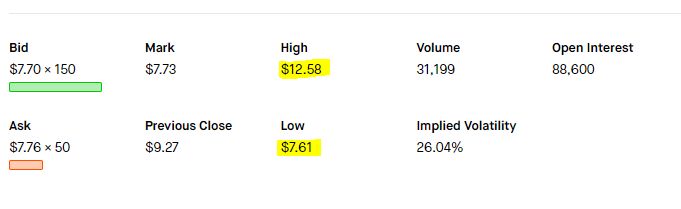

I’ve watching $UVXY puts here. Entering bottom bollinger territory on the daily, sort of coming out of a double top and maybe crossing over the 9 and 20

Retail is my watchlist today, WMT missed earnings and is down premarket, watching for post earnings scalps due to volatility. It’s important to note that WMT has some very strong historical support in that 135-134 range

TGT is down in sympathy, and reports earnings tomorrow. Looking for direction to scalp as well.

HD beat earnings today and is up, probably gonna a try scalping calls at open if SPY stays up to ride volatility.

There’s a mine field of fed meetings so be careful.

Seems to me $UVXY is trading in a predictable pattern since November of last year. Predictable in that the 9 and 21 crossovers can be used (even though they’re lagging) as a continuation of the trend. Looking a bit more closely, there are certain patterns that are being formed that seem to predict at least downward trends. These trends last about a month or so (from peak to valley). Yesterday if you took puts, depending on your strike, they would be up anywhere from 15-25%. Would love for some of the smart brains here to take a look into this: