Got some Aug 19 IPOF 10c for $.09. Think we get one more pump sometime between now and August.

Just throwing out a quick WATCH OUT with SIDU tomorrow. Been noticing a ton of eyes and meme/retard strength looks to be getting behind it. It has shot up the popularity list on WeBull to #6 on their list (take that with a grain of salt).

I flatout just took a wild gamble on this and it happened to pay for once. I’ve already sold 110 of my 300 shares for my cost basis.

I wouldn’t have taken this bet if they weren’t collaborating with Raytheon (RTX, which I happen to very much like and am bullish on) and didn’t take any time today (stupidly) to do any research on SIDU themselves and know nothing of their financials etc. but will be planning to do so tomorrow (Friday).

So PLEASE, be careful.

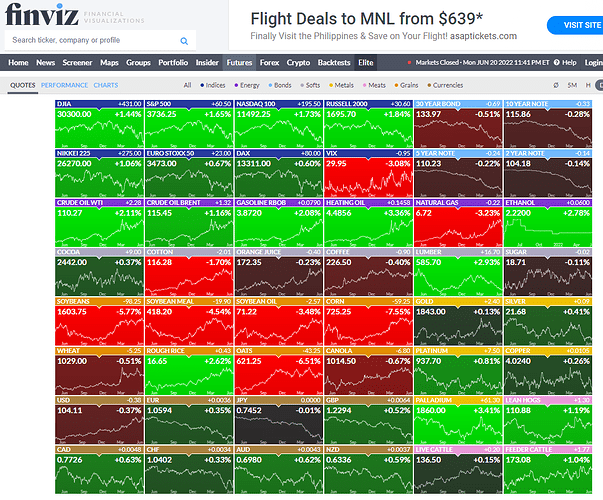

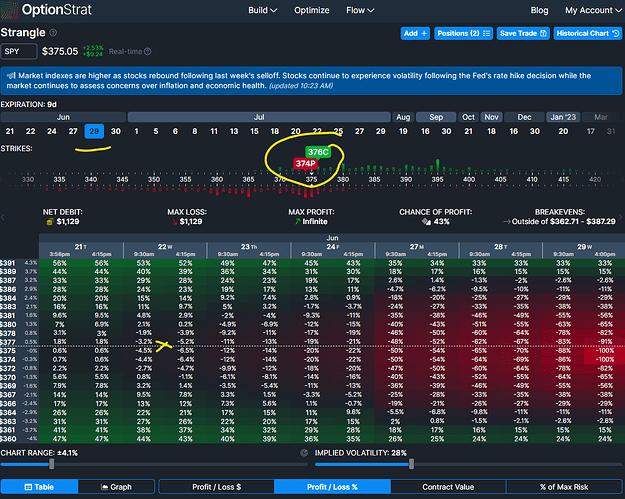

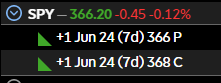

I’ll be picking up new SPY Strangles at Market close.

No charts, but Risk-to-Reward ratio will be presented with help from Optionstrat.

Do mind that iV fluctuates and specific to the strikes/pair.

OpEx will be the 24th.

*These past 3weeks, I prefer to sell my positions at Market Open the next Trading Day.

*IF/when they’re In-The-Money, 3min to 10min max, for optimum gains, before iV drops, Market sell (Limit sell only if they’re really deep in green).

*IF/when they’re losing, immediately at Market price.

*Best for WeBull accounts.

*Best for accounts with at least $2-5k.

No ER strangles in sight yet.

Will update 5min before close.

Love a SPY strangle, let’s go

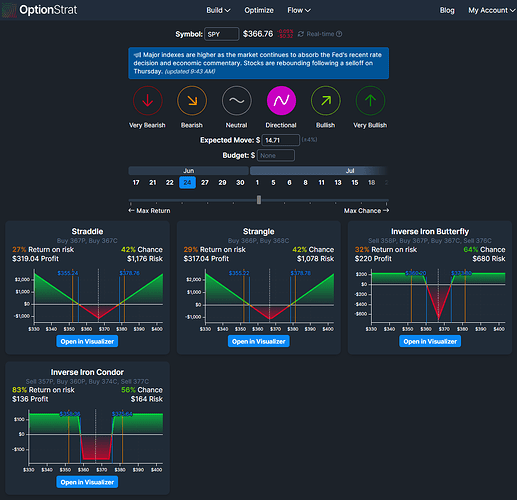

Here’s a quick glance with Optionstrat’s Optimized-Directional trades…

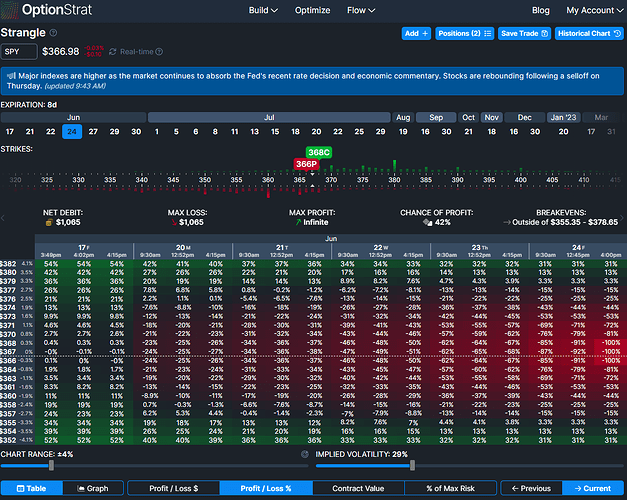

And here’s the Strangle Risk-to-Ratio chart…

366P with 368C, June 24th OpEx.

IF you are using a free account with Optionstrat, the numbers will be delayed, but still a good guide.

Best to look at VIX and SPY Volatility in ToS while to get your entries.

I will be using my 2nd account to take this trade.

Looking for an entry right now.

I might also take a 1width trade with my main account, or pick the same trade above.

Probably closer to 4:10pm in WeBull.

Taking this play with you. You’d be aiming to sell this Tuesday near open?

Yes boss.

In with my 2nd account, now entering with my main.

In Rexx I trust

CFVI (Rumble) shares are very close to NAV rn. CFVI tends to run with DWAC so it’s not a bad time to load up on shares in anticipation of another upcoming catalyst related to Trump or any other influential conservative politician/celebrity etc.

Also, was able to get a fill for an August 9c for $1.20.

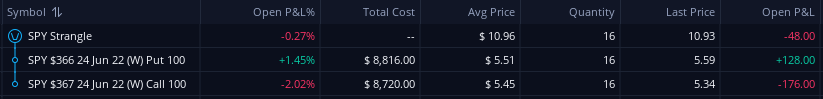

Any reason for one width in the lower position and two in the higher?

I simply have more capital in the main account.

Since 1width are a bit more expensive, I go with the 2width.

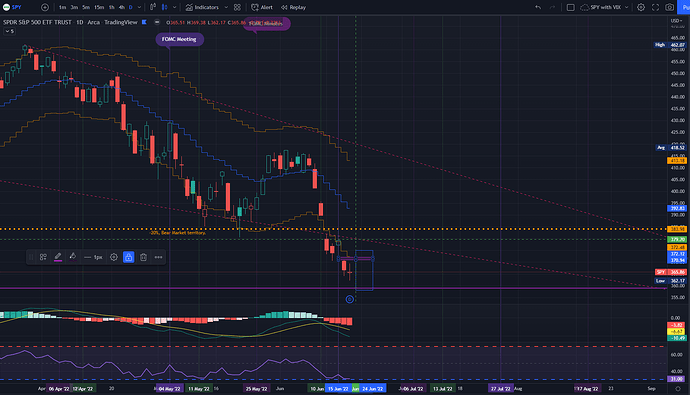

SPY, 378-380 channel might be a hard resistance tomorrow…

Assuming Indices hold their bullish momentum at open, that is.

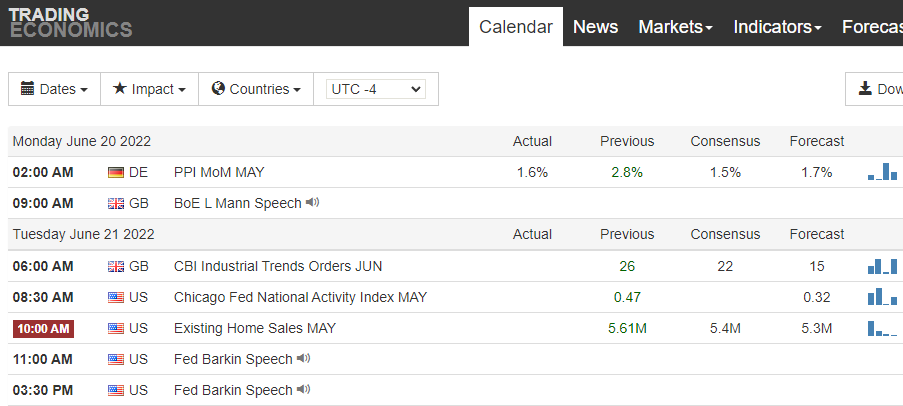

There’s a report coming in at 10am, best to keep that in mind as well (for day trades).

No, I’m not flying to Manila anytime soon.

Sold all these at profit.

Sitting out the rest of the day until close.

Keeping an eye out for THCA redemption numbers. They’re unlikely to be significant since it’s been frontloaded and has traded above nav of $10.33. The extension meeting was today.

Exited this at profit.

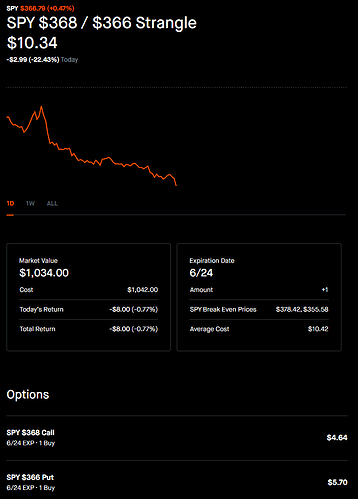

Took 14 new ones and might hold until next Monday–same strike pairing, same opex.

With the bad numbers reported by GB and CA pre-market, there was no good reason for the pump…

My bet is that SPY will test the lows (and possibly go a bit lower) tomorrow.

S&P PMI numbers will be out tomorrow.

After this trade, I will take another vacation, and won’t be back for a long while.

I’m way overdue on Social Media detoxification (or something like that).

It was good and fun trading with you all, and I pray yall keep green.

Noticed energy sectors crossing 200ma to downside.

XLE - SPDR energy etf (29% from high)

XOP - SPDR O&G E&P (31% from high)

oil & gas is extremely precarious right now. tread very carefully. but this could also be buying at max fear. I still have conviction in my plays, please do research if you want to get in.

Out of these with 14% gain…

Great week. Jesus is Great.

Will buy new undies today.

Thank You, my Lord!