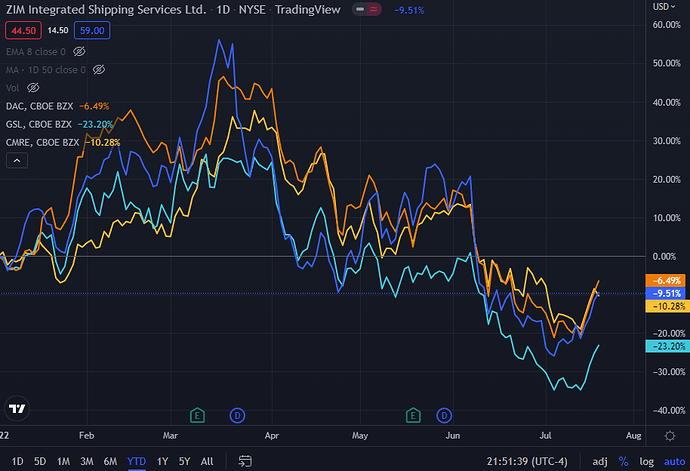

There seems to be a secular tailwind on shipping. Probably some combination of higher volumes than 2021, upward adjusted guidance from MATX and earnings coming up, for dividend capture. I didn’t end up catching any of the spreads - they ran away from me and I did not feel like chasing on a green day. Thinking of getting Aug ATM calls instead though, not just on ZIM, but on three other tickers: DAC, GSL and CMRE.

Earnings are as follows:

- DAC: 01 Aug

- CMRE: 26 Jul

- GSL: 01 Aug

- ZIM: 18 Aug

I like these most out of the ones I track. They also have liquid, or somewhat liquid options.

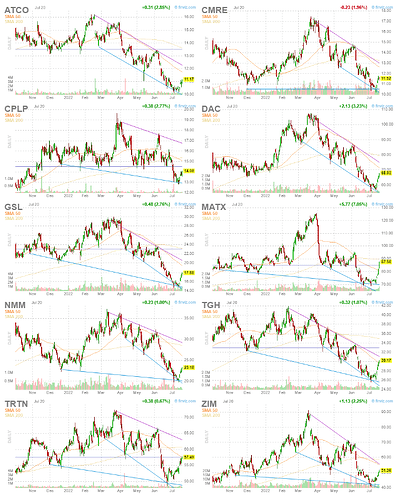

Please use this link to check out the group of shippers we could choose from.